S Corp Salary 60/40 Rule Calculator

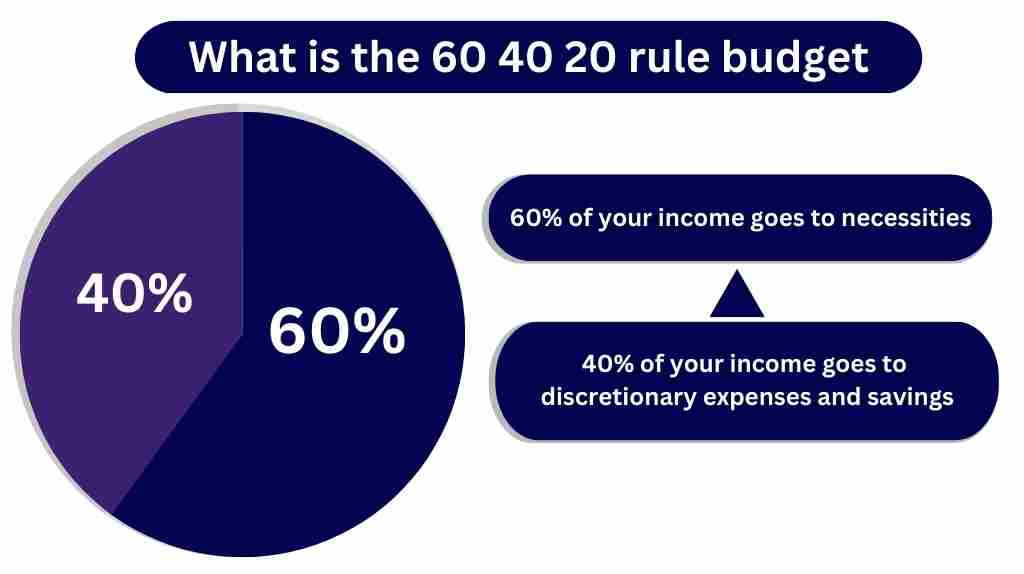

S Corp Salary 60/40 Rule Calculator - Web s corp tax savings calculator table of contents if your business is registered as an s corp, you could expect to save a considerable amount on your taxes. Web without a safe harbor or definitive guidance on what constitutes a reasonable salary, s corporations have resorted to various rules of thumb, such as a ratio of salary to. According to the 60/40 rule, the owner should pay themselves a salary equal to 60% of. Web this is not an irs rule and not a safe harbor rule. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation.

Salary.com has been visited by 10k+ users in the past month Web suppose an s corporation generates an annual income of $100,000. Web s corp tax savings calculator table of contents if your business is registered as an s corp, you could expect to save a considerable amount on your taxes. This includes the total revenue plus $150,000 of business expenses, salary of $50,000, and payroll. Divide your business income into 2 parts and designate 60% as salary and 40% as a distribution. Web a 60/40 split, allocating 60% to salaries and 40% to distributions. Web net taxable income for an s corp is calculated by adjusting its gross income.

Analysing investment strategies the 60/40 rule Holborn Assets

Web the s corp 60/40 rule. Divide your business income into 2 parts and designate 60% as salary and 40% as a distribution. Salary.com has been visited by 10k+ users in the past month The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. To qualify for.

What Is The 60/40 Rule Budget? (With Examples) Why Budgeting

To qualify for s corporation status, the corporation must. Web the s corp 60/40 rule. Web take the quiz what happens if your s corp earns profits in excess of your reasonable compensation? Web jul 26, 2021 11 mins hernan barona reasonable compensation in the corporate world the very nature of c corp and s.

Home

Web suppose an s corporation generates an annual income of $100,000. The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Web this is not an irs rule and not a safe harbor rule. Web the s corp 60/40 rule. Salary.com has been visited by 10k+ users.

What Is The 60/40 Rule Budget? (With Examples) Wealth of Geeks

For example, if an s corp owner. Web without a safe harbor or definitive guidance on what constitutes a reasonable salary, s corporations have resorted to various rules of thumb, such as a ratio of salary to. To qualify for s corporation status, the corporation must. Web a rule of thumb that has been used.

How to Set Your S Corp Salary Understanding Reasonable Compensation

Web s corp tax savings calculator table of contents if your business is registered as an s corp, you could expect to save a considerable amount on your taxes. This includes the total revenue plus $150,000 of business expenses, salary of $50,000, and payroll. For example, if an s corp owner. Web this is not.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web take the quiz what happens if your s corp earns profits in excess of your reasonable compensation? Setting salary at anything over the social security wage base ($142,800 for 2021 and. Web a rule of thumb that has been used by many is the 60/40 rule. Web suppose an s corporation generates an annual.

What Is The 60/40 Rule Budget? (With Examples) Why Budgeting

Setting salary at anything over the social security wage base ($142,800 for 2021 and. This includes the total revenue plus $150,000 of business expenses, salary of $50,000, and payroll. Web the methods for determining reasonable compensation range from detailed compensation analysis reports to the 60/40 rule, which allocates 60% of business. Divide your business income.

60 40 RULE YouTube

Web this is not an irs rule and not a safe harbor rule. Web the s corp 60/40 salary rule. Web a rule of thumb that has been used by many is the 60/40 rule. Web without a safe harbor or definitive guidance on what constitutes a reasonable salary, s corporations have resorted to various.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web s corp tax savings calculator table of contents if your business is registered as an s corp, you could expect to save a considerable amount on your taxes. Web the methods for determining reasonable compensation range from detailed compensation analysis reports to the 60/40 rule, which allocates 60% of business. It was developed by.

What Is The 60/40 Rule Budget? (With Examples) Wealth of Geeks

For example, if an s corp owner. Web a 60/40 split, allocating 60% to salaries and 40% to distributions. This is where you pay 60% of your business income as your salary and the remaining 40% as a distribution. Web take the quiz what happens if your s corp earns profits in excess of your.

S Corp Salary 60/40 Rule Calculator Web jul 26, 2021 11 mins hernan barona reasonable compensation in the corporate world the very nature of c corp and s corp business entities is to gross high profits. This is where you pay 60% of your business income as your salary and the remaining 40% as a distribution. The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Web when your company, or any company, pays you $10,000 in shareholder wages, 7.65% is withheld from your pay check for the employee’s portion of payroll. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation.

Divide Your Business Income Into 2 Parts And Designate 60% As Salary And 40% As A Distribution.

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web this is not an irs rule and not a safe harbor rule. The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. Web without a safe harbor or definitive guidance on what constitutes a reasonable salary, s corporations have resorted to various rules of thumb, such as a ratio of salary to.

Web The S Corp 60/40 Rule.

Web when your company, or any company, pays you $10,000 in shareholder wages, 7.65% is withheld from your pay check for the employee’s portion of payroll. According to the 60/40 rule, the owner should pay themselves a salary equal to 60% of. Setting salary at anything over the social security wage base ($142,800 for 2021 and. Enter your estimated annual business net income and the.

Web S Corp Tax Savings Calculator Table Of Contents If Your Business Is Registered As An S Corp, You Could Expect To Save A Considerable Amount On Your Taxes.

For example, if an s corp owner. This includes the total revenue plus $150,000 of business expenses, salary of $50,000, and payroll. Web suppose an s corporation generates an annual income of $100,000. Web the methods for determining reasonable compensation range from detailed compensation analysis reports to the 60/40 rule, which allocates 60% of business.

Web Jul 26, 2021 11 Mins Hernan Barona Reasonable Compensation In The Corporate World The Very Nature Of C Corp And S Corp Business Entities Is To Gross High Profits.

Salary.com has been visited by 10k+ users in the past month It was developed by practitioners as a simple guide for determining a reasonable salary. Web net taxable income for an s corp is calculated by adjusting its gross income. In this case, you can take those profits as distributions.