Restricted Stock Tax Calculator

Restricted Stock Tax Calculator - Restricted stocks are unregistered shares of ownership in a corporation that are issued. Web updated january 09, 2024 reviewed by thomas brock what is restricted stock? To use the rsu projection calculator, walk through the following steps. A restricted stock unit is a grant valued in terms of company stock, but company stock is not. Web overview restricted stock units (rsus) and stock grants are often used by companies to reward their employees with an investment in the company rather than.

It will also determine if. A restricted stock unit is a grant valued in terms of company stock, but company stock is not. Are the taxes on rsus different from the taxes on options? Web we have created a free excel tool to help you with the rsu tax calculation. Web first, restricted stock units or rsus are not the same thing as stock options. Web consult your tax adviser regarding the income tax consequences to you. Web for example, if you have 300 shares vest and they’re worth $10 a share, you’ll need to pay tax on income of $3,000.

Navigating Your EquityBased Compensation Restricted Stock

It will also determine if. Simply enter your inputs and it will calculate your rsu tax bill. Web first, restricted stock units or rsus are not the same thing as stock options. Web overview restricted stock units (rsus) and stock grants are often used by companies to reward their employees with an investment in the.

Restricted Stock Unit (RSU) Tax Calculator — EquityFTW

Web a restricted stock unit (rsu) is an award of stock shares, usually given as a form of employee compensation. Are the taxes on rsus different from the taxes on options? Simply enter your inputs and it will calculate your rsu tax bill. Estimate how much your rsu value will increase per year. In order.

Restricted Stock Units Jane Financial

The recipient must meet certain conditions before the. Are the taxes on rsus different from the taxes on options? Web we have created a free excel tool to help you with the rsu tax calculation. Determine the fair market value of the vested rsus on the vesting date (s). Web what is restricted stock and.

Restricted Stock Unit (RSU) How It Works and Pros and Cons

Web we have created a free excel tool to help you with the rsu tax calculation. Web learn about restricted stock units (rsus) and awards (rsas), including what they are, how they’re taxed, and how to sell your shares. Web consult your tax adviser regarding the income tax consequences to you. Web updated january 09,.

Restricted Stock Units RSU Taxation, Vesting, Calculator & More

Web consult your tax adviser regarding the income tax consequences to you. Assuming a 30% tax bracket, your tax bill. Web the four taxes you’ll owe when you receive a paycheck or when an rsu vests include: Estimate how much your rsu value will increase per year. Web overview restricted stock units (rsus) and stock.

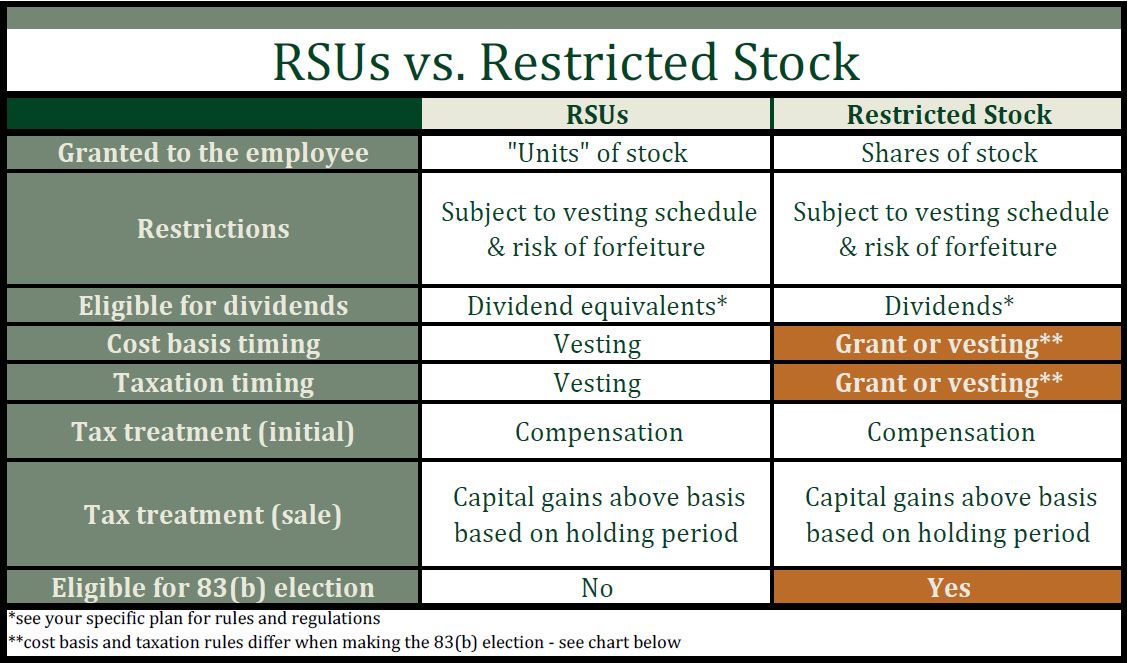

Restricted Stock Units vs. Restricted Stock Awards

Restricted stocks are unregistered shares of ownership in a corporation that are issued. Estimate how much your rsu value will increase per year. Assuming a 30% tax bracket, your tax bill. Simply enter your inputs and it will calculate your rsu tax bill. 31 dec 2022 us income taxes guide restricted stock represents shares that.

Restricted Stock Units (RSUs) Tax Calculator * Level Up Financial Planning

In order to pay the tax, alice chooses to sell half of the stock. Solved • by turbotax • 817 • updated december 15, 2023 restricted stock (not to be confused with a restricted. Determine the fair market value of the vested rsus on the vesting date (s). Input your current marginal tax rate on.

Restricted Stock Units RSU Taxation, Vesting, Calculator & More

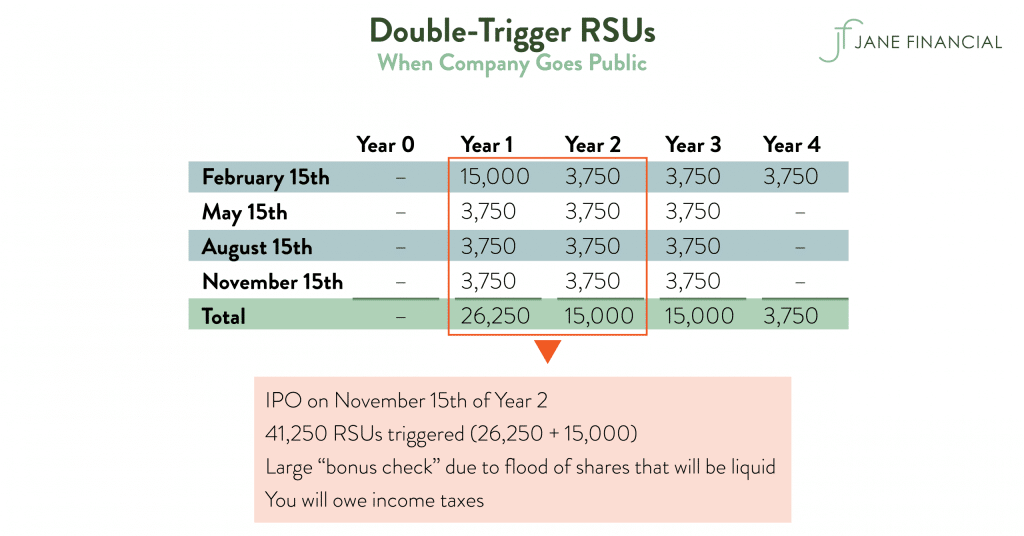

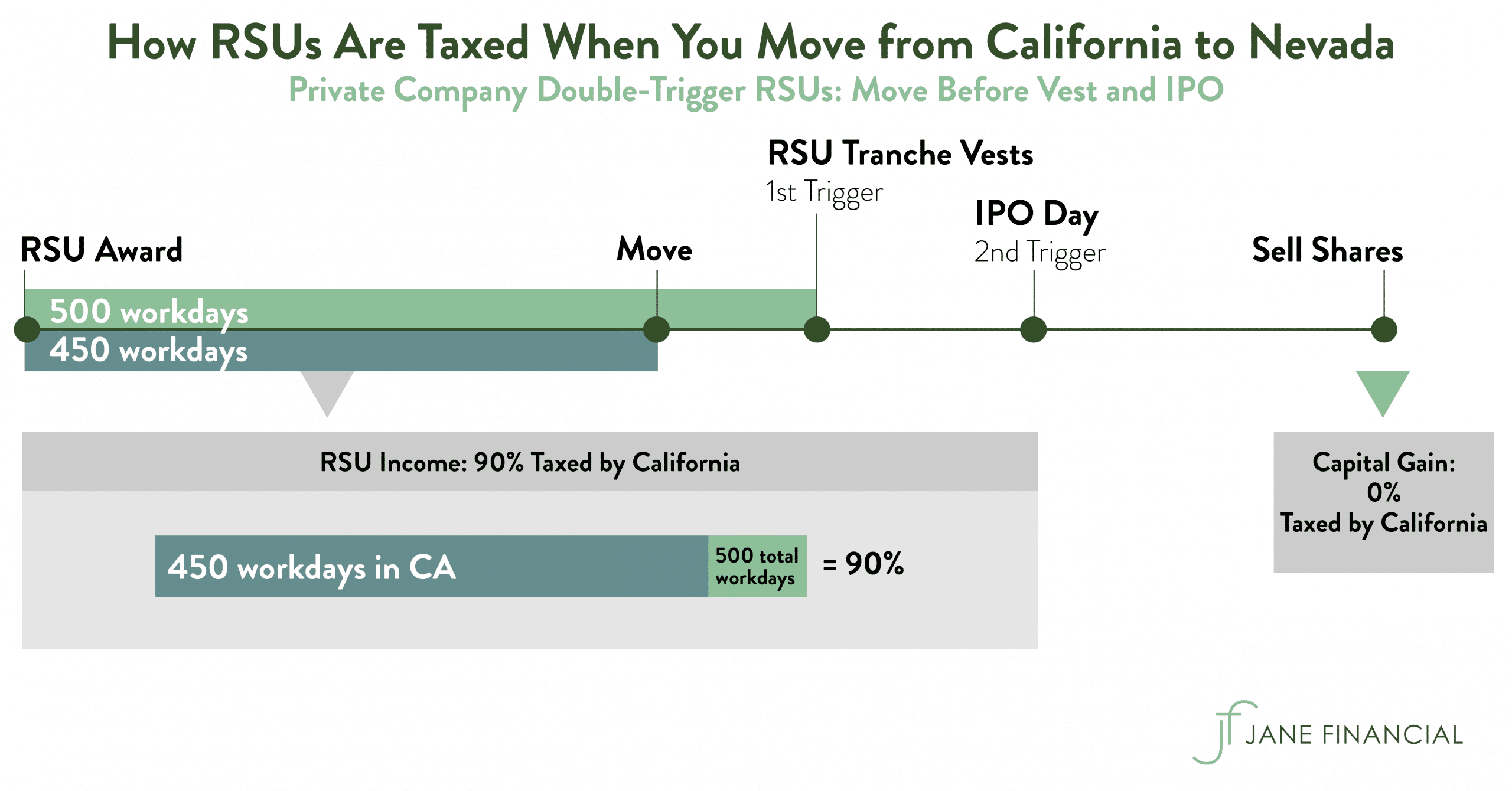

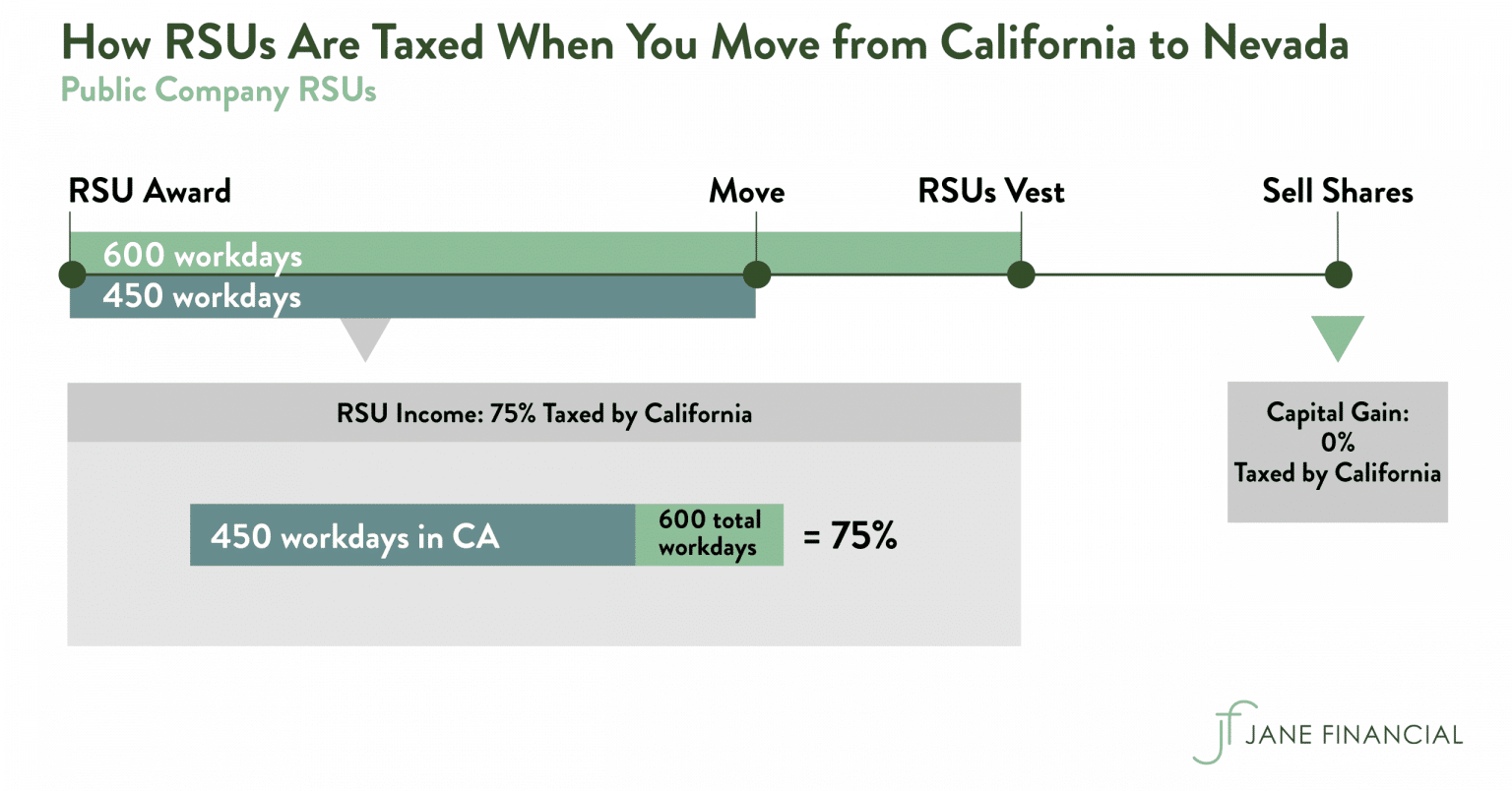

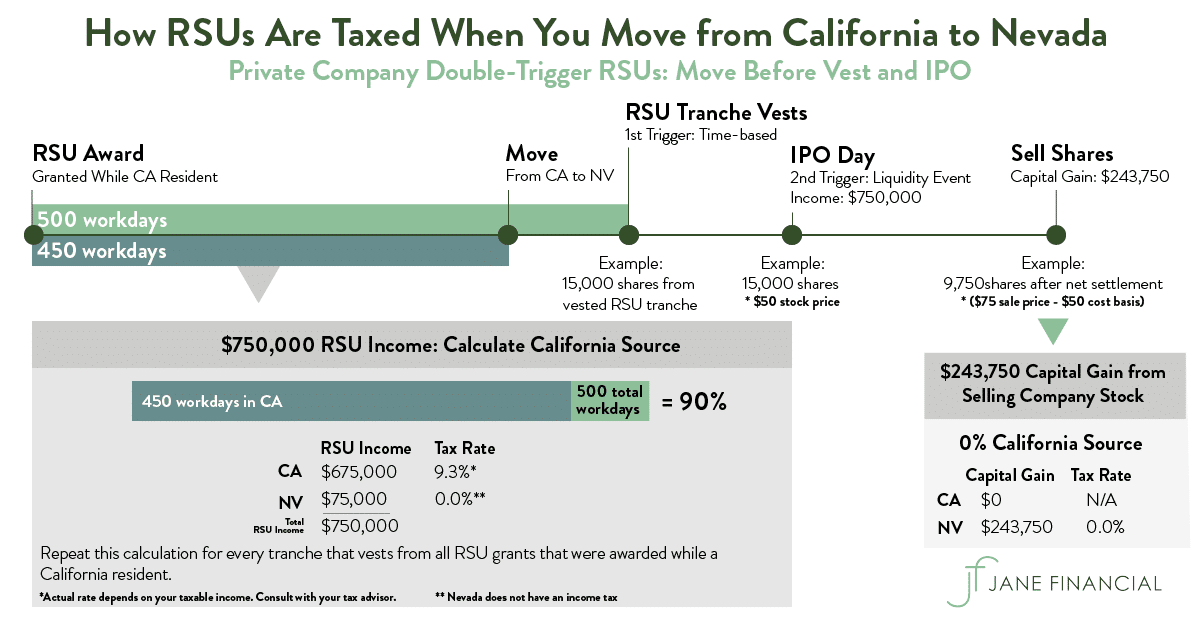

Are the taxes on rsus different from the taxes on options? Assuming a 30% tax bracket, your tax bill. Stock options are typically offered by private companies and should be approached differently. Web this online calculator allows you to estimate both federal and state taxes due to an ipo or vested rsus and is especially.

Restricted Stock Units RSU Taxation, Vesting, Calculator & More

Web a restricted stock award share is a grant of company stock in which the recipient’s rights in the stock are restricted until the shares vest (or lapse in restrictions). Restricted stocks are unregistered shares of ownership in a corporation that are issued. 31 dec 2022 us income taxes guide restricted stock represents shares that.

Restricted Stock Units RSU Taxation, Vesting, Calculator & More

Input your current marginal tax rate on vesting rsus. Stock options are typically offered by private companies and should be approached differently. Restricted stocks are unregistered shares of ownership in a corporation that are issued. It will also determine if. Web learn about restricted stock units (rsus) and awards (rsas), including what they are, how.

Restricted Stock Tax Calculator Are the taxes on rsus different from the taxes on options? Web we have created a free excel tool to help you with the rsu tax calculation. Simply enter your inputs and it will calculate your rsu tax bill. Web consult your tax adviser regarding the income tax consequences to you. Estimate how much your rsu value will increase per year.

Web Overview Restricted Stock Units (Rsus) And Stock Grants Are Often Used By Companies To Reward Their Employees With An Investment In The Company Rather Than.

Web updated january 09, 2024 reviewed by thomas brock what is restricted stock? Web we have created a free excel tool to help you with the rsu tax calculation. Web for example, if you have 300 shares vest and they’re worth $10 a share, you’ll need to pay tax on income of $3,000. Simply enter your inputs and it will calculate your rsu tax bill.

Determine The Fair Market Value Of The Vested Rsus On The Vesting Date (S).

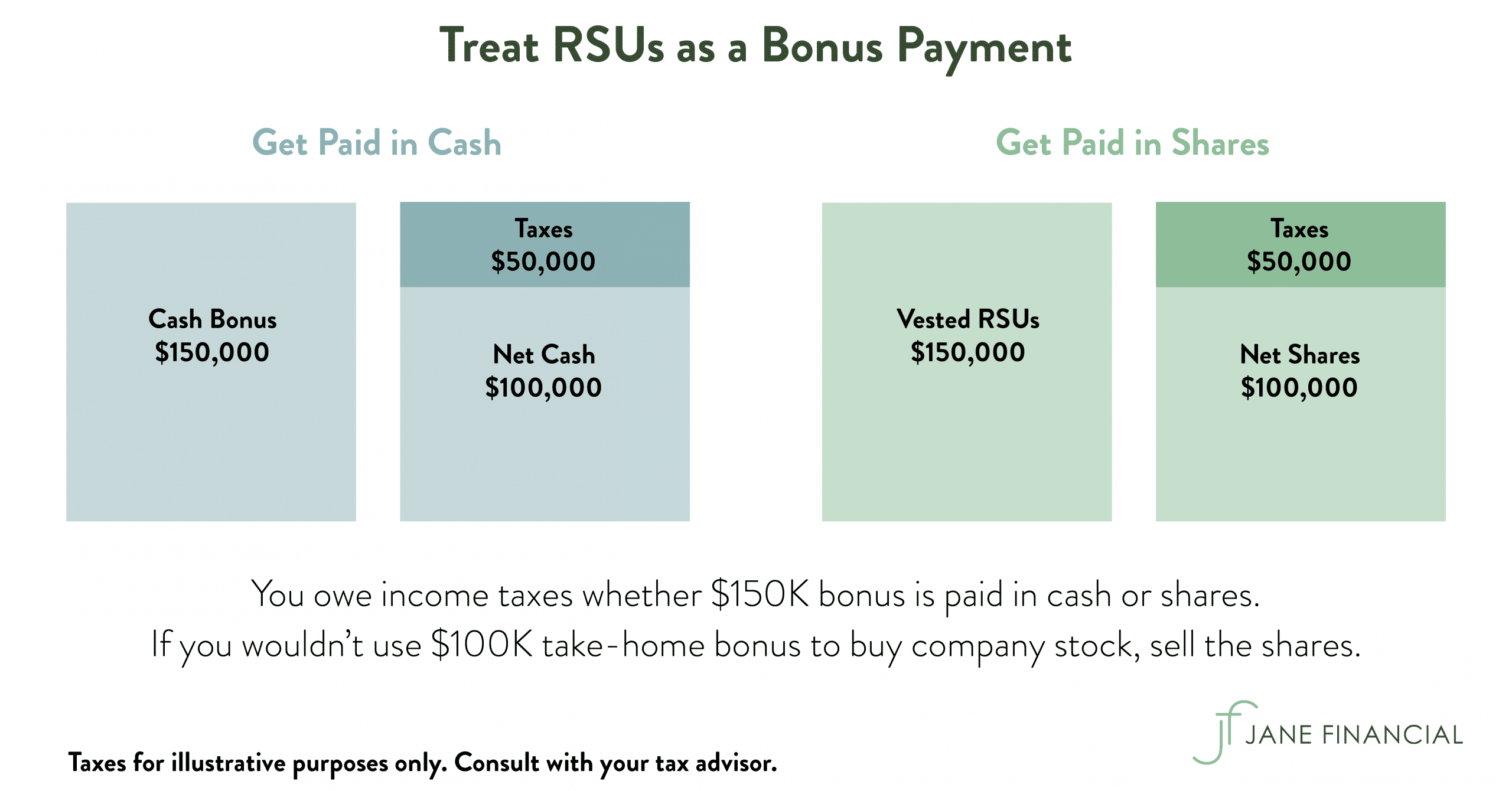

Web what is a restricted stock unit (rsu)? Web alice now has a tax liability on the $25,000 worth of stock, which is taxed at the ordinary income rate. Web the four taxes you’ll owe when you receive a paycheck or when an rsu vests include: In order to pay the tax, alice chooses to sell half of the stock.

To Report The Sale Of Shares, You’ll.

Web 529 state tax calculator learning quest 529 plan education savings account custodial account overview custodial transfer. Web consult your tax adviser regarding the income tax consequences to you. The recipient must meet certain conditions before the. Solved • by turbotax • 817 • updated december 15, 2023 restricted stock (not to be confused with a restricted.

Are The Taxes On Rsus Different From The Taxes On Options?

Input your current marginal tax rate on vesting rsus. Estimate how much your rsu value will increase per year. Assuming a 30% tax bracket, your tax bill. Web this online calculator allows you to estimate both federal and state taxes due to an ipo or vested rsus and is especially useful as it takes into account capital gains, deductions.

:max_bytes(150000):strip_icc()/Restricted-stock-unit-c46e678be3ea4ed19368bec0f1adb990.jpg)