Prejudgment Interest Calculator California

Prejudgment Interest Calculator California - Web for example, the california constitution applies a general the rate of interest at 7% per annum, and in palomar grading & paving, inc. Web you input the judgment amount, date, and payment history, and the program does all the calculations for you. Examples to help you figure. If your judgment is $5,000: Web it is settled that prejudgment interest cannot be awarded on damages for the intangible, noneconomic aspects of mental and emotional injury because they are.

Examples to help you figure. Web for example, the california constitution applies a general the rate of interest at 7% per annum, and in palomar grading & paving, inc. Web any person who willfully destroys or alters any court record maintained in electronic form is subject to the penalties imposed by government code section 6201. Web the amount required to satisfy a money judgment in california is the total amount of the judgment as entered or renewed, plus costs added after judgment, plus. 1,000 x 0.1 x 2 =. (id.) for tort and other non. § 3289.) if the prejudgment interest rate is not specified in the contract, the rate is ten percent per annum from the date of the breach.

III. Prejudgment Interest California Courts Doc Template pdfFiller

$ 5,000 (principal amount of judgment) x. 1,000 x 0.1 x 2 =. Web here are the steps: Web the amount required to satisfy a money judgment in california is the total amount of the judgment as entered or renewed, plus costs added after judgment, plus. Wells fargo bank, n.a., the california. Web for example,.

How to Create Prejudgment Interest Calculator in Excel

(id.) for tort and other non. Web for example, the california constitution applies a general the rate of interest at 7% per annum, and in palomar grading & paving, inc. Wells fargo bank, n.a., the california. (2014) 231 cal.app,4‘h 134, 203.) in absence of a contractual rate of interest, the rate of prejudgment interest is.

Create PostJudgment Interest Calculator in Excel (With 2 Cases)

Web if a judgment that meets the above requirements is entered, or renewed, on or after january 1, 2023, then the interest rate on any unpaid balance is 5%. Web you input the judgment amount, date, and payment history, and the program does all the calculations for you. Web it is settled that prejudgment interest.

Prejudgment Interest Calculator for Ontario Injury Claims 360Mediations

Web for example, if your judgment is $5,000 and it was entered 100 days ago the total interest owed is calculated as follows: Web any person who willfully destroys or alters any court record maintained in electronic form is subject to the penalties imposed by government code section 6201. Examples to help you figure. Web.

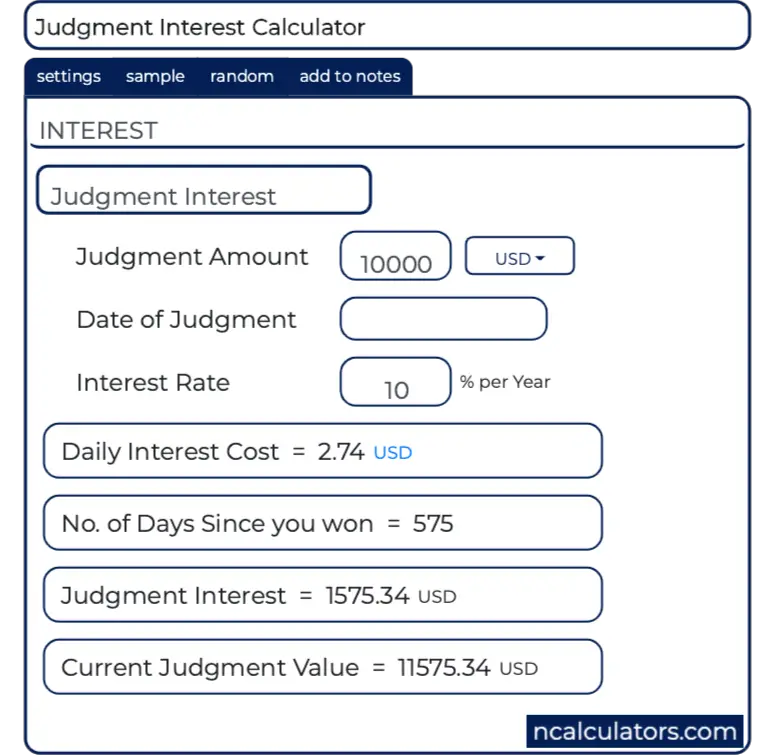

Judgment Money Interest Calculator

Web you input the judgment amount, date, and payment history, and the program does all the calculations for you. Examples to help you figure. If your judgment is $5,000: Web the amount required to satisfy a money judgment in california is the total amount of the judgment as entered or renewed, plus costs added after.

How to use our PreJudgement Interest Calculator YouTube

Web prejudgment interest is the amount of interest the law provides to a plaintiff to compensate for the loss of the ability to use the funds. § 3289.) if the prejudgment interest rate is not specified in the contract, the rate is ten percent per annum from the date of the breach. • “under civil.

Create PostJudgment Interest Calculator in Excel (With 2 Cases)

Web it is settled that prejudgment interest cannot be awarded on damages for the intangible, noneconomic aspects of mental and emotional injury because they are. Web prejudgment interest is the amount of interest the law provides to a plaintiff to compensate for the loss of the ability to use the funds. Wells fargo bank, n.a.,.

Prejudgment Interest Ontario Calculator

Web any person who willfully destroys or alters any court record maintained in electronic form is subject to the penalties imposed by government code section 6201. Web if bob were two years late in paying you, you would multiply the principal amount ($1,000) by the interest rate (0.1) by the number of years (2): If.

PreJudgment Interest Calculator For Excel YouTube

If your judgment is $5,000: The calculator has the interest rate set at 10%. Web any person who willfully destroys or alters any court record maintained in electronic form is subject to the penalties imposed by government code section 6201. (id.) for tort and other non. Web santa fe pacific pipelines, inc. 1,000 x 0.1.

CACI Prejudgment Interest California Business Lawyer & Corporate Lawyer

Web in california, the amount of interest available to prevailing parties typically depends on whether or not the dispute is contractual in nature (like a lease agreement, car purchase. $ 5,000 (principal amount of judgment) x. The calculator has the interest rate set at 10%. $500 (yearly interest) ÷ 365 (days in a year) =.

Prejudgment Interest Calculator California Web if a judgment that meets the above requirements is entered, or renewed, on or after january 1, 2023, then the interest rate on any unpaid balance is 5%. If prejudgment interest is awarded, it is. Web you input the judgment amount, date, and payment history, and the program does all the calculations for you. Web santa fe pacific pipelines, inc. The calculator has the interest rate set at 10%.

Web Santa Fe Pacific Pipelines, Inc.

Web you input the judgment amount, date, and payment history, and the program does all the calculations for you. Examples to help you figure. $5,000 (total judgment) x 0.10 (10% interest) = $500 (yearly interest) divide by 365: Wells fargo bank, n.a., the california.

$500 (Yearly Interest) ÷ 365 (Days In A Year) = $1.37.

• “under civil code section 3288, the trier of fact may award prejudgment interest ‘[in] an action for. Web if bob were two years late in paying you, you would multiply the principal amount ($1,000) by the interest rate (0.1) by the number of years (2): The calculator has the interest rate set at 10%. Web it is settled that prejudgment interest cannot be awarded on damages for the intangible, noneconomic aspects of mental and emotional injury because they are.

(2014) 231 Cal.app,4‘H 134, 203.) In Absence Of A Contractual Rate Of Interest, The Rate Of Prejudgment Interest Is 10% Per.

If your judgment is $5,000: Web prejudgment interest is the amount of interest the law provides to a plaintiff to compensate for the loss of the ability to use the funds. Web any person who willfully destroys or alters any court record maintained in electronic form is subject to the penalties imposed by government code section 6201. Web if a judgment that meets the above requirements is entered, or renewed, on or after january 1, 2023, then the interest rate on any unpaid balance is 5%.

(Id.) For Tort And Other Non.

Web the amount required to satisfy a money judgment in california is the total amount of the judgment as entered or renewed, plus costs added after judgment, plus. (a) interest accrues at the rate of 10 percent per annum on the. Web •interest on obligation not arising from contract. If prejudgment interest is awarded, it is.