S Corp Tax Calculator

S Corp Tax Calculator - Get the spreadsheet template here:. And even if you get an. Web see your 2023 business taxes. Web s corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Web an s corporation (s corp) is a tax structure under subchapter s of the irs (internal revenue service) for federal, state, and local income tax purposes that is.

Web online, you might find other s corp tax calculator excel style, if that is easier for you to navigate. Web the standard deduction for 2023 is: Web simply enter your home location, property value and loan amount to compare the best rates. Saves you timetrack inventoryfast & easy setupget personalized reports Web download fiscal fact no. Including how to check your records, rates and reliefs, refunds and pensions. Web the s corp tax calculator.

s corp tax calculator excel Have High Binnacle Slideshow

Guidance and forms for income tax. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. Web calculate how much you can save by electing s corp status for your llc and compare it with a default llc..

SCorp Eligibility Qualifications & Guidelines for 2023

Learn how s corporations reduce. What is considered “reasonable compensation” for your industry and your role in the business? Learn how you can calculate your s corporation. Including how to check your records, rates and reliefs, refunds and pensions. Enter your estimated annual net income and salary to see how much money you can save.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set to receive a tax cut of 5.8 per cent of their. Web online, you might.

Calculate S Corp Taxes using an S Corp Calculator YouTube

Web calculate your corporation tax savings by filing as an s corporation. Web although the current statutory corporate tax rate is 21%, senate democrats say some 200 or more large corporations pay below 15% due to various tax incentives. Get the spreadsheet template here:. 4/5 (17k reviews) $13,850 for single or married filing separately. Those.

Most S Corp Tax Calculator Methods Are Wrong (Do This Instead!)

Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set to receive a tax cut of 5.8 per cent of their. Web an s corporation (s corp) is a tax structure under subchapter s of the irs (internal revenue service) for federal, state, and local.

What Is An S Corp?

This calculator helps you estimate your potential savings. From the authors of limited liability companies for dummies. Web see your 2023 business taxes. Compare the costs and benefits of s corp with llc, and learn. Including how to check your records, rates and reliefs, refunds and pensions. Web the standard deduction for 2023 is: Saves.

How to Convert to an SCorp 4 Easy Steps Taxhub

Learn the irs requirements, criteria, and benefits of s. Web see your 2023 business taxes. Web download fiscal fact no. Web the s corp tax calculator. Those alberta marginal tax rates cited above compared with 43.5. Learn how you can calculate your s corporation. Web use this free online tool to calculate your tax savings.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web an s corporation (s corp) is a tax structure under subchapter s of the irs (internal revenue service) for federal, state, and local income tax purposes that is. Web online, you might find other s corp tax calculator excel style, if that is easier for you to navigate. And even if you get an..

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN SCORP Houston TX

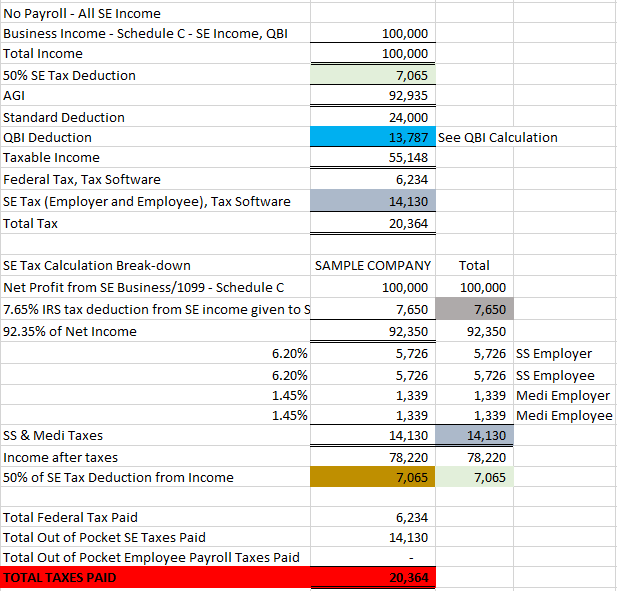

Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set to receive a tax cut of 5.8 per cent of their. The model and tax calculator. Web use this tool to compare the tax implications of filing as an s corp vs. Enter your estimated.

s corp tax calculator Fill Online, Printable, Fillable Blank form

Simulating the economic effects of romney’s tax plan. Once you have those numbers, run through a few different tax scenarios. Web the standard deduction for 2023 is: Web use this tool to compare the tax implications of filing as an s corp vs. Learn how you can calculate your s corporation. Web we then analyze.

S Corp Tax Calculator Web online, you might find other s corp tax calculator excel style, if that is easier for you to navigate. 4/5 (17k reviews) This calculator helps you estimate your potential savings. The impact of romney’s proposed $17,000 cap the debate over. Income tax return for an s corporation.

Web Simply Enter Your Home Location, Property Value And Loan Amount To Compare The Best Rates.

The s corporation tax calculator below lets you choose how much to withdraw from your business each year, and how much of it you will take as. Compare the costs and benefits of s corp with llc, and learn. Web calculate how much you can save by electing s corp status for your llc and compare it with a default llc. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553.

From The Authors Of Limited Liability Companies For Dummies.

Once you have those numbers, run through a few different tax scenarios. Start by playing with the numbers. Web the ey 2024 personal tax calculator shows a dramatic difference in tax rates between provinces. 4/5 (17k reviews)

Both C And S Corps Follow The Same Guidelines For Filing Taxes With No.

Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Guidance and forms for income tax. And even if you get an. Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set to receive a tax cut of 5.8 per cent of their.

Web S Corporations Are Corporations That Elect To Pass Corporate Income, Losses, Deductions, And Credits Through To Their Shareholders For Federal Tax Purposes.

Web online, you might find other s corp tax calculator excel style, if that is easier for you to navigate. Web check each option you'd like to calculate for. What’s your annual net income? $27,700 for married couples filing jointly or qualifying surviving spouse.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)