S Corp Vs C Corp Tax Calculator

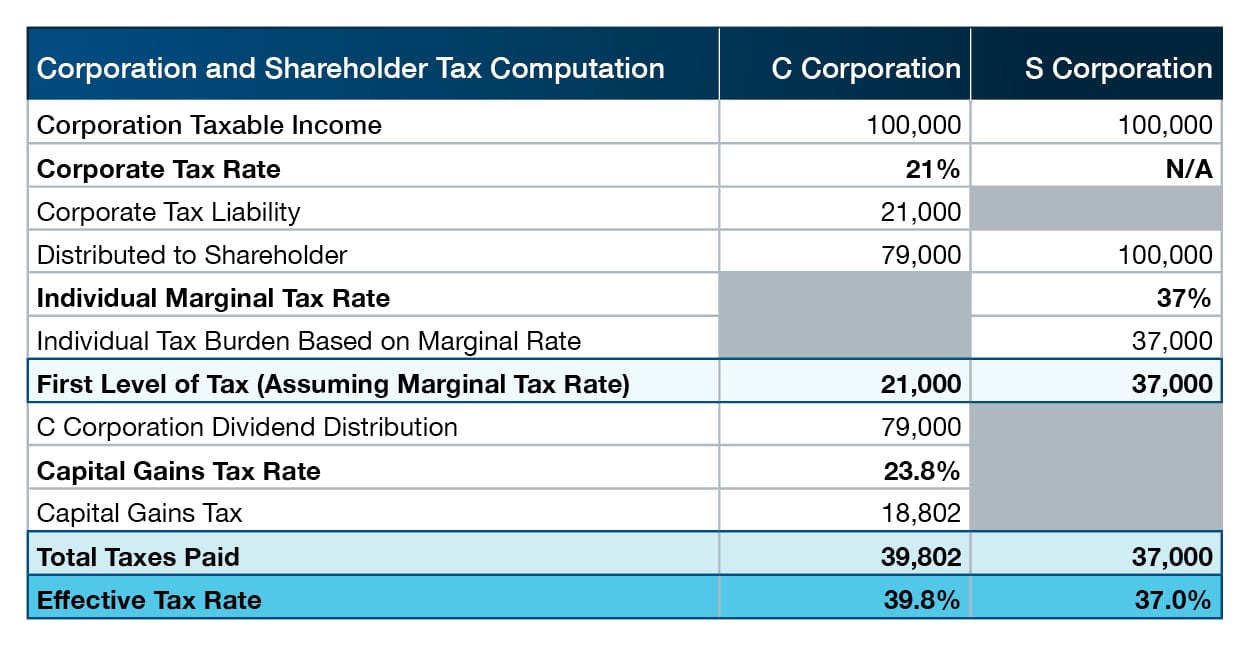

S Corp Vs C Corp Tax Calculator - Web shareholders must then pay tax on their dividend shares. Web since the c corp tax rate is 21% under the 2017 tax cuts and jobs act, the corporate tax bite isn't as deep as it used to be, but s corps are still often better for. Web this tax calculator will help alert you before you choose an s corp. A c corporation (c corp) has double taxation: Web you can write off losses:

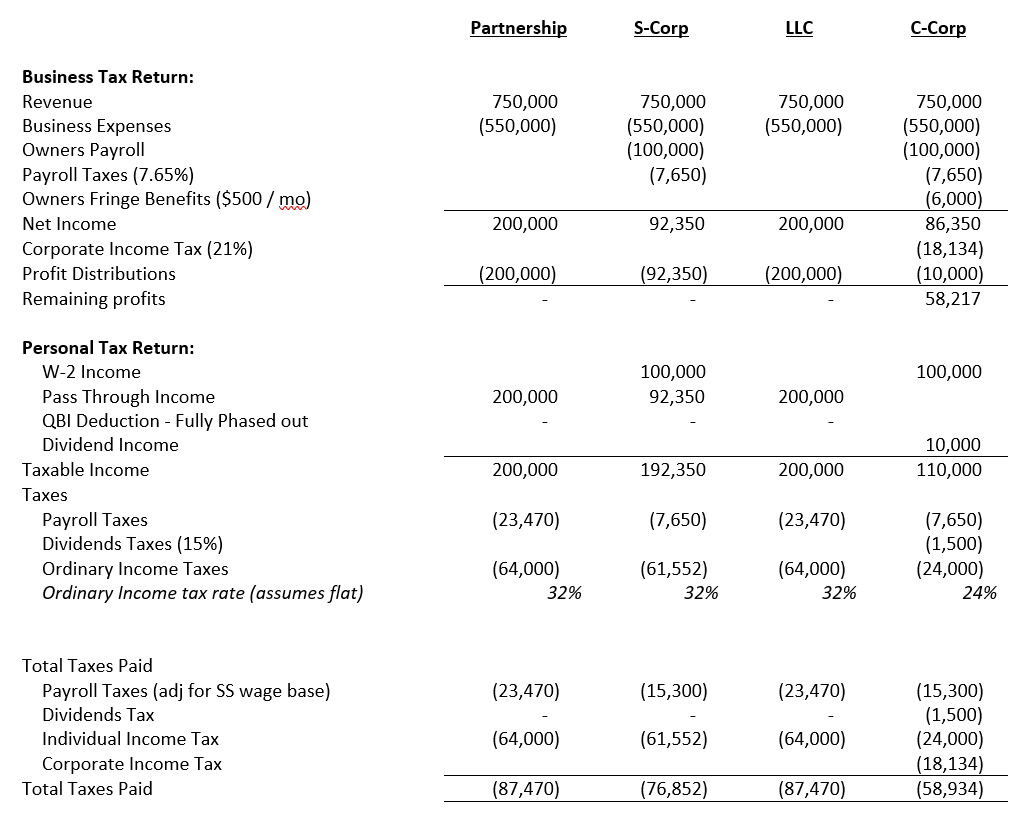

A c corporation (c corp) has double taxation: Web the annual tax for c corporations is the greater of 8.84% of the corporation's net income or $800. Web you can write off losses: However sometimes a cpa can help you avoid expensive state unemployment, so with. Like an s corp, a c corp is a tax election that determines how a business pays taxes to the irs. File taxes once a year: Enter your estimated annual business net income and the.

Difference Between S Corp and C Corp Difference Between

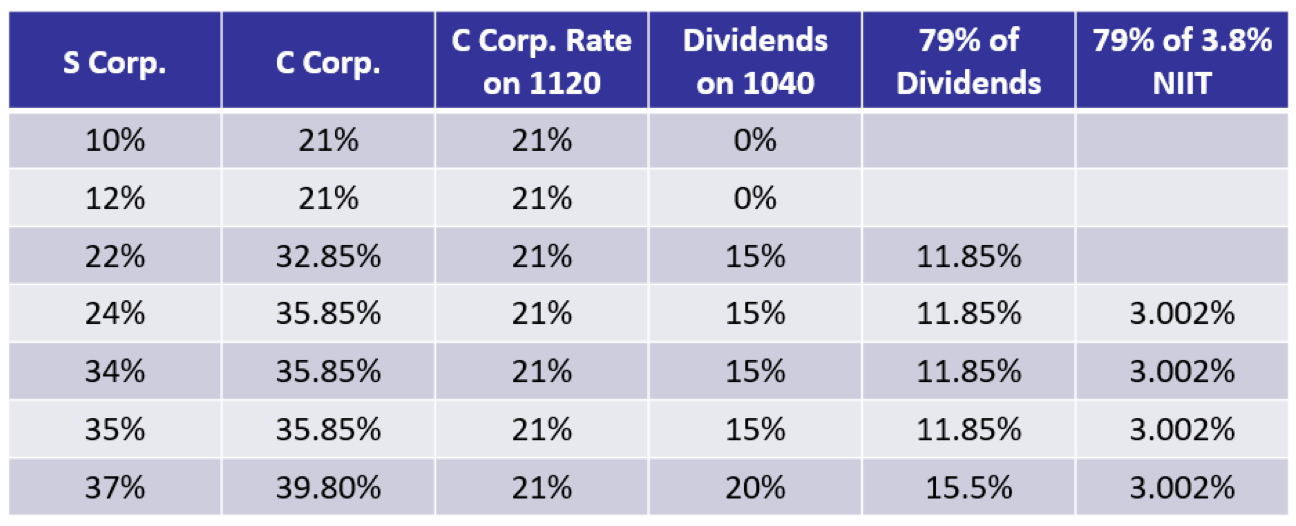

Irsfreshstart.org has been visited by 10k+ users in the past month The se tax rate for business. Web several factors distinguish the tax advantages of both s corps and c corps. Web s corp vs c corp: Web this tax calculator will help alert you before you choose an s corp. This calculator helps you.

SCorp vs CCorp Which is Better? UpFlip

Enter your estimated annual business net income and the. A c corporation (c corp) has double taxation: File taxes once a year: S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web what is the difference between an s corp and a c.

What is Double Taxation for CCorps? The Exciting Secrets of Pass

Even a comparison based on the. Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. File taxes once a year: Enter your estimated annual business net income and the. Web s corp vs c corp: As opposed to a c corp, with an s.

C Corporation vs S Corporation Top 4 Differences (Infographics)

Choosing the c corp or s corp status for a business can have a sizable effect on its. As opposed to a c corp, with an s corp you can write off business losses on your personal income statements. Enter your estimated annual business net income and the. This calculator helps you understand the difference.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web several factors distinguish the tax advantages of both s corps and c corps. As of january 1, 2000, newly incorporated or qualified corporations are. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. A c corporation (c corp) has double taxation:.

How Changes in Corporate Tax Rate Can Affect Choice of C vs. S Corp.

Web updated july 7, 2020: File taxes once a year: Like an s corp, a c corp is a tax election that determines how a business pays taxes to the irs. As opposed to a c corp, with an s corp you can write off business losses on your personal income statements. Web s corp.

S Crop Vs C Crop Business structure, Accounting services, Tax accountant

Irsfreshstart.org has been visited by 10k+ users in the past month By default, the earnings of an llc are passed on to your personal income and exposed to. Web shareholders must then pay tax on their dividend shares. The business is taxed at a flat tax rate (currently 21%). Choosing the c corp or s.

S Corporation or C Corporation Under the Tax Cuts and Jobs Act PYA

Web $0 learn more » more: Web you can write off losses: S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. As of january 1, 2000, newly incorporated or qualified corporations are. A c corporation (c corp) has double taxation: Like an s.

C Corp vs. S Corp, Partnership, Proprietorship, and LLC What Is the

Web $0 learn more » more: Llc is a legal entity that determines how assets are owned. By default, the earnings of an llc are passed on to your personal income and exposed to. The business is taxed at a flat tax rate (currently 21%). Web use this s corp tax rate calculator to get.

Tax CPA Tips S Corp v C Corp Which is Best?

Enter your estimated annual business net income and the. Web since the c corp tax rate is 21% under the 2017 tax cuts and jobs act, the corporate tax bite isn't as deep as it used to be, but s corps are still often better for. Web use this s corp tax rate calculator to.

S Corp Vs C Corp Tax Calculator Web this tax calculator will help alert you before you choose an s corp. A c corporation (c corp) has double taxation: Web updated july 7, 2020: Web $0 learn more » more: Enter your estimated annual business net income and the.

By Default, The Earnings Of An Llc Are Passed On To Your Personal Income And Exposed To.

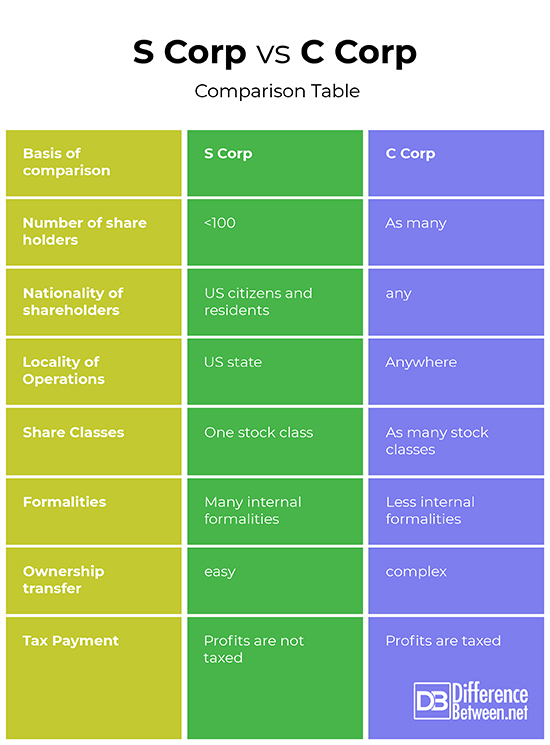

Listed below are the elements that differentiate s corp and c corp from each other: As opposed to a c corp, with an s corp you can write off business losses on your personal income statements. Web form 1120 is the us corporate income tax return for c corporations. Web $0 learn more » more:

Choosing The C Corp Or S Corp Status For A Business Can Have A Sizable Effect On Its.

Web what is the difference between an s corp and a c corp? This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Web this tax calculator will help alert you before you choose an s corp. Even a comparison based on the.

The Se Tax Rate For Business.

However sometimes a cpa can help you avoid expensive state unemployment, so with. Web since the c corp tax rate is 21% under the 2017 tax cuts and jobs act, the corporate tax bite isn't as deep as it used to be, but s corps are still often better for. Web several factors distinguish the tax advantages of both s corps and c corps. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation.

The Business Is Taxed At A Flat Tax Rate (Currently 21%).

Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. Web you can write off losses: Llc is a legal entity that determines how assets are owned. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)