S Corp Tax Calculator Excel

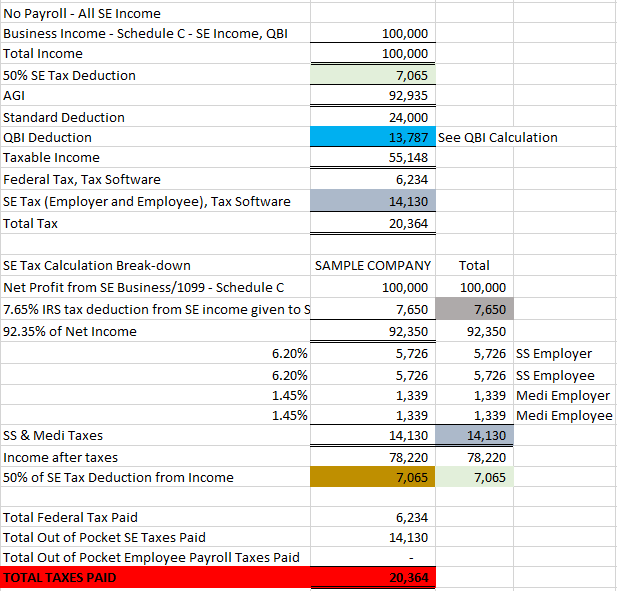

S Corp Tax Calculator Excel - This calculator template is prepared in ms excel format. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. From the authors of limited liability companies for dummies. If you are currently a single member llc then you are generally going to be reporting your income. Web one of the largest additional costs will be your tax filing at the end of the year.

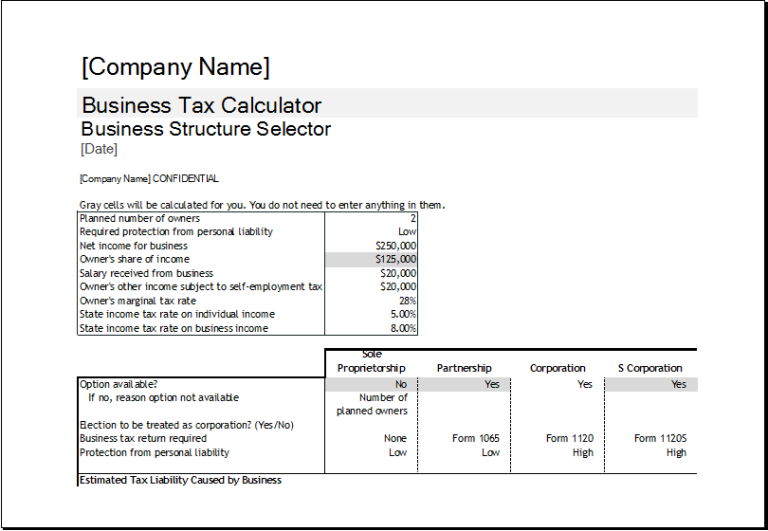

Web online, you might find other s corp tax calculator excel style, if that is easier for you to navigate. This calculator helps you estimate your potential savings. This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Get the spreadsheet template here:. We shall be looking at this comparison in terms of the taxes that can. Web s corp tax calculator. Web download corporate tax calculator template:

Corporation Tax Calculator Excel Excel Templates

Once you have those numbers, run through a few different tax scenarios. Web here is an illustration that offers insights into a comparison drawn between the s corp and a sole proprietorship. Before using the s corp tax calculator, you will. Get the spreadsheet template here:. For landscapers1099 tax formfor online sellersfor consultants Start by.

UK Corporation Tax Calculator Excel Template for Corporation Tax

This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Enter your tax profile to get your full tax report. Get the spreadsheet template here:. Free estimate of your tax savings becoming an s corporation. Web here is an illustration that offers insights into a comparison drawn between the s.

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN SCORP Houston TX

For landscapers1099 tax formfor online sellersfor consultants This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. 15.3% of $150,000 = $22,950. Before using the s corp tax calculator, you will. From the authors of limited liability companies for dummies. What’s your.

Understanding Corporation Tax Calculator Free Sample, Example

Web taxhub has the perfect calculator for you! From the authors of limited liability companies for dummies. To qualify for s corporation status, the corporation must. If you are currently a single member llc then you are generally going to be reporting your income. This guide will walk you through the steps necessary to convert.

s corp tax calculator excel Have High Binnacle Slideshow

Ms excel can be easily converted into a calculator by defining some. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. To qualify for s corporation status, the corporation must. This calculator template is prepared in ms excel format. If you.

Corporate Tax Calculator Template for Excel Excel Templates

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web for example, after calculating a tax cost or savings upon conversion from a sole proprietorship to an s corporation under the various income scenarios, the case. Web download corporate tax calculator template:.

s corp tax calculator Fill Online, Printable, Fillable Blank form

Web here is an illustration that offers insights into a comparison drawn between the s corp and a sole proprietorship. For landscapers1099 tax formfor online sellersfor consultants Get the spreadsheet template here:. To qualify for s corporation status, the corporation must. Web for example, after calculating a tax cost or savings upon conversion from a.

How to Convert to an SCorp 4 Easy Steps Taxhub

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Enter your tax profile to get your full tax report. Web download corporate tax calculator template: This calculator helps you understand the difference between filing taxes as a sole proprietor vs. S corporation.

S Corp Tax Calculator Excel

This calculator template is prepared in ms excel format. Web one of the largest additional costs will be your tax filing at the end of the year. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. To qualify for s corporation.

What Is An S Corp?

To qualify for s corporation status, the corporation must. Once you have those numbers, run through a few different tax scenarios. Free estimate of your tax savings becoming an s corporation. This calculator helps you estimate your potential savings. Enter your tax profile to get your full tax report. What’s your annual net income? Web.

S Corp Tax Calculator Excel Web for example, after calculating a tax cost or savings upon conversion from a sole proprietorship to an s corporation under the various income scenarios, the case. What’s your annual net income? This calculator template is prepared in ms excel format. For landscapers1099 tax formfor online sellersfor consultants What is considered “reasonable compensation” for your industry and your role in the business?

Web One Of The Largest Additional Costs Will Be Your Tax Filing At The End Of The Year.

This calculator helps you estimate your potential savings. What is considered “reasonable compensation” for your industry and your role in the business? If you are currently a single member llc then you are generally going to be reporting your income. Web for example, after calculating a tax cost or savings upon conversion from a sole proprietorship to an s corporation under the various income scenarios, the case.

Before Using The S Corp Tax Calculator, You Will.

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web click calculate to show your savings. Web updated july 7, 2020: Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business.

Web Taxhub Has The Perfect Calculator For You!

From the authors of limited liability companies for dummies. Once you have those numbers, run through a few different tax scenarios. Free estimate of your tax savings becoming an s corporation. Start by playing with the numbers.

To Qualify For S Corporation Status, The Corporation Must.

Web here is an illustration that offers insights into a comparison drawn between the s corp and a sole proprietorship. This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Ms excel can be easily converted into a calculator by defining some. What’s your annual net income?