Roth Vs Traditional Calculator 401K

Roth Vs Traditional Calculator 401K - Web roth vs traditional 401 (k) and your paycheck calculator use the calculator below to help determine which option will be best and how it might affect your paycheck. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Traditional ira calculator roth vs. It can help lower your lifetime taxes significantly. Roth 1 uses the same contribution amount as the traditional 401 (k) plan.roth 1 adjusts the contribution.

Web retirement plan savings rate 5% estimated annual rate of return 8% estimated tax rate 25% during retirement inputs years in retirement 20 years estimated annual rate of. Use these free retirement calculators to determine how. Traditional ira calculator roth vs. Web high yield $10,000 mma. Web roth 401(k) vs. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web the calculator generates two roth 401 (k) plans for you to compare.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Web roth vs traditional 401 (k) calculator which account type is right for me? Web roth 401(k) vs. Choosing between a roth vs. A 401 (k) contribution can be an effective retirement tool. Traditional ira calculator calculate your earnings and more an ira can be an effective retirement tool. Web this gives roth ira holders.

roth ira vs traditional ira Choosing Your Gold IRA

Web roth 401 (k) vs. Current age (1 to 120) your annual. According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. For the 2023 tax year, those who are under the age of 50 can contribute $6,500 and those age 50 and older can.

Roth 401k Might Make You Richer Millennial Money

Web roth vs traditional 401 (k) calculator which account type is right for me? Traditional ira calculator calculate your earnings and more an ira can be an effective retirement tool. As of january 2006, there is a new type of 401. Web the calculator generates two roth 401 (k) plans for you to compare. Web.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

For the 2023 tax year, those who are under the age of 50 can contribute $6,500 and those age 50 and older can contribute up to $7,500 to either a roth or. A 401 (k) contribution can be an effective retirement tool. Web roth 401 (k) $ 177,592. Web high yield $10,000 mma. Web roth.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. Web roth 401 (k) $ 177,592. Use these free retirement calculators to determine how. Web average income = $59,000/year expected annual retirement withdrawal = $225,000 these figures align perfectly to my newfound understanding of the.

401k Roth Vs Traditional Photos

Traditional ira depends on your income level and financial goals. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web the calculator generates two roth 401 (k) plans for you to compare. Web this gives.

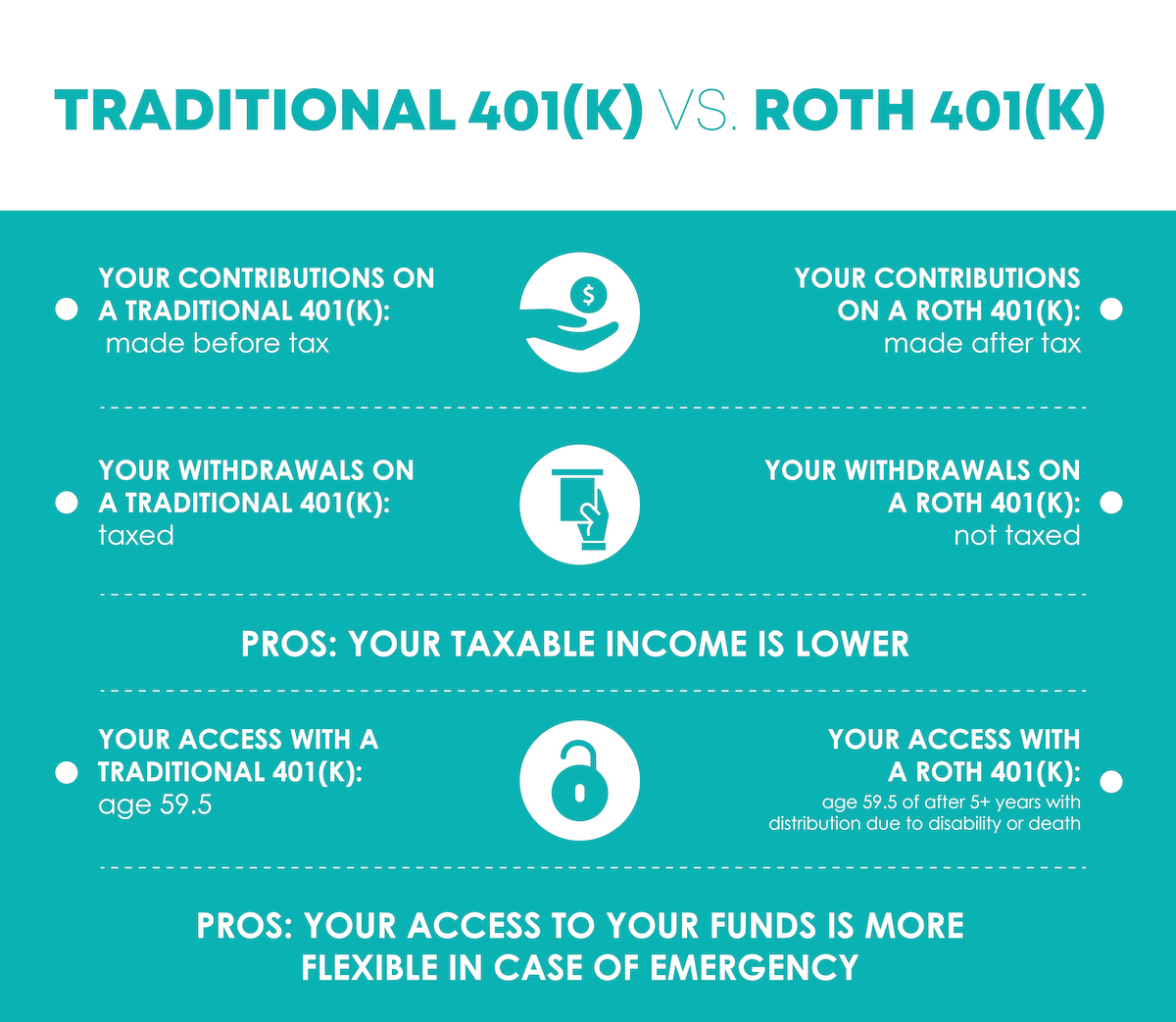

Roth 401(k) vs. Traditional 401(k)

Web most ira contributions go into this kind of account. Access to advisorsadvice & guidance Web roth 401 (k) $ 177,592. Roth 1 uses the same contribution amount as the traditional 401 (k) plan.roth 1 adjusts the contribution. Traditional ira calculator roth vs. As of january 2006, there is a new type of 401. The.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

As of january 2006, there is a new type of 401 (k) contribution. Choosing between a roth vs. Roth 1 uses the same contribution amount as the traditional 401 (k) plan.roth 1 adjusts the contribution. Web roth vs traditional 401 (k) and your paycheck calculator use the calculator below to help determine which option will.

Roth 401k calculator with match ChienSelasi

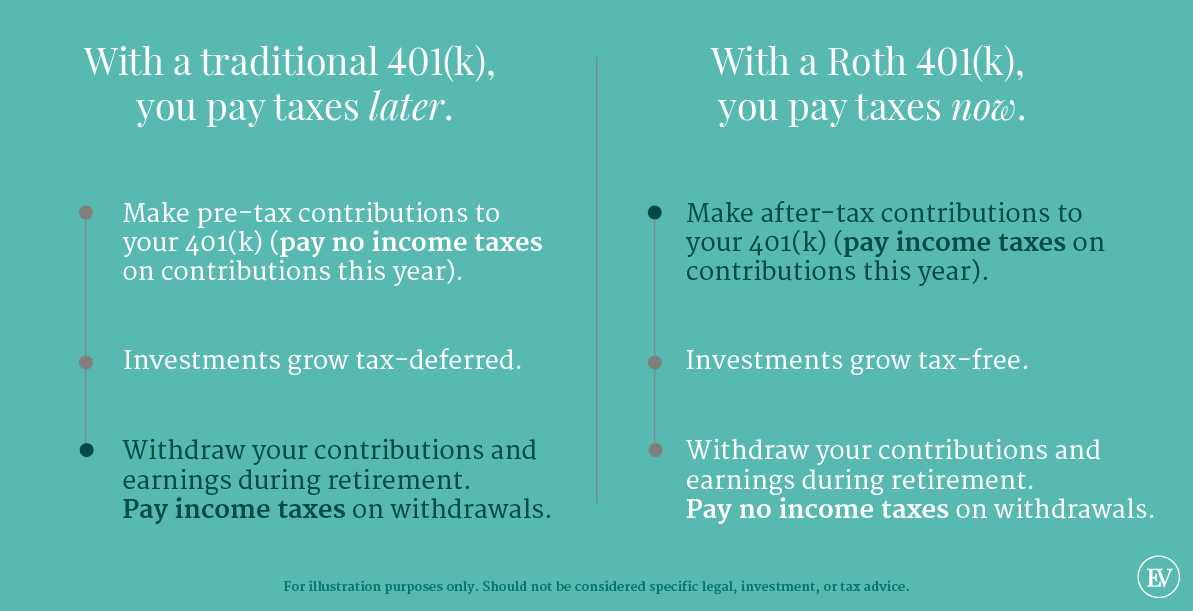

Web roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are withdrawn later — for many investors, this. Access to advisorsadvice & guidance Web roth 401 (k) vs. Web roth vs traditional 401 (k) and your paycheck calculator use the.

Traditional vs Roth 401(k) What You Need to Know

Roth 1 uses the same contribution amount as the traditional 401 (k) plan.roth 1 adjusts the contribution. Use these free retirement calculators to determine how. For the 2023 tax year, those who are under the age of 50 can contribute $6,500 and those age 50 and older can contribute up to $7,500 to either a.

Roth Vs Traditional Calculator 401K Current age (1 to 120) your annual. Web updated february, 2024 roth vs. The roth 401 (k) allows you to contribute to your 401 (k) account on an. Traditional ira depends on your income level and financial goals. As of january 2006, there is a new type of 401 (k) contribution.

Web High Yield $10,000 Mma.

Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are withdrawn later — for many investors, this. A 401 (k) contribution can be an effective retirement tool. Choosing between a roth vs.

Web Roth Vs Traditional 401 (K) Calculator Which Account Type Is Right For Me?

Traditional ira calculator roth vs. For the 2023 tax year, those who are under the age of 50 can contribute $6,500 and those age 50 and older can contribute up to $7,500 to either a roth or. Web roth 401(k) vs. Roth 1 uses the same contribution amount as the traditional 401 (k) plan.roth 1 adjusts the contribution.

Web Roth 401 (K) $ 177,592.

Access to advisorsadvice & guidance Traditional 401 (k) and your paycheck a 401 (k) can be an effective retirement tool. This tool compares the hypothetical. Web average income = $59,000/year expected annual retirement withdrawal = $225,000 these figures align perfectly to my newfound understanding of the roth.

Protect Your Familyaffordable Policiesknowledgeable Agents

Web roth 401 (k) vs. The roth 401 (k) allows you to contribute to your 401 (k) account on an. Web the calculator generates two roth 401 (k) plans for you to compare. Web updated february, 2024 roth vs.