Probate Fees California Calculator

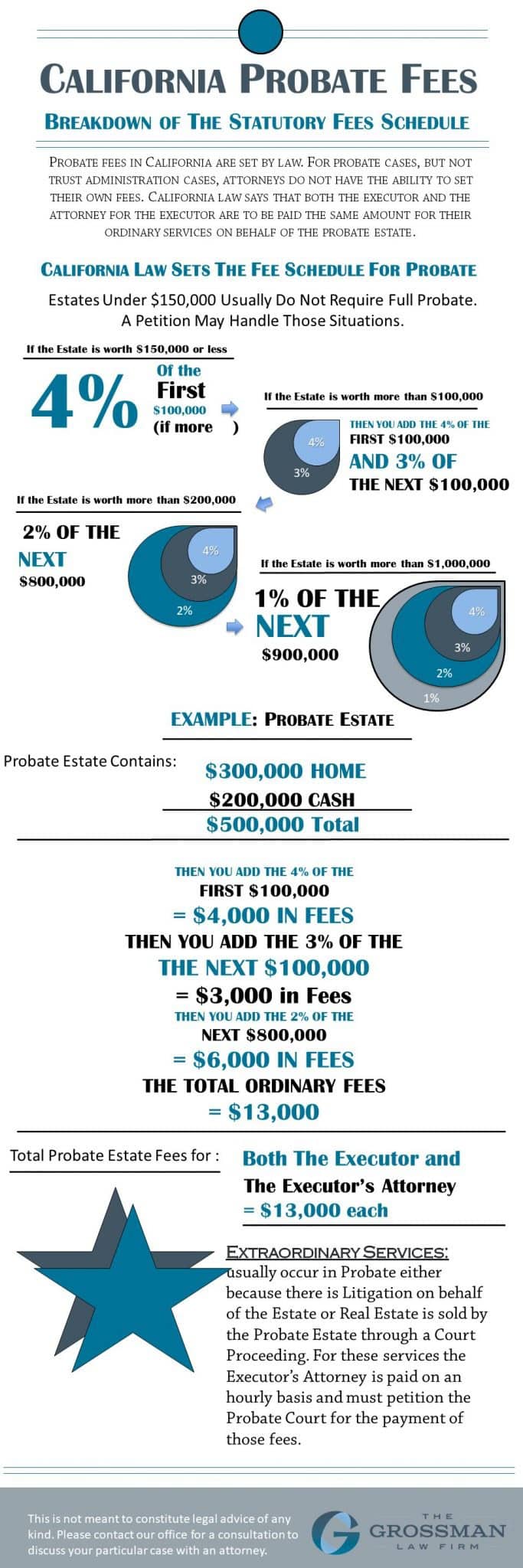

Probate Fees California Calculator - Web probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Estimated value of the estate. There will be fees to file documents with the court, to publish a notice in a newspaper, to have an appraiser such. To make this calculation easier, we've created a probate fee calculator to help you.

Web calculate probate attorney fees in california with our handy fee calculator. Web probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Estimated value of the estate. Get a clear estimate of your legal expenses. Web california probate fee calculator. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Web as you can see, probate fees increase proportionally with the size of the estate.

California Probate Fees (Simplified) How Much Does Probate Cost In 2023?

Web how to calculate probate fees in california. Calculate attorney & executor fees. Web california probate fee calculator. To make this calculation easier, we've created a probate fee calculator to help you. Web typical costs of a probate case. Web using the estimated gross value of the estate, not including debts, calculate the statutory fees.

California Statutory Probate Fees Law Office of Christina Gorokhovsky

An estate worth $200,000 would require $7,000 in california probate fees ($4,000 for the first. Web statutory fee compensation calculator this calculator will assist in calculating statutory commissions and attorney's fees. Get a clear estimate of your legal expenses. Calculate attorney & executor fees. In this section, lets talk about how are probate fees calculated.

Estate Probate Attorney in California — Montecito Law Group

The following calculator may help you determine. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Web california probate fee calculator. Please use the california probate calculator below to estimate probate attorney’s fees and executor commissions for the administration.

How To Calculate Probate Fees (2020) a Tutorial by Probate Attorney in

To make this calculation easier, we've created a probate fee calculator to help you. Web please use the calculator below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over $150,000, but less than. Web use the calculator below to estimate probate attorney's fees and executor commissions for the administration.

Estimated Fees for Filings in the San Diego Civil and Probate Courts

In this section, lets talk about how are probate fees calculated in california. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Executor and attorney fees are calculated by statute as a percentage of the estate’s value. Calculate attorney.

The total cost of probate in California in 2024

Web california probate fee calculator. Web use the calculator below to estimate probate attorney's fees and executor commissions for the administration of estates valued over $150,000, but less than $25,000,000. Web 2 minute read cost of probate in california curious about the cost of probate in california? Web how to calculate probate fees in california..

California Probate Process The Hayes Law Firm

Web calculate probate attorney fees in california with our handy fee calculator. Web using the estimated gross value of the estate, not including debts, calculate the statutory fees for a california probate for estates over $166,250 but less than $10,000,000. The statutory california probate fee. Depending on the amount and type of. Web as you.

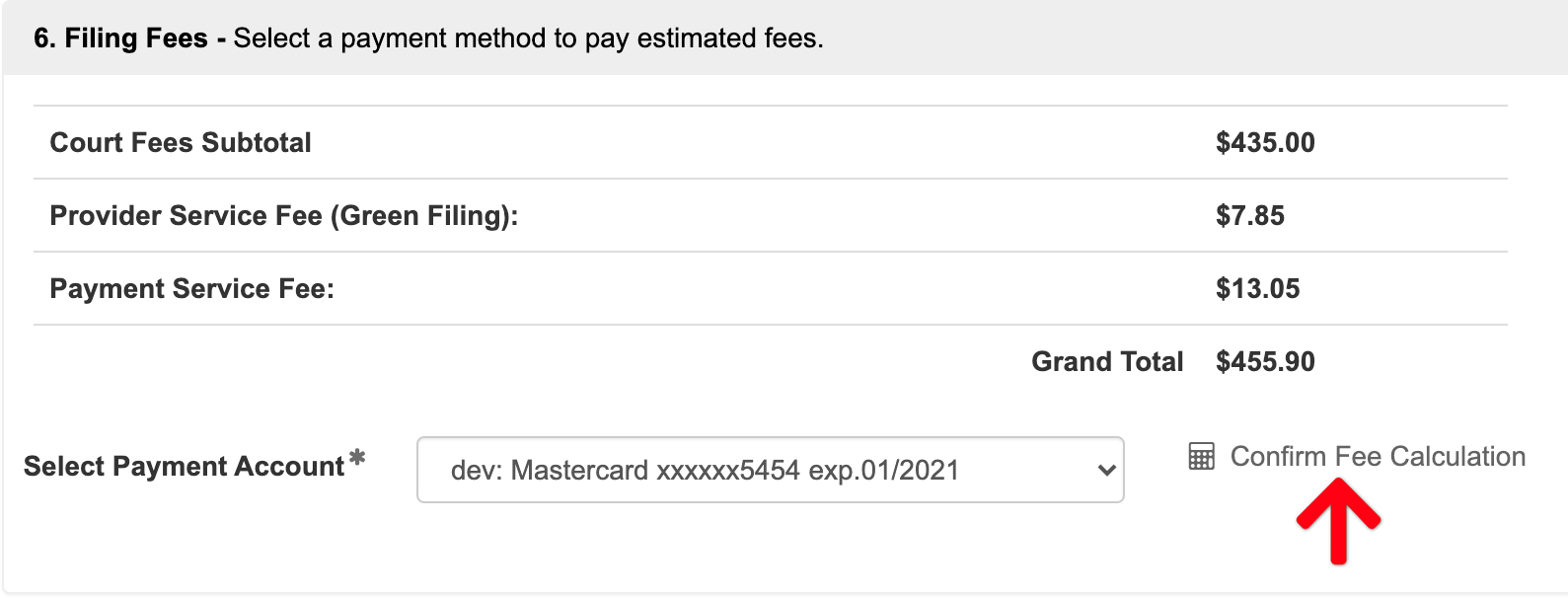

Probate Fee Calculator Pacific Estate Planning

Web california probate fee calculator. The following calculator may help you determine. Web statutory fee compensation calculator this calculator will assist in calculating statutory commissions and attorney's fees. Web probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Filing fees.

Paying Your California Probate Lawyer The Grossman Law Firm APC

There will be fees to file documents with the court, to publish a notice in a newspaper, to have an appraiser such. Web use our ca probate fee calculator below to estimate probate fees for estates over $184,500, but less than $10,000,000. Web calculate probate attorney fees in california with our handy fee calculator. Estimated.

Estate Planning in California Probate Fees Apportionment

Please use the california probate calculator below to estimate probate attorney’s fees and executor commissions for the administration of. In this section, lets talk about how are probate fees calculated in california. Depending on the amount and type of. Executor and attorney fees are calculated by statute as a percentage of the estate’s value. Web.

Probate Fees California Calculator There will be fees to file documents with the court, to publish a notice in a newspaper, to have an appraiser such. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Web california probate fee calculator: In this section, lets talk about how are probate fees calculated in california. An estate worth $200,000 would require $7,000 in california probate fees ($4,000 for the first.

Flat Ratewills And Trust Planningcall For A Consult

Depending on the amount and type of. Web executor's commission total attorney's fees and executor's commission explanation of calculation 4 percent of first $100,000 4% statutory probate fee 3 percent of next. Web typical costs of a probate case. The following calculator may help you determine.

Web Use The Calculator Below To Estimate Probate Attorney's Fees And Executor Commissions For The Administration Of Estates Valued Over $150,000, But Less Than $25,000,000.

Web use the “calculator” below to estimate statutory attorney fees for a california probate for estates over $166,250, but less than $10,000,000. Web probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Web california probate fee calculator. * publication costs vary around the state with $200 being about the cheapest and $1,000 being about the most expensive.

Web As You Can See, Probate Fees Increase Proportionally With The Size Of The Estate.

Web statutory fee compensation calculator this calculator will assist in calculating statutory commissions and attorney's fees. Executor and attorney fees are calculated by statute as a percentage of the estate’s value. $28,000 (lawyer) + $28,000 (executor) = $56,000 in total statutory fees. An estate worth $200,000 would require $7,000 in california probate fees ($4,000 for the first.

Web Use Our Ca Probate Fee Calculator Below To Estimate Probate Fees For Estates Over $184,500, But Less Than $10,000,000.

Filing fees and other fees. Probate calculator estimated value of real and. Web california probate fee calculator: Get a clear estimate of your legal expenses.