S Corp Vs Sole Proprietorship Tax Calculator

S Corp Vs Sole Proprietorship Tax Calculator - Web set your business up for success with our free 2023 small business tax calculator. Web s corp vs sole proprietorship tax. Web this means that the taxes you pay on your business income, as well as your business deductions, are the same as for a sole proprietorship. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web check each option you'd like to calculate for.

Once you have those numbers, run through a few different tax scenarios. Intuit.com has been visited by 1m+ users in the past month Web our s corp vs. If you buy through our links, we may earn a. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Web may 8, 2023 we'll show you our 117 tax planning strategies save a minimum of $10k in taxes.guaranteed! Web check each option you'd like to calculate for.

S Corp vs. Sole Proprietorship Taxes Explaining the Differences Todd

Running a business as an s corporation saves more taxes than being a sole proprietor or an llc. Web s corp s corp vs sole proprietorship matt jensen updated oct 13, 2020 we independently review recommendations. You’re thinking a set of setting up a new business. Once you have those numbers, run through a few.

One Person Corporation vs Sole Proprietorship Pros and Cons of these

The income taxes you'll pay on your. Running a business as an s corporation saves more taxes than being a sole proprietor or an llc. You’re thinking a set of setting up a new business. Once you have those numbers, run through a few different tax scenarios. Web check each option you'd like to calculate.

Sole Proprietor vs SCorporation in 2019

Web however, we have provided this business tax calculator to give you a rough estimate of the types of tax savings your business could have if you incorporate. Web s corp vs llc. You’re thinking a set of setting up a new business. What is considered “reasonable compensation” for your industry and your role in.

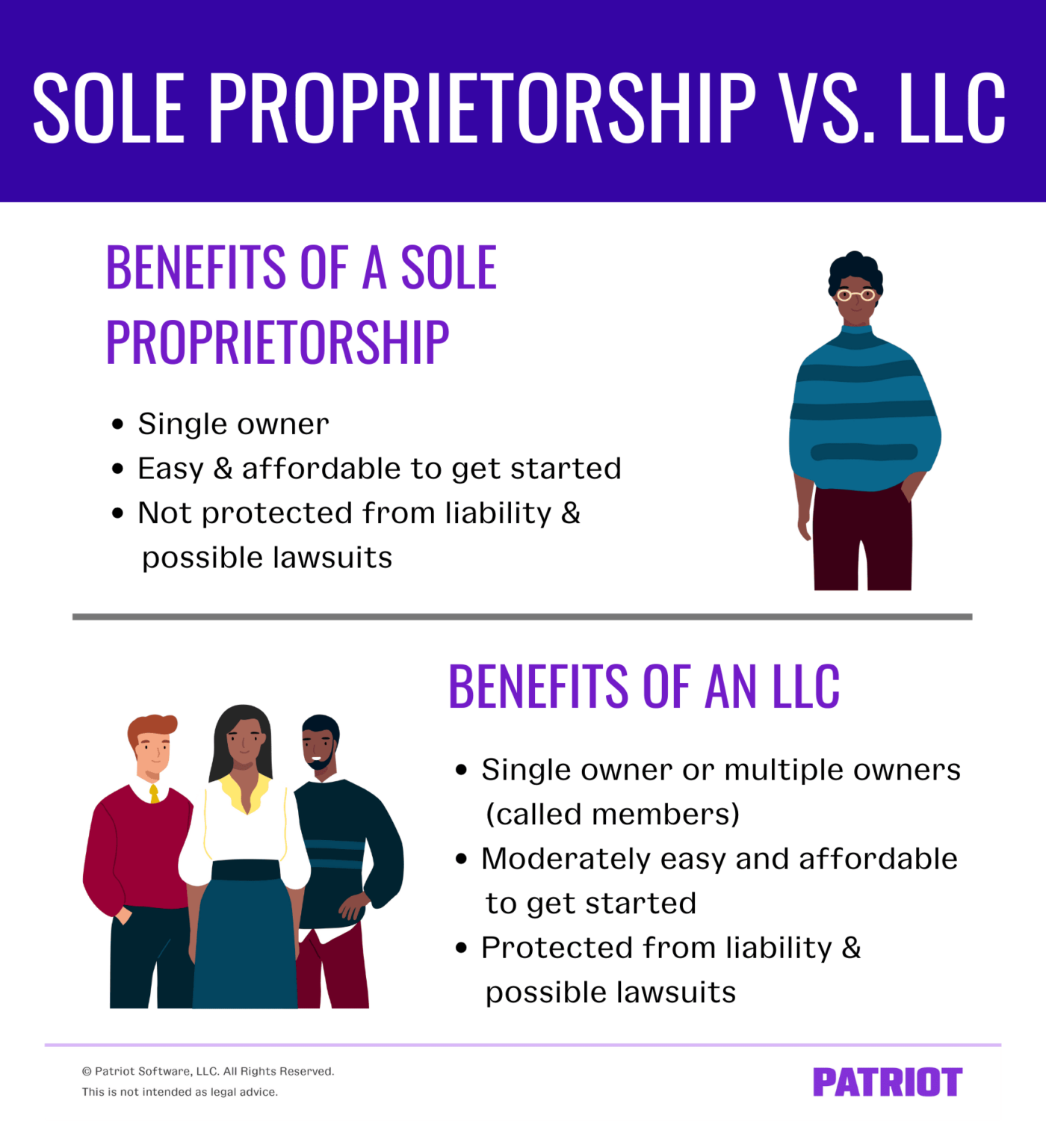

Which is Best for Your Business Sole Proprietorship vs. LLC?

Web updated july 7, 2020: Web s corp vs llc. Web s corp s corp vs sole proprietorship matt jensen updated oct 13, 2020 we independently review recommendations. If you buy through our links, we may earn a. Web s corp vs sole proprietorship tax. Web however, we have provided this business tax calculator to.

What Is An S Corp?

Web s corp vs sole proprietorship tax. Once you have those numbers, run through a few different tax scenarios. This calculator helps you understand the difference between filing. Start by playing with the numbers. What is considered “reasonable compensation” for your industry and your role in the business? Web s corp s corp vs sole.

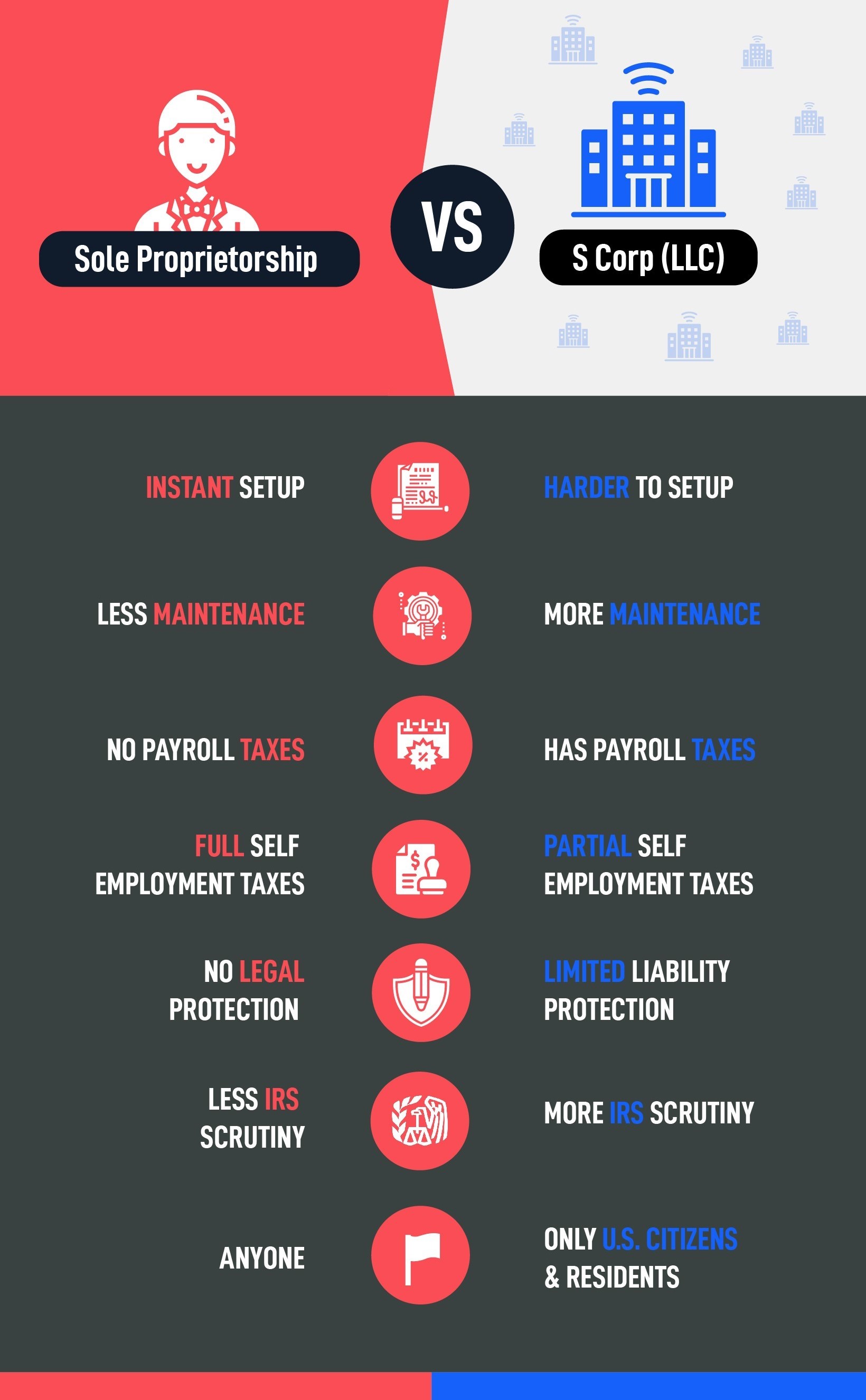

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

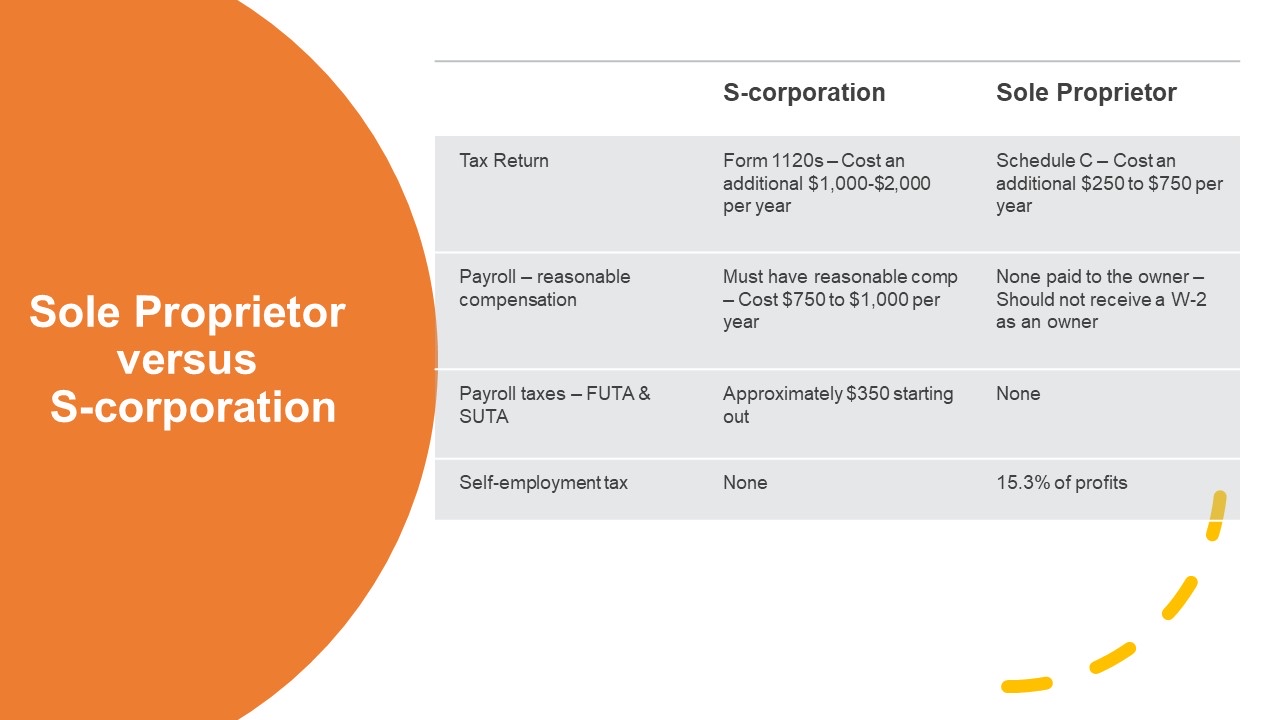

Web updated july 7, 2020: Web s corp s corp vs sole proprietorship matt jensen updated oct 13, 2020 we independently review recommendations. Web tax calculation example of sole proprietor versus s corp with same net profit. Web may 8, 2023 we'll show you our 117 tax planning strategies save a minimum of $10k in.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web s corp vs sole proprietorship | pros & cons (infographic 🆚). Web however, we have provided this business tax calculator to give you a rough estimate of the types of tax savings your business could have if you incorporate. What is considered “reasonable compensation” for your industry and your role in the business? This.

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

Web tax calculation example of sole proprietor versus s corp with same net profit. If you buy through our links, we may earn a. The income taxes you'll pay on your. Once you have those numbers, run through a few different tax scenarios. Intuit.com has been visited by 1m+ users in the past month What’s.

SCorp Eligibility Qualifications & Guidelines for 2023

Web s corp s corp vs sole proprietorship matt jensen updated oct 13, 2020 we independently review recommendations. This calculator helps you understand the difference between filing. You’re thinking a set of setting up a new business. Explore aarp® benefitsfinance calculatorstax advice & toolsbudget guides & advice Entity type dropdown revenue total expenses meals/entertainment expenses.

3 Major Differences Between Sole Proprietorship & One Person

Entity type dropdown revenue total expenses meals/entertainment expenses estimated tax. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Explore aarp® benefitsfinance calculatorstax advice & toolsbudget guides & advice Web updated july 7, 2020: The tax bill would depend on the owner's other tax. Once.

S Corp Vs Sole Proprietorship Tax Calculator Entity type dropdown revenue total expenses meals/entertainment expenses estimated tax. Intuit.com has been visited by 1m+ users in the past month Web s corp vs sole proprietorship tax. Web this means that the taxes you pay on your business income, as well as your business deductions, are the same as for a sole proprietorship. Start by playing with the numbers.

If You Buy Through Our Links, We May Earn A.

Running a business as an s corporation saves more taxes than being a sole proprietor or an llc. Read ahead to calculate your s corp tax. Start by playing with the numbers. Web however, we have provided this business tax calculator to give you a rough estimate of the types of tax savings your business could have if you incorporate.

Web Our S Corp Vs.

Web s corp vs llc. You’re thinking a set of setting up a new business. Explore aarp® benefitsfinance calculatorstax advice & toolsbudget guides & advice As a sole proprietor self employment.

Intuit.com Has Been Visited By 1M+ Users In The Past Month

Web may 8, 2023 we'll show you our 117 tax planning strategies save a minimum of $10k in taxes.guaranteed! Web tax calculation example of sole proprietor versus s corp with same net profit. What’s your annual net income? What is considered “reasonable compensation” for your industry and your role in the business?

Web Check Each Option You'd Like To Calculate For.

Web s corporation tax savings calculator. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Pros & cons (infographic 🆚) explore when to consider an s corp and or stay sole prop. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)