Roth 401K Vs Traditional 401K Calculator

Roth 401K Vs Traditional 401K Calculator - Web this gives roth ira holders a greater degree of investment freedom than employees who have 401 (k) plans (even though the fees charged for 401 (k)s are. It can help lower your lifetime taxes significantly. Web there are multiple types of 401(k) plans, including a traditional, roth, or solo 401(k) plan. Web the basic difference between a traditional and a roth 401 (k) is when you pay the taxes. Web most ira contributions go into this kind of account.

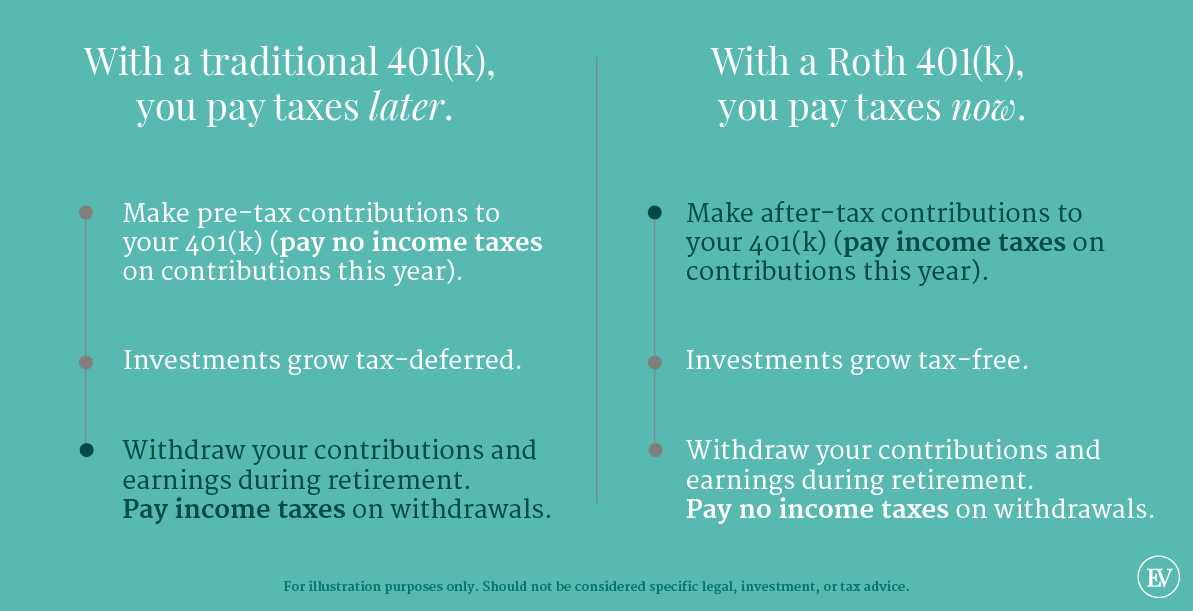

Web roth 401 (k) vs. Current age (1 to 120) your annual. Understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. 1) traditional 401 (k) deductible account fully funded, contributions. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. Web find out which kind of 401 (k) is best for you with this calculator. Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Current age (1 to 120) your annual. Web compare the benefits of a traditional 401 (k) and a roth 401 (k) with this calculator. Web roth vs traditional 401 (k) and your paycheck calculator use the calculator below to help determine which option will be best and how it might affect your paycheck. Web the.

What's the Difference Between a Traditional 401k and Roth 401k

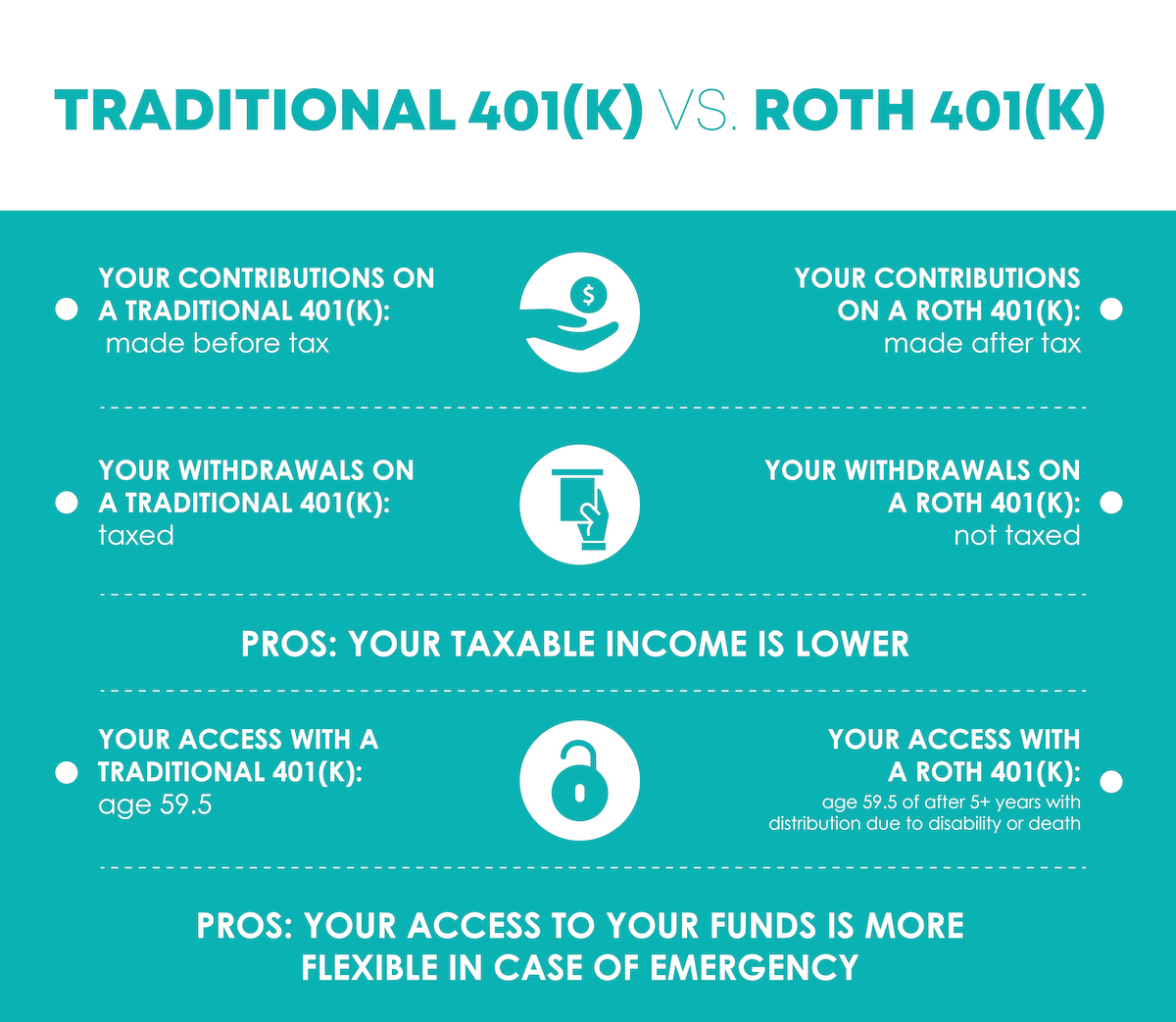

Web many companies have added a roth option to their 401(k) plans.; Current age (1 to 120) your annual. Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years. It can help lower your lifetime taxes.

Roth 401(k) vs. Traditional 401(k)

Web income tax bracket (accumulation phase) (0% to 75%) taxation of contribution options. 1) the value of the account after you. Understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. Web most ira contributions go into this kind of account. It can help lower your lifetime taxes.

Roth 401k Vs Traditional 401 K Which Is Better Robotandro

Web income tax bracket (accumulation phase) (0% to 75%) taxation of contribution options. Compare contributions, earnings, withdrawals and taxes for roth and traditional 401 (k) plans. Web the basic difference between a traditional and a roth 401 (k) is when you pay the taxes. Web with a roth employer contribution, the company (your business) takes.

Roth 401k Might Make You Richer Millennial Money

Web income tax bracket (accumulation phase) (0% to 75%) taxation of contribution options. Web insights & education roth 401 (k) vs. Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k. Web after tax total at retirement. It can help.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

Traditional 401 (k) calculator if available in your employer's plan, the 401 (k) roth allows you to contribute to your 401 (k) account on an. Retirement planningveterans resourcesinvestment calculatorstax advice & tools Compare contributions, earnings, withdrawals and taxes for roth and traditional 401 (k) plans. Web income tax bracket (accumulation phase) (0% to 75%) taxation.

roth ira vs 401k Choosing Your Gold IRA

Web most ira contributions go into this kind of account. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. Web use our 401k calculator to determine the pros and cons of saving in a.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Web compare the benefits of a traditional 401 (k) and a roth 401 (k) with this calculator. Web roth 401 (k) vs. Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income. Retirement planningveterans resourcesinvestment calculatorstax advice & tools Web roth vs traditional 401 (k) calculator roth 401 (k) contributions.

Roth 401k calculator with match ChienSelasi

Understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. For the roth 401 (k), this is the total value of the account. Web there are multiple types of 401(k) plans, including a traditional, roth, or solo 401(k) plan. It can help lower your lifetime taxes significantly. Retirement.

401k Roth Vs Traditional Photos

Web roth 401 (k) vs. Web use our 401k calculator to determine the pros and cons of saving in a traditional 401k versus a roth 401k by seeing the difference in potential growth for each vehicle and. Learn how to calculate your earnings, contributions, and withdrawals for each option and find. 1) traditional 401 (k).

Roth 401K Vs Traditional 401K Calculator Current age (1 to 120) your annual. Retirement planningveterans resourcesinvestment calculatorstax advice & tools Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years. Web use this calculator to compare the costs and savings scenarios of roth 401 (k) and traditional 401 (k) contributions. Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k.

Web Roth Vs Traditional 401 (K) Calculator Roth 401 (K) Contributions Are A Relatively New Type Of 401 (K) That Allows You To Invest Money After Taxes, And Pay No Taxes When Funds Are.

Web many companies have added a roth option to their 401(k) plans.; 1) the value of the account after you. Retirement planningveterans resourcesinvestment calculatorstax advice & tools Web there are multiple types of 401(k) plans, including a traditional, roth, or solo 401(k) plan.

Traditional 401(K)S And Roth 401(K)S Are Taxed Differently;

Web compare the benefits of a traditional 401 (k) and a roth 401 (k) with this calculator. Web most ira contributions go into this kind of account. Web what our roth 401k vs traditional 401k calculator will do for you the above example tells you the basic difference between a 401k and a roth 401k—one is. Compare contributions, earnings, withdrawals and taxes for roth and traditional 401 (k) plans.

Web Roth Vs Traditional 401 (K) And Your Paycheck Calculator Use The Calculator Below To Help Determine Which Option Will Be Best And How It Might Affect Your Paycheck.

Web use this calculator to compare the costs and savings scenarios of roth 401 (k) and traditional 401 (k) contributions. Learn how to choose the best option for your. Web use our 401k calculator to determine the pros and cons of saving in a traditional 401k versus a roth 401k by seeing the difference in potential growth for each vehicle and. For the traditional 401 (k), this is the sum of two parts:

Web Find Out Which Kind Of 401 (K) Is Best For You With This Calculator.

Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k. Money you withdraw from a roth 401 (k) will not be taxed.