Recovery Startup Business Erc Calculation

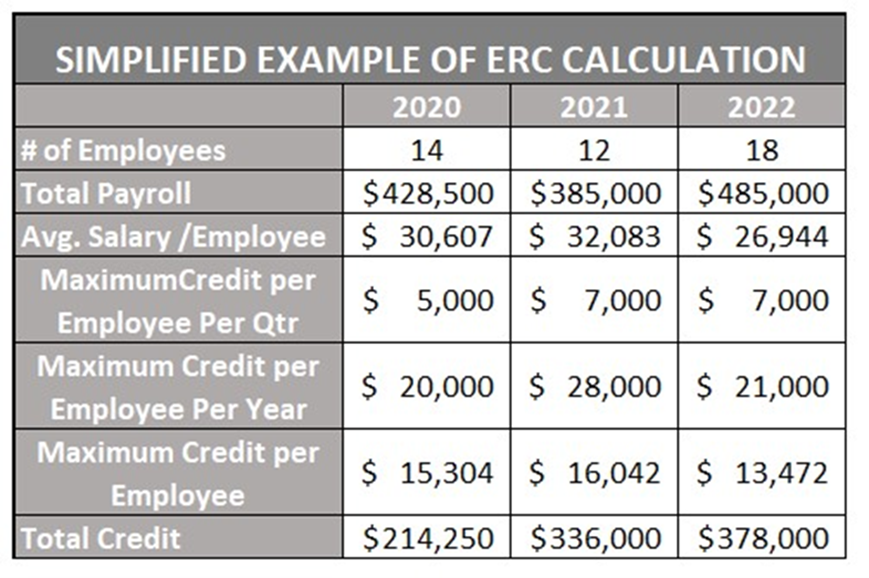

Recovery Startup Business Erc Calculation - Although the employee retention credit (erc), a fully refundable payroll tax credit many. Web the maximum amount of the erc for the first two calendar quarters in 2021 was 70% of up to $10,000 of an employee’s qualified wages per calendar quarter (i.e., a. Web as a recovery startup business, you’re eligible to receive up to a maximum of $50,000 of erc per quarter in the third and fourth quarters of 2021. Web average gross receipts test eligibility benefits of the recovery startup credit issues with the recovery startup credit erc: Nationwide valuationsfree consultationfast turn around

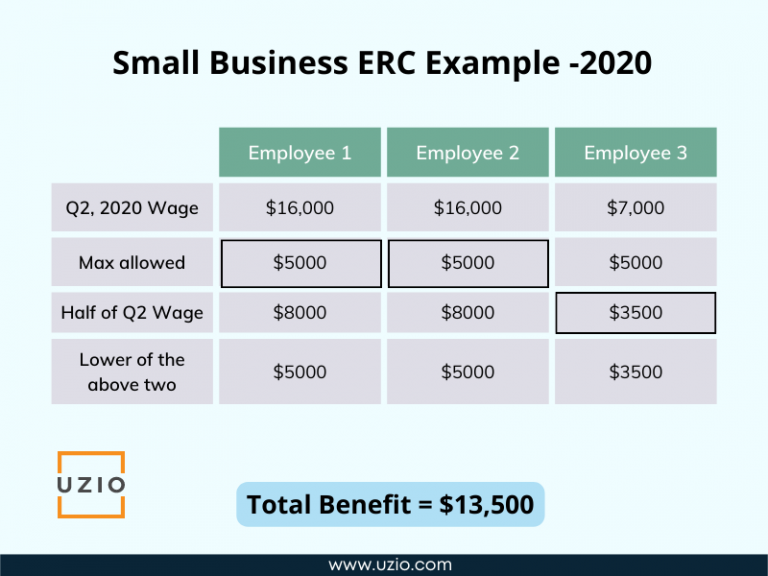

Although the employee retention credit (erc), a fully refundable payroll tax credit many. Web the maximum amount of the erc for the first two calendar quarters in 2021 was 70% of up to $10,000 of an employee’s qualified wages per calendar quarter (i.e., a. How to claim the erc. Web recovery startup businesses are the only businesses that may claim erc through the end of the year. Guidance on additional eligibility requirements is. You must have 1 or more employees (other than >50% owners and certain family members of. Askforfunding.com has been visited by 10k+ users in the past month

Employee Retention Credit (ERC) Calculator Gusto

Web recovery startup businesses qualify for the erc by having one or more employees (excluding >50% owners and certain family members), starting operations on. Web a recovery startup business can still claim the erc for wages paid after june 30, 2021, and before january 1, 2022. Nationwide valuationsfree consultationfast turn around Web as a recovery.

Last Chance to Recover ERC Tax Credit

Web as a recovery startup business owner, you can claim a tax credit for 70% of their first $10,000 in qualified wages for the third and fourth quarters of 2021. You must have 1 or more employees (other than >50% owners and certain family members of. Web expands the types of eligible employers to include.

Are you a recovery startup business? ERC Made Simple by Lendio YouTube

Web under the recovery startup provision, the credit amount is 70% of qualified wages paid from either the start of the new trade business or july 1, 2021, whichever is. Guidance on additional eligibility requirements is. The employee retention credit (erc) was created by the. Web as a recovery startup business owner, you can claim.

What is ERC and how can I claim It? UZIO Inc

Guidance on additional eligibility requirements is. Web recovery startup businesses are the only businesses that may claim erc through the end of the year. Web average gross receipts test eligibility benefits of the recovery startup credit issues with the recovery startup credit erc: Web to be eligible as a recovery startup business, you can't be.

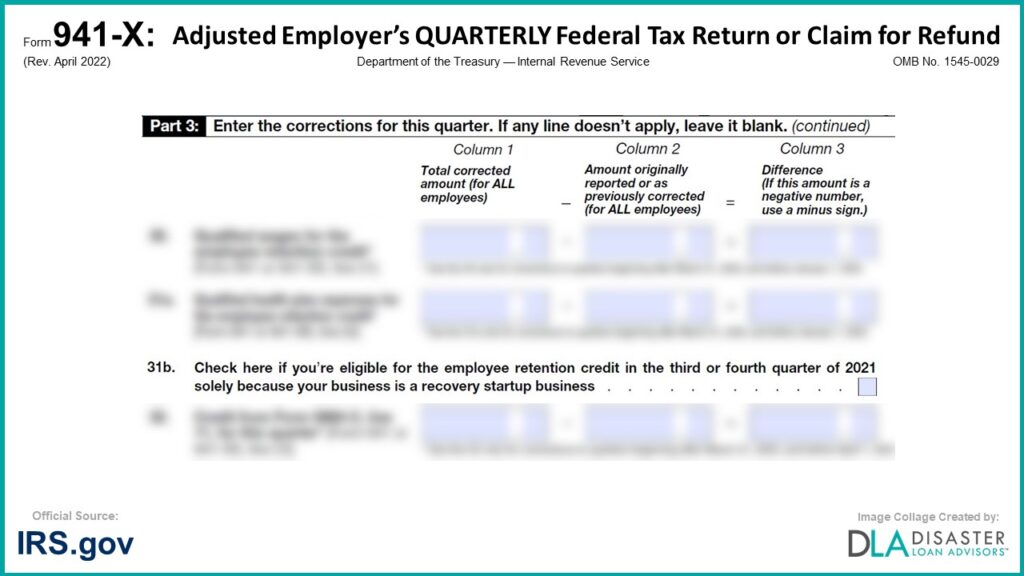

941X 31b. Recovery Startup Business Checkbox, Form Instructions

Eligible businesses that didn't claim the credit when they filed their original employment tax return can claim the credit by filing adjusted employment tax returns. Web average gross receipts test eligibility benefits of the recovery startup credit issues with the recovery startup credit erc: Web as a recovery startup business, you’re eligible to receive up.

Recovery Start up Business ERC YouTube

Web as a recovery startup business, you’re eligible to receive up to a maximum of $50,000 of erc per quarter in the third and fourth quarters of 2021. Web under the recovery startup provision, the credit amount is 70% of qualified wages paid from either the start of the new trade business or july 1,.

ERC Credit Calculation Worksheet Free Calculator Online Employee

Web as a recovery startup business, you’re eligible to receive up to a maximum of $50,000 of erc per quarter in the third and fourth quarters of 2021. Web a recovery startup business can still claim the erc for wages paid after june 30, 2021, and before january 1, 2022. Eligible employers may still claim.

What is Recovery Startup Business? 2023 ERC Updates and Facts ERC

Web a recovery startup business can still claim the erc for wages paid after june 30, 2021, and before january 1, 2022. Web expands the types of eligible employers to include a “recovery startup business” (as defined under section 3134(c)(5) of the code) with a separate maximum credit amount;. Web recovery startup businesses are the.

Employee Retention Credit (ERC) Calculator Gusto

Web recovery startup businesses qualify for the erc by having one or more employees (excluding >50% owners and certain family members), starting operations on. Guidance on additional eligibility requirements is. Eligible businesses that didn't claim the credit when they filed their original employment tax return can claim the credit by filing adjusted employment tax returns..

Recovery Startup Business Employee Retention Tax Credit YouTube

Web the only businesses eligible for erc in q4 of 2021 are recovery startup businesses (those businesses that started after february 15, 2020 and have gross. A recovery startup business has its own erc eligibility requirements. Web for example, after beginning to carry on a trade or business on july 1, 2020, an entity had.

Recovery Startup Business Erc Calculation Web as a recovery startup business owner, you can claim a tax credit for 70% of their first $10,000 in qualified wages for the third and fourth quarters of 2021. Web recovery startup businesses are the only businesses that may claim erc through the end of the year. Web as a recovery startup business, here is what you need to qualify for the erc: Web for example, after beginning to carry on a trade or business on july 1, 2020, an entity had gross receipts through december 31, 2020, of $475,000. Web a recovery startup business is any employer that began carrying on any trade or business after february 15, 2020.

How To Claim The Erc.

Nationwide valuationsfree consultationfast turn around Web the only businesses eligible for erc in q4 of 2021 are recovery startup businesses (those businesses that started after february 15, 2020 and have gross. Web as a recovery startup business owner, you can claim a tax credit for 70% of their first $10,000 in qualified wages for the third and fourth quarters of 2021. Web to be eligible as a recovery startup business, you can't be eligible for erc under the full or partial suspension test or the gross receipts test.

Guidance On Additional Eligibility Requirements Is.

Web average gross receipts test eligibility benefits of the recovery startup credit issues with the recovery startup credit erc: Askforfunding.com has been visited by 10k+ users in the past month Web a recovery startup business is any employer that began carrying on any trade or business after february 15, 2020. Although the employee retention credit (erc), a fully refundable payroll tax credit many.

Web The Maximum Amount Of The Erc For The First Two Calendar Quarters In 2021 Was 70% Of Up To $10,000 Of An Employee’s Qualified Wages Per Calendar Quarter (I.e., A.

Web recovery startup businesses are the only businesses that may claim erc through the end of the year. Eligible employers may still claim the erc for prior quarters. Web expands the types of eligible employers to include a “recovery startup business” (as defined under section 3134(c)(5) of the code) with a separate maximum credit amount;. Web as a recovery startup business, you’re eligible to receive up to a maximum of $50,000 of erc per quarter in the third and fourth quarters of 2021.

Web A Recovery Startup Business Can Still Claim The Erc For Wages Paid After June 30, 2021, And Before January 1, 2022.

Web as a recovery startup business, here is what you need to qualify for the erc: The employee retention credit (erc) was created by the. Web under the recovery startup provision, the credit amount is 70% of qualified wages paid from either the start of the new trade business or july 1, 2021, whichever is. You must have 1 or more employees (other than >50% owners and certain family members of.