S Corp Vs Llc Tax Calculator

S Corp Vs Llc Tax Calculator - If you're torn between keeping. Web the qbi is deducted from a business’s net profit minus capital gains/losses, dividends, or interest income. 100k+ nonprofits filedlegal protectionkickstart your businesslegal help since 2001 Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Web an s corp is a tax status election that your llc, corporation, or partnership makes with the irs to be taxed as an s corp.

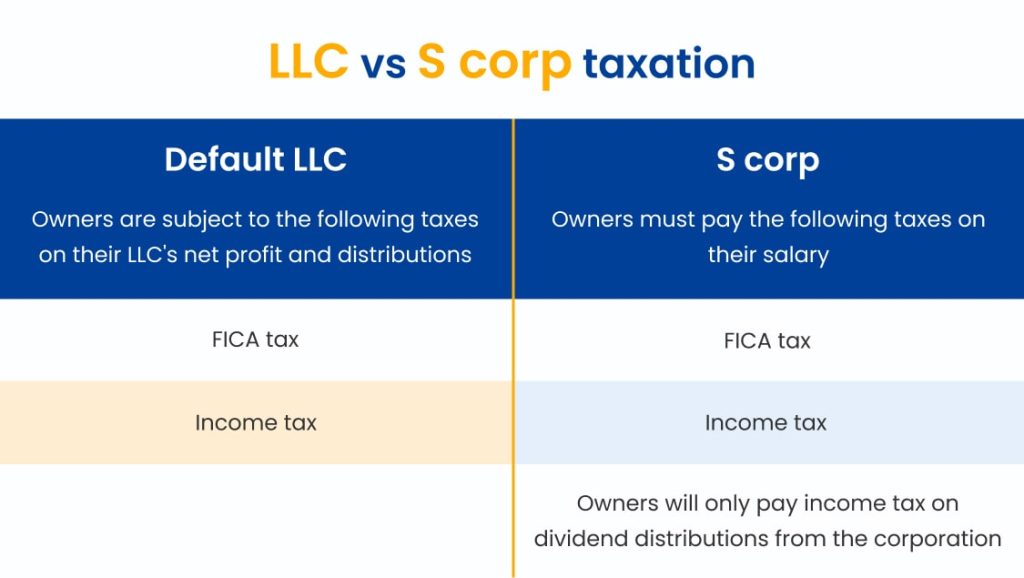

Web the qbi is deducted from a business’s net profit minus capital gains/losses, dividends, or interest income. Web choosing the right business structure is an important decision that will impact your taxes, paperwork, and even personal liability in law. Llc taxes s corp vs. Web an llc vs. Any legal entity (llc, partnership, corporation) can. Web the biggest difference between s corporations and llcs is how they are taxed. Free small business & llc tax estimates.

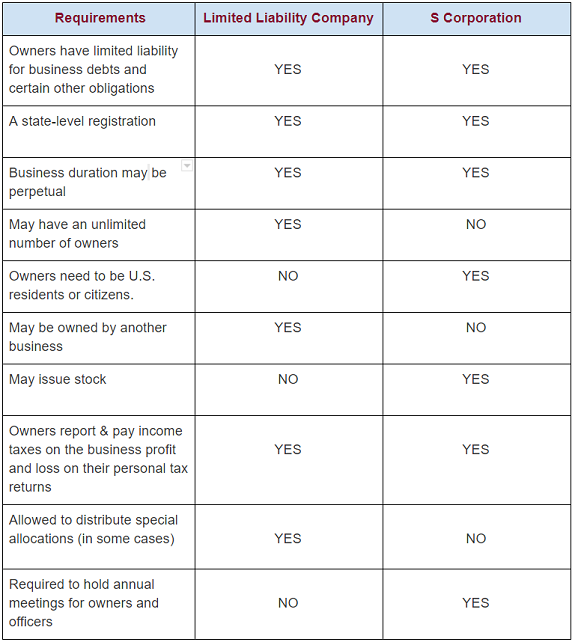

Detailed Explanation For Difference Between LLC and S Corp

The primary method to reduce taxes as an s corporation owner is setting the right salary. Web an s corp is a tax status election that your llc, corporation, or partnership makes with the irs to be taxed as an s corp. Web choosing the right business structure is an important decision that will impact.

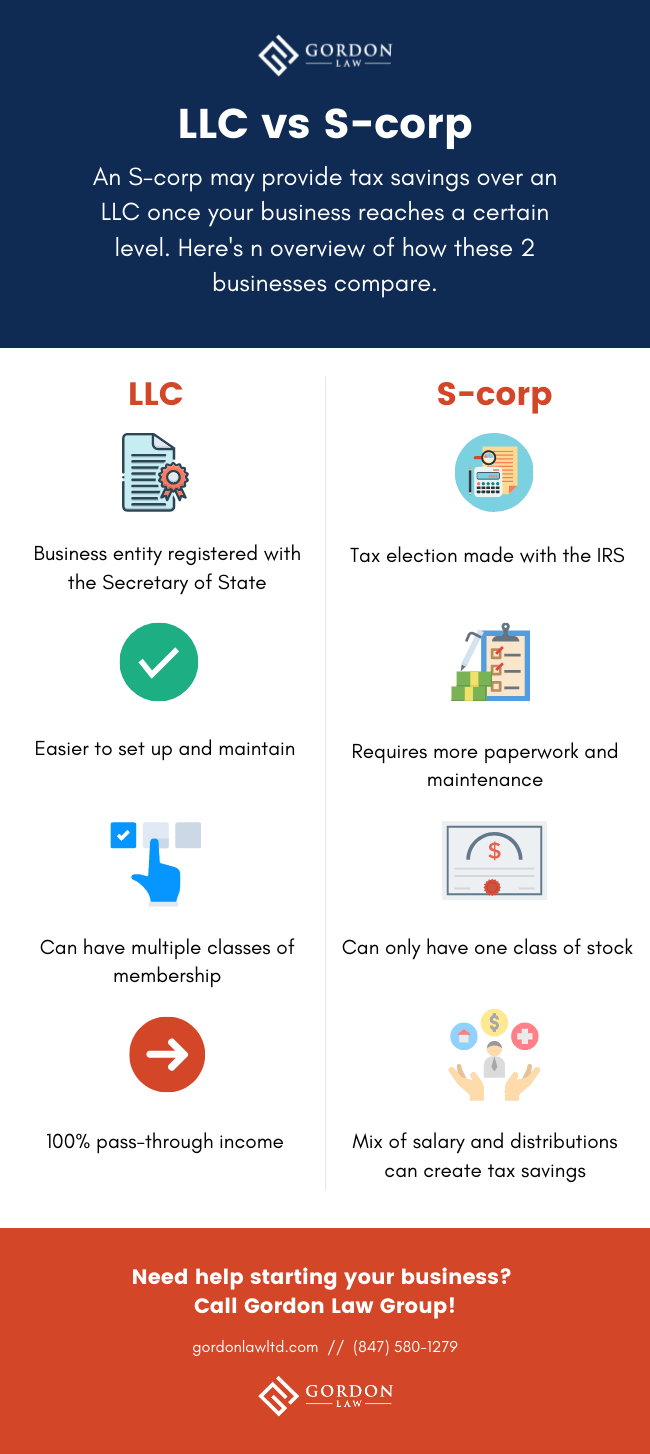

S Corp vs. LLC Q&A, Pros & Cons of Each, and More

A cpa can walk you through an llc. In essence, only an llc or company. Web an llc vs. Llc tax benefits calculator faqs about llc vs. Web quick links the difference between llc and s corp s corp vs. This allows owners to pay less in self. Both companies offer liability protection against the.

LLC vs SCorporation Which One Can Save You More On Your Taxes? — RBA

It can help you compare the potential tax savings between filing as an llc vs. Read ahead to calculate your s corp tax. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to create. Web the se tax rate for business owners is 15.3%.

What Entrepreneurs Should Know About SCorps Pixel Law

Web our llc vs. This allows owners to pay less in self. How much can i save? Get the spreadsheet template here:. Web the biggest difference between s corporations and llcs is how they are taxed. Web quick links the difference between llc and s corp s corp vs. As of 2024, a single filer.

LLC vs S CORPORATION Tax Benefits, Savings & Implications

Web choosing the right business structure is an important decision that will impact your taxes, paperwork, and even personal liability in law. Both companies offer liability protection against the owners'. Web the s corp tax calculator is also an s corp vs. Web a limited liability company (llc) and an s corporation (s corp) are.

What Is An S Corp?

Get the spreadsheet template here:. Web what's the best tax treatment for your startup? How much can i save? Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. Web the biggest difference between s corporations and llcs is how they are taxed. Both.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. As of 2024, a single filer who earns less than $191,950. Web what's the best tax treatment for your startup? Web our s corp vs. Web businesses that are incorporated, such as.

S Corp vs. LLC What’s the Difference? TRUiC

Includes both state and federal. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web llc tax calculator. S corp how to change llc to s corp. Any legal entity (llc, partnership, corporation) can. Web our s corp vs. As of 2024,.

LLC vs S Corp Taxes, Ownership & Formation Requirements

Web llc tax calculator. 100k+ nonprofits filedlegal protectionkickstart your businesslegal help since 2001 Web the s corp tax calculator is also an s corp vs. The primary method to reduce taxes as an s corporation owner is setting the right salary. Web the se tax rate for business owners is 15.3% tax of the first.

LLC, Scorp, or Ccorp? Guide to Choosing a Business Structure

Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. Normally these taxes are withheld by your employer. Web balance your salary for maximum tax savings. A sole proprietorship automatically exists whenever you are engaging in business by and for. Any legal entity (llc,.

S Corp Vs Llc Tax Calculator Web what's the best tax treatment for your startup? Enter your tax profile to discover bonus tax savings. A cpa can walk you through an llc. Enter your estimated annual business net income and the. A sole proprietorship automatically exists whenever you are engaging in business by and for.

Web Our S Corp Vs.

$5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Normally these taxes are withheld by your employer. Free small business & llc tax estimates. Web shareholders must then pay tax on their dividend shares.

S Corporation Tax Calculator Can Help You Determine Your Tax Obligations Based On The Type Of Business Structure You Want To Create.

Enter your tax profile to discover bonus tax savings. Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. Web choosing the right business structure is an important decision that will impact your taxes, paperwork, and even personal liability in law. To compare an llc vs s corporation here’s the general formula.

Web Businesses That Are Incorporated, Such As Llcs And Corporations, Can Choose The Irs Tax Status Known As An S Corporation Or The S Corp.

Web total s corp tax estimator: Web s corp vs llc tax savings calculator electing s corp status allows llc owners to be taxed as employees of the business. Llc tax benefits calculator faqs about llc vs. Web this s corp tax calculator reveals your biggest costs, which can derail how much you could save.

The Primary Method To Reduce Taxes As An S Corporation Owner Is Setting The Right Salary.

A sole proprietorship automatically exists whenever you are engaging in business by and for. Web the qbi is deducted from a business’s net profit minus capital gains/losses, dividends, or interest income. Web balance your salary for maximum tax savings. Web quick links the difference between llc and s corp s corp vs.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)