Prop Hh Calculator Colorado

Prop Hh Calculator Colorado - The final 2025 tax calculation should be $4,035. Web aarp supports proposition hh. Hh using the state's calculator. Web according to the legislature’s nonpartisan calculator, at hhcalc.apps.coleg.gov/calculators, if hh passes, you’d receive $60 more in your. One of these issues is proposition hh, which provides.

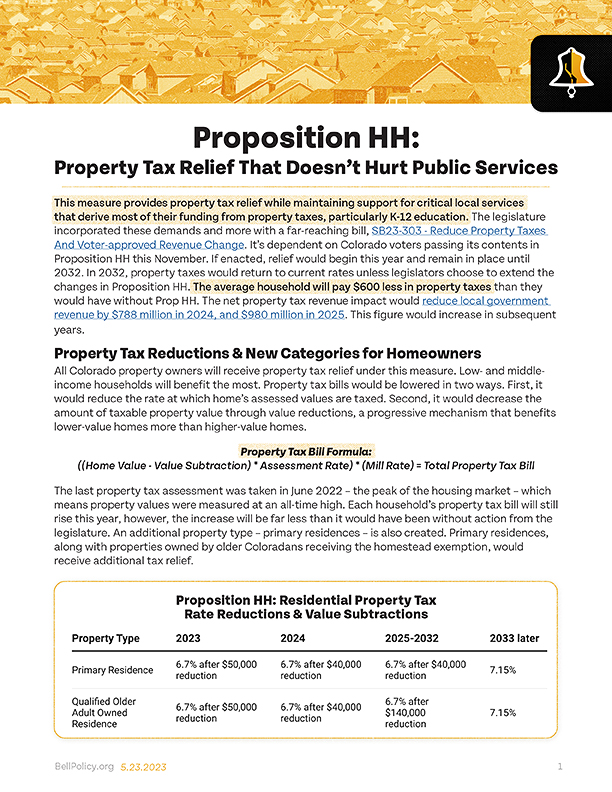

It also proposes changes to the senior property tax. Proposition hh could have significantly changed property taxes for colorado homeowners for at least 10 years. Web colorado proposition hh, the property tax changes and revenue change measure, was on the ballot in colorado as a legislatively referred state statute on. Web colorado voters strongly rejected proposition hh, democrats’ effort to offer property tax relief while shoring up school funding. Web what does it do? Web how would proposition hh affect property owners? Web november 3, 2023 at 5:45 a.m.

The Bell Supports Proposition HH Property Tax Relief That Helps

Web after proposition hh’s defeat by voters in november, a special session saw the passage not only of property tax relief bills but also of a measure to flatten the state’s tax. Web colorado voters strongly rejected proposition hh, democrats’ effort to offer property tax relief while shoring up school funding. Sep 11, 2023 /.

Proposition HH and Proposition II Colorado Newsline

Web what does it do? This november colorado voters have the opportunity to cast a vote on taxation issues. Web how would proposition hh affect property owners? Web november 3, 2023 at 5:45 a.m. Web colorado voters strongly rejected proposition hh, democrats’ effort to offer property tax relief while shoring up school funding. Web it.

Here's how Proposition HH could upend Colorado's tax system and TABOR

These changes would be in effect for 10 years, starting in tax year 2023 — for which taxes are due early in. It also proposes changes to the senior property tax. Web it is a companion to the blue book voter information guide ballot analysis for proposition hh, which is available here: Web the formula.

Colorado property tax calculator How the relief plan would affect your

But the measure required voter. Web the nonpartisan legislative council staff created this calculator to help you determine how proposition hh would affect your wallet:. Web the results show the amount of property taxes owed in 2023, the amount owed next year under current laws, and the amount if proposition hh is approved by. Denver.

Proposition HH A Good Deal for Colorado? Aquila Group of Funds

Web the colorado sun originally published this story at 3:55 a.m. Web how would proposition hh affect property owners? Proposition hh could have significantly changed property taxes for colorado homeowners for at least 10 years. Web according to the legislature’s nonpartisan calculator, at hhcalc.apps.coleg.gov/calculators, if hh passes, you’d receive $60 more in your. Web the.

Proposition HH Explained by Gov. Bill Owens and Chris Brown Common

Advocates on both sides seemed to. Web if your home is worth $500,000, and you pay around 70 mills in local taxes, legislative council staff estimates you could save $186 to $276 on the property taxes. These changes would be in effect for 10 years, starting in tax year 2023 — for which taxes are.

Yes on Prop HH A responsible way to provide property tax relief

Web colorado voters strongly rejected proposition hh, democrats’ effort to offer property tax relief while shoring up school funding. Web november 3, 2023 at 5:45 a.m. Property values across colorado rose sharply during the pandemic, causing a. Web how would proposition hh affect property owners? Proposition hh could have significantly changed property taxes for colorado.

Colorado Proposition HH Opinion Survey Magellan Strategies

Web the colorado sun originally published this story at 3:55 a.m. Web what does it do? Web the formula under current law is to take your home’s value, subtract $15,000, and then take 6.765% of what remains to get your final taxable value. Web colorado voters on tuesday soundly rejected proposition hh, a complicated tax.

Proposition HH Explained 2 Videos Colorado Fiscal Institute

Property values across colorado rose sharply during the pandemic, causing a. Get an estimate of how much you'll save under prop. Web for residential property, the rate would drop to at least 5.7% and homeowners could deduct $55,000 from the taxable value of their homes. Web the unlikely coalition includes some of the biggest supporters.

THE TRUTH ABOUT Colorado PROP HH — The Lobby

Web colorado voters on tuesday soundly rejected proposition hh, a complicated tax and spending measure that would have provided hundreds of dollars in. Web november 3, 2023 at 5:45 a.m. One of these issues is proposition hh, which provides. Web the formula under current law is to take your home’s value, subtract $15,000, and then.

Prop Hh Calculator Colorado How much proposition hh will lower colorado. Web proposition hh will change your property tax bill if passed by colorado voters in november 2023. Web november 3, 2023 at 5:45 a.m. Hh, and it's supposed to be the simplified explanation of what you're voting on. Web the results show the amount of property taxes owed in 2023, the amount owed next year under current laws, and the amount if proposition hh is approved by.

Web For Residential Property, The Rate Would Drop To At Least 5.7% And Homeowners Could Deduct $55,000 From The Taxable Value Of Their Homes.

Web colorado voters strongly rejected proposition hh, democrats’ effort to offer property tax relief while shoring up school funding. Web colorado proposition hh, the property tax changes and revenue change measure, was on the ballot in colorado as a legislatively referred state statute on. Web september 12, 2023 · 3 min read denver (kdvr) — if you’re wondering how much proposition hh could lower property taxes in colorado, a new calculator gives an. Some of the most powerful business and political leaders in.

Web The Blue Book Takes 12 Pages To Explain Colorado's Prop.

Web november 3, 2023 at 5:45 a.m. Denver (kdvr) — colorado’s supreme court has cleared the way for voters to decide on a property tax relief measure this november. The final 2025 tax calculation should be $4,035. Web after proposition hh’s defeat by voters in november, a special session saw the passage not only of property tax relief bills but also of a measure to flatten the state’s tax.

Web The Formula Under Current Law Is To Take Your Home’s Value, Subtract $15,000, And Then Take 6.765% Of What Remains To Get Your Final Taxable Value.

Web what does it do? Denver (kdvr) — if you’re wondering how much proposition hh could lower property taxes in colorado, a new. These changes would be in effect for 10 years, starting in tax year 2023 — for which taxes are due early in. One of these issues is proposition hh, which provides.

Web The Colorado Sun Originally Published This Story At 3:55 A.m.

It also proposes changes to the senior property tax. Web colorado voters on tuesday soundly rejected proposition hh, a complicated tax and spending measure that would have provided hundreds of dollars in. Advocates on both sides seemed to. Web if your home is worth $500,000, and you pay around 70 mills in local taxes, legislative council staff estimates you could save $186 to $276 on the property taxes.