S Corp Income Tax Calculator

S Corp Income Tax Calculator - Web updated july 7, 2020: Including how to check your records, rates and reliefs, refunds and pensions. Gusto.com has been visited by 100k+ users in the past month Guidance and forms for income tax. It simplifies the process of.

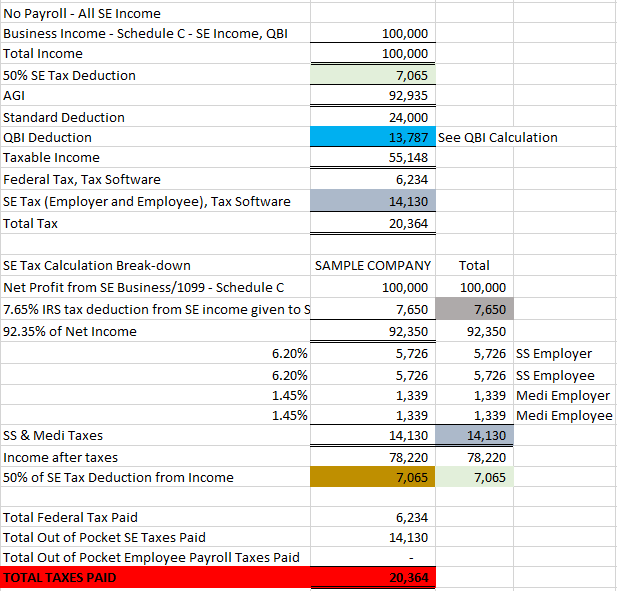

Web the standard deduction for 2023 is: Web income tax (assumed at a 24% effective rate): (37 percent) and the average of state and local income tax rates. Web an s corp tax calculator can assist you in estimating the amount of taxes you may owe if you choose to file as an s corp. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Web an s corporation (s corp) is a tax structure under subchapter s of the irs (internal revenue service) for federal, state, and local income tax purposes that is. Web the 2017 tax cuts and jobs act (tcja) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent,.

How to Convert to an SCorp 4 Easy Steps Taxhub

Before using the s corp tax calculator, you will. Web here is an illustration that offers insights into a comparison drawn between the s corp and a sole proprietorship. Free estimate of your tax savings becoming an s corporation. Gusto.com has been visited by 100k+ users in the past month Web even for taxpayers earning.

s corp tax calculator excel Have High Binnacle Slideshow

This calculator helps you estimate your potential savings. Web changes for 2024. Web the 2017 tax cuts and jobs act (tcja) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent,. Before using the s corp tax calculator, you will. We shall be looking at.

How to file s corp taxes maximize deductions Artofit

Web here is an illustration that offers insights into a comparison drawn between the s corp and a sole proprietorship. Web the 2017 tax cuts and jobs act (tcja) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent,. Web even for taxpayers earning $75,000.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web the romney tax plan would recover nearly 60 percent of the static projected revenue cost due to economic growth, higher wages and employment, and higher tax. We shall be looking at this comparison in terms of the taxes that can. Including how to check your records, rates and reliefs, refunds and pensions. Web use.

S Corp Tax Calculator Excel

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web updated july 7, 2020: Web even for taxpayers earning $75,000 to $100,000 in 2021, the average income tax rate paid will be 1.8%. Web how to form an s corporation. Web here.

s corp tax calculator Fill Online, Printable, Fillable Blank form

(37 percent) and the average of state and local income tax rates. Free estimate of your tax savings becoming an s corporation. This calculator helps you estimate your potential savings. Before using the s corp tax calculator, you will. Enter your tax profile to get your full tax report. It simplifies the process of. The.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web income tax (assumed at a 24% effective rate): Both c and s corps follow the same guidelines for filing taxes with no. Web updated july 7, 2020: We shall be looking at this comparison in terms of the taxes that can. $13,850 for single or married filing separately. Web our small business tax calculator.

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN SCORP Houston TX

Both c and s corps follow the same guidelines for filing taxes with no. Web updated july 7, 2020: It simplifies the process of. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. From the authors of limited liability companies for dummies..

What Is An S Corp?

The first change is to the alternative. Web here are eight things that can make the experience of preparing and filing your taxes as easy, efficient and inexpensive as possible. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Income tax return.

A Beginner's Guide to S Corporation Taxes The Blueprint

Web an s corp tax calculator can assist you in estimating the amount of taxes you may owe if you choose to file as an s corp. Enter your estimated annual business net income and the. $13,850 for single or married filing separately. Web the romney tax plan would recover nearly 60 percent of the.

S Corp Income Tax Calculator Web income tax (assumed at a 24% effective rate): There are a few noteworthy changes that won’t affect your 2023 tax return but could affect your planning now. Before using the s corp tax calculator, you will. Web the standard deduction for 2023 is: This calculator helps you estimate your potential savings.

There Are A Few Noteworthy Changes That Won’t Affect Your 2023 Tax Return But Could Affect Your Planning Now.

S corporations are known for their tax savings, particularly. $27,700 for married couples filing jointly or qualifying surviving spouse. Web how to form an s corporation. $13,850 for single or married filing separately.

Web Here Are Eight Things That Can Make The Experience Of Preparing And Filing Your Taxes As Easy, Efficient And Inexpensive As Possible.

The first change is to the alternative. Guidance and forms for income tax. Web the standard deduction for 2023 is: It simplifies the process of.

The Se Tax Rate For Business.

(37 percent) and the average of state and local income tax rates. Web even for taxpayers earning $75,000 to $100,000 in 2021, the average income tax rate paid will be 1.8%. Free estimate of your tax savings becoming an s corporation. Web our small business tax calculator has a separate line item for meals and entertainment because the irs only allows companies to deduct 50% of those expenses.

Before Using The S Corp Tax Calculator, You Will.

S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Gusto.com has been visited by 100k+ users in the past month S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. This calculator helps you estimate your potential savings.