R&D Tax Credit Calculation

R&D Tax Credit Calculation - Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. You could be eligible to claim back up to 33% of your research and development spend from hmrc. Industry leadercorporate taxproduct developmentcloud computing Web learn how to calculate the federal research and development (r&d) tax credit using the regular research credit (rrc) method or the alternative simplified credit (asc). Web learn how to calculate the r&d tax credit for your business using two methods:

Business activities that improve products, processes or services in a way that requires some level of experimentation,. Current year qres = $10,000. Learn how to get the full benefit of the credit by using the stages of your. Web however, many businesses may find that the extra work is worth the effort when claiming the r&d tax credit. Here’s how to calculate the r&d credit using the. Discover how much you can claim in r&d tax credits for expenditures on the development of new software, technology, products and processes. Web r&d tax credit calculator | clarus r+d estimate your r&d tax credit see if you qualify and estimate your potential benefit with our r&d tax credit calculator.

R&D Tax Credit Explained 2022 Tax Credits Calculation with Free

Web so how do you know whether you’re eligible? The results from our r&d tax credit calculator. Web r&d tax credit calculator. What activities make you eligible for the r&d tax credit? Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. Over the past.

R&D Tax Credits explained Eligibility, definition and calculation

Find out who can claim it, what expenses can be used, and how to get. What activities make you eligible for the r&d tax credit? Many activities qualify for the r&d tax credit and the eide bailly r&d tax. Web the federal research and development (r&d) tax credit results in a dollar for dollar reduction.

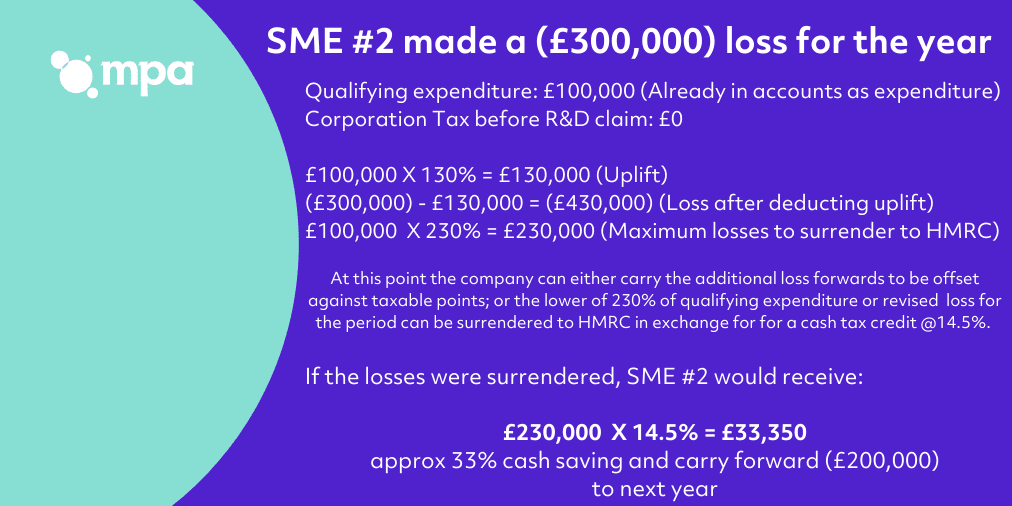

R&D tax credit calculation examples MPA

Discover how much you can claim in r&d tax credits for expenditures on the development of new software, technology, products and processes. Business activities that improve products, processes or services in a way that requires some level of experimentation,. Web use this simple calculator to see if you qualify for the r&d tax credit and.

R&D Tax Credit Calculator Strike Tax Advisory

Web the federal research and development (r&d) tax credit results in a dollar for dollar reduction in a company’s tax liability for certain domestic expenses. Discover how much you can claim in r&d tax credits for expenditures on the development of new software, technology, products and processes. Learn how to get the full benefit of.

R&D Tax Credit Rates For RDEC Scheme ForrestBrown

Let kruze consulting handle your startup’s r&d tax. Discover how much you can claim in r&d tax credits for expenditures on the development of new software, technology, products and processes. Here’s how to calculate the r&d credit using the. What activities make you eligible for the r&d tax credit? Web use this simple calculator to.

R&D Tax Credit Guidance for SMEs Market Business News

Web r&d tax credit calculator estimate your federal and state r&d tax credit with our free tax credit calculator. Minimum base amount = 50% of current year qres = 0.5 * $10,000 = $5,000. Web learn how to calculate the r&d tax credit for your business using two methods: Web the federal research and development.

R&D Tax Credits Calculation Examples G2 Innovation

Web the federal research and development (r&d) tax credit results in a dollar for dollar reduction in a company’s tax liability for certain domestic expenses. What activities make you eligible for the r&d tax credit? Many activities qualify for the r&d tax credit and the eide bailly r&d tax. Web so how do you know.

R&D tax credit calculator Calculate your R&D tax credit estimate in

Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. Here’s how to calculate the r&d credit using the. Web learn how to calculate the r&d tax credit for your business using two methods: Business activities that improve products, processes or services in a way.

R&D tax credit calculation examples MPA

Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. Industry leadercorporate taxproduct developmentcloud computing Business activities that improve products, processes or services in a way that requires some level of experimentation,. For the current year (2023): Web r&d.

12+ The Best Ways How To Calculate R&D Tax Credit

Find out who can claim it, what expenses can be used, and how to get. Minimum base amount = 50% of current year qres = 0.5 * $10,000 = $5,000. Web how do you calculate the r&d tax credit? What activities make you eligible for the r&d tax credit? Web r&d tax credit calculator |.

R&D Tax Credit Calculation Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. The results from our r&d tax credit calculator. Web r&d tax credit calculator | clarus r+d estimate your r&d tax credit see if you qualify and estimate your potential benefit with our r&d tax credit calculator. Even if the us senate passes the bipartisan business tax bill the house ok’d last week, companies will still have years of lingering questions. Many activities qualify for the r&d tax credit and the eide bailly r&d tax.

Many Activities Qualify For The R&D Tax Credit And The Eide Bailly R&D Tax.

Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. Even if the us senate passes the bipartisan business tax bill the house ok’d last week, companies will still have years of lingering questions. Industry leadercorporate taxproduct developmentcloud computing Web r&d tax credit calculator.

Let Kruze Consulting Handle Your Startup’s R&D Tax.

Web learn how to calculate the r&d tax credit for your business using two methods: Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. Web so how do you know whether you’re eligible? Web learn how to calculate the federal research and development (r&d) tax credit using the regular research credit (rrc) method or the alternative simplified credit (asc).

Find Out Who Can Claim It, What Expenses Can Be Used, And How To Get.

Business activities that improve products, processes or services in a way that requires some level of experimentation,. Web businesses that invest in research and development (r&d) and want to reduce their tax liability via the federal r&d tax credit must be able to properly support claimed, qualified. Web r&d tax credit calculator | clarus r+d estimate your r&d tax credit see if you qualify and estimate your potential benefit with our r&d tax credit calculator. Industry leadercorporate taxproduct developmentcloud computing

Current Year Qres = $10,000.

Over the past year, there have been many developments regarding the research and development (r&d) tax credit and other tax treatment of r&d that can. Web however, many businesses may find that the extra work is worth the effort when claiming the r&d tax credit. Web how do you calculate the r&d tax credit? What activities make you eligible for the r&d tax credit?

.jpg)