S Corp Tax Calculator California

S Corp Tax Calculator California - Web although california’s tax rules generally follow the federal rules for computing the s corporation’s income, california taxes this income at the corporate. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. California s corporation tax is the state income tax charged to an s corporation, along with annual franchise taxes and other fees. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. $ what percentage of this will be paid to you as salary?

In this example, you’d take 40% of your profit as an employee salary, and. Web updated july 7, 2020: $ what percentage of this will be paid to you as salary? Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Web what's the best tax treatment for your startup? As of january 1, 2000, newly incorporated or qualified corporations are. Everything you need to know to pay contractors with form 1099 aug 18, 2022 s corp.

s corp tax calculator Fill Online, Printable, Fillable Blank form

Before using the s corp tax calculator, you will. Just complete the fields below with your best estimates and then register to get your cpa or. It simplifies the process of. Web here’s what it means for you. Web llc vs s corp california. Enter your estimated annual business net income and the. Web llc’s.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. $ what percentage of this will be paid to you as salary? 4/5 (216k reviews) Web updated june 28, 2020: It simplifies the process of. S corporation tax calculator can help you determine.

SCorp Eligibility Qualifications & Guidelines for 2023

California s corporation tax is the state income tax charged to an s corporation, along with annual franchise taxes and other fees. Web llc vs s corp california. This calculator helps you estimate your potential savings. Web october 2, 2023 s corp tax calculator: It simplifies the process of. As of january 1, 2000, newly.

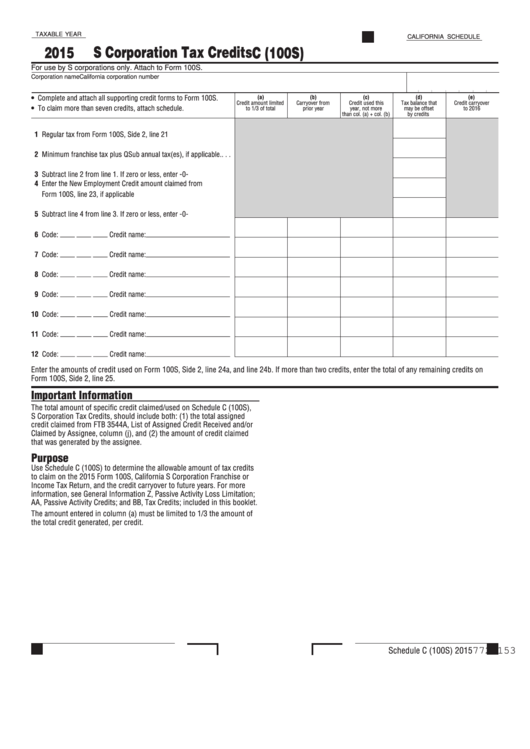

Fillable Schedule C (100s) S Corporation Tax Credits Form

Web here’s a chart that shows how much social security and medicare tax you can save with s corp taxation. Web updated july 7, 2020: The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. You’ll also need to file form 100s every year, and.

s corp tax calculator excel Have High Binnacle Slideshow

S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Should your california llc become an s corp? Web updated july 7, 2020: (for example, you could pay yourself. Web an s corporation's annual tax is the greater of 1.5 percent of the corporation's.

S Corp Tax Calculator LLC vs C Corp vs S Corp

Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Web an s corporation's annual tax is the greater of 1.5 percent of the corporation's net income or $800. As of january 1, 2000, newly incorporated or qualified corporations are. Web llc vs.

How to Start an S Corp in California California S Corp

Web what's the best tax treatment for your startup? Web here’s a chart that shows how much social security and medicare tax you can save with s corp taxation. This guide will help you understand the costs and benefits. Web here are eight things that can make the experience of preparing and filing your taxes.

How to Convert to an SCorp 4 Easy Steps Taxhub

The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Just complete the fields below with your best estimates and then register to get your cpa or. Web what's the best tax treatment for your startup? (for example, you could pay yourself. In this example,.

State Corporate Tax Rates and Brackets Tax Foundation

$ what percentage of this will be paid to you as salary? Web updated june 28, 2020: S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. Web what's the best tax treatment for your startup? It simplifies the process of. Web although california’s tax rules.

What Is An S Corp?

The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web we tax every s corporation that has california source income 1.5%. Web here’s what it means.

S Corp Tax Calculator California Web an s corp tax calculator can assist you in estimating the amount of taxes you may owe if you choose to file as an s corp. Before using the s corp tax calculator, you will. (for example, you could pay yourself. Just complete the fields below with your best estimates and then register to get your cpa or. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to.

Web Here’s A Chart That Shows How Much Social Security And Medicare Tax You Can Save With S Corp Taxation.

Web although california’s tax rules generally follow the federal rules for computing the s corporation’s income, california taxes this income at the corporate. Web llc vs s corp california. This calculator helps you estimate your potential savings. Before using the s corp tax calculator, you will.

Web What's The Best Tax Treatment For Your Startup?

Everything you need to know to pay contractors with form 1099 aug 18, 2022 s corp. Web updated july 7, 2020: S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit.

From The Authors Of Limited Liability Companies For Dummies.

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. This guide will help you understand the costs and benefits. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Just complete the fields below with your best estimates and then register to get your cpa or.

Visit Our Tax Rates Table For Complete List Of Tax Rates Your Minimum Franchise Tax ($800) Is Due The First.

In this example, you’d take 40% of your profit as an employee salary, and. Web an s corporation's annual tax is the greater of 1.5 percent of the corporation's net income or $800. 4/5 (216k reviews) It simplifies the process of.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)