Research And Development Credit Calculation

Research And Development Credit Calculation - Plus, it carries forward 20 years. Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. Section 41 for taxpayers that expense research and. Multiply the average by 50% to determine. Web calculate the average:

Web use our simple calculator to see if you qualify for the r&d tax credit and if so, by how much. Web the federal research and development tax credit can be a boon to businesses, but as with any portion of the tax code, the rules surrounding it are complex. Web if, in 2023, a to z construction had qualified research expenses of $70,000, they would calculate the available r&d credit as follows: The r&d tax credit calculator is best viewed in chrome or firefox. Plus, it carries forward 20 years. Web updated guidance for allowance of the credit for increasing research activities under i.r.c. Web how to calculate the r&d credit, including:

Research and Development Costs Plan Projections

Web estimate your federal and state r&d tax credit with our free tax credit calculator. Web r&d payroll tax credit calculator. Web calculate the average: Web how do you calculate the r&d credit? Multiply the average by 50% to determine. In some cases, businesses may be able to apply the r&d. Web the federal research.

Research and Development tax credit Grant Thornton

Web the federal research and development tax credit can be a boon to businesses, but as with any portion of the tax code, the rules surrounding it are complex. Find the average of qualified research expenses for the three preceding tax years. Web qualified r&d expenses are used to calculate the credit, which is applied.

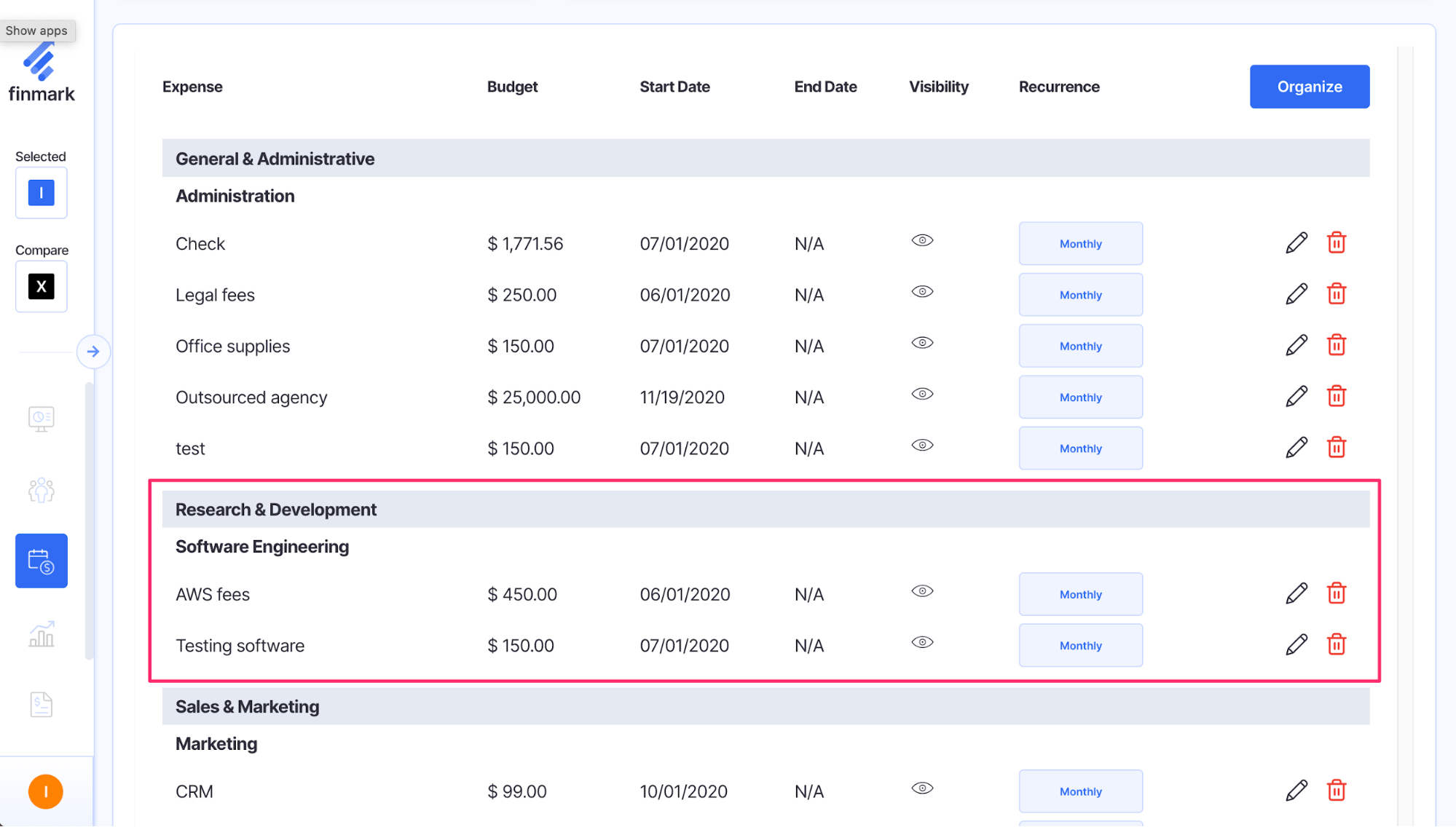

Research And Development Expenses (R&D Expense List) Finmark

Web use our simple calculator to see if you qualify for the r&d tax credit and if so, by how much. Find the average of qualified research expenses for the three preceding tax years. Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. Business activities that.

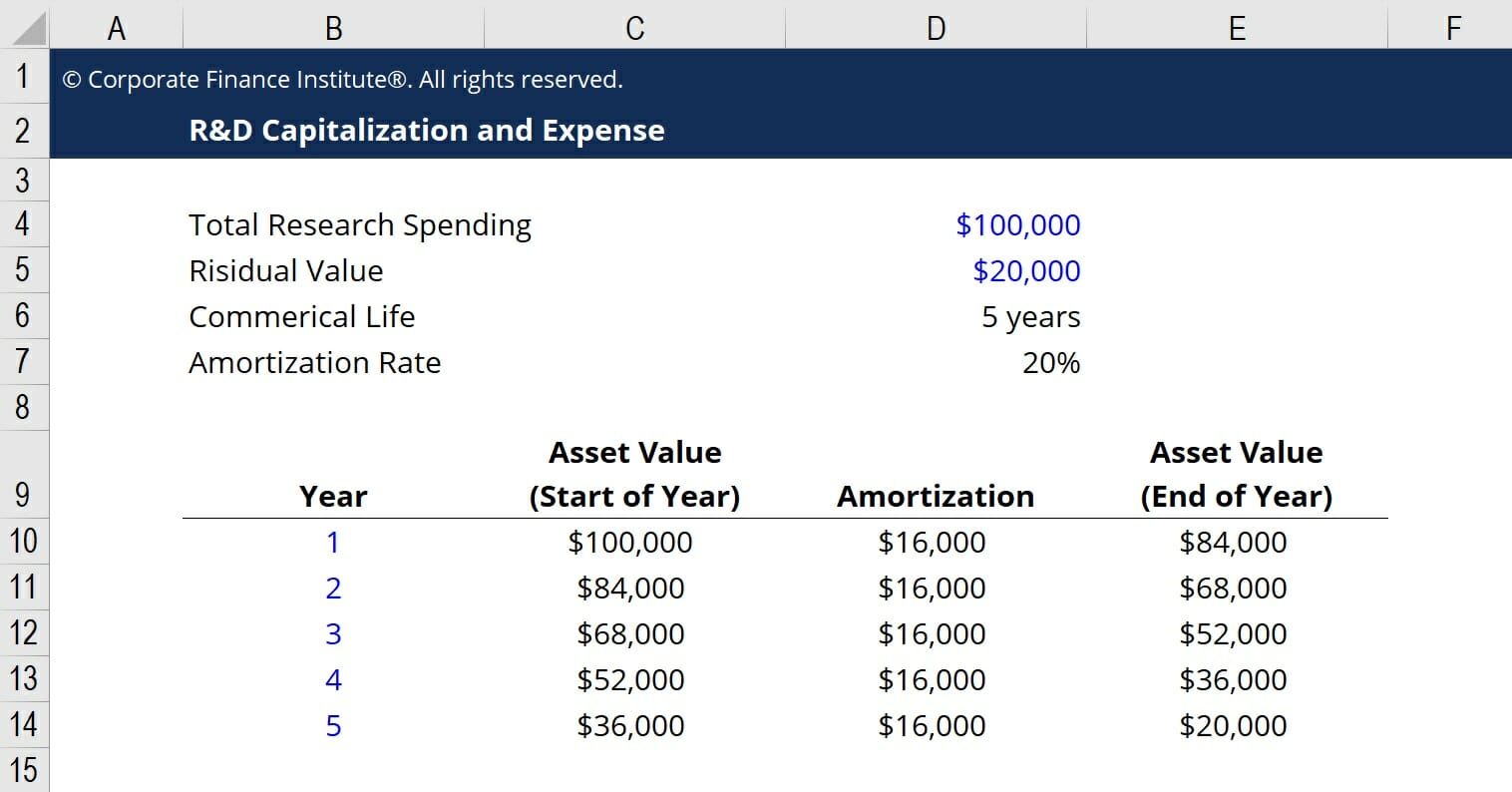

R&D Capitalization vs Expense How to Capitalize R&D

Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. Web r&d payroll tax credit calculator. Multiply the average by 50% to determine. Web estimate your federal and state r&d tax credit with our free tax credit calculator. Web if, in 2023, a to z construction had.

The Cost Of Research And Development Direct And Indirect Costs

Web how to calculate the r&d credit, including: Web how do you calculate the r&d credit? Find the average of qualified research expenses for the three preceding tax years. Plus, it carries forward 20 years. Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. The r&d.

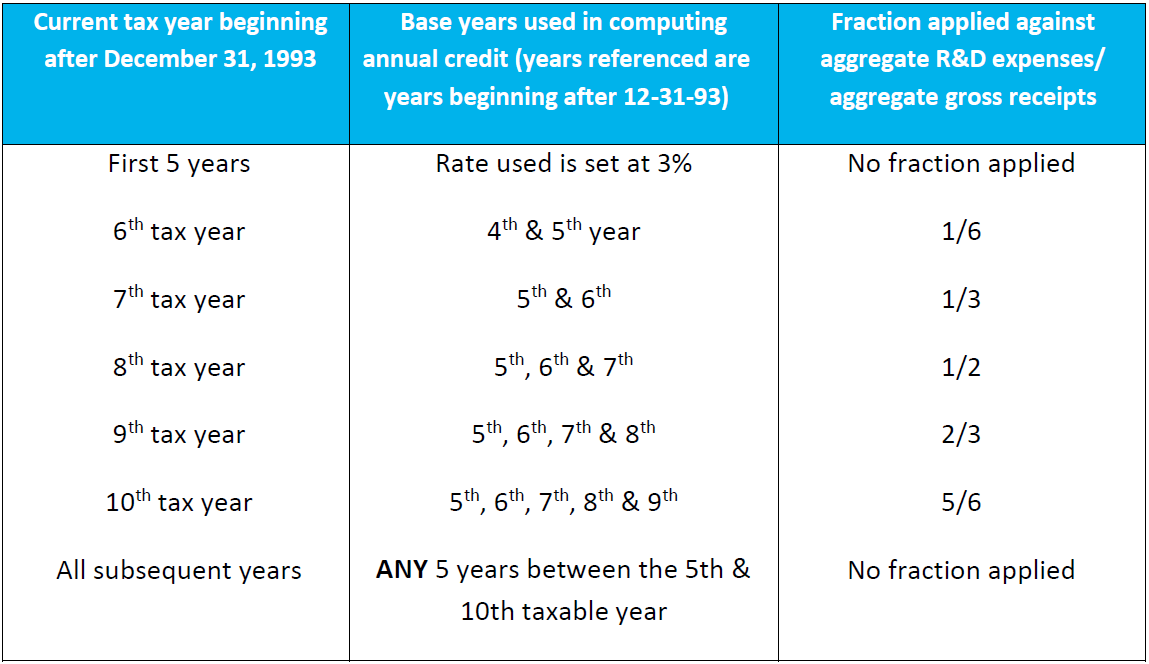

Understanding the Research and Development Credit The CPA Journal

In some cases, businesses may be able to apply the r&d. Find the average of qualified research expenses for the three preceding tax years. Web how do you calculate the r&d credit? Web updated guidance for allowance of the credit for increasing research activities under i.r.c. Section 41 of the internal revenue code provides a.

Qualifying Expenses for the Expanded Research and Development Credit

The results from our r&d tax credit calculator are only estimated figures and. Section 41 of the internal revenue code provides a credit for increasing research activities. The r&d tax credit calculator is best viewed in chrome or firefox. Section 41 for taxpayers that expense research and. Find the average of qualified research expenses for.

Research and Development Tax Credit Toolkit

Calculating qualified research expenses, base calculations under the regular credit and alternative simplified credit methods,. Web r&d payroll tax credit calculator. Plus, it carries forward 20 years. The r&d tax credit calculator is best viewed in chrome or firefox. Web use our simple calculator to see if you qualify for the r&d tax credit and.

"Research And Development Tax Credit" WEC CPA

Web how to calculate the r&d credit, including: Section 41 of the internal revenue code provides a credit for increasing research activities. Business activities that improve products, processes or services in a way that requires some level of experimentation,. The results from our r&d tax credit calculator are only estimated figures and. Find the average.

Research and Development (R&D) Tax Credit Applicability and Benefits

Section 41 of the internal revenue code provides a credit for increasing research activities. In some cases, businesses may be able to apply the r&d. Plus, it carries forward 20 years. A taxpayer's research credit is based, in part, on. Web how do you calculate the r&d credit? Web how to calculate the r&d credit,.

Research And Development Credit Calculation Web if, in 2023, a to z construction had qualified research expenses of $70,000, they would calculate the available r&d credit as follows: Section 41 of the internal revenue code provides a credit for increasing research activities. Web how to calculate the r&d credit, including: Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. Web previously, qualified small businesses could utilize their r&d tax credits to offset the 6.2% employer portion of social security payroll tax liability up to $250,000.

Web How To Calculate The R&D Credit, Including:

Business activities that improve products, processes or services in a way that requires some level of experimentation,. Web estimate your federal and state r&d tax credit with our free tax credit calculator. In some cases, businesses may be able to apply the r&d. The r&d tax credit calculator is best viewed in chrome or firefox.

The Results From Our R&D Tax Credit Calculator Are Only Estimated Figures And.

Web calculate the average: Web qualified r&d expenses are used to calculate the credit, which is applied to federal income tax liability. Web how do you calculate the r&d credit? Multiply the average by 50% to determine.

Calculating Qualified Research Expenses, Base Calculations Under The Regular Credit And Alternative Simplified Credit Methods,.

Find the average of qualified research expenses for the three preceding tax years. Web updated guidance for allowance of the credit for increasing research activities under i.r.c. Web r&d payroll tax credit calculator. Web use our simple calculator to see if you qualify for the r&d tax credit and if so, by how much.

Section 41 For Taxpayers That Expense Research And.

A taxpayer's research credit is based, in part, on. Section 41 of the internal revenue code provides a credit for increasing research activities. Web the federal research and development tax credit can be a boon to businesses, but as with any portion of the tax code, the rules surrounding it are complex. Web previously, qualified small businesses could utilize their r&d tax credits to offset the 6.2% employer portion of social security payroll tax liability up to $250,000.