Relocation Tax Calculator

Relocation Tax Calculator - Web for example, if you moved a distance of 1,485 miles with 10,000 pounds of household goods, you would multiply $203.96 (the rate for distances between 1,001 and. The minimum combined 2024 sales tax rate for romney, west virginia is. What changed for relocation tax? Types and amounts of moving expenses. The impact of romney’s proposed $17,000 cap the debate over.

Use our domestic relocation cost calculator to get an estimate of an employee move. Web if two or more states that are involved in your relocation impose an income tax on relocation benefits, then your relocation benefits may be taxed by both states. Different needs require different investments in the move. Web download fiscal fact no. Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. Web you’ve come to the right place. Web what is the sales tax rate in romney, west virginia?

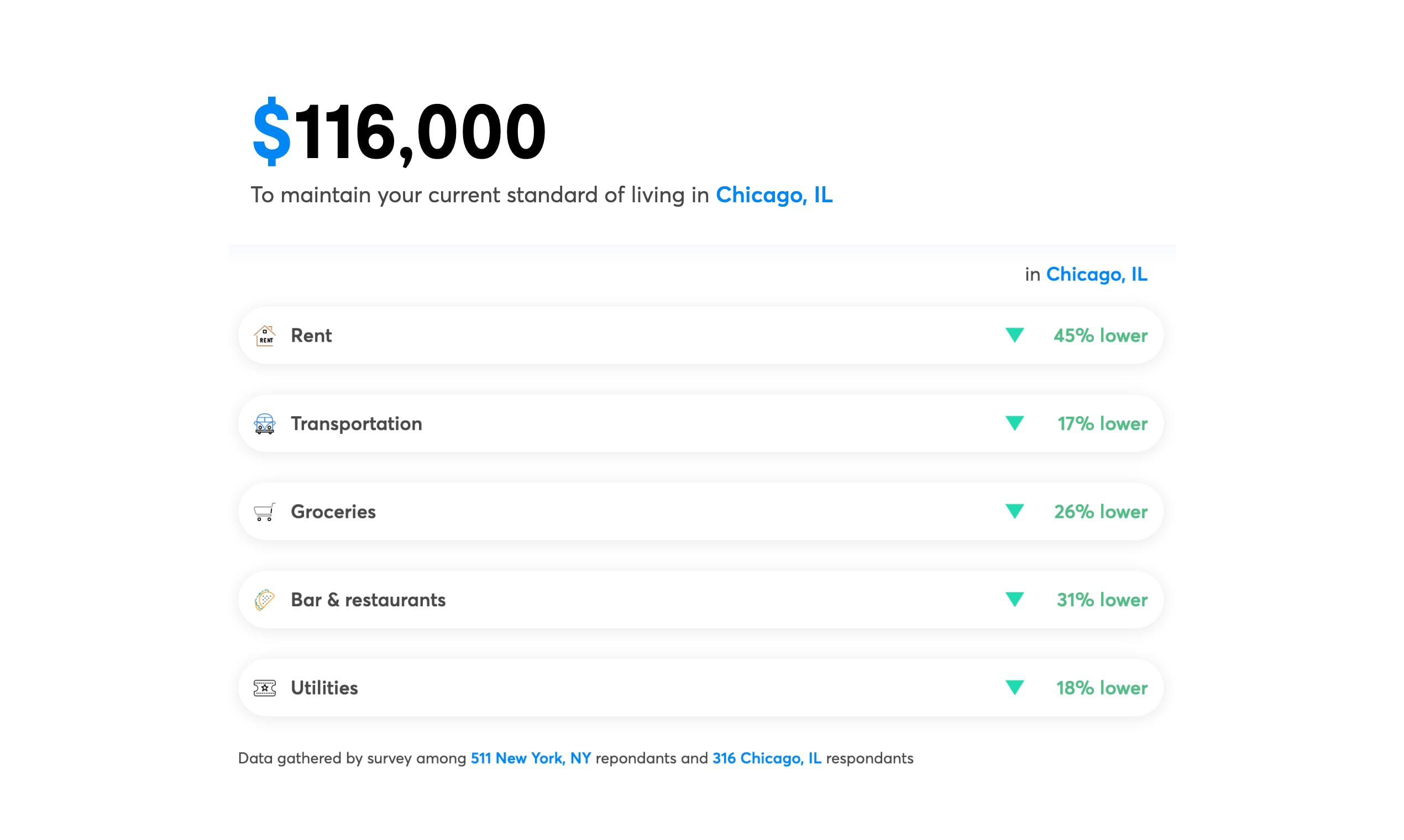

Relocation Calculator Cost of living calculator to plan your

Types and amounts of moving expenses. Plus, get news and advice related to tax brackets, property taxes, estate taxes and more. A gross up is when the gross amount. Web you’ve come to the right place. Simulating the economic effects of romney’s tax plan. The minimum combined 2024 sales tax rate for romney, west virginia.

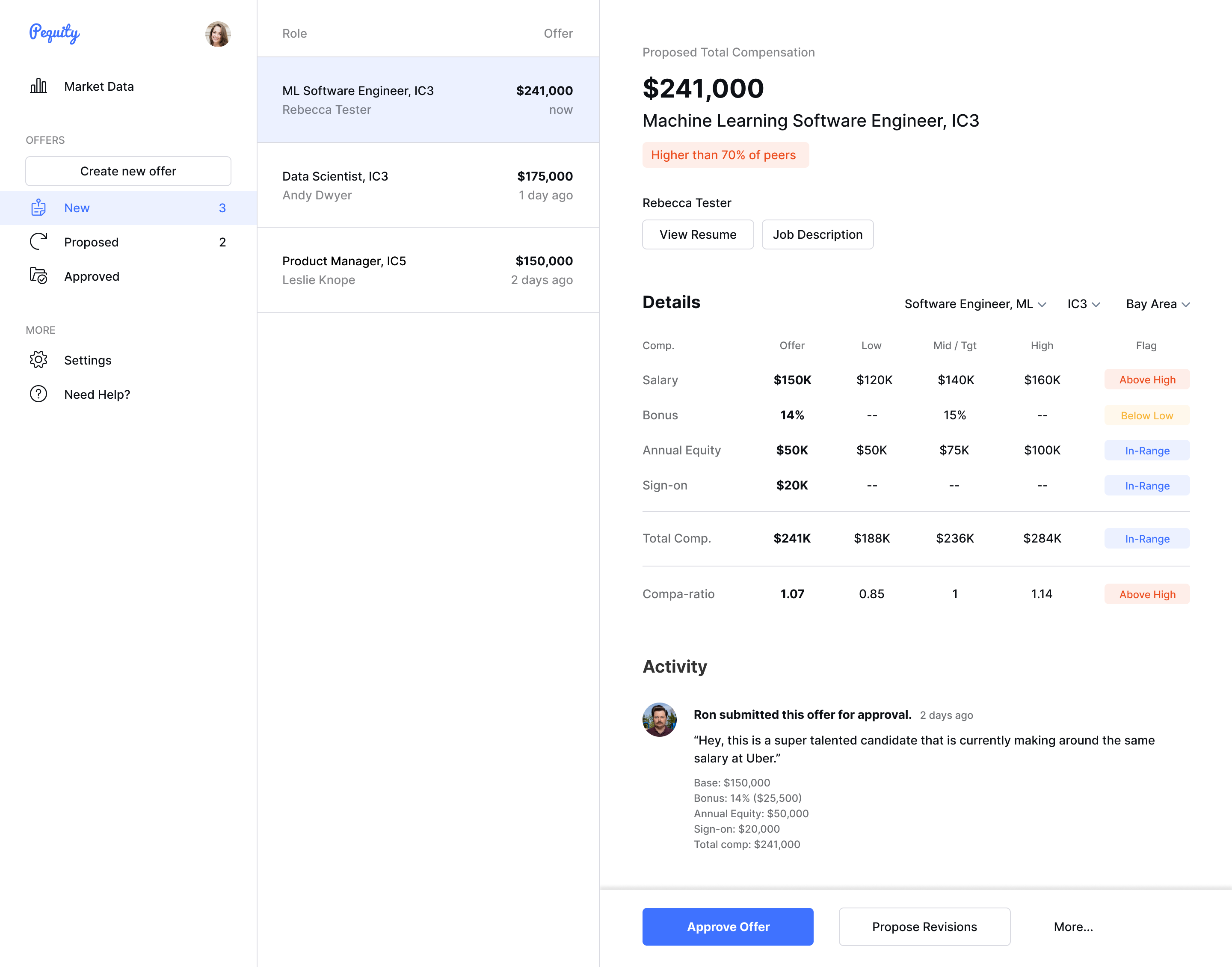

Pequity Relocation Calculator

Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. Web for variable lump sum relocation packages, a major factor in calculating the lump sum amount was the employee’s status as a renter or homeowner. Web.

Tax Checklist for Moving States Optima Tax Relief

Web download fiscal fact no. Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. Employers could also deduct relocation expenses incurred when. Web to calculate a relocation gross up, take one minus the tax rate.

Real Moving Cost Calculator for out of state moves

Web we recommend contacting your hr department for more information specifically regarding your unique relocation and company policies. Types and amounts of moving expenses. The impact of romney’s proposed $17,000 cap the debate over. Input your income, deductions, and credits to determine your potential tax bill. A gross up is when the gross amount. Web.

Relocation Calculator Cost of living calculator to plan your

Web download fiscal fact no. The minimum combined 2024 sales tax rate for romney, west virginia is. Web to calculate a relocation gross up, take one minus the tax rate and divide the taxable expenses by that amount. Simulating the economic effects of romney’s tax plan. Determine which services you will need and which you..

Relocation Cost Calculator [2024 Moving Expenses]

Employers could also deduct relocation expenses incurred when. Web your assessed value would be $60,000 (60% of market value). Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 9:17 am. Plus, get news and advice related to tax brackets, property taxes, estate taxes and.

Relocation Calculator House Moving Costs and Resources

Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. How does tax gross up? The minimum combined 2024 sales tax rate for romney, west virginia is. Determine which services you will need and which you..

Corporate Relocation Calculators North American Van Lines

The minimum combined 2024 sales tax rate for romney, west virginia is. Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. A gross up is when the gross amount. Web calculate your estimated relocation cost.

Relocation Budget Calculator MarocMama Shop

Web to calculate a relocation gross up, take one minus the tax rate and divide the taxable expenses by that amount. Web this interview will help you determine if you can deduct your moving expenses. Web your assessed value would be $60,000 (60% of market value). Simulating the economic effects of romney’s tax plan. Web.

Relocation Budget Calculator TransferEASE Relocation Inc. Brokerage

Types and amounts of moving expenses. Web for example, if you moved a distance of 1,485 miles with 10,000 pounds of household goods, you would multiply $203.96 (the rate for distances between 1,001 and. Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have.

Relocation Tax Calculator Web calculate your estimated relocation cost with our helpful tool. Web if two or more states that are involved in your relocation impose an income tax on relocation benefits, then your relocation benefits may be taxed by both states. Web for variable lump sum relocation packages, a major factor in calculating the lump sum amount was the employee’s status as a renter or homeowner. The minimum combined 2024 sales tax rate for romney, west virginia is. A gross up is when the gross amount.

Web What Is The Sales Tax Rate In Romney, West Virginia?

How does tax gross up? Different needs require different investments in the move. Types and amounts of moving expenses. Web this interview will help you determine if you can deduct your moving expenses.

File With Confidenceexpense Estimatoreasy And Accurateaudit Support Guarantee

The impact of romney’s proposed $17,000 cap the debate over. Web for example, if you moved a distance of 1,485 miles with 10,000 pounds of household goods, you would multiply $203.96 (the rate for distances between 1,001 and. Determine which services you will need and which you. A gross up is when the gross amount.

Web To Calculate A Relocation Gross Up, Take One Minus The Tax Rate And Divide The Taxable Expenses By That Amount.

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 9:17 am. You can then find your taxes by dividing assessed value by 100 and multiplying by the rate, 0.80. Tools you can use with all the changes to tax laws and their effect on relocating and moving employees that have occurred over the past few years, it is. Web your assessed value would be $60,000 (60% of market value).

Input Your Income, Deductions, And Credits To Determine Your Potential Tax Bill.

Plus, get news and advice related to tax brackets, property taxes, estate taxes and more. Before the tax cuts and jobs act of 2017, relocation benefits were not considered taxable income for employees. Web calculate your estimated relocation cost with our helpful tool. Web if two or more states that are involved in your relocation impose an income tax on relocation benefits, then your relocation benefits may be taxed by both states.

![Relocation Cost Calculator [2024 Moving Expenses]](https://arcrelocation.com/wp-content/uploads/2020/11/tax-1024x684.jpg)