Property Tax Calculator Michigan

Property Tax Calculator Michigan - Web calculate your property tax estimate is: Web the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes. Web michigan property tax calculator. Web property tax estimator you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Our oakland county property tax calculator can estimate your property taxes based on similar properties, and show you how your.

The homestead property tax credit. The michigan department of treasury has a real property tax estimator to use on its website. Web michigan property transfer tax calculator calculate real estate transfer tax rates property transfer tax is an assessment charged by both the state of michigan and the. Web tax tools, estimators, and calculators individual income tax tax tools 2023 retirement and pension estimator worksheet 2 (tier 3 michigan standard deduction) estimator. Web michigan property tax calculator. Web property tax estimator you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Web michigan property tax calculator overview of michigan your michigan has some to the highest property tax estimates in the country.

How MI property taxes are calculated and why your bills are rising

Web are you a homeowner filing your individual income taxes? Web property tax estimator you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Web a tax rate of 32 mills ($32 of taxes for every $1,000 of taxable value a taxable value of fifty thousand dollars.

Michigan property tax Fill out & sign online DocHub

After two months, 5% of the unpaid tax amount is assessed each month. The great ocean state’s middle effective. Web michigan property tax. Web homestead property tax credit information. Web estimate my kent county property tax. Web a tax rate of 32 mills ($32 of taxes for every $1,000 of taxable value a taxable value.

Statewide Average Property tax Millage Rates in Michigan, 19902008

Our oakland county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Enter your property's current market value and. Web michigan property tax calculator overview of michigan your michigan has some to the highest property tax estimates in the country. Web the millage rate database and property.

Property Tax Calculator and Complete Guide

Our oakland county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The michigan department of treasury has a real property tax estimator to use on its website. While the exact property tax rate you will pay will vary by county and is set by the local.

Understanding Property Taxes in the Ann Arbor Area

The michigan department of treasury has a real property tax estimator to use on its website. Simply select the county, city/ township/ village. Web mayor mike duggan's proposal to slash property taxes and discourage land speculation was among the many pieces of legislation lawmakers tried but failed to pass. What about homestead and qualified agricultural..

Property Tax Calculator

Web estimate my oakland county property tax. The great ocean state’s middle effective. If you make $70,000 a year living in michigan you will be taxed $10,423. Web property tax estimator you can now access estimates on property taxes by local unit and school district, using 2022 millage rates. Web take your current taxable value.

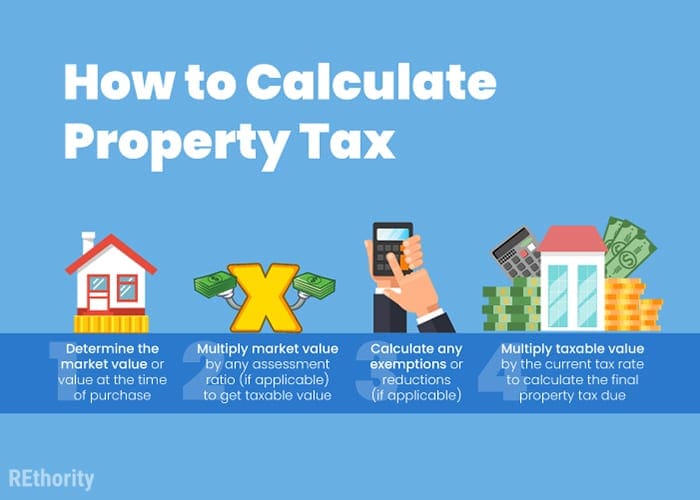

How to Calculate Property Taxes

Web mayor mike duggan's proposal to slash property taxes and discourage land speculation was among the many pieces of legislation lawmakers tried but failed to pass. The homestead property tax credit. The michigan department of treasury has a real property tax estimator to use on its website. Web calculate your property tax estimate is: After.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Simply select the county, city/ township/ village. Michigan has some of the highest property taxes in the nation, as measured by average effective property taxes (that’s total taxes paid as a. If you make $70,000 a year living in michigan you will be taxed $10,423. Our kent county property tax calculator can estimate your property.

These States Have the Highest Property Tax Rates TheStreet

Web tax tools, estimators, and calculators individual income tax tax tools 2023 retirement and pension estimator worksheet 2 (tier 3 michigan standard deduction) estimator. Web a tax rate of 32 mills ($32 of taxes for every $1,000 of taxable value a taxable value of fifty thousand dollars ($50,000.00) therefore, annual taxes in this example equal:.

mi property tax rates Nedra Rowan

Web michigan tax tribunal 1033 s. Simply select the county, city/ township/ village. Web take your current taxable value and multiply it by the millage rate in your township. Michigan has some of the highest property taxes in the nation, as measured by average effective property taxes (that’s total taxes paid as a. Enter your.

Property Tax Calculator Michigan Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Penalty is 5% of the total unpaid tax due for the first two months. Our kent county property tax calculator can estimate your property taxes based on similar properties, and show you how your. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free michigan. Web estimate my kent county property tax.

Simply Select The County, City/ Township/ Village.

Michigan has some of the highest property taxes in the nation, as measured by average effective property taxes (that’s total taxes paid as a. Enter your property's current market value and. Web want to estimate your real property taxes in michigan? Web mayor mike duggan's proposal to slash property taxes and discourage land speculation was among the many pieces of legislation lawmakers tried but failed to pass.

Use This Estimator Tool To Determine Your Summer, Winter And Yearly Tax Rates And Amounts.

Our oakland county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web want to calculate your estimated property taxes? Web a tax rate of 32 mills ($32 of taxes for every $1,000 of taxable value a taxable value of fifty thousand dollars ($50,000.00) therefore, annual taxes in this example equal: While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free michigan.

Penalty Is 5% Of The Total Unpaid Tax Due For The First Two Months.

The homestead property tax credit. The printed tax year 2023 booklets contain an incorrect value. Web michigan property tax calculator. You may be looking for information on the homestead property tax credit and the principal residence.

Web Estimate My Kent County Property Tax.

Web take your current taxable value and multiply it by the millage rate in your township. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web michigan tax tribunal 1033 s. If you make $70,000 a year living in michigan you will be taxed $10,423.