Qualified Business Income Deduction Calculator

Qualified Business Income Deduction Calculator - The standard deduction for 2023 is: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Wow, new 20 percent deduction for business income. Don’t worry about which worksheet your return qualifies for. the irs has set january 23, 2023 as the official start to tax filing season.

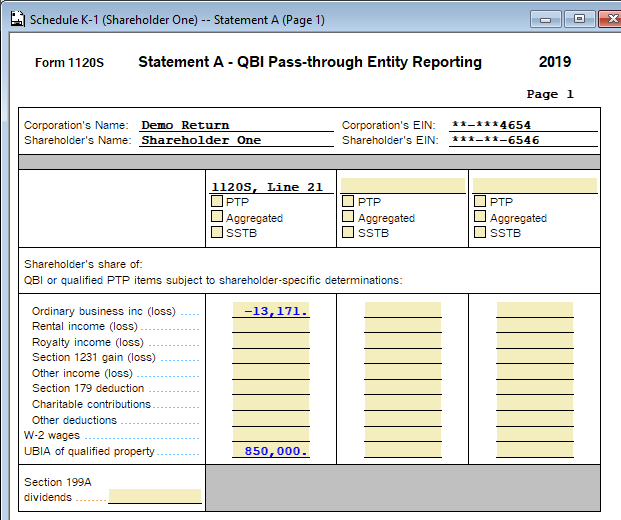

You can get help from the qbi calculator to easily calculate your deductions. Don’t worry about which worksheet your return qualifies for. Use separate schedules a, b, c, and/or d, as. Web 20% of qualified business income: Web the qualified business income deduction (qbi) allows eligible business owners and some trusts and estates to deduct up to 20% of their qbi, plus 20% of qualified real. Web updated march 23, 2023. Jul 15, 2021 • 4 min read.

How to enter and calculate the qualified business deduction

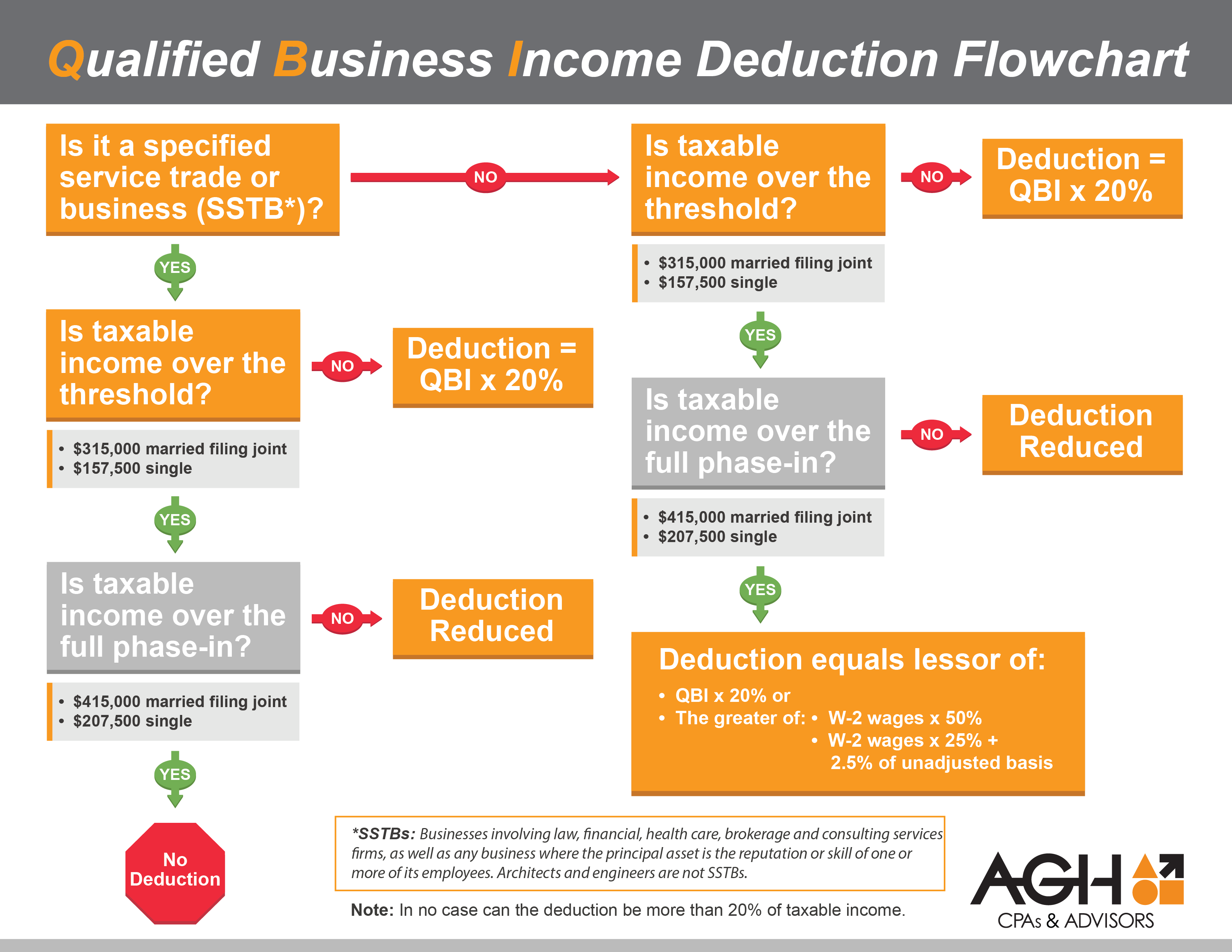

A 20% qbi deduction is a tax. Qbi = $300,000 (and 20% of qbi =. Total taxable income = $400,000; Web for tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “single” or “married filing jointly,” and included in their federal adjusted. Web this worksheet is designed for tax.

Qualified Business (QBI) Deduction

Web jack and jill are joint filers, and here’s the info they’ll need to calculate their qbi deduction: $27,700 for married couples filing jointly or. Web 20% of qualified business income: $13,850 for single or married filing separately. Web qualified business income (qbi) for definition of qualified property see tax reform: Web the income threshold.

What Is the QBI Tax Deduction and Who Can Claim It?

Web updated march 23, 2023. Web standard deduction amounts. Using the simplified worksheet or the complex worksheet. Jul 15, 2021 • 4 min read. You can deduct up to 60% of your. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of.

What Is The Deduction For Qualified Business businesser

Jul 15, 2021 • 4 min read. Web standard deduction amounts. The standard deduction for 2023 is: Use this form to figure your qualified business income deduction. The qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new. Web jack.

Update On The Qualified Business Deduction For Individuals

Qbi = $300,000 (and 20% of qbi =. You can deduct up to 60% of your. Jul 15, 2021 • 4 min read. Using the simplified worksheet or the complex worksheet. Web 20% of qualified business income: Web jack and jill are joint filers, and here’s the info they’ll need to calculate their qbi deduction:.

How to enter and calculate the qualified business deduction

Web for tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “single” or “married filing jointly,” and included in their federal adjusted. the irs has set january 23, 2023 as the official start to tax filing season. Web 20% of qualified business income: Web jack and jill are joint.

Understanding the New Qualified Business Deduction

Web updated march 23, 2023. Web for tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “single” or “married filing jointly,” and included in their federal adjusted. Jul 15, 2021 • 4 min read. How to calculate a qualified business income deduction. Web 20% of qualified business income: Total.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy

Use this form to figure your qualified business income deduction. The standard deduction for 2023 is: $13,850 for single or married filing separately. Web when the taxpayer’s income (including taxpayers that are considered specified service businesses) is below $157,500 or $315,000 for married filing jointly,. Qbi = $300,000 (and 20% of qbi =. Jul 15,.

How Does The 20 QBID Work? QBID Calculator What Qualifies

Web jack and jill are joint filers, and here’s the info they’ll need to calculate their qbi deduction: Web 20% of qualified business income: The qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new. Qbi = $300,000 (and 20%.

Qualified Business Deduction QBI Calculator 2023 2024

Using the simplified worksheet or the complex worksheet. Web to calculate the qualified business income (qbi) deduction, you must complete your personal tax return and calculate the net income from your business. Web the income threshold started in 2018 at $315,000 for a married couple filing jointly and $157,500 for single individuals, married people filing.

Qualified Business Income Deduction Calculator Web 20% of qualified business income: Don’t worry about which worksheet your return qualifies for. A 20% qbi deduction is a tax. The qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new. You can get help from the qbi calculator to easily calculate your deductions.

Web This Worksheet Is Designed For Tax Professionals To Evaluate The Type Of Legal Entity A Business Should Consider, Including The Application Of The Qualified Business Income.

Web the income threshold started in 2018 at $315,000 for a married couple filing jointly and $157,500 for single individuals, married people filing separately and heads of. The standard deduction for 2023 is: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web updated march 23, 2023.

Wow, New 20 Percent Deduction For Business Income.

Use this form to figure your qualified business income deduction. A 20% qbi deduction is a tax. The qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new. $13,850 for single or married filing separately.

Web Standard Deduction Amounts.

Web the qualified business income deduction (qbi) allows eligible business owners and some trusts and estates to deduct up to 20% of their qbi, plus 20% of qualified real. Web qualified business income (qbi) for definition of qualified property see tax reform: $27,700 for married couples filing jointly or. You can get help from the qbi calculator to easily calculate your deductions.

How To Calculate A Qualified Business Income Deduction.

Using the simplified worksheet or the complex worksheet. You can deduct up to 60% of your. Web 20% of qualified business income: the irs has set january 23, 2023 as the official start to tax filing season.