Reasonable Compensation Calculator

Reasonable Compensation Calculator - Web the reasonable compensation s corp calculator is a valuable tool for s corporation owners to determine an appropriate salary for themselves. The cost approach, market approach, and income approach. Web why rcreports the fastest, most credible way to determine reasonable compensation. However, if cash or property or the right to. Web this video covers how to calculate what the amount of reasonable compensation is for your specific business.

Web the amount of the compensation will never exceed the amount received by the shareholder either directly or indirectly. You will complete a survey that takes into account all factors the irs suggests you use as well as other geographic and database information. Web the irs is particular about paying yourself a reasonable salary since your salary is subject to payroll taxes. Web choose between the three irs approved approaches and tap into the largest source of credible wage data in the country to quickly create accurate, customized reasonable. Web use our detailed calculator to determine how much you could save. However, if cash or property or the right to. There are a variety of ways to calculate your.

Reasonable Compensation Analysis RCReports

Web the irs recognizes three approved approaches to calculate reasonable compensation: Web with reasonable compensation, taxpayers need to thread the needle between paying an amount that is too high or too low depending on the situation. The cost approach, market approach, and income approach. Web a free calculator to convert a salary between its hourly,.

What is a reasonable salary for an S corp? With Jamie Trull!

Web why rcreports the fastest, most credible way to determine reasonable compensation. Salary.com has been visited by 10k+ users in the past month Web the amount of the compensation will never exceed the amount received by the shareholder either directly or indirectly. Web with reasonable compensation, taxpayers need to thread the needle between paying an.

Reasonable Compensation Analysis RCReports

Features packed with the tools and resources you need for success. Web why rcreports the fastest, most credible way to determine reasonable compensation. Web irc section 162 does not require that all business expenses be reasonable in amount, only compensation; Web choose between the three irs approved approaches and tap into the largest source of.

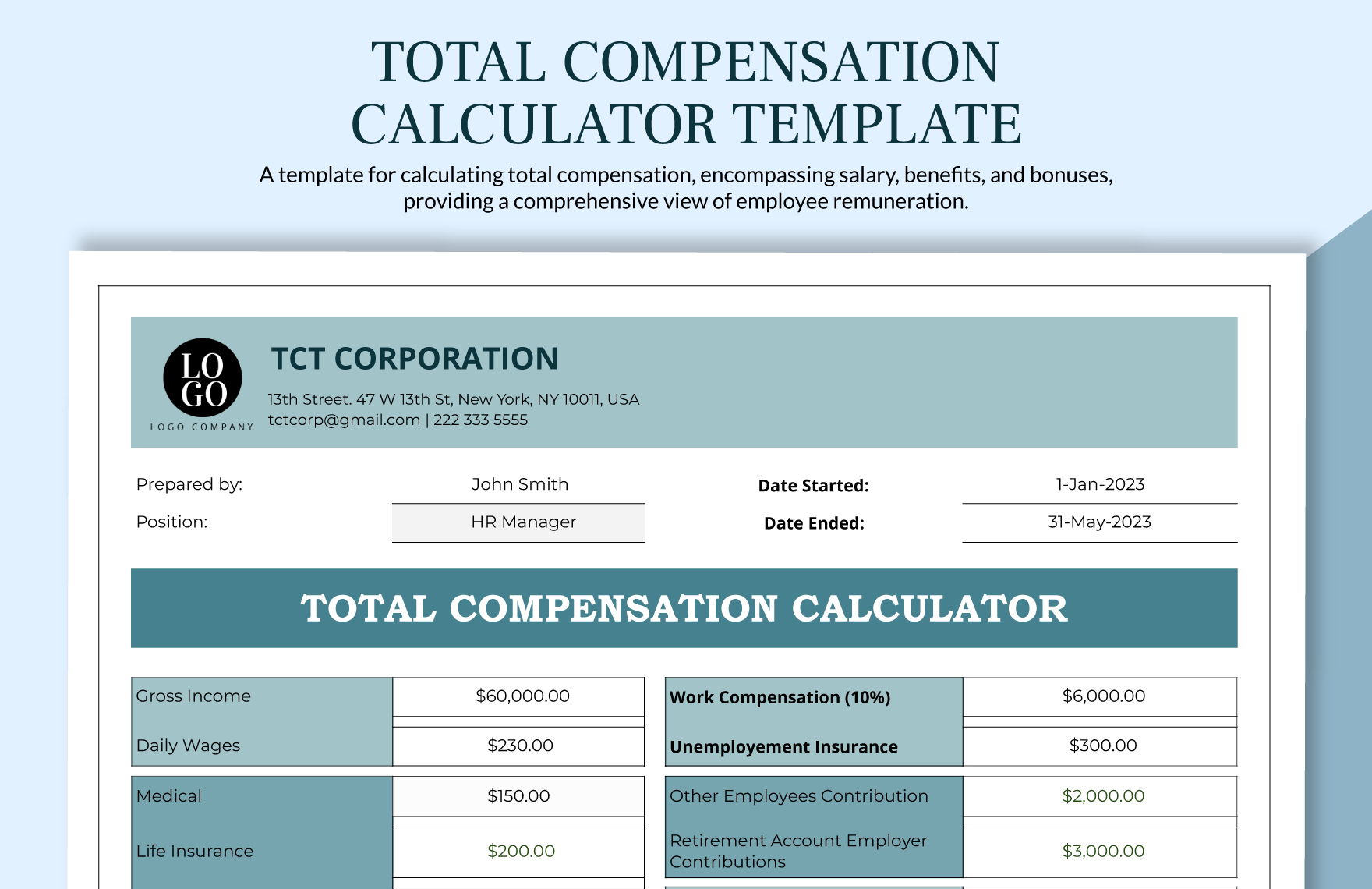

Total Compensation Calculator Measure & Improve Your Compensation Strategy

Salary.com has been visited by 10k+ users in the past month Web with reasonable compensation, taxpayers need to thread the needle between paying an amount that is too high or too low depending on the situation. Adjustments are made for holiday and vacation days. Web choose between the three irs approved approaches and tap into.

Reasonable Compensation Analysis RCReports

Although the definition of what constitutes a “reasonable” wage may seem subjective,. There are a variety of ways to calculate your. Then, you will be provided with a downloadable pdf report that you can use immediately to. Web purpose the purpose of this job aid is to assist irs valuation professionals (valuation analysts) in their.

The Cost Approach of Determining Reasonable Compensation RCReports

Then, you will be provided with a downloadable pdf report that you can use immediately to. Salary.com has been visited by 10k+ users in the past month The cost approach, market approach, and income approach. Web this video covers how to calculate what the amount of reasonable compensation is for your specific business. Features packed.

Determining Reasonable Compensation For An S Corporation MC Bell Law

Web with reasonable compensation, taxpayers need to thread the needle between paying an amount that is too high or too low depending on the situation. The irs requires that distributions and other payments by an s corporation to a corporate officer must be. However, if cash or property or the right to. Web the irs.

How is reasonable compensation calculated? [Scorporation owner W2s

Web the irs recognizes three approved approaches to calculate reasonable compensation: The cost approach, market approach, and income approach. This tool takes the guesswork out of determining compensation. Web s corp officer wages must be reasonable. Web this video covers how to calculate what the amount of reasonable compensation is for your specific business. Web.

How to Determine S Corporation Reasonable Compensation The

Web purpose the purpose of this job aid is to assist irs valuation professionals (valuation analysts) in their examination of reasonable compensation. Web the irs is particular about paying yourself a reasonable salary since your salary is subject to payroll taxes. Then, you will be provided with a downloadable pdf report that you can use.

Total Compensation Calculator Template Google Docs, Google Sheets

Features packed with the tools and resources you need for success. Web the amount of the compensation will never exceed the amount received by the shareholder either directly or indirectly. Although the definition of what constitutes a “reasonable” wage may seem subjective,. There are a variety of ways to calculate your. Web choose between the.

Reasonable Compensation Calculator However, the courts have held that an expense must not. Web the amount of the compensation will never exceed the amount received by the shareholder either directly or indirectly. Salary.com has been visited by 10k+ users in the past month Web the irs recognizes three approved approaches to calculate reasonable compensation: Web the irs is particular about paying yourself a reasonable salary since your salary is subject to payroll taxes.

Web Why Rcreports The Fastest, Most Credible Way To Determine Reasonable Compensation.

Although the definition of what constitutes a “reasonable” wage may seem subjective,. Web s corp officer wages must be reasonable. Salary.com has been visited by 10k+ users in the past month The irs requires that distributions and other payments by an s corporation to a corporate officer must be.

Web The Amount Of The Compensation Will Never Exceed The Amount Received By The Shareholder Either Directly Or Indirectly.

Salary.com has been visited by 10k+ users in the past month Web the reasonable compensation s corp calculator is a valuable tool for s corporation owners to determine an appropriate salary for themselves. Web a free calculator to convert a salary between its hourly, biweekly, monthly, and annual amounts. Web use our detailed calculator to determine how much you could save.

The Cost Approach, Market Approach, And Income Approach.

However, the courts have held that an expense must not. You will complete a survey that takes into account all factors the irs suggests you use as well as other geographic and database information. Web irc section 162 does not require that all business expenses be reasonable in amount, only compensation; There are a variety of ways to calculate your.

Web With Reasonable Compensation, Taxpayers Need To Thread The Needle Between Paying An Amount That Is Too High Or Too Low Depending On The Situation.

Features packed with the tools and resources you need for success. Web choose between the three irs approved approaches and tap into the largest source of credible wage data in the country to quickly create accurate, customized reasonable. This tool takes the guesswork out of determining compensation. Web the irs is particular about paying yourself a reasonable salary since your salary is subject to payroll taxes.