S Corp Vs Llc Calculator

S Corp Vs Llc Calculator - Web this guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to calculate your tax savings. Web our llc vs. Normally these taxes are withheld by your employer. Let's start significantly lowering your tax bill now. Web a limited liability company (llc) is a legal business structure.

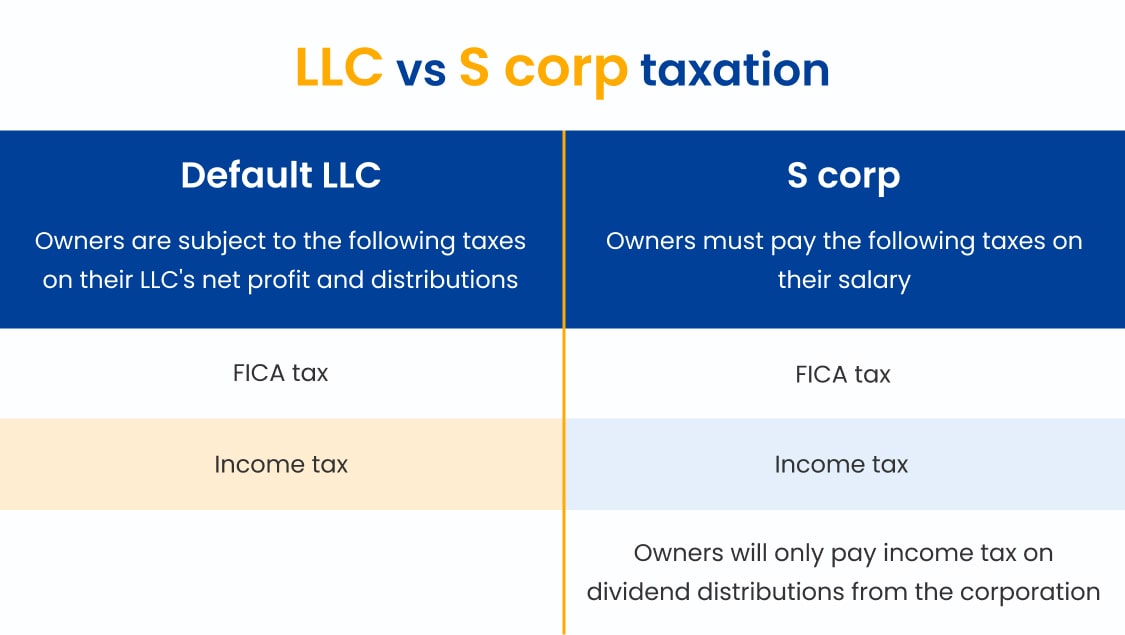

Read ahead to calculate your s corp tax. However their downside is their complexity and hidden costs. Use this s corp tax rate calculator to get started. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. This means that the business’s income passes through to the owners. Web a limited liability company (llc) is a legal business structure. Web shareholders must then pay tax on their dividend shares.

S Corp vs. LLC Q&A, Pros & Cons of Each, and More

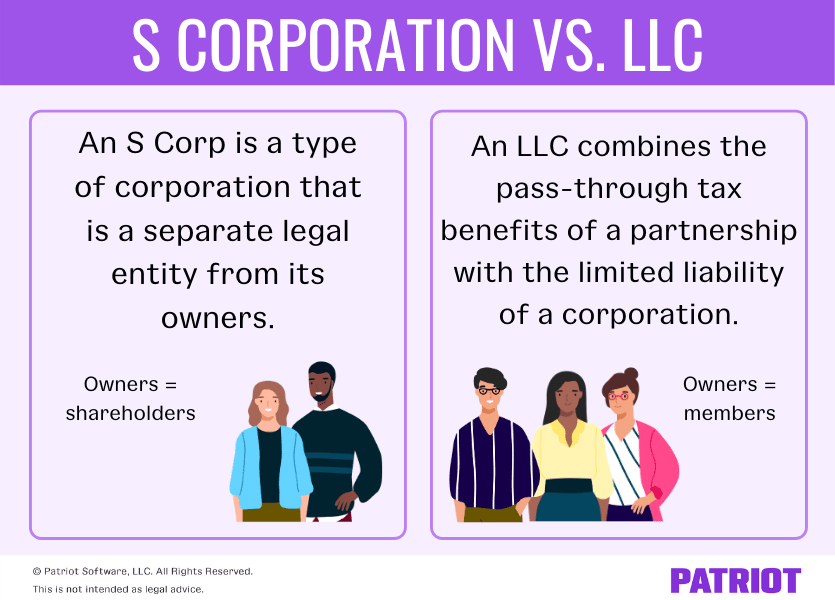

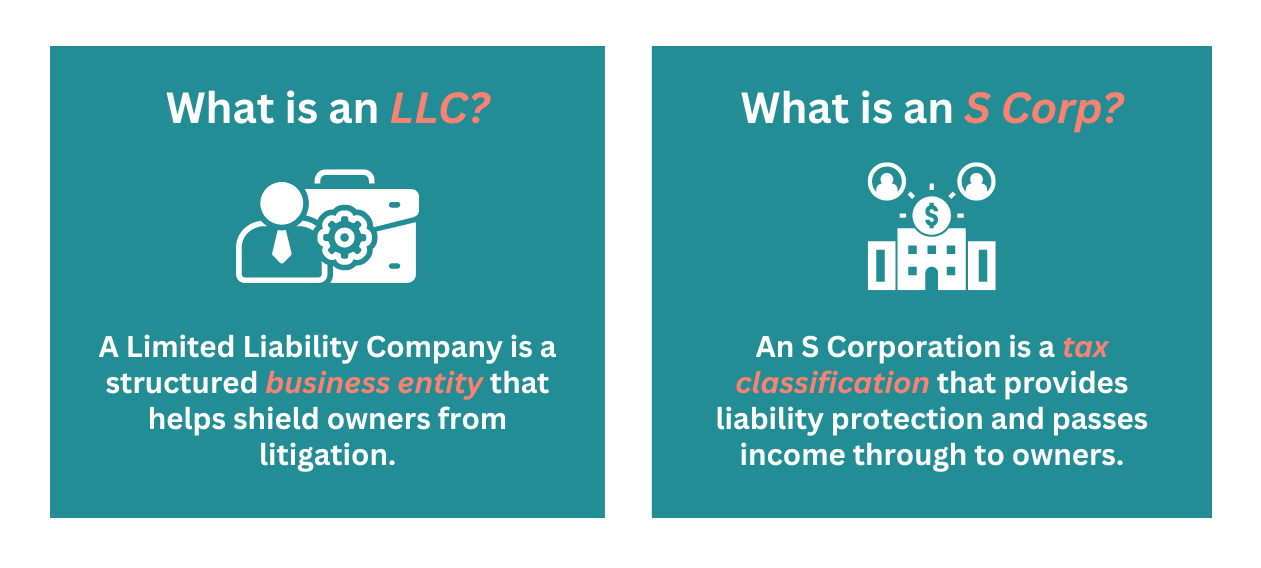

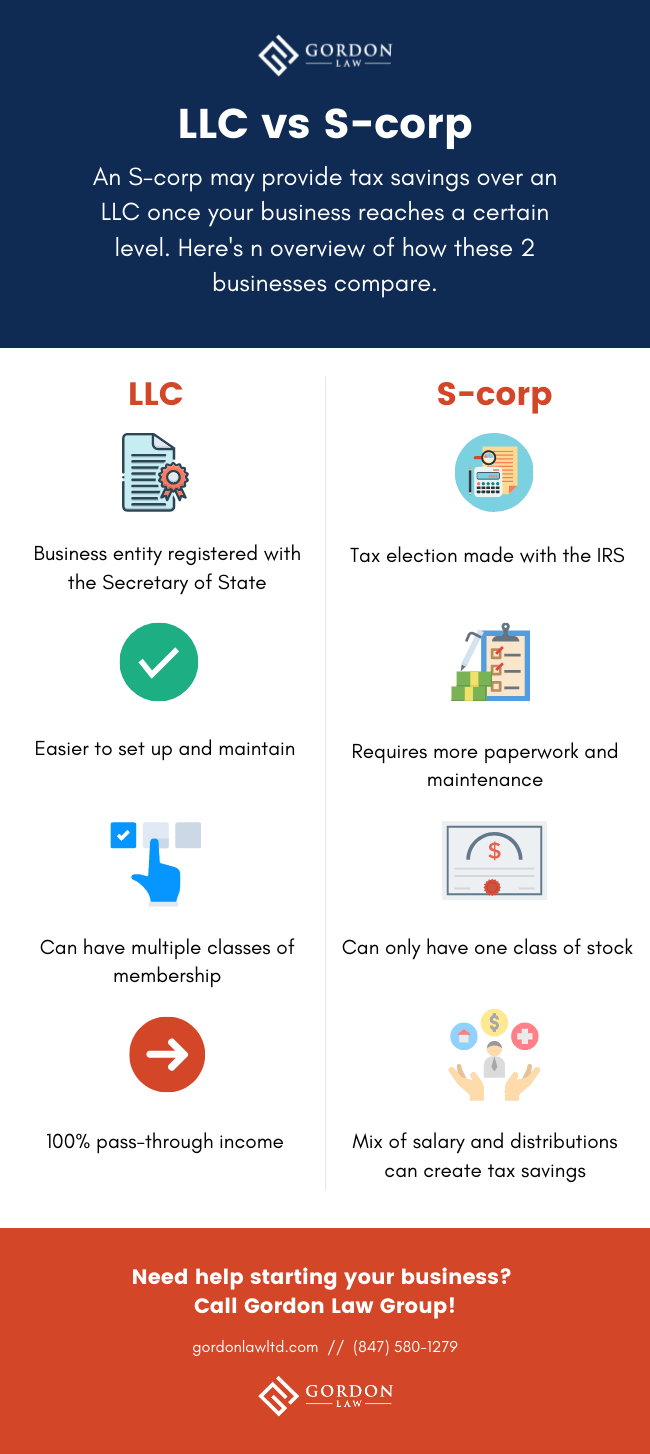

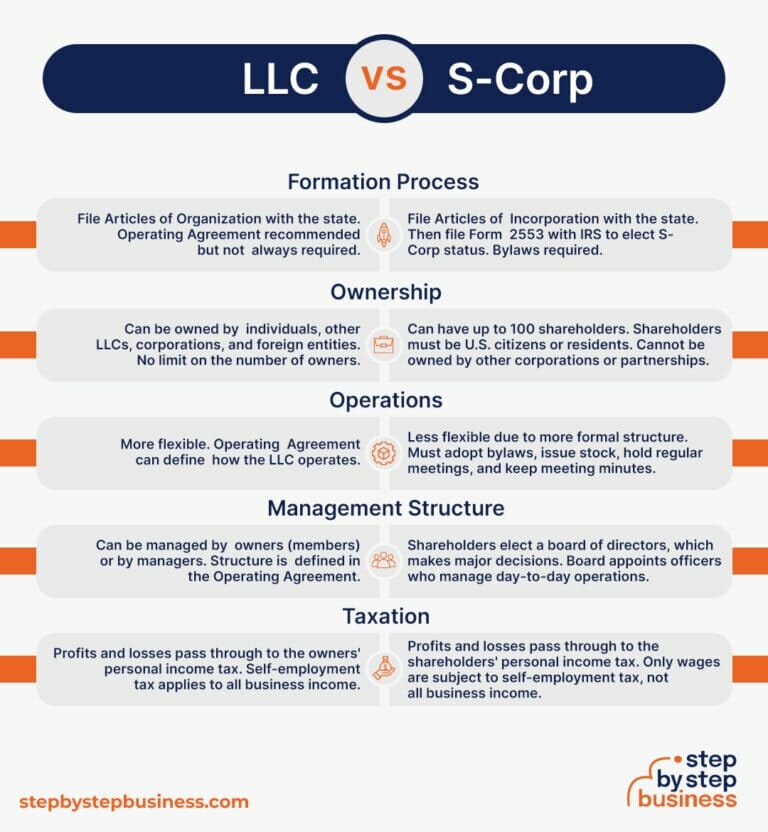

Web the difference between llc and s corp is that an llc is a business entity while an s corp is a tax classification. This means that the business’s income passes through to the owners. Web check each option you'd like to calculate for. Consider the type of business you run, the. Web the qbi.

S Corp Toolbox

This means that the business’s income passes through to the owners. Web a limited liability company (llc) is a legal business structure. Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. Whether you're curious about establishing an llc. Llc tax calculator guide will.

LLC vs. S Corp (Full Comparison) Pros & Cons Revealed

As of 2024, a single filer who earns less than $191,950. Web shareholders must then pay tax on their dividend shares. This s corp tax calculator reveals. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web the difference between llc and s.

Can an S Corp Own an LLC? Here’s Everything You Need to Know Acumen

Whether you're curious about establishing an llc. Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Llc tax benefits calculator faqs about llc vs..

Detailed Explanation For Difference Between LLC and S Corp

Intuit.com has been visited by 1m+ users in the past month In this example, by opting for an s corp, the consultant could potentially save $17k in. Whether you're curious about establishing an llc. It can help you compare the potential tax savings between filing as an llc vs. Web our llc vs. Should you.

LLC versus SCorp Denver Business Law Colorado Estate Planning

Web updated july 7, 2020: Web a limited liability company (llc) is a legal business structure. Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. Read ahead to calculate your s corp tax. Web freelancers and consultants: Llc tax benefits calculator.

LLC, Scorp, or Ccorp? Guide to Choosing a Business Structure

Web updated july 7, 2020: Normally these taxes are withheld by your employer. As of 2024, a single filer who earns less than $191,950. Web our s corp vs. Whether you're curious about establishing an llc. Web the qbi is deducted from a business’s net profit minus capital gains/losses, dividends, or interest income. Let's start.

LLC vs SCorporation Which One Can Save You More On Your Taxes? — RBA

Should you convert from an llc to an s corp? Web s corporations are a celebrated strategy by the self employed. Normally these taxes are withheld by your employer. Web shareholders must then pay tax on their dividend shares. Taxes for an s corp vs. Web here are steps to consider taking when choosing between.

LLC vs. SCorp Key Differences Step By Step Business

Web our s corp vs. In this example, by opting for an s corp, the consultant could potentially save $17k in. Bizee.com has been visited by 10k+ users in the past month Web s corporations are a celebrated strategy by the self employed. Web for s corporations, the deduction would apply to income taken as.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web check each option you'd like to calculate for. Bizee.com has been visited by 10k+ users in the past month Web s corporations are a celebrated strategy by the self employed. This means that the business’s income passes through to the owners. Should you convert from an llc to an s corp? Read ahead to.

S Corp Vs Llc Calculator Web the s corp tax calculator is also an s corp vs. However their downside is their complexity and hidden costs. Use this s corp tax rate calculator to get started. Web updated july 7, 2020: As of 2024, a single filer who earns less than $191,950.

S Corp How To Change Llc To S Corp Tl;Dr:

Web updated july 7, 2020: Whether you're curious about establishing an llc. Web check each option you'd like to calculate for. Should you convert from an llc to an s corp?

Total Taxes Paid As S Corp:

Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. Consider the type of business you run, the. Get the spreadsheet template here:. In this example, by opting for an s corp, the consultant could potentially save $17k in.

Let's Start Significantly Lowering Your Tax Bill Now.

Web our llc vs. Web here are steps to consider taking when choosing between an llc and an s corporation: Web start using mycorporation's s corporation tax savings calculator. Use this s corp tax rate calculator to get started.

A Sole Proprietorship Automatically Exists Whenever You Are Engaging In Business By And For.

Web for s corporations, the deduction would apply to income taken as distributions, not salaries. Web freelancers and consultants: Taxes for an s corp vs. It can help you compare the potential tax savings between filing as an llc vs.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)