Property Tax Calculator Collin County Texas

Property Tax Calculator Collin County Texas - Adoption of fy24 tax rate (pdf) city of frisco tax rates (for fiscal year 2023) collin county. Hudforeclosed.com has been visited by 10k+ users in the past month Collin county collects, on average, 2.19% of a property's. Web property tax calculator personal property tax protest property tax property tax exemptions download forms important dates you qualify for a collin county appraisal. Web collin county, texas mckinney:

Hudforeclosed.com has been visited by 10k+ users in the past month Web the collin county assessor is responsible for appraising real estate and assessing a property tax on properties located in collin county, texas. You can contact the collin. Web collin county commissioners have approved the county's property tax rate for the upcoming fiscal year. Web the median property tax in collin county, texas is $4,351 per year for a home worth the median value of $199,000. Web property tax calculator personal property tax protest property tax property tax exemptions download forms important dates you qualify for a collin county appraisal. Collin county collects, on average, 2.19% of a property's.

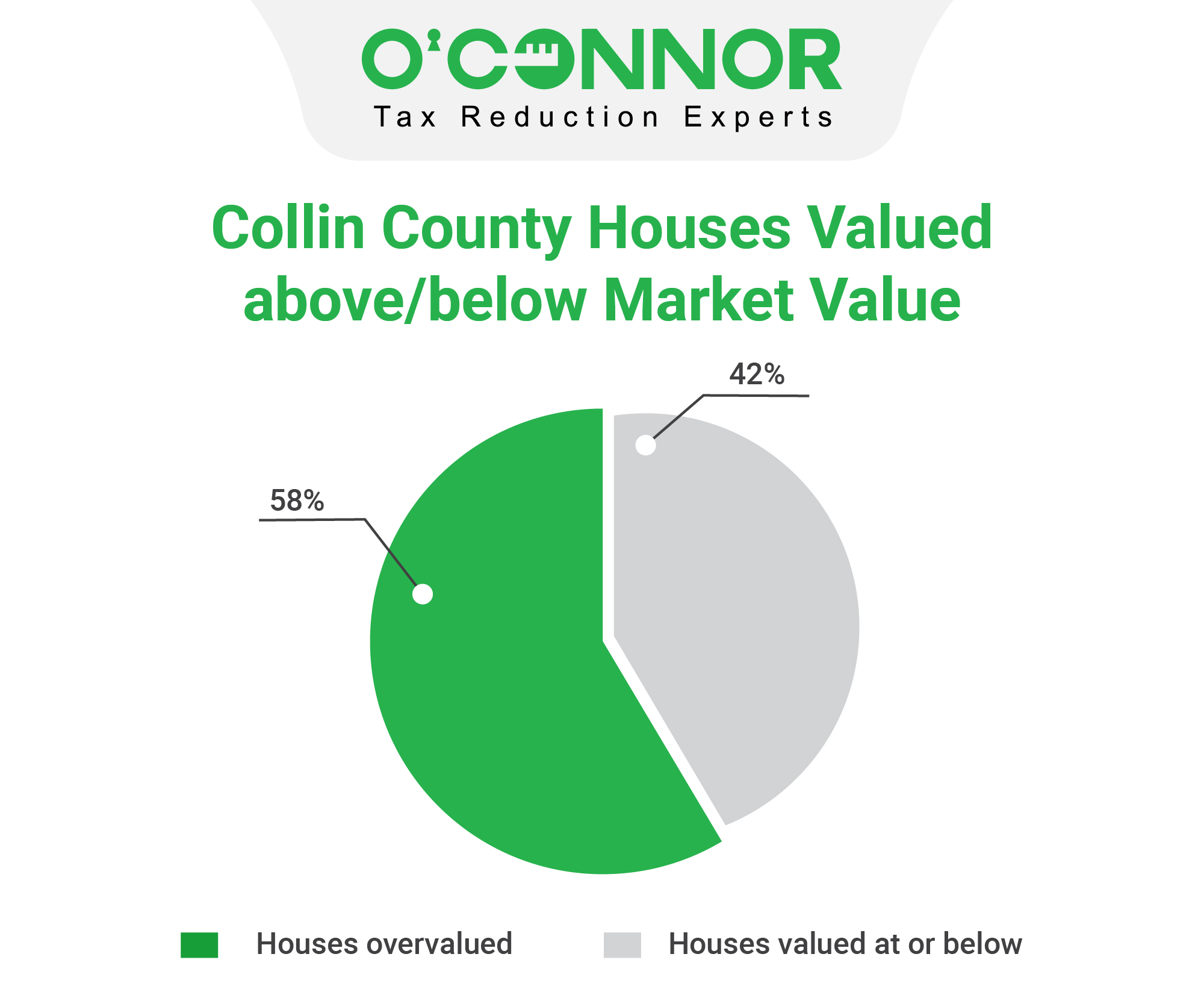

Collin County Tax Assessment Market Value

Adoption of fy24 tax rate (pdf) city of frisco tax rates (for fiscal year 2023) collin county. Enter your 2023 certified appraisal value. Web see where your property taxes go and how they are spent. Web collin county, texas | home | basics | questions. Web all three locations listed below accept property tax payments..

Property Tax Plano Texas Collin County CAD YouTube

If you do not know the account number try searching by owner name/address. Web online taxes helpful hints account number account numbers can be found on your tax statement. (total sales tax to the city of allen is 2.00%) collin county sales tax. Web the assignment of the collin cad is to develop annual valuations.

How to Calculate Property Tax in Texas

Web the assignment of the collin cad is to develop annual valuations for every property located within collin county at market value with the effective date of january 1st. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web the collin county assessor is responsible.

Collin County Shapefile and Property Data Texas County GIS Data

This calculator uses the 2023 tax percentages and inputting a. Web collin county, texas mckinney: Find the tax rate for your property’s. Web online taxes helpful hints account number account numbers can be found on your tax statement. Our collin county property tax calculator can estimate your property taxes based on similar properties, and show.

Who Pays the Biggest Collin County Tax Increases? Texas Scorecard

Web the collin county assessor is responsible for appraising real estate and assessing a property tax on properties located in collin county, texas. You will need your collin county appraised value and the names of the taxing units that apply to your property. This can be found on your collin county. Web the median property.

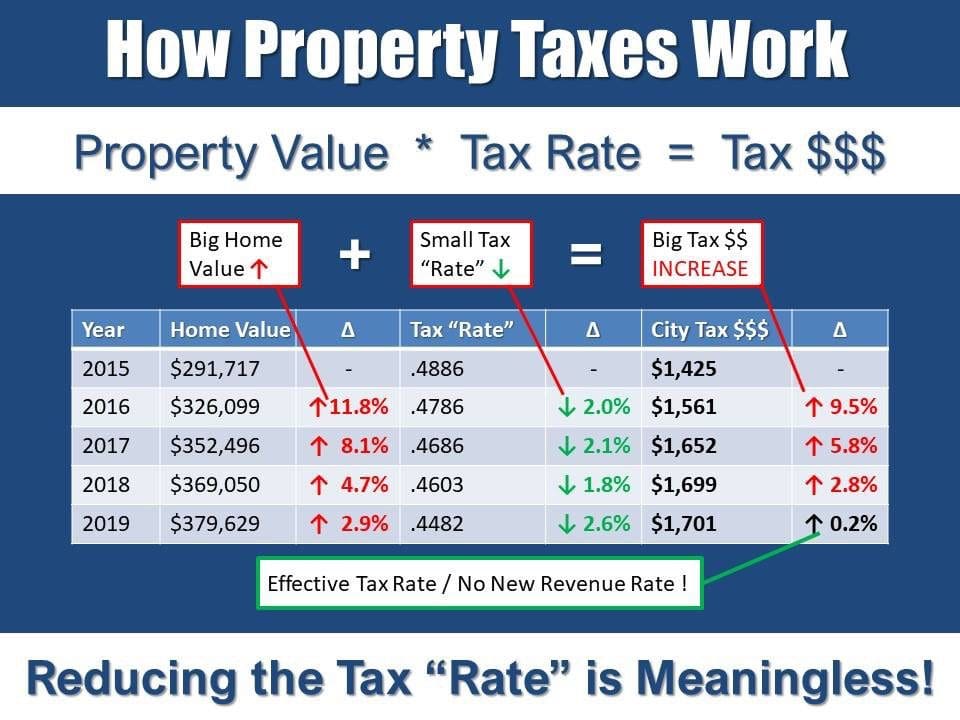

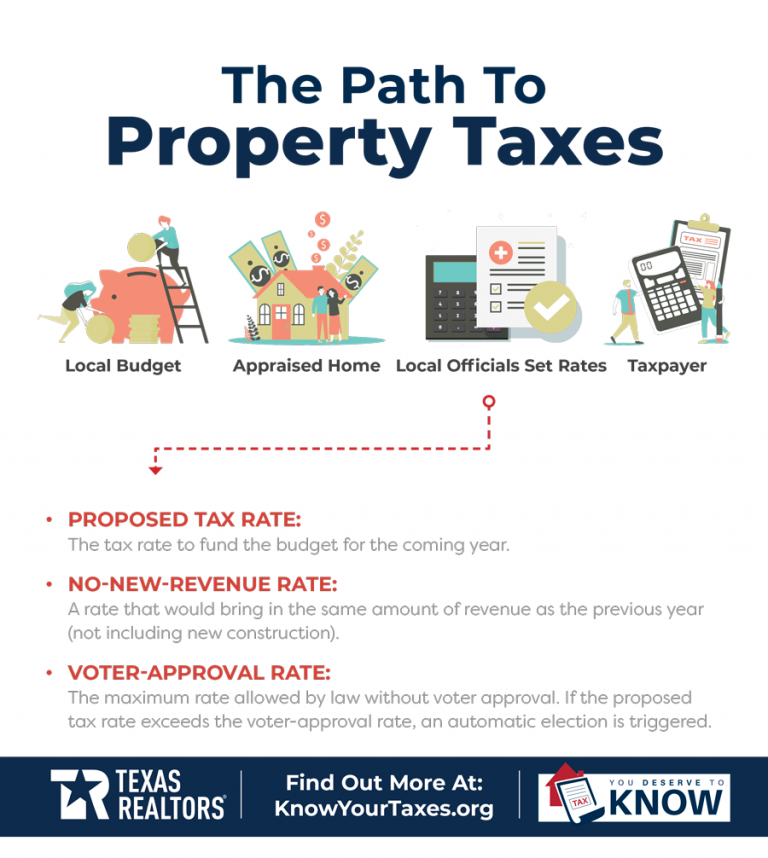

Commentary How Property Taxes Work Texas Scorecard

Enter your 2023 certified appraisal value. You will need your collin county appraised value and the names of the taxing units that apply to your property. Web online taxes helpful hints account number account numbers can be found on your tax statement. Web see where your property taxes go and how they are spent. Web.

Kaufman cad ovasgsj

Our collin county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web estimate my collin county property tax. Web the collin county assessor is responsible for appraising real estate and assessing a property tax on properties located in collin county, texas. Find the tax rate for.

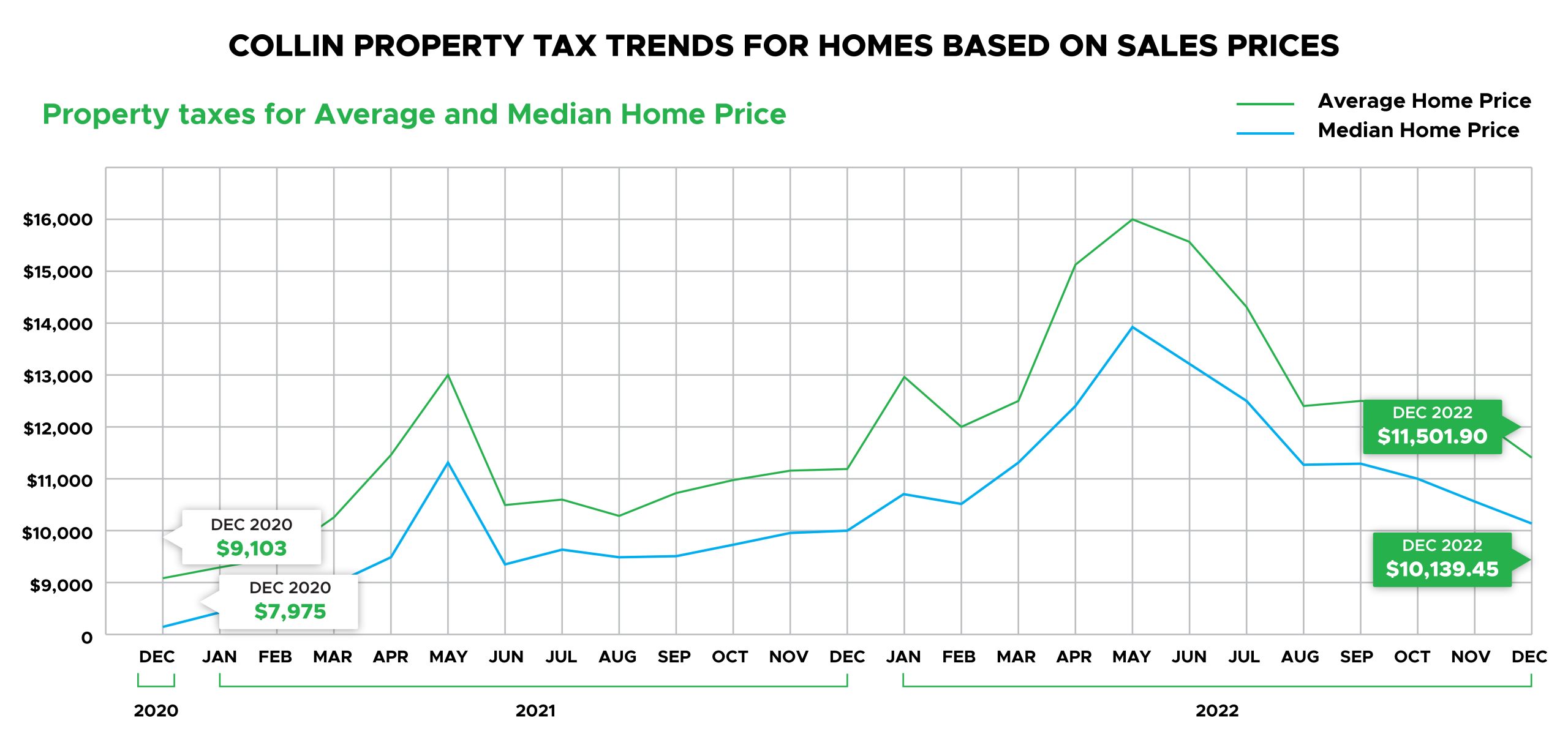

Collin County Property Tax Collin Home Prices

Any special requests such as tax certificates, vit, etc. Most collin county homeowners are likely see a higher. If you do not know the account number try searching by owner name/address. Web the collin county assessor is responsible for appraising real estate and assessing a property tax on properties located in collin county, texas. This.

Home Collin County Association of REALTORS®

Must be made at the mckinney office only. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Hudforeclosed.com has been visited by 10k+ users in the past month Web collin county, texas mckinney: Web schedule an appointment tax account lookup. This can be found on.

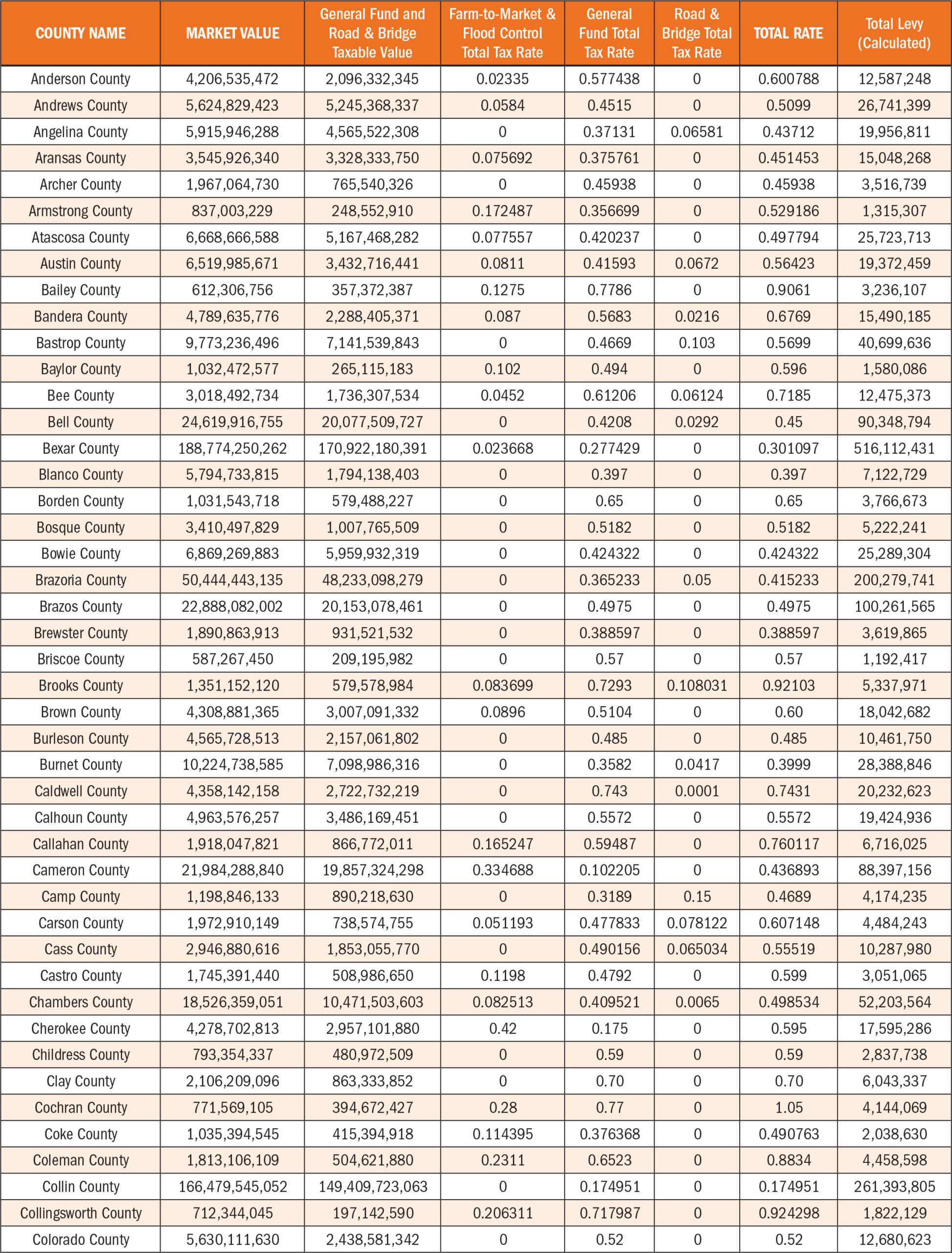

2019 County Property Tax Report Texas County Progress

Web our texas property tax calculator calculates the taxes you’ll pay after buying a property in the state of texas. You can contact the collin. Web online taxes helpful hints account number account numbers can be found on your tax statement. Determine the appraised value of your property. Web collin county, texas | home |.

Property Tax Calculator Collin County Texas Web collin county, texas mckinney: Web all three locations listed below accept property tax payments. You will need your collin county appraised value and the names of the taxing units that apply to your property. Web estimate my collin county property tax. This can be found on your collin county.

Adoption Of Fy24 Tax Rate (Pdf) City Of Frisco Tax Rates (For Fiscal Year 2023) Collin County.

Web the collin county assessor is responsible for appraising real estate and assessing a property tax on properties located in collin county, texas. Web property tax calculator personal property tax protest property tax property tax exemptions download forms important dates you qualify for a collin county appraisal. Web estimate my collin county property tax. You can contact the collin.

This Calculator Uses The 2023 Tax Percentages And Inputting A.

Our collin county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web schedule an appointment tax account lookup. Web the assignment of the collin cad is to develop annual valuations for every property located within collin county at market value with the effective date of january 1st. You will need your collin county appraised value and the names of the taxing units that apply to your property.

Web Search & Pay Property Tax.

Web collin county, texas | home | basics | questions. Collin county collects, on average, 2.19% of a property's. Determine the appraised value of your property. This can be found on your collin county.

Web Online Taxes Helpful Hints Account Number Account Numbers Can Be Found On Your Tax Statement.

Collin county tax rates ; Find the tax rate for your property’s. Tax rate and budget information required by tax code 26.18. (total sales tax to the city of allen is 2.00%) collin county sales tax.