Roth Ira Versus 401K Calculator

Roth Ira Versus 401K Calculator - Web based on their age, income, contributions, and the amount they expect to withdraw in retirement, we found that only 9% of the respondents should actually invest. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. Get the match if your employer offers a. 2 roth ira contributions, by comparison, are.

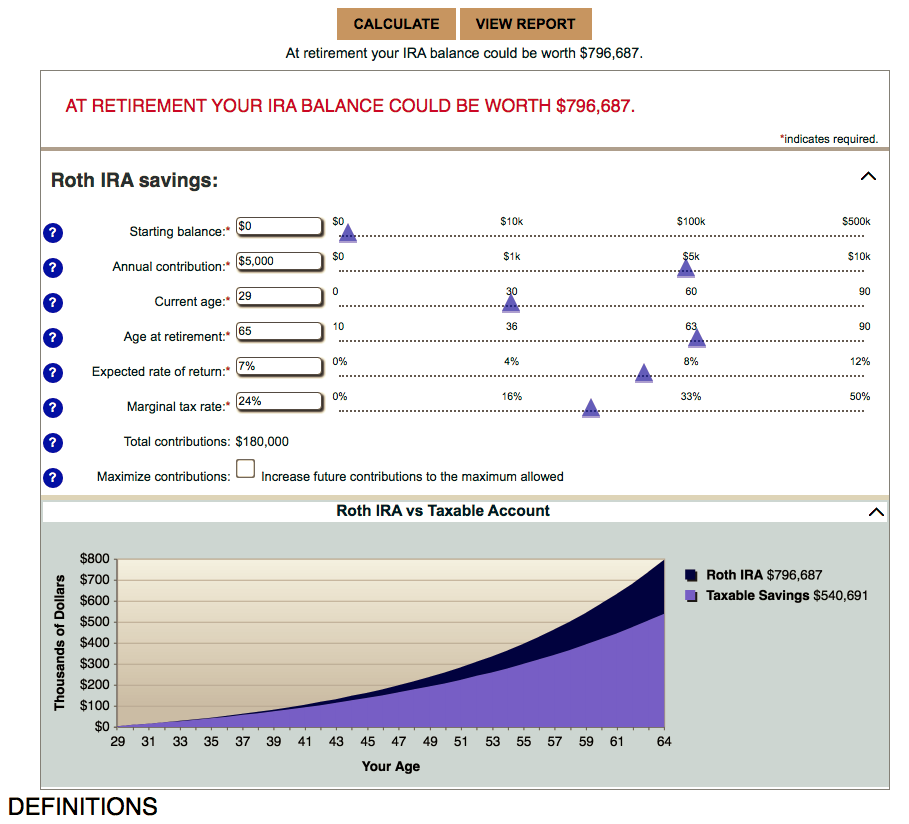

It is mainly intended for use by u.s. Fidelity smart money key takeaways roth iras and roth 401 (k)s can both. A key piece of this puzzle is understanding if you can combine a roth ira with a 401(k). This tool compares the hypothetical results. The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Web traditional vs roth calculator. Web this calculator estimates the balances of roth ira savings and compares them with regular taxable account.

How to Use a Roth IRA Calculator Ready to Roth

Roth ira learn about these types of retirement accounts. Get the match if your employer offers a. Web why you should invest in a roth account for retirement. A key piece of this puzzle is understanding if you can combine a roth ira with a 401(k). Web use this free roth ira calculator to find.

401k vs roth ira calculator Choosing Your Gold IRA

This tool compares the hypothetical results. Web m aking sense of your retirement savings options often feels like unraveling a puzzle. To get the most accurate projections,. The roth 401(k) allows you to contribute to your 401(k) account on an. Advantages of a roth ira here are some advantages a roth ira has over a.

Roth 401k calculator with match ChienSelasi

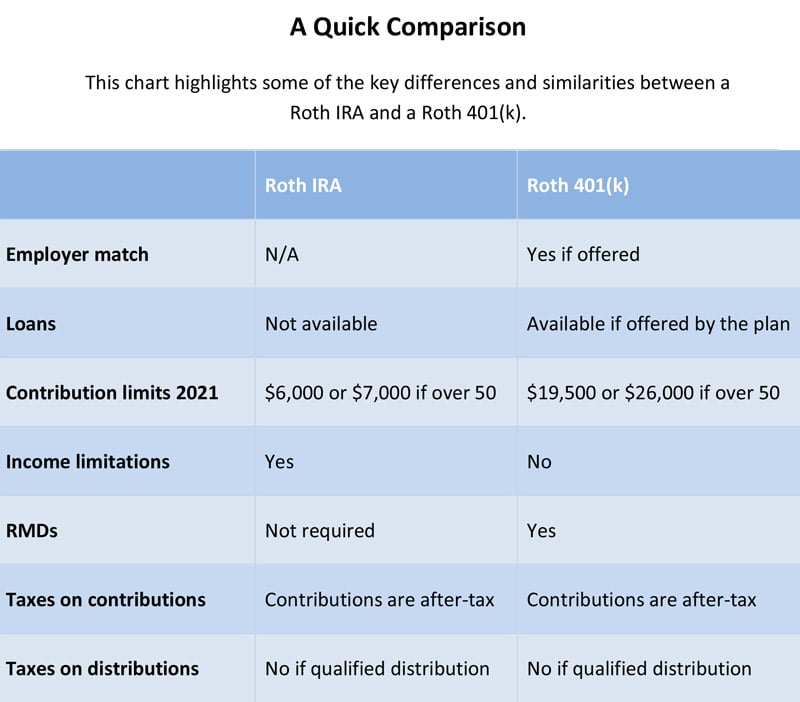

Web advertisement we’ve created a chart for you to compare roth 401 (k)s and roth iras. The roth 401(k) allows you to contribute to your 401(k) account on an. Choosing between a roth vs. Starting in 2026, you won't be able to deposit catch. Web use this free roth ira calculator to find out how.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. 2 roth ira contributions, by.

Infographic Roth Vs Traditional Ira Which Is Right For You ZOHAL

Web why you should invest in a roth account for retirement. In fact, 61.2% of all ira contributions that are. Web updated december 21, 2023 reviewed by david kindness fact checked by jared ecker roth ira vs. Web ira contribution limits for 2024. This tool compares the hypothetical results. Annuity & life insurancegrowth & protection.retirement.

The Ultimate Roth 401(k) Guide District Capital Management

In 2023, you can stash away up to $22,500 in a roth 401 (k)—$30,000 if you're age 50 or older. Fidelity smart money key takeaways roth iras and roth 401 (k)s can both. Get the match if your employer offers a. 2 roth ira contributions, by comparison, are. Web when you convert money to a.

roth ira vs 401k Choosing Your Gold IRA

Roth ira learn about these types of retirement accounts. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution in. Web ira contribution limits for 2024. In fact, 61.2% of all ira contributions that are. The roth 401(k).

roth ira vs roth 401k Choosing Your Gold IRA

In fact, 61.2% of all ira contributions that are. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution in. Web according to fidelity, the vast majority of ira contributions end up going to a roth ira, rather.

Roth IRA Vs 401k Comparing Retirement Savings Options 2023

Web advertisement we’ve created a chart for you to compare roth 401 (k)s and roth iras. Annuity & life insurancegrowth & protection.retirement planning.annuity & life insurance. For the 2023 tax year, those who are under the age of 50 can contribute $6,500 and those age 50 and older can contribute up to $7,500 to either.

Roth 401(k) vs. Roth IRA Which Is Better? ThinkAdvisor

Web why you should invest in a roth account for retirement. Web 7 min print roth 401 (k) vs. In fact, 61.2% of all ira contributions that are. It is mainly intended for use by u.s. The roth 401(k) allows you to contribute to your 401(k) account on an. To get the most accurate projections,..

Roth Ira Versus 401K Calculator Web according to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional one. Web advertisement we’ve created a chart for you to compare roth 401 (k)s and roth iras. Web based on their age, income, contributions, and the amount they expect to withdraw in retirement, we found that only 9% of the respondents should actually invest. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. In 2023, you can stash away up to $22,500 in a roth 401 (k)—$30,000 if you're age 50 or older.

2 Roth Ira Contributions, By Comparison, Are.

In fact, 61.2% of all ira contributions that are. Access to advisorsadvice & guidance Fidelity smart money key takeaways roth iras and roth 401 (k)s can both. A key piece of this puzzle is understanding if you can combine a roth ira with a 401(k).

The Limit For Both Traditional And Roth Iras Is $7,000 Total From Among All Accounts, A $500 Increase From The $6,500 Limit In 2023.

In 2023, you can stash away up to $22,500 in a roth 401 (k)—$30,000 if you're age 50 or older. Web traditional 401k or roth ira calculator traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. Annuity & life insurancegrowth & protection.retirement planning.annuity & life insurance. Roth ira learn about these types of retirement accounts.

Web Use This Roth Ira Vs.

Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web based on their age, income, contributions, and the amount they expect to withdraw in retirement, we found that only 9% of the respondents should actually invest. To get the most accurate projections,. Here are the other main differences between.

For The 2023 Tax Year, Those Who Are Under The Age Of 50 Can Contribute $6,500 And Those Age 50 And Older Can Contribute Up To $7,500 To Either A Roth Or.

Web updated december 21, 2023 reviewed by david kindness fact checked by jared ecker roth ira vs. Web this calculator estimates the balances of roth ira savings and compares them with regular taxable account. The roth 401(k) allows you to contribute to your 401(k) account on an. Web traditional vs roth calculator.