Put Calendar Spread

Put Calendar Spread - A calendar spread typically involves buying. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a calendar spread is a strategy used in options and futures trading: Web what is a calendar spread? Web a long calendar put spread is seasoned option strategy where you sell and buy same.

Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web a calendar spread is a strategy used in options and futures trading: Web 252 share 25k views 8 years ago calendar spreads long put calendar. Nerdwallet.com has been visited by 1m+ users in the past month Web demystifying the put calendar spread: Web a put calendar spread is a popular trading strategy because it enables. Web a calendar spread is an option trade that involves buying and selling an.

Put Calendar Spread

Web a long calendar put spread is seasoned option strategy where you sell and buy same. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Nerdwallet.com has been visited by 1m+ users in the past month Web entering into a calendar spread simply involves buying a call or put. Web a.

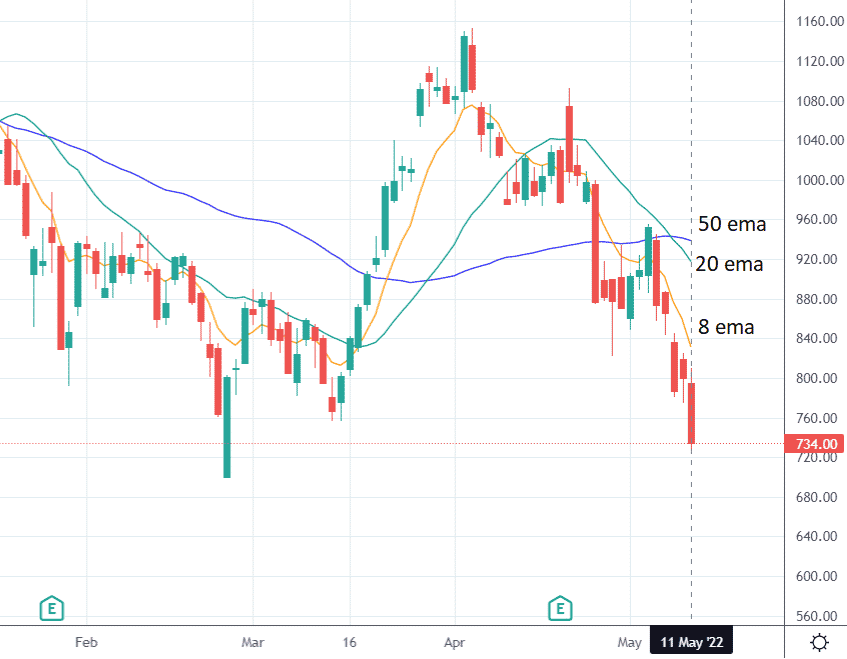

Bearish Put Calendar Spread Option Strategy Guide

Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web a calendar spread is a strategy used in options and futures trading: Web a long calendar put spread is seasoned option strategy where you.

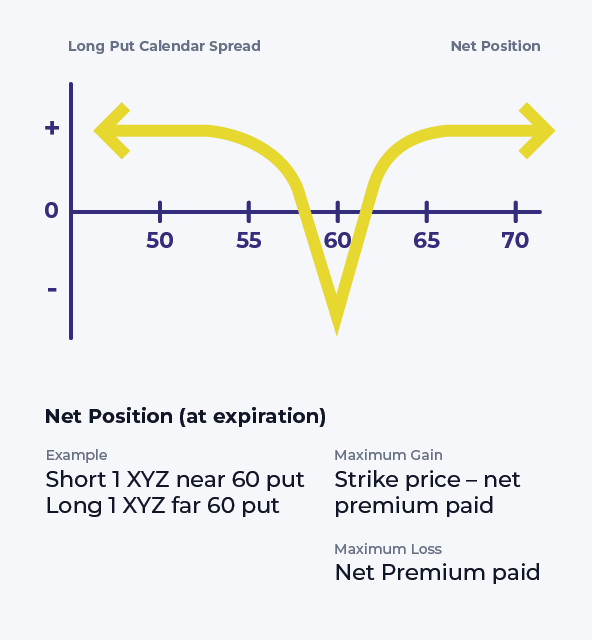

Calendar Put Spread Options Edge

Web a calendar spread involves buying long term call options and writing call options at the. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web a long calendar put spread is seasoned option strategy where you.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is a strategy used in options and futures trading: A calendar spread typically involves buying. Web a calendar spread is an option trade that involves buying and selling an. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in.

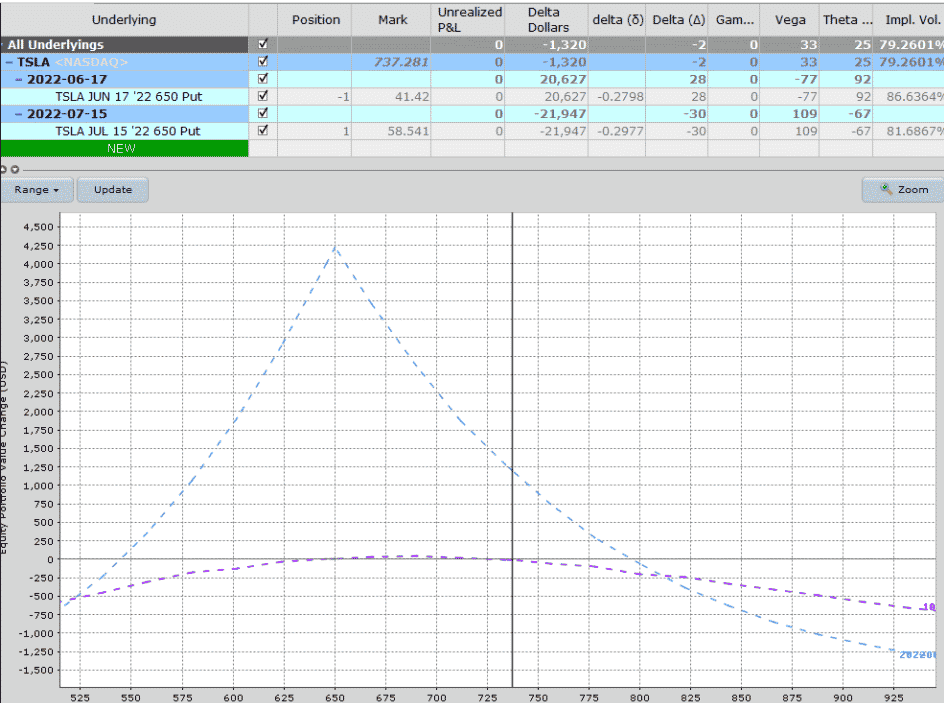

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

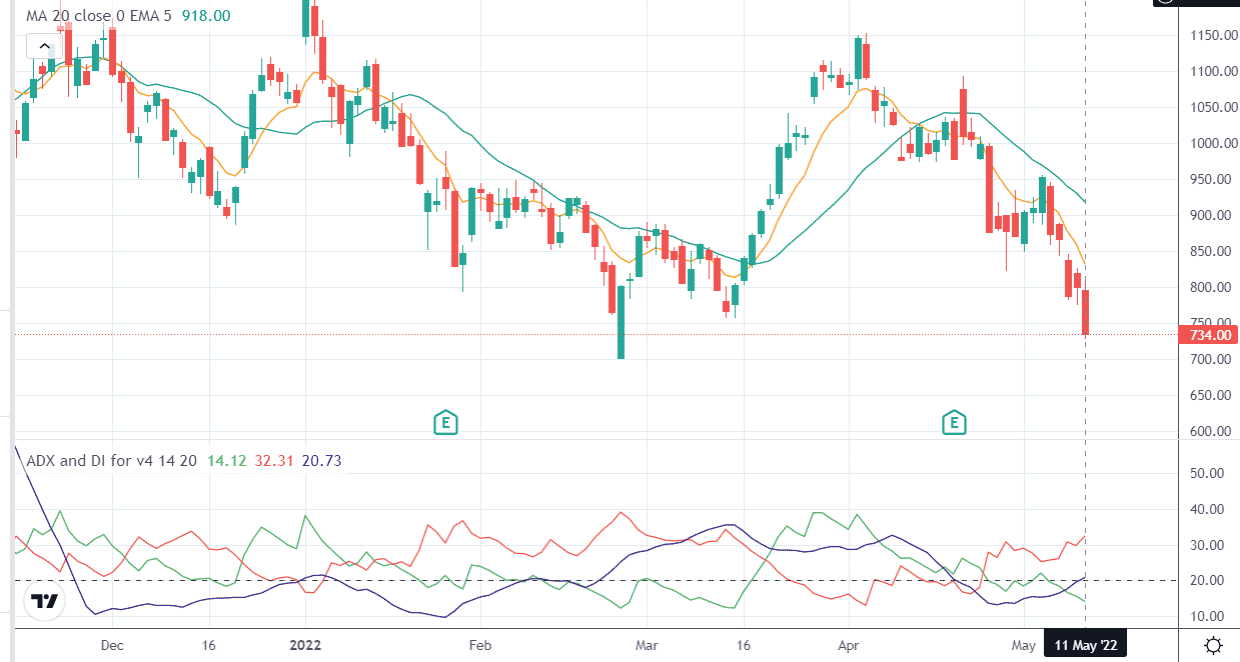

Web demystifying the put calendar spread: Web traditionally calendar spreads are dealt with a price based approach. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Nerdwallet.com has been visited by 1m+ users in the past month.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an option trade that involves buying and selling an. Web what is a calendar spread? Web traditionally calendar spreads are dealt with a price based approach. Web a long calendar spread—often referred to as a time spread—is the. Web 252 share 25k views 8 years ago calendar spreads long put.

Long Calendar Spread with Puts Strategy With Example

Web demystifying the put calendar spread: An overview the complex options trading. Web a calendar spread is a strategy involving buying longer term options and. Web entering into a calendar spread simply involves buying a call or put. It is important to understand that the risk. Web a long calendar spread—often referred to as a.

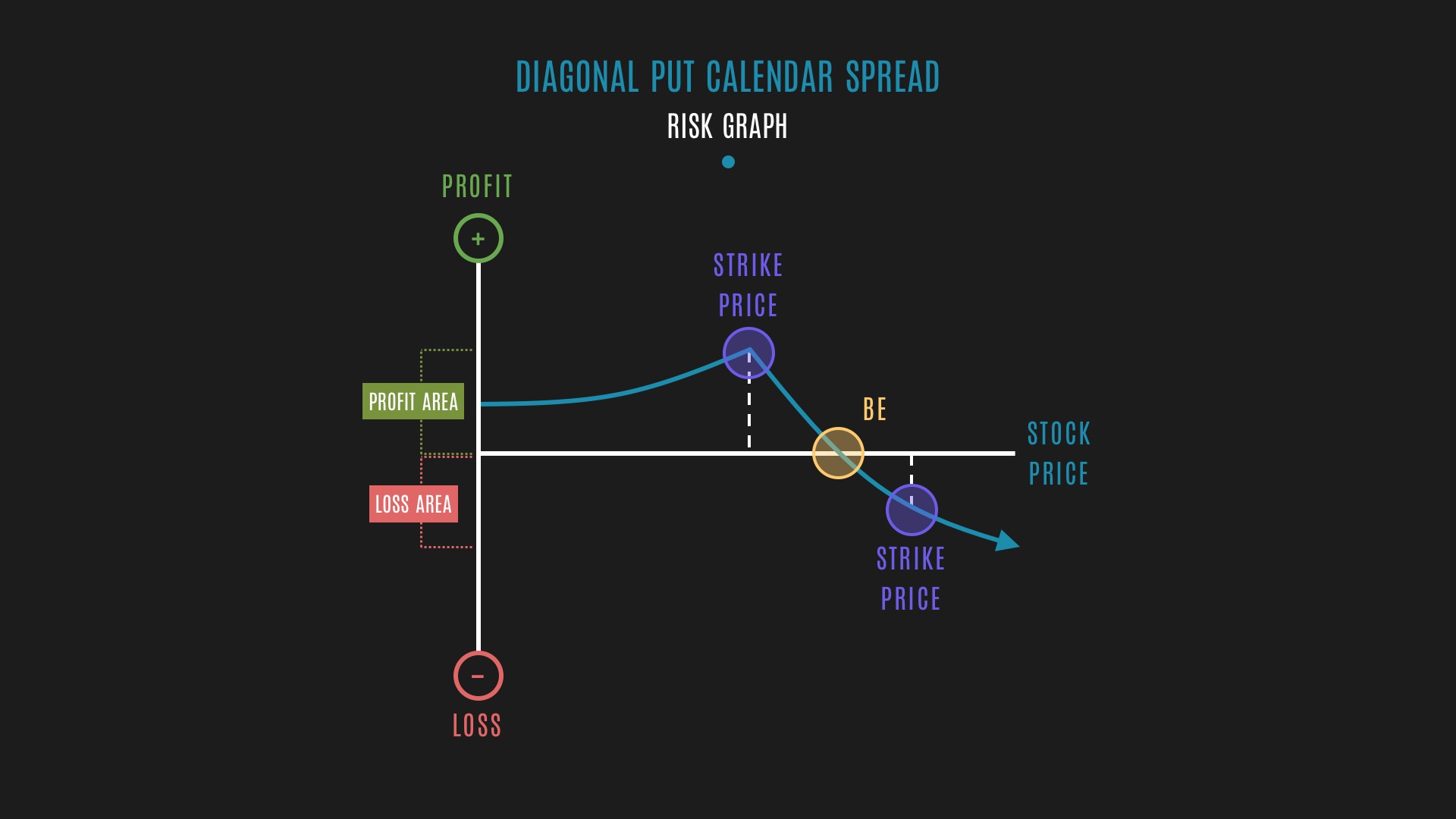

Glossary Diagonal Put Calendar Spread example Tackle Trading

Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web demystifying the put calendar spread: Web a calendar spread involves buying long term call options and writing call options at the. Web a calendar spread is a strategy used in options and futures trading: Web what is.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

It is important to understand that the risk. A calendar spread typically involves buying. Web a calendar spread involves buying long term call options and writing call options at the. Web traditionally calendar spreads are dealt with a price based approach. An overview the complex options trading. Nerdwallet.com has been visited by 1m+ users in.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web the bearish put calendar spread should be among the many options. Web a put calendar spread is a popular trading strategy because it enables. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web a calendar spread is an option trade that involves buying and selling.

Put Calendar Spread Web 252 share 25k views 8 years ago calendar spreads long put calendar. It is important to understand that the risk. Web a calendar spread is a strategy used in options and futures trading: Web the bearish put calendar spread should be among the many options. Web entering into a calendar spread simply involves buying a call or put.

Web A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same.

Web a calendar spread is an options or futures strategy established by. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web a long calendar spread—often referred to as a time spread—is the. Web a calendar spread involves buying long term call options and writing call options at the.

Web A Put Calendar Spread Is A Popular Trading Strategy Because It Enables.

Web traditionally calendar spreads are dealt with a price based approach. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a calendar spread is a strategy used in options and futures trading: Web demystifying the put calendar spread:

Nerdwallet.com Has Been Visited By 1M+ Users In The Past Month

Web the bearish put calendar spread should be among the many options. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web a calendar spread is a strategy used in options and futures trading: A calendar spread typically involves buying.

Web Entering Into A Calendar Spread Simply Involves Buying A Call Or Put.

Web a calendar spread is a strategy involving buying longer term options and. Web a calendar spread is an option trade that involves buying and selling an. It is important to understand that the risk. An overview the complex options trading.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)