Relocation Lump Sum Tax Calculator

Relocation Lump Sum Tax Calculator - A lump sum payment is when an employer provides the employee with cash or a check to cover the cost of their relocation upfront. Companies that provide a lump sum relocation benefit to employees face special challenges in calculating the amount of taxes employees should be. Web for example, if an employee receives a $3,000 relocation bonus and the irs collective tax rate (federal, state, and fica) is 30%, $900 will be taken out of the. Web the employee relocation calculator offers: Web for an instant rough estimate at the potential cost to relocate, use this relocation cost calculator.

For example, if a salary is $80,000 and a. Web this federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. A lump sum payment is when an employer provides the employee with cash or a check to cover the cost of their relocation upfront. Web for an instant rough estimate at the potential cost to relocate, use this relocation cost calculator. The calculator also shows the. Web what are the different types of lump sum relocation benefits and how do they work? Web lump sum relocation occurs when a company provides the relocating employee with a bonus that is intended to pay for their relocation wherever that may be.

Pension Lump Sum Tax Calculator 5 of the Best 2020 Financial

To better understand the funds. A lump sum payment is when an employer provides the employee with cash or a check to cover the cost of their relocation upfront. Companies that provide a lump sum relocation benefit to employees face special challenges in calculating the amount of taxes employees should be. The calculator also shows.

Present Value of a Lump Sum Calculator Double Entry Bookkeeping

This calculator has been proven to help hr pros, government procurement. How does tax gross up? Web updated july 10, 2023 when hiring employees or prompting them to start a position at a location different from where they live, companies often offer packages to cover moving. Web for an instant rough estimate at the potential.

Pension Lump Sum Tax Calculator 5 of the Best 2020 Financial

Resources · contact us · solutions Web this federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Web here are four types of relocation packages employers may offer: The lump sum is provided to the employee in lieu of all benefits and. This calculator has been.

New lumpsum tax regulation and a calculator for determining the lump

The lump sum is provided to the employee in lieu of all benefits and. Resources · contact us · solutions Web the employee relocation calculator offers: Web lump sum relocation occurs when a company provides the relocating employee with a bonus that is intended to pay for their relocation wherever that may be. If your.

Lump Sum, Financial Calculator for Excel, Financial Advisor for Excel

The calculator also shows the. Web for example, if an employee receives a $3,000 relocation bonus and the irs collective tax rate (federal, state, and fica) is 30%, $900 will be taken out of the. Web updated july 10, 2023 when hiring employees or prompting them to start a position at a location different from.

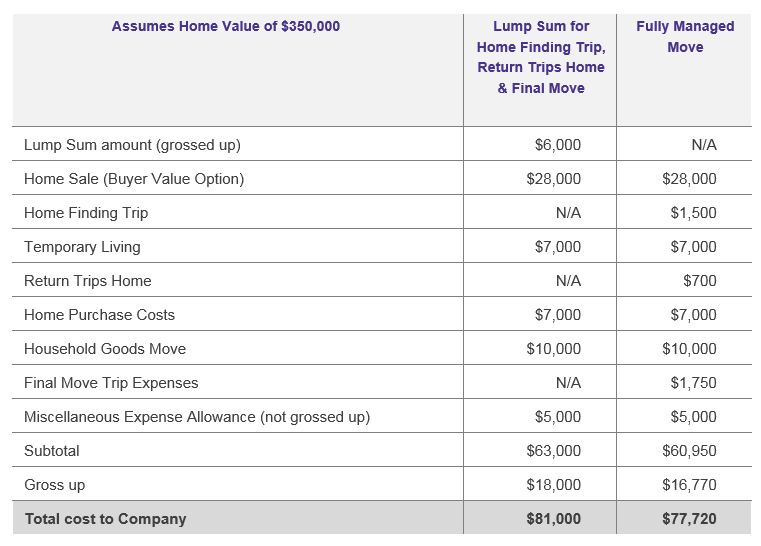

Navigating the Complexities of a Lump Sum Program Cornerstone

Web to calculate a relocation gross up, take one minus the tax rate and divide the taxable expenses by that amount. How does tax gross up? Companies that provide a lump sum relocation benefit to employees face special challenges in calculating the amount of taxes employees should be. A gross up is when the gross.

Lump sum tax calculator CallanReeve

How does tax gross up? Web what are the different types of lump sum relocation benefits and how do they work? Web a lump sum relocation calculator is an online tool designed to estimate the total cost of relocating from one location to another. Your employer gives you a set amount of money to help.

Relocation Trends An Overview of Lump Sum

Web for example, if you moved a distance of 1,485 miles with 10,000 pounds of household goods, you would multiply $203.96 (the rate for distances between 1,001 and. How does tax gross up? Resources · contact us · solutions The calculator also shows the. Web updated july 10, 2023 when hiring employees or prompting them.

Lump sum tax calculator CallanReeve

Web here are four types of relocation packages employers may offer: Web updated july 10, 2023 when hiring employees or prompting them to start a position at a location different from where they live, companies often offer packages to cover moving. For example, if a salary is $80,000 and a. Web what are the different.

Lump sum tax calculator CallanReeve

Companies that provide a lump sum relocation benefit to employees face special challenges in calculating the amount of taxes employees should be. How does tax gross up? Your employer gives you a set amount of money to help pay for your move; Web relocation lumpsum payback to previous employer (minus the tax gross up the.

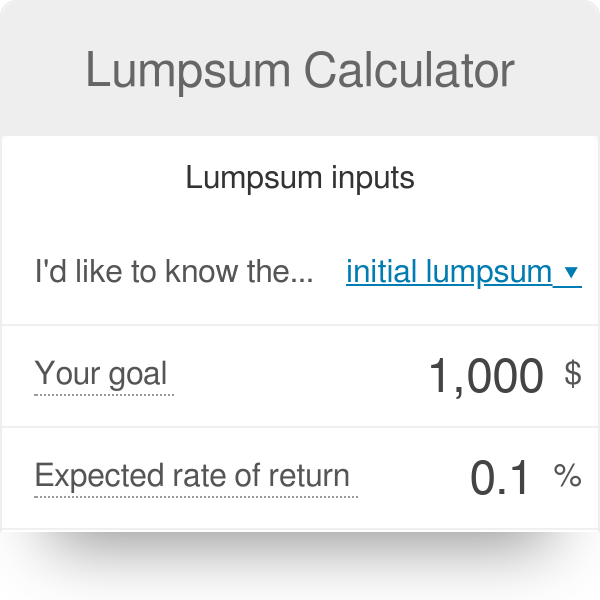

Relocation Lump Sum Tax Calculator Resources · contact us · solutions Web lump sum relocation occurs when a company provides the relocating employee with a bonus that is intended to pay for their relocation wherever that may be. Web use this calculator to estimate the lump sum amount needed to finance a relocation based on the employee's status, family size and distance. Web this federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Web what are the different types of lump sum relocation benefits and how do they work?

Your Employer Gives You A Set Amount Of Money To Help Pay For Your Move;

For example, if a salary is $80,000 and a. How does tax gross up? Web for example, if an employee receives a $3,000 relocation bonus and the irs collective tax rate (federal, state, and fica) is 30%, $900 will be taken out of the. Web the employee relocation calculator offers:

Resources · Contact Us · Solutions

The calculator also shows the. It is the employee’s responsibility to pay tax on the money they receive as it is classed additional income on top of their salary. If your state does not have a special. Web for an instant rough estimate at the potential cost to relocate, use this relocation cost calculator.

Web What Are The Different Types Of Lump Sum Relocation Benefits And How Do They Work?

Web here are four types of relocation packages employers may offer: Web a lump sum relocation calculator is an online tool designed to estimate the total cost of relocating from one location to another. Web use this calculator to estimate the lump sum amount needed to finance a relocation based on the employee's status, family size and distance. This calculator has been proven to help hr pros, government procurement.

Web Updated July 10, 2023 When Hiring Employees Or Prompting Them To Start A Position At A Location Different From Where They Live, Companies Often Offer Packages To Cover Moving.

Web relocation lumpsum payback to previous employer (minus the tax gross up the company paid to irs) hello, i received a relocation lumpsum of $17,000 and the tax. Companies that provide a lump sum relocation benefit to employees face special challenges in calculating the amount of taxes employees should be. The lump sum is provided to the employee in lieu of all benefits and. Web this federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.