Roth Vs Traditional 401K Paycheck Calculator

Roth Vs Traditional 401K Paycheck Calculator - Web a roth 401(k) is a kind of hybrid between a roth ira and a 401(k), with some rules from each kind of plan. Web most ira contributions go into this kind of account. Web a close cousin of the traditional 401 (k), the roth 401 (k) takes the tax treatment of a roth ira and applies it to your workplace plan: Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. Web adults 50 and older can contribute an additional $7,500 to their 401 (k) plans in 2024.

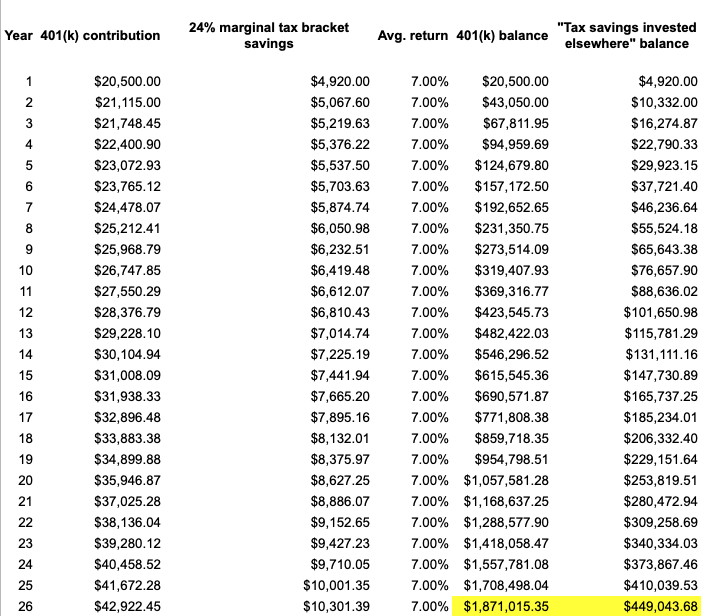

Web roth 401 (k) $ 177,592. Today’s workplace gives you two choices for saving with a 401 (k) — a traditional 401 (k) and a roth 401 (k). Traditional calculator to compare the savings and benefits of each option and to see the impact on your taxes, investment earnings, and paycheck. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. Web your company may match your contributions. In total, qualifying adults can save up to $30,500 per year.

roth ira vs 401k Choosing Your Gold IRA

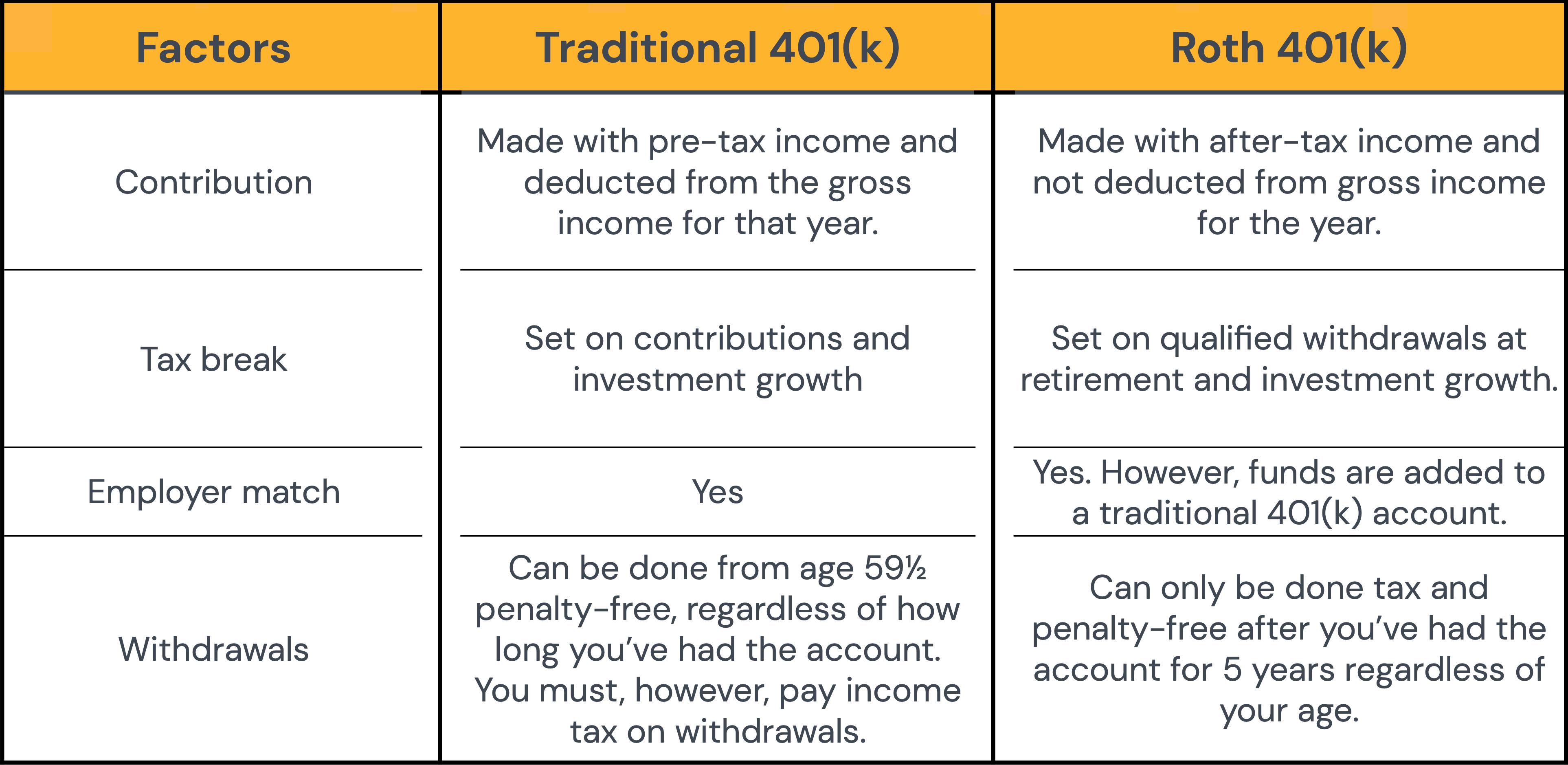

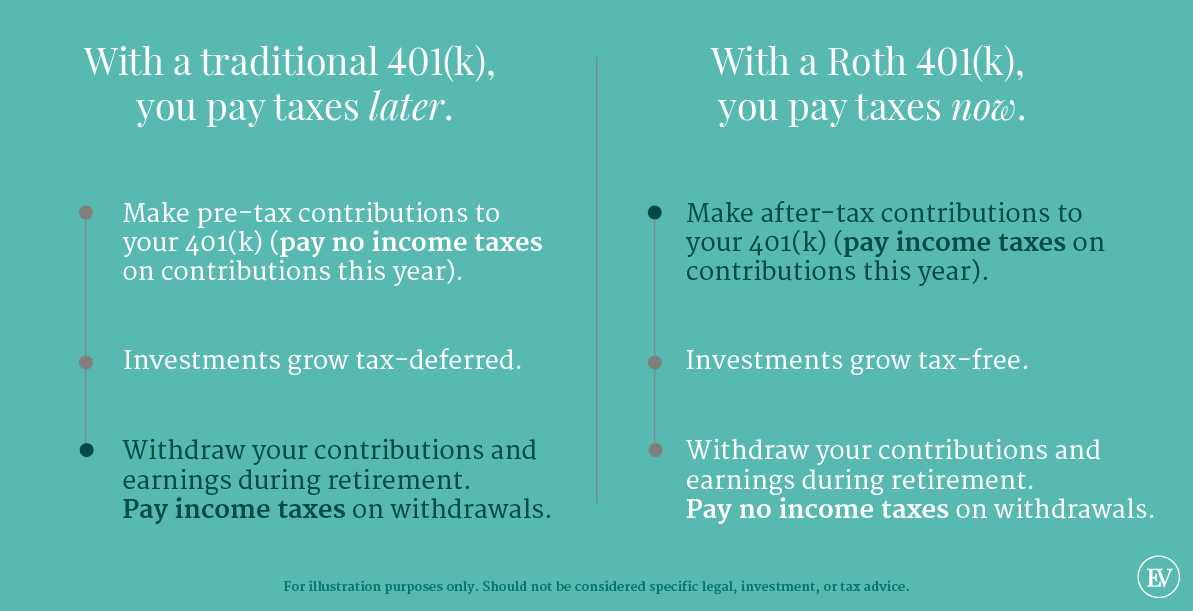

Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. Understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. Web roth 401 (k) $ 177,592. Traditional calculator to compare the savings and benefits of.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. As of january 2006, there is a new type of 401. A traditional 401 (k) may be comparable to a roth 401 (k) *. The limit for both traditional and roth iras is $7,000.

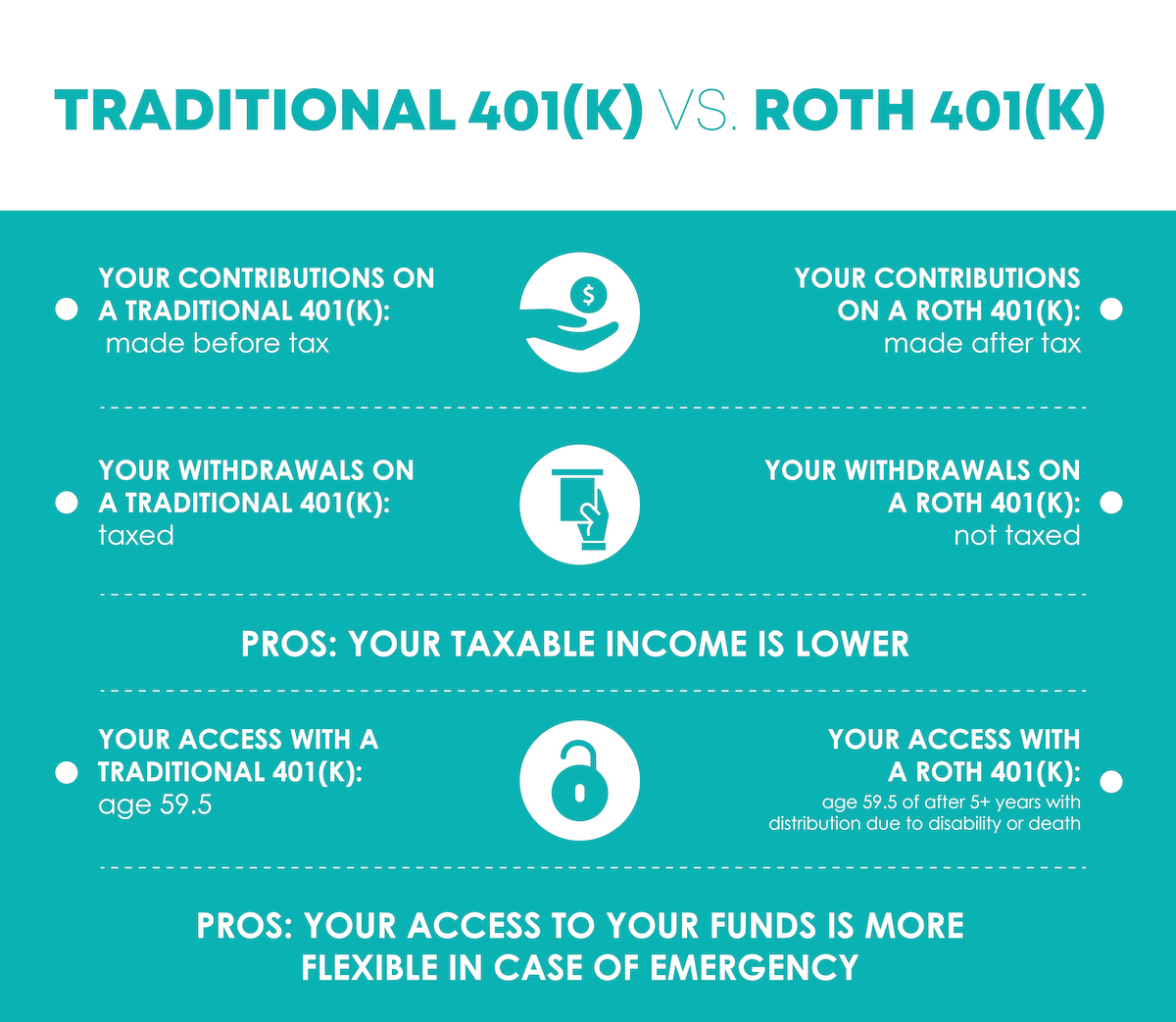

The Differences Between a Roth 401(k) and a Traditional 401(k)

Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. A traditional 401 (k) may be comparable to a roth 401 (k) *..

401k vs roth ira calculator Choosing Your Gold IRA

Web your company may match your contributions. In total, qualifying adults can save up to $30,500 per year. The roth 401(k) allows you to contribute to your 401(k) account on an. Web roth 401 (k) $ 177,592. Web adults 50 and older can contribute an additional $7,500 to their 401 (k) plans in 2024. While.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

While your plan may not have a deferral. Web ira contribution limits for 2024. Traditional calculator to compare the savings and benefits of each option and to see the impact on your taxes, investment earnings, and paycheck. Web use this calculator to help determine the option that could work for you and how it might.

Traditional 401(k) vs. Roth How to Decide — Millennial Money with Katie

Access to advisorsadvice & guidance Web a close cousin of the traditional 401 (k), the roth 401 (k) takes the tax treatment of a roth ira and applies it to your workplace plan: Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years..

Traditional vs Roth 401(k) What You Need to Know

Web a roth 401(k) is a kind of hybrid between a roth ira and a 401(k), with some rules from each kind of plan. Access to advisorsadvice & guidance Traditional calculator to compare the savings and benefits of each option and to see the impact on your taxes, investment earnings, and paycheck. Your required minimum.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Web ira contribution limits for 2024. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that.

401k Roth Vs Traditional Photos

Traditional calculator to compare the savings and benefits of each option and to see the impact on your taxes, investment earnings, and paycheck. Web your company may match your contributions. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. The roth 401(k).

Traditional vs Roth 401(k) Key Differences and Choosing One

The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. Web your company may match your contributions. Web if you.

Roth Vs Traditional 401K Paycheck Calculator Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Web use this calculator to help determine the option that could work for you and how it might affect your paycheck. Your required minimum distribution, therefore, is $6,098. In total, qualifying adults can save up to $30,500 per year. Web ira contribution limits for 2024.

While Your Plan May Not Have A Deferral.

In total, qualifying adults can save up to $30,500 per year. Web ira contribution limits for 2024. Web roth 401 (k) $ 177,592. Age and retirement plan information:

Web When You Convert Money To A Roth Ira, You Will Need To Pay Income Taxes On The Entire Amount In The Tax Year That You Make The Conversion.

The roth 401(k) allows you to contribute to your 401(k) account on an. A 401(k) contribution can be an effective retirement tool. Web if you choose 'roth' the calculator will increase the assumed contribution to your 'traditional' option to equal the same net take home pay. Web most ira contributions go into this kind of account.

A Traditional 401 (K) May Be Comparable To A Roth 401 (K) *.

Understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. Web roth 401(k) plan withholding this is the percent of your gross income you put into a after tax retirement account such as a roth 401(k). Web use this roth vs. If you choose 'traditional' the.

We Will Never Call, Text.

The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Today’s workplace gives you two choices for saving with a 401 (k) — a traditional 401 (k) and a roth 401 (k). Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web adults 50 and older can contribute an additional $7,500 to their 401 (k) plans in 2024.