S Corp Vs W2 Calculator

S Corp Vs W2 Calculator - S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. Learn how you can calculate your s corporation taxes. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Compare your income and tax situation when you work as a w2. Web #1 members don't see this ad.

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. Web llc vs s corp tax calculator: In this article, i will break down. Web #1 members don't see this ad. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Before using the s corp tax calculator, you will need to:.

1099 Vs. W2 Difference Between Independent Contractors & Employees

Web 1099 or your own corporation vs. Before determining her rate alice must know if she will be a 1099 contractor or work on the w2 of a staffing agency. The owner takes a salary of $150,000 leaving $2,850,000 to. As an owner of an s corp, you receive something called limited liability protection. Use.

What's the Difference Between W2, 1099, and CorptoCorp Workers?

Compare your income and tax situation when you work as a w2. Web s corp tax savings calculator. Web october 2, 2023 s corp tax calculator: Let's start significantly lowering your tax bill now. As an owner of an s corp, you receive something called limited liability protection. Web this s corp tax calculator reveals.

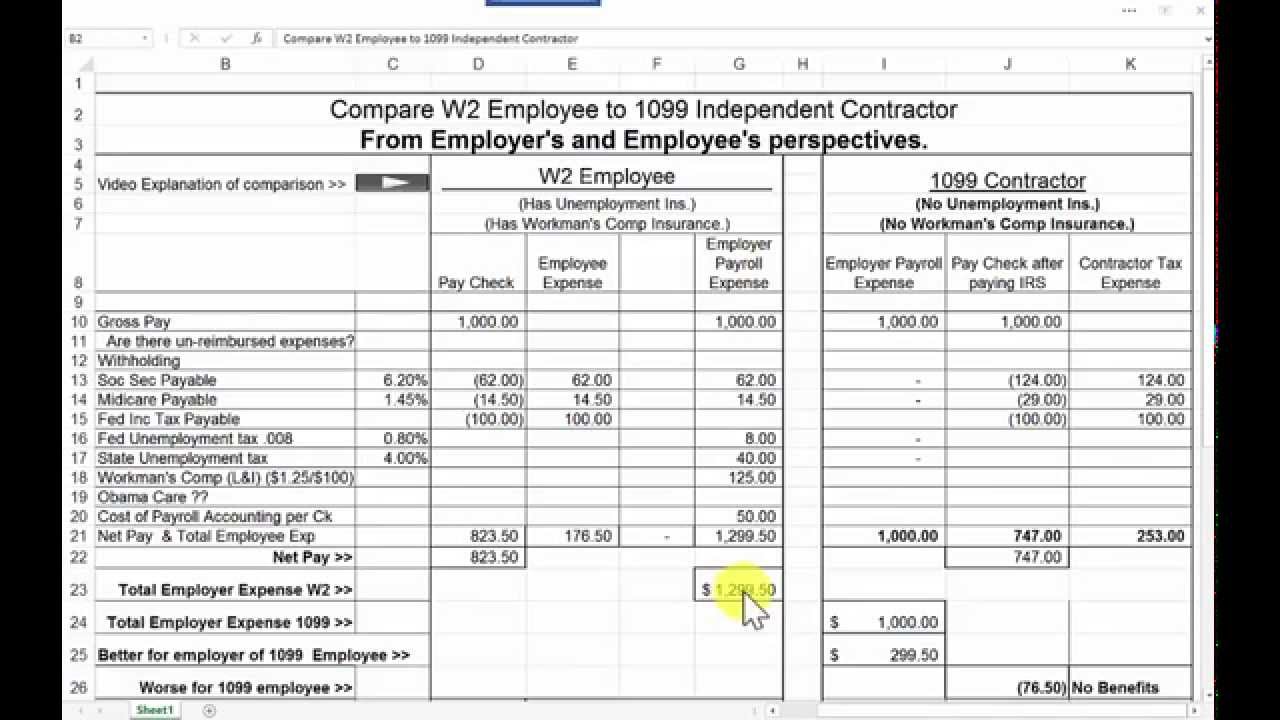

11 B Comparison of W2 employee to 1099 independent contractor13 min

This means you’re not personally. To compare an llc vs s corporation here’s the general formula. In this article, i will break down. Use this s corp tax rate calculator to get started. Everything you need to know. Web 1099 or your own corporation vs. Before using the s corp tax calculator, you will need.

How to Convert to an SCorp 4 Easy Steps Taxhub

Web november 18, 2021 by editorial staff linkedin what is the difference between corp to corp vs w2? Before determining her rate alice must know if she will be a 1099 contractor or work on the w2 of a staffing agency. Web s corp tax savings calculator. Let's start significantly lowering your tax bill now..

1099 vs W2 What’s the difference? QuickBooks

Web 1099 or your own corporation vs. Web taxhub has the perfect calculator for you! Let's start significantly lowering your tax bill now. Web s corp tax savings calculator. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Before determining her rate.

Business Owner Insurance Premium Deduction When Owner Has Medicare

Use this s corp tax rate calculator to get started. To compare an llc vs s corporation here’s the general formula. Before using the s corp tax calculator, you will need to:. This calculator helps you understand the difference between filing taxes as a sole proprietor vs. Number of days not worked. Web thinks of.

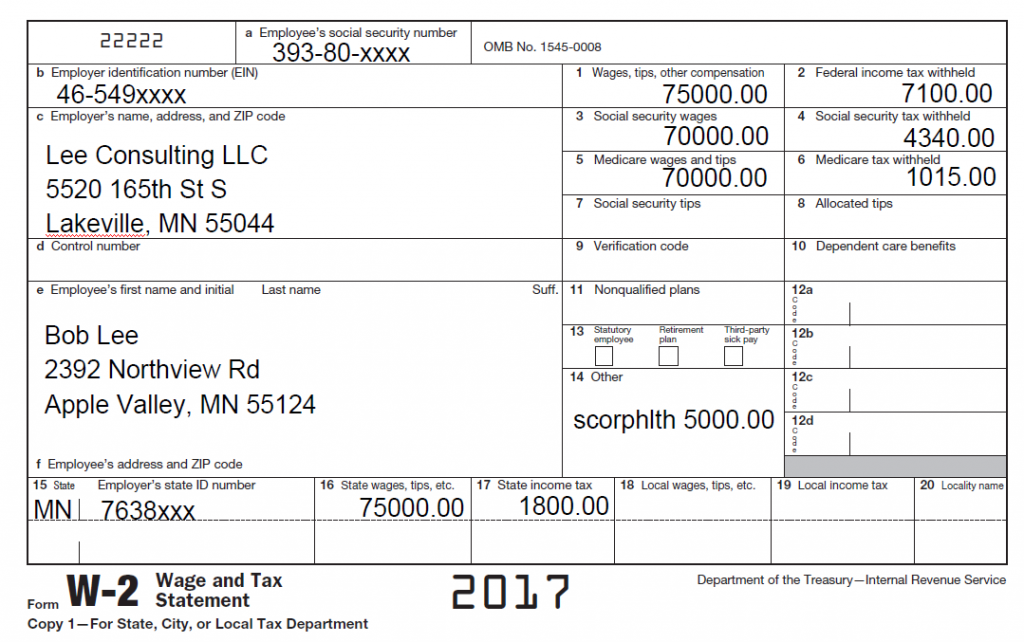

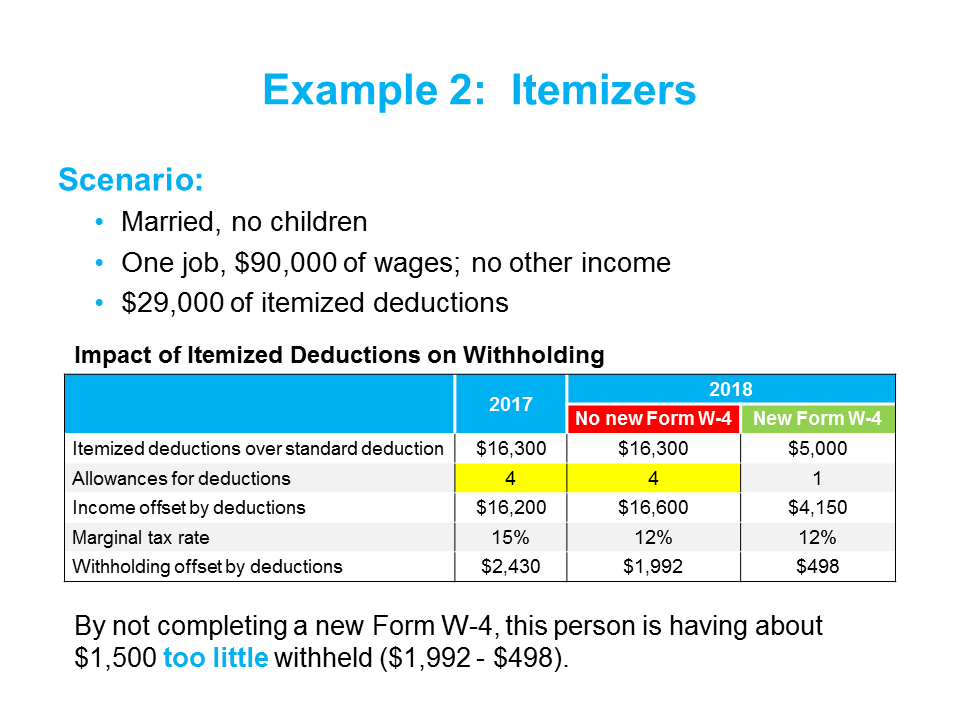

IRS W 2 Withholding Calculator Tax Withholding Estimator 2021

Learn how you can calculate your s corporation taxes. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Before determining her rate alice must know if she will be a 1099 contractor or work on the w2 of a staffing agency..

What's the Difference Between W2, 1099, and CorptoCorp Workers?

Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web llc vs s corp tax calculator: Web october 2, 2023 s corp tax calculator:.

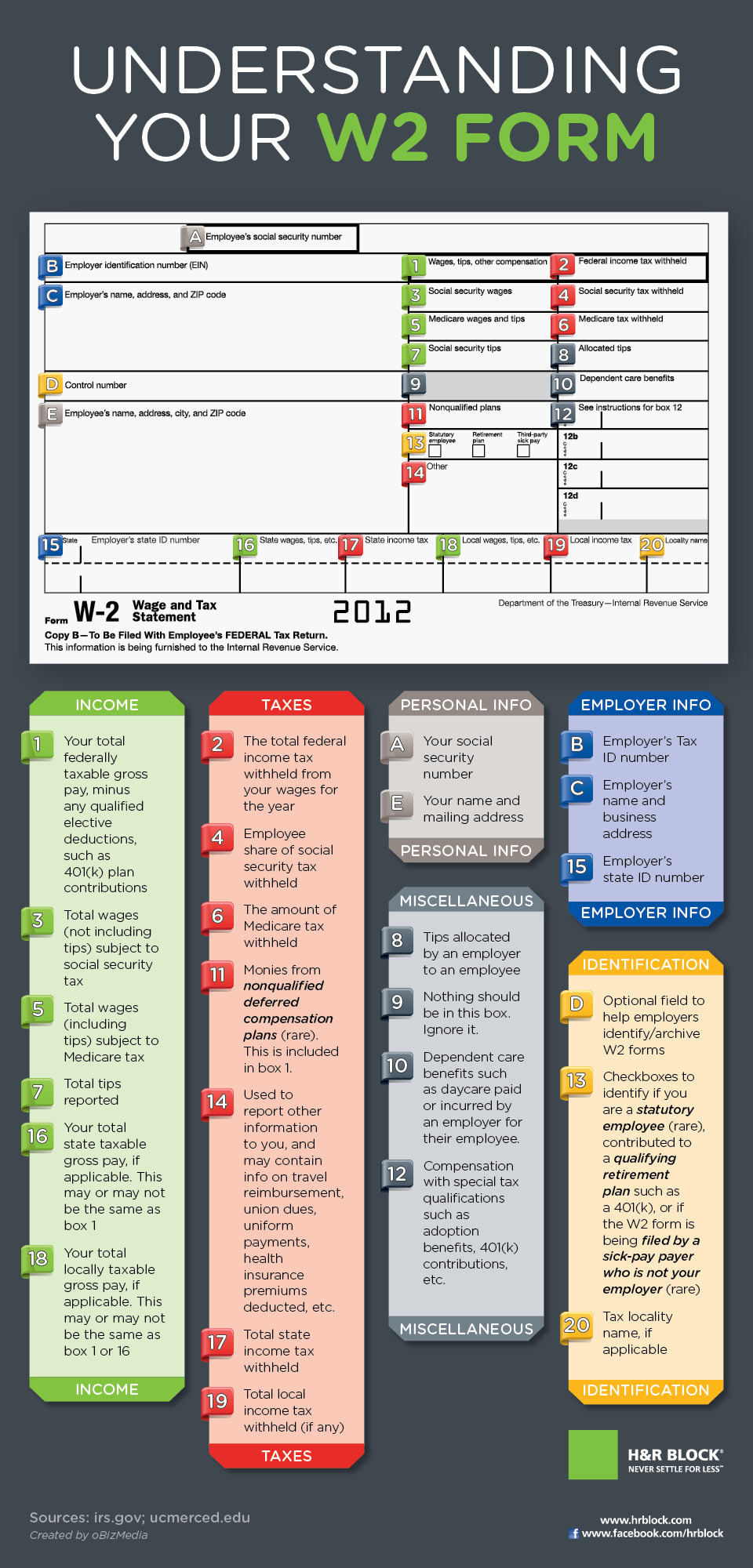

The Complete Guide To The W2 Form Visual.ly

Web start using mycorporation's s corporation tax savings calculator. Everything you need to know. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how.

Understanding Your Tax Forms The W2

The #1 entity structure for a cash balance plan. What are the pros and cons? Before using the s corp tax calculator, you will need to:. Web s corp tax savings calculator. As an owner of an s corp, you receive something called limited liability protection. Before determining her rate alice must know if she.

S Corp Vs W2 Calculator Web start using mycorporation's s corporation tax savings calculator. The owner takes a salary of $150,000 leaving $2,850,000 to. Web llc vs s corp tax calculator: To compare an llc vs s corporation here’s the general formula. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for.

Let’s Look And See What The Employment Taxes Would Be For Both Entities Below:

What are the pros and cons? The owner takes a salary of $150,000 leaving $2,850,000 to. Before using the s corp tax calculator, you will need to:. This calculator helps you understand the difference between filing taxes as a sole proprietor vs.

As An Owner Of An S Corp, You Receive Something Called Limited Liability Protection.

Web october 2, 2023 s corp tax calculator: Web november 18, 2021 by editorial staff linkedin what is the difference between corp to corp vs w2? Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web this s corp tax calculator reveals your biggest costs, which can derail how much you could save.

If Your Business Is Registered As An S Corp, You Could Expect To Save A Considerable Amount On Your.

Number of days not worked. Hi, i'm trying to get a sense of the taxation benefit in california of working as an employee getting a w2 vs an independent. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Learn how you can calculate your s corporation taxes.

Web S Corp Tax Savings Calculator.

Web 1099 or your own corporation vs. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for. Compare your income and tax situation when you work as a w2. Web start using mycorporation's s corporation tax savings calculator.