R&D Credit Calculation

R&D Credit Calculation - Paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. Web our r&d tax credit calculator estimates the tax relief you can claim under the sme scheme. Traditional method under the traditional method, the credit is 20% of the company’s. Web who is eligible for the r&d tax credit? Web the research and development (r&d) tax credit is one of the most significant domestic tax credits remaining under current tax law.

As part of the process, they need to identify qualifying expenses and. Web businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Traditional method under the traditional method, the credit is 20% of the company’s. Web how adp can help maximize your capture of eligible r&d tax credits. First, determine if your business is eligible. Adp helps make claiming r&d tax credits simple and predictable. Web use our simple calculator to see if you qualify for the r&d tax credit and if so, by how much.

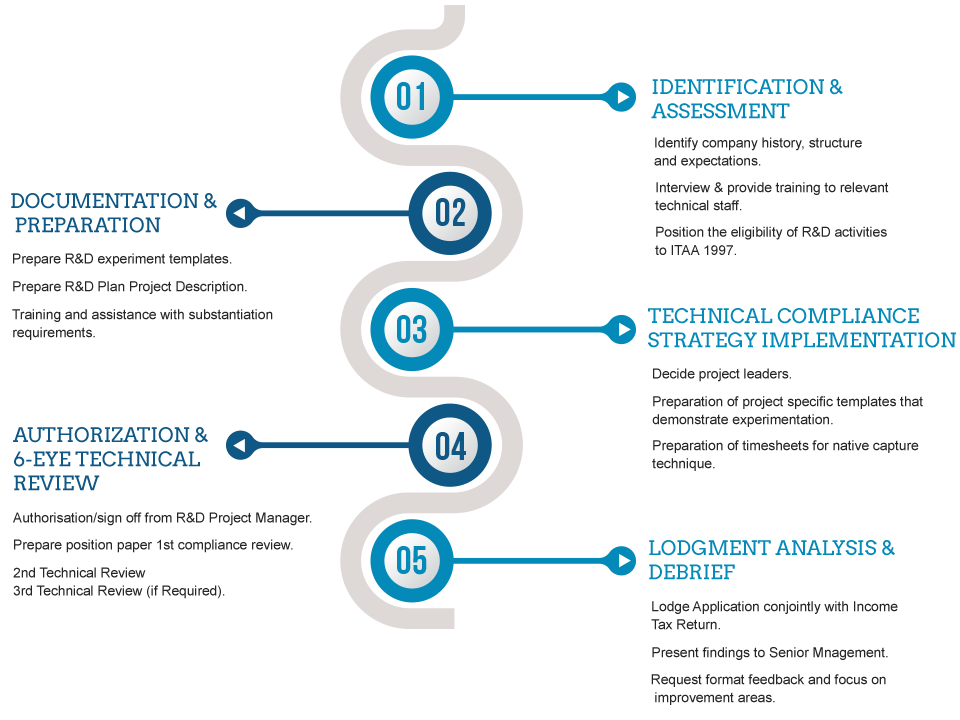

The R&D Tax Credit Process 5 Easy Steps Swanson Reed UK

Wondering how to calculate the r&d tax credit? Estimate your federal and state r&d tax credit with our free tax credit calculator. Complete in a few simple steps! Adp helps make claiming r&d tax credits simple and predictable. Web use our simple calculator to see if you qualify for the r&d tax credit and if.

R&D Tax Credits Calculator Free To Use No Sign Up Counting King

Let kruze consulting handle your startup’s r&d tax. Paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. No industry or business type is. Wondering how to calculate the r&d tax credit? As part of the process, they need to identify qualifying expenses and. Web in the traditional.

R&D Tax Credit Calculator Strike Tax Advisory

Let kruze consulting handle your startup’s r&d tax. These differences are configured within our proprietary calculator. No industry or business type is. Wondering how to calculate the r&d tax credit? This is the scheme that covers most startups, and it offers a higher rate of tax. Web the research and development (r&d) tax credit is.

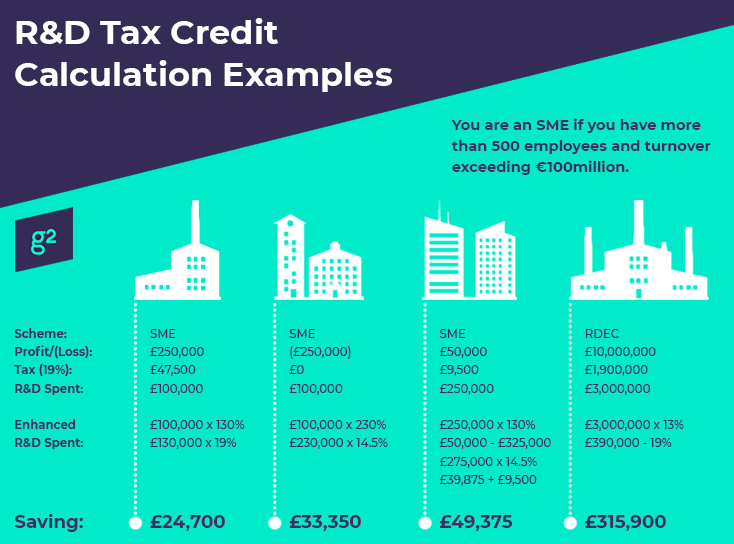

r&d tax credit calculation example uk Rod Rhea

Web the research and development (r&d) tax credit is one of the most significant domestic tax credits remaining under current tax law. Traditional method under the traditional method, the credit is 20% of the company’s. There are r&d credit limitations when finding the qualified expenses associated with determining a credit. Identify your qualifying r&d spend.

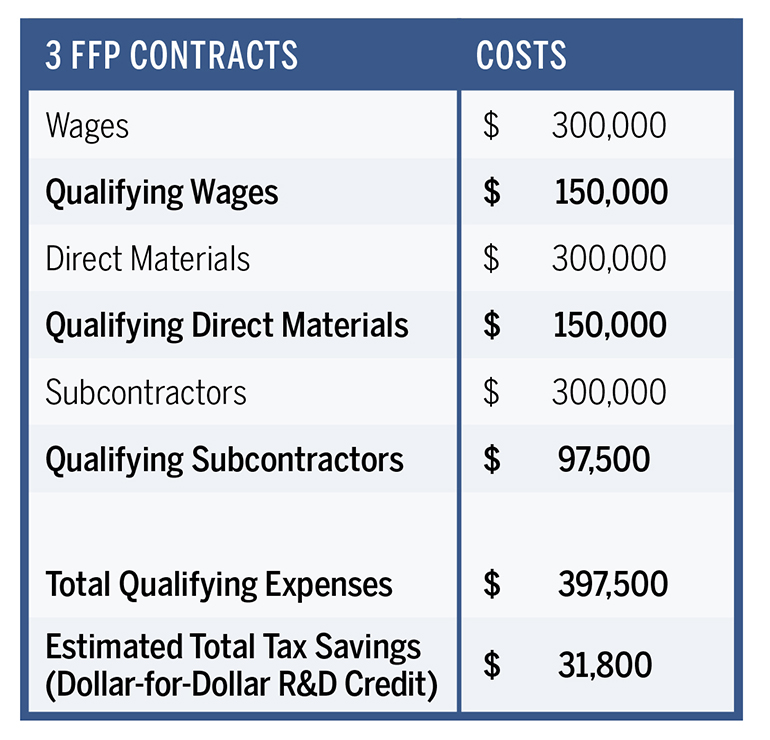

Navigating the R&D Tax Credit

Industry leadercorporate taxproduct developmentcloud computing Complete in a few simple steps! Web businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. These differences are configured within our proprietary calculator. Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form.

R&D tax credit calculator Calculate your R&D tax credit estimate in

Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes. There are r&d credit limitations when finding the qualified expenses associated with determining a credit. Industry leadercorporate taxproduct developmentcloud computing This is the scheme that covers most startups, and it offers.

r&d tax credit calculation example Simple Choice Blogged Photo Exhibition

One of the leading reasons. Adp helps make claiming r&d tax credits simple and predictable. Let kruze consulting handle your startup’s r&d tax. Web r&d tax credit calculation example. As part of the process, they need to identify qualifying expenses and. First, determine if your business is eligible. Traditional method under the traditional method, the.

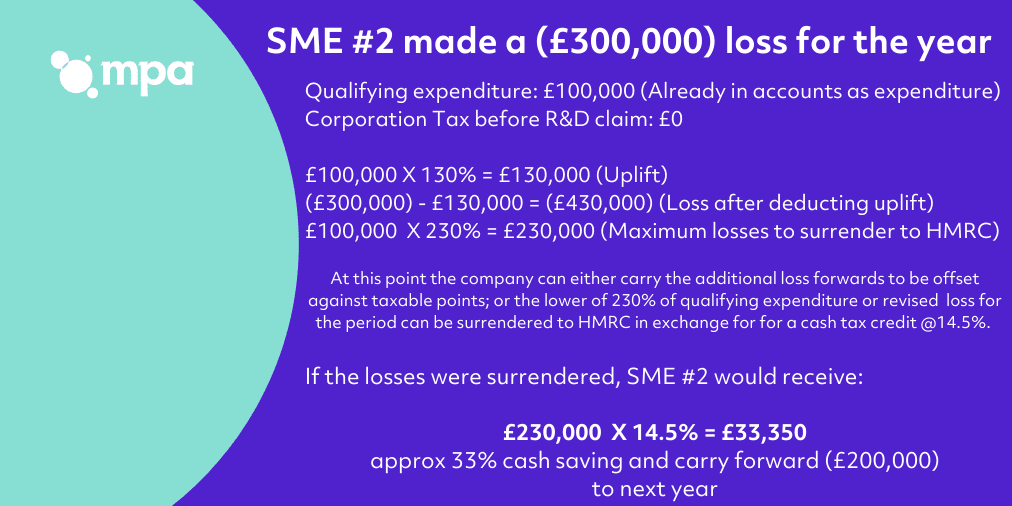

R&D tax credit calculation examples MPA

Web learn how to calculate the federal research and development (r&d) tax credit using the regular research credit (rrc) method or the alternative simplified credit (asc). No industry or business type is. One of the leading reasons. Traditional method under the traditional method, the credit is 20% of the company’s. Web use our simple calculator.

An Infographic on HMRC R&D Tax Credits RDP Associates

Let kruze consulting handle your startup’s r&d tax. Industry leadercorporate taxproduct developmentcloud computing Complete in a few simple steps! The results from our r&d tax credit calculator. Paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. This is the scheme that covers most startups, and it offers.

R&D Tax Credit Claim Template For Smes

Estimate your federal and state r&d tax credit with our free tax credit calculator. Organizations that seek to develop new or improve products. Paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. Web each industry experiences varying levels of research, development, and innovation. Web learn how to.

R&D Credit Calculation This is the scheme that covers most startups, and it offers a higher rate of tax. Web businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Web the research and development (r&d) tax credit is one of the most significant domestic tax credits remaining under current tax law. Web our r&d tax credit calculator estimates the tax relief you can claim under the sme scheme. No industry or business type is.

Web R&D Tax Credit Calculation:

Web businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. This is the scheme that covers most startups, and it offers a higher rate of tax. One of the leading reasons. Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes.

First, Determine If Your Business Is Eligible.

Web if a company’s activities qualify for the r&d tax credit, there are two ways to calculate it. As part of the process, they need to identify qualifying expenses and. Web who is eligible for the r&d tax credit? The results from our r&d tax credit calculator.

Organizations That Seek To Develop New Or Improve Products.

There are r&d credit limitations when finding the qualified expenses associated with determining a credit. Web r&d tax credit calculation example. Web the research and development (r&d) tax credit is one of the most significant domestic tax credits remaining under current tax law. Estimate your federal and state r&d tax credit with our free tax credit calculator.

Web In The Traditional Or The Regular Research Credit Method, The R&D Credit Amounts To 20% Of A Company’s Current Year Qualified Research Expenses Over A Base Amount.

Traditional method under the traditional method, the credit is 20% of the company’s. Industry leadercorporate taxproduct developmentcloud computing Paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. Industry leadercorporate taxproduct developmentcloud computing