S Corp Tax Savings Calculator

S Corp Tax Savings Calculator - Aim for a salary sweet spot. Instantly calculate the time and money you can potentially save. Free estimate of your tax savings becoming an s corporation. Enter your estimated annual business net income and the. Web balance your salary for maximum tax savings.

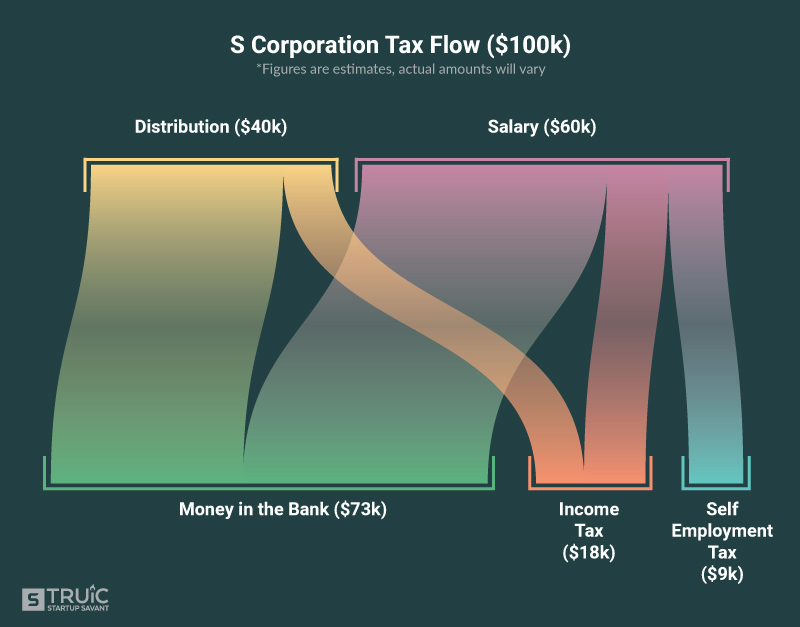

Web s corp tax savings calculator table of contents if your business is registered as an s corp, you could expect to save a considerable amount on your taxes. Web shareholders must then pay tax on their dividend shares. Use a holding company—transfer your company’s “safe income” (for tax purposes, any leftover cash earned through your business) to a holding. Web balance your salary for maximum tax savings. Web retirement retirement planning social security 401(k)s 401(k) savings calculator roth and traditional iras roth ira calculator. So let’s say you decide that an appropriate salary for you is about $40,000. $27,700 for married couples filing jointly or qualifying surviving spouse.

What Is An S Corp?

Web shareholders must then pay tax on their dividend shares. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Web balance your salary for maximum tax savings. So let’s say you decide that an appropriate salary for you is about $40,000. This means you’re not.

S Corp Tax Savings Calculator

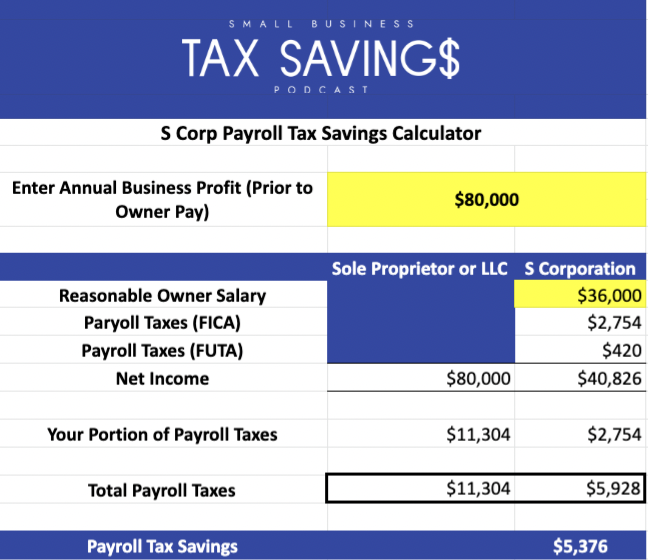

Web to make this a reality, our tax experts have crafted an intuitive s corp savings calculator. There are a few noteworthy changes that won’t affect your 2023 tax return but could affect your planning now. Web calculate s corp taxes to reduce taxes and protect personal assets by forming an llc taxed as an.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web calculate s corp taxes to reduce taxes and protect personal assets by forming an llc taxed as an s corp. Expense estimatorfile with confidenceeasy and accurateaudit support guarantee Read ahead to calculate your s corp tax. Llc tax calculator guide will explain how to tell whether an s corp election is right for your.

S Corp Tax Calculator LLC vs C Corp vs S Corp

Expense estimatorfile with confidenceeasy and accurateaudit support guarantee Understand the taxes you have to pay as an s corp for your. Enter a reasonable salary for yourself: Web the cost of filing the extra tax return for the s corporation would eat up more than the tax savings. Web to make this a reality, our.

How Starting an S Corp Could Lower Your Taxes by 5,000 Tax Savings

The model and tax calculator. Calculate how much you can save by choosing an s corp. Understand the taxes you have to pay as an s corp for your. Web the standard deduction for 2023 is: There are a few noteworthy changes that won’t affect your 2023 tax return but could affect your planning now..

S Corp Reasonable Salary TRUiC

Small business · business · business planning · investments · contact us Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Web two ways to defer taxes are: Enter a reasonable salary for yourself: Instantly calculate the time and money you can potentially save. Web.

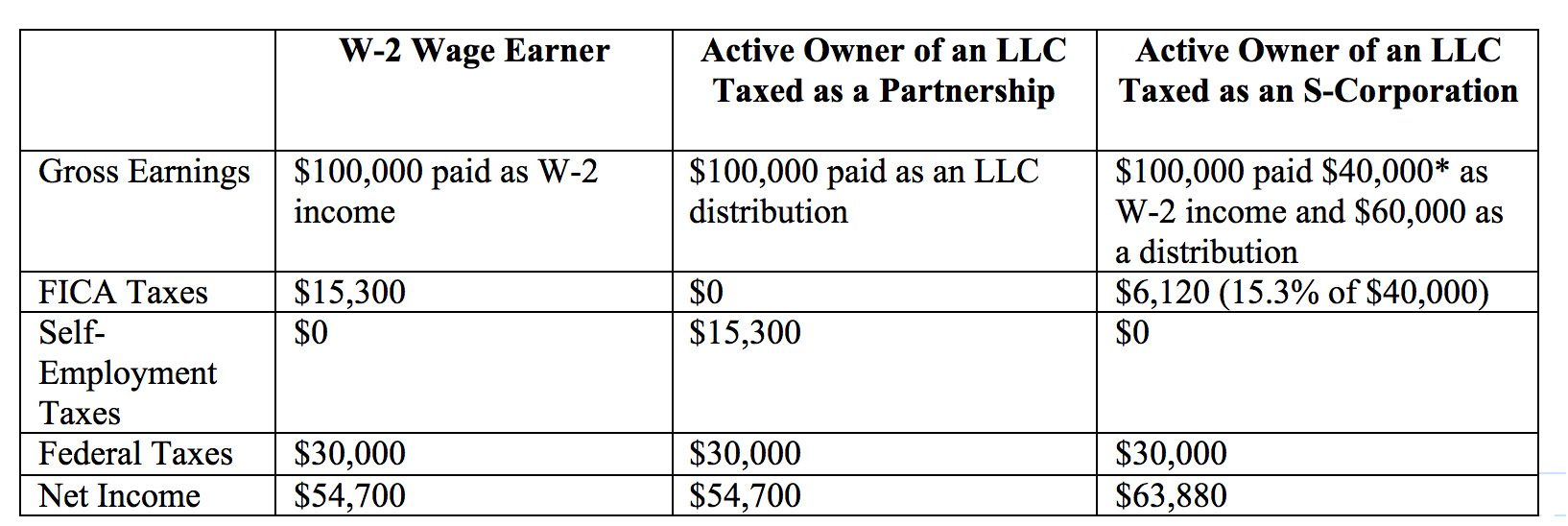

taxsavingsscorpchart Cenkus Law

As an owner of an s corp, you receive something called limited liability protection. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. S corp tax on distributions. This guide will walk you.

S corp Tax Deductions in 2021 Tax deductions, Savings calculator

This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Web retirement retirement planning social security 401(k)s 401(k) savings calculator roth and traditional iras roth ira calculator. Understand the taxes you have to pay as an s corp for your. Web the.

SCorp Tax Savings Calculator Ask Spaulding

Calculate how much you can save by choosing an s corp. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. $27,700 for married couples filing jointly or qualifying surviving spouse. Understand the taxes you have to pay as an s corp for.

SCorp Eligibility Qualifications & Guidelines for 2023

Web this is a savings of $4590.00. This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Web retirement retirement planning social security 401(k)s 401(k) savings calculator roth and traditional iras roth ira calculator. The first change is to the alternative. Understand the taxes you have to pay as an.

S Corp Tax Savings Calculator Web changes for 2024. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Aim for a salary sweet spot. Web to make this a reality, our tax experts have crafted an intuitive s corp savings calculator. S corp tax on distributions.

So Let’s Say You Decide That An Appropriate Salary For You Is About $40,000.

This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Calculate how much you can save by choosing an s corp. The primary method to reduce taxes as an s corporation owner is setting the right salary. Instantly calculate the time and money you can potentially save.

Small Business · Business · Business Planning · Investments · Contact Us

Web the standard deduction for 2023 is: Read ahead to calculate your s corp tax. Web taxhub has the perfect calculator for you! Expense estimatorfile with confidenceeasy and accurateaudit support guarantee

Web The Cost Of Filing The Extra Tax Return For The S Corporation Would Eat Up More Than The Tax Savings.

Web to make this a reality, our tax experts have crafted an intuitive s corp savings calculator. There are a few noteworthy changes that won’t affect your 2023 tax return but could affect your planning now. There is still one thing a business owner can do: The se tax rate for business.

Web With An S Corp, You Will Only Have To Pay That 15.3% Se Tax On Your Salary, But Not The Net Earnings.

It only acts as a. Free estimate of your tax savings becoming an s corporation. Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set to receive a tax cut of 5.8 per cent of their. One of the primary benefits.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)