R&D Tax Credit Calculation Example

R&D Tax Credit Calculation Example - Web r&d tax credit calculation examples step 1: It will talk about the rules and regulations of such a. Web peter corley jason banks this guide is to help those who might claim for research and development tax relief. The r&d tax credit scheme can provide valuable cash for your. Traditional method under the traditional method, the credit is 20% of the company’s.

Traditional method under the traditional method, the credit is 20% of the company’s. The r&d tax credit scheme can provide valuable cash for your. Average annual qre gross receipts over four years. Web r&d tax credit calculation examples step 1: Web the quick answer the research and development tax credit (r&d credit) is a general business credit available to businesses that created or improved a product or. £1,000,000 your spend estimate £50,000 previous explore more? It will talk about the rules and regulations of such a.

12+ The Best Ways How To Calculate R&D Tax Credit

It will talk about the rules and regulations of such a. The r&d tax credit scheme can provide valuable cash for your. Web estimate your federal and state r&d tax credit with our free tax credit calculator. Web home r&d tax credit calculator are you getting the full benefit of the r&d tax credit? The.

How To Be Proactive With R&D Tax Credits Accountants Guide

Web wondering how to calculate the r&d tax credit? The biggest part of an r&d tax credit. The results from our r&d tax credit calculator are only estimated figures and. 22, 2017, president trump signed the tax cuts and job act of 2017 (tcja) into law. One of the leading reasons businesses fail to benefit.

Hedy Brent

Web wondering how to calculate the r&d tax credit? Web home r&d tax credit calculator are you getting the full benefit of the r&d tax credit? Web £ calculate your claim estimate: Web one year ago, on dec. Easily predict how much you could be eligible for with our r&d tax credit calculator. Identify your.

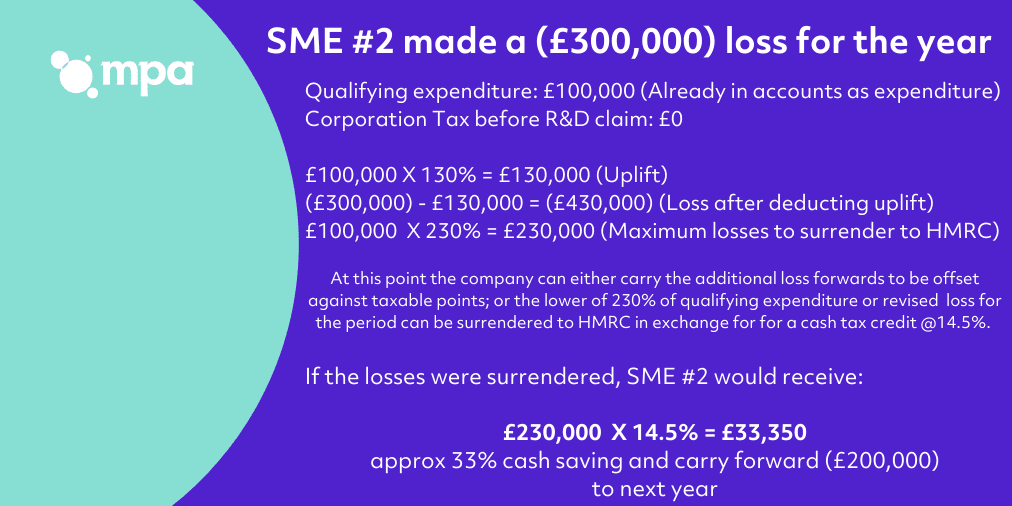

R&D tax credit calculation examples MPA

Web one year ago, on dec. Average annual qre gross receipts over four years. First, determine if your business is eligible. Traditional method under the traditional method, the credit is 20% of the company’s. Expense estimatorfile with confidenceeasy and accurateaudit support guarantee Web the federal research and development (r&d) tax credit results in a dollar.

PPT The R&D Tax Credit PowerPoint Presentation, free download ID

£1,000,000 your spend estimate £50,000 previous explore more? The money companies spend on technology and innovation can offset payroll and. Web amount cashed in for tax credit. Web estimate your federal and state r&d tax credit with our free tax credit calculator. Traditional method under the traditional method, the credit is 20% of the company’s..

R&D Tax Credit Rates For RDEC Scheme ForrestBrown

Web paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. Web home r&d tax credit calculator are you getting the full benefit of the r&d tax credit? First, determine if your business is eligible. Traditional method under the traditional method, the credit is 20% of the company’s..

r&d tax credit calculation example uk Rod Rhea

Web wondering how to calculate the r&d tax credit? It will talk about the rules and regulations of such a. 22, 2017, president trump signed the tax cuts and job act of 2017 (tcja) into law. The results from our r&d tax credit calculator are only estimated figures and. Web paul sundin, cpa october 26,.

R&D tax credit calculation examples MPA

This legislation provided the most sweeping changes to. Average annual qre gross receipts over four years. Web peter corley jason banks this guide is to help those who might claim for research and development tax relief. The r&d tax credit scheme can provide valuable cash for your. (£208,000) hmrc will allow the company to cash.

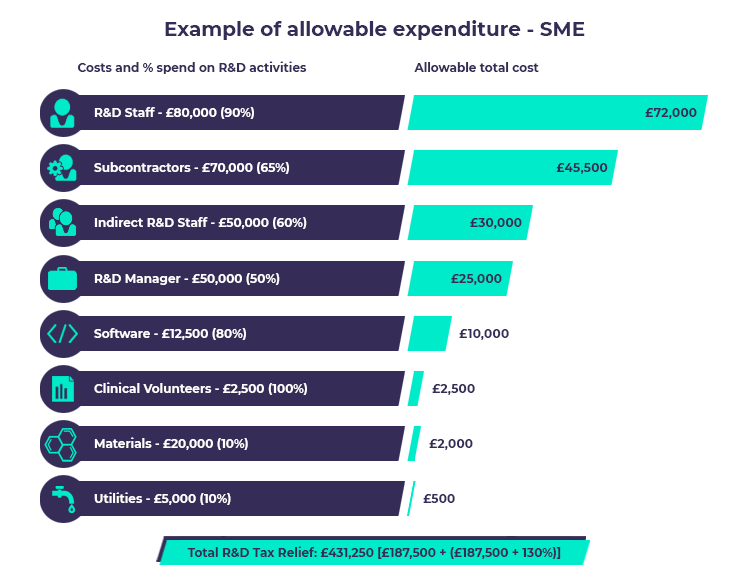

R&D Tax Credits The Essential Guide (2020)

First, determine if your business is eligible. Web home r&d tax credit calculator are you getting the full benefit of the r&d tax credit? Web the quick answer the research and development tax credit (r&d credit) is a general business credit available to businesses that created or improved a product or. This legislation provided the.

R&D Tax Credits explained Eligibility, definition and calculation

£1,000,000 your spend estimate £50,000 previous explore more? It is a great way for business owners to take advantage of this. Web one year ago, on dec. One of the leading reasons businesses fail to benefit from r&d tax. Web estimate your federal and state r&d tax credit with our free tax credit calculator. (£208,000).

R&D Tax Credit Calculation Example Web wondering how to calculate the r&d tax credit? Web if a company’s activities qualify for the r&d tax credit, there are two ways to calculate it. First, determine if your business is eligible. Our tax credit calculator requires just a few critical pieces of. Web the federal research and development (r&d) tax credit results in a dollar for dollar reduction in a company’s tax liability for certain domestic expenses.

Web R&D Tax Credit Calculator.

The money companies spend on technology and innovation can offset payroll and. It is a great way for business owners to take advantage of this. £1,000,000 your spend estimate £50,000 previous explore more? Web the federal research and development (r&d) tax credit results in a dollar for dollar reduction in a company’s tax liability for certain domestic expenses.

Traditional Method Under The Traditional Method, The Credit Is 20% Of The Company’s.

Web amount cashed in for tax credit. Web home r&d tax credit calculator are you getting the full benefit of the r&d tax credit? Web paul sundin, cpa october 26, 2022 r&d tax credits have been gaining in popularity in recent years. First, determine if your business is eligible.

Average Annual Qre Gross Receipts Over Four Years.

Our tax credit calculator requires just a few critical pieces of. The biggest part of an r&d tax credit. Web £ calculate your claim estimate: One of the leading reasons businesses fail to benefit from r&d tax.

Identify Your Qualifying R&D Spend (Qualifying Expenditure, Or Qe).

This legislation provided the most sweeping changes to. 22, 2017, president trump signed the tax cuts and job act of 2017 (tcja) into law. The results from our r&d tax credit calculator are only estimated figures and. The r&d tax credit scheme can provide valuable cash for your.

.jpg)