S Corp Reasonable Salary Calculator

S Corp Reasonable Salary Calculator - Gusto.com has been visited by 100k+ users in the past month The cost approach, market approach, and income approach. Web employers and employees split social security taxes. Web october 2, 2023 s corp tax calculator: The employer pays 6.2% of the first $106,800 while the employee pays the additional 4.2%.

Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. S corps are corporations opting to flow their. Your net profit is $70,000 a year before your salary. Web the irs recognizes three approved approaches to calculate reasonable compensation: Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web you’re an owner of a programming s corp in los angeles, california. What is an s corp?

S Corp Reasonable Salary TRUiC

Web you’re an owner of a programming s corp in los angeles, california. Web the irs recognizes three approved approaches to calculate reasonable compensation: Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. S corps are corporations opting to flow.

What is a reasonable salary for an S corp? With Jamie Trull!

Web to find a reasonable salary for an s corporation owner/employee, consider how you would find a reasonable salary amount for any new employee. Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. Gusto.com has been visited by 100k+ users.

How to Determine S Corporation Reasonable Compensation The

Web in 2014, however, employers paid 6.2 percent of an employee’s wages up to $117,000. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web the 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Before using the.

Determining Reasonable Compensation For An S Corporation MC Bell Law

Web employers and employees split social security taxes. Before using the s corp tax calculator, you will. Web to find a reasonable salary for an s corporation owner/employee, consider how you would find a reasonable salary amount for any new employee. For example, if an s corp owner earns $50,000. Web you’re an owner of.

What Is an S Corp “Reasonable Salary”? How to Pay Yourself — Collective

Web employers and employees split social security taxes. The cost approach, market approach, and income approach. Web to find a reasonable salary for an s corporation owner/employee, consider how you would find a reasonable salary amount for any new employee. Web $250,000 $0 $250,000 $500,000 b) what is the salary you would pay yourself? What.

How to Set Your S Corp Salary Understanding Reasonable Compensation

Web employers and employees split social security taxes. 16, 2022 can you help your s corp clients determine a reasonable compensation? Before using the s corp tax calculator, you will. S corps are corporations opting to flow their. The employer pays 6.2% of the first $106,800 while the employee pays the additional 4.2%. The cost.

S Corp Toolbox

Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? S corps are corporations opting to flow their. 16, 2022 can you help your s corp clients determine a reasonable compensation? Web our s corp tax calculator will estimate whether electing an s corp will result in.

What is a reasonable salary for an S corp? With Jamie Trull!

Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. For example, if an s corp owner earns $50,000. Web the irs recognizes three approved approaches to calculate reasonable compensation: Web our s corp tax calculator will estimate whether electing an.

What is a reasonable salary for an S corp? With Jamie Trull!

Web the 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Web employers and employees split social security taxes. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. What is an s corp? Web.

Reasonable salaries What every S corp owner needs to know Finaloop

What is an s corp? Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. Web in 2014, however, employers paid 6.2 percent.

S Corp Reasonable Salary Calculator Before using the s corp tax calculator, you will. Web you’re an owner of a programming s corp in los angeles, california. 16, 2022 can you help your s corp clients determine a reasonable compensation? Web learn what is an s corp “reasonable salary”, get s corp salary examples and know the tax benefits of running an s corp. Web to find a reasonable salary for an s corporation owner/employee, consider how you would find a reasonable salary amount for any new employee.

Gusto.com Has Been Visited By 100K+ Users In The Past Month

What is an s corp? Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Web the net income of $137,700 is the maximum for the social security taxes, but the rest of the income is still subject to 2.9% medicare taxes that has no limit. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation.

Web You’re An Owner Of A Programming S Corp In Los Angeles, California.

Web october 2, 2023 s corp tax calculator: Web the irs recognizes three approved approaches to calculate reasonable compensation: Your net profit is $70,000 a year before your salary. Before using the s corp tax calculator, you will.

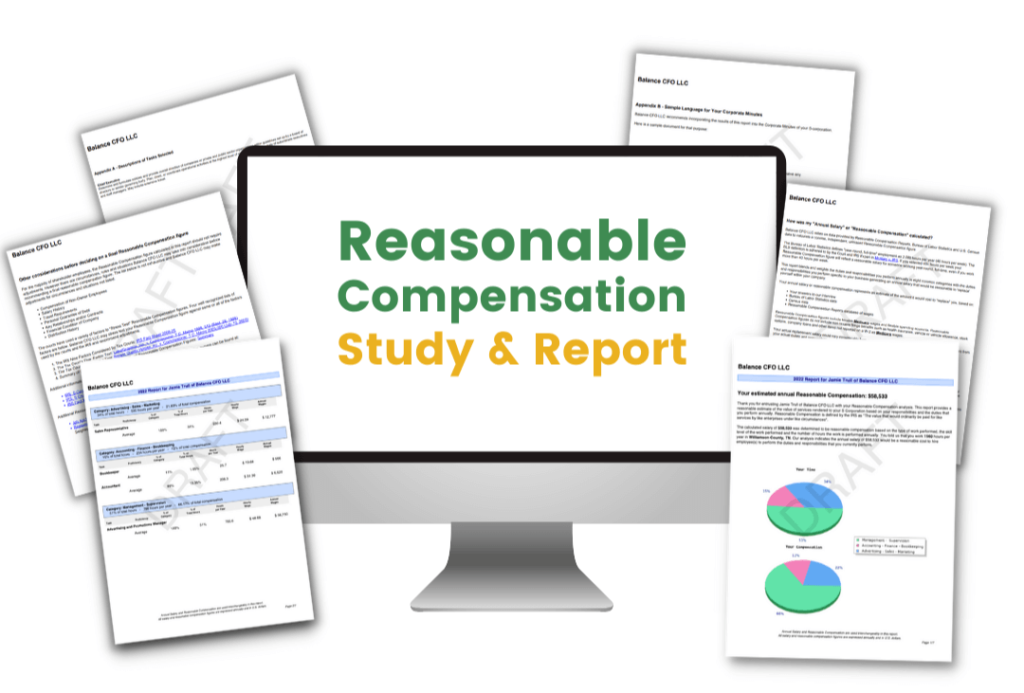

Web The Reasonable Compensation S Corp Calculator Is A Valuable Tool For S Corporation Owners To Determine An Appropriate Salary For Themselves.

Web the 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Glassdoor tells you that the average. S corps are corporations opting to flow their. Web to find a reasonable salary for an s corporation owner/employee, consider how you would find a reasonable salary amount for any new employee.

Web Learn What Is An S Corp “Reasonable Salary”, Get S Corp Salary Examples And Know The Tax Benefits Of Running An S Corp.

3 what factors determine a reasonable salary? Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web in 2014, however, employers paid 6.2 percent of an employee’s wages up to $117,000. 16, 2022 can you help your s corp clients determine a reasonable compensation?

.png)