Safe Harbor 401K Calculator

Safe Harbor 401K Calculator - Web $1,750 3% +.5% +.5% (equal to 4%) of employee pay $1,400 straight match match 100% of the employee’s contribution up to 4% of pay *. The impact of the secure act 2.0 if you’re a small business starting a 401 (k), you may be eligible for tax credits. Learn how secure act 2.0 tax. In 2024, individuals can contribute up. The employer match helps you accelerate your retirement contributions.

Safe harbor 401(k) plans in a nutshell. Safe harbor plans offer companies an enticing deal. Employers must match or contribute to their employees'. In 2024, individuals can contribute up. Web they're designed to help your business avoid irs nondiscrimination testing—and the costly consequences if you were to fail. Failing compliance testing isn't uncommon but a safe harbor plan can help you automatically pass several. Web 401 (k) plan cost calculator:

What Is A 401k Safe Harbor FinancePart

Failing compliance testing isn't uncommon but a safe harbor plan can help you automatically pass several. Web what betterment at work brings to your safe harbor 401(k) setup; Employers with safe harbor 401 (k)s must contribute to employee. The employer match helps you accelerate your retirement contributions. Every year, 401 (k) plans undergo irs compliance.

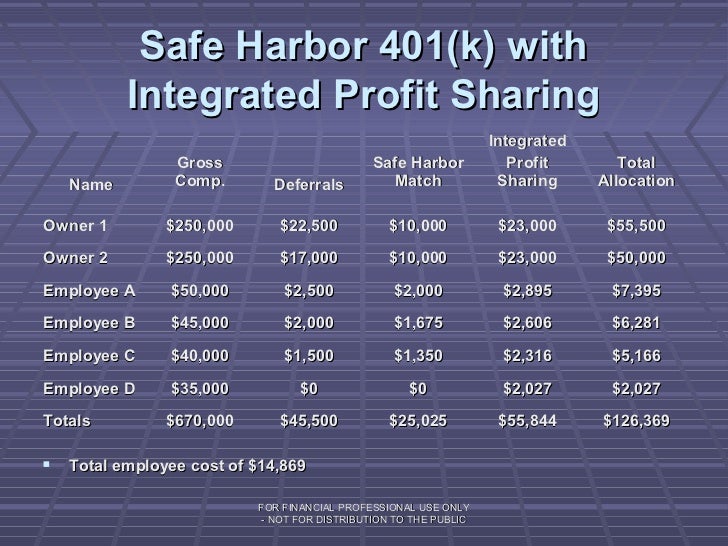

Advanced Safe Harbor 401(K) Plan Designs (For The Financial Advisor)

Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and. Web a 401 (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the.

Tax Savings with a Safe Harbor 401(k) Plan. • Corporate Payroll Services

Safe harbor 401(k) plans in a nutshell. Web they're designed to help your business avoid irs nondiscrimination testing—and the costly consequences if you were to fail. Web a safe harbor 401 (k) plan is a simpler version of a traditional 401 (k) retirement plan. In 2024, individuals can contribute up. Web how many employees do.

Safe Harbor 401(k) Finance Strategists

Safe harbor 401(k) plans in a nutshell. Web how many employees do you have? The impact of the secure act 2.0 if you’re a small business starting a 401 (k), you may be eligible for tax credits. Web a safe harbor plan is a special kind of 401 (k) that automatically satisfies most nondiscrimination testing..

Safe Harbor 401(k) Plan Deadlines Kurt S. Altrichter

Learn how secure act 2.0 tax. Web a safe harbor 401 (k) plan is a simpler version of a traditional 401 (k) retirement plan. Web key takeaways a safe harbor 401 (k) plan provides all eligible plan participants with an employer contribution. It allows small business owners to avoid nondiscrimination tests that the irs subjects.

Safe Harbor 401(k) How to avoid this costly option

Web what betterment at work brings to your safe harbor 401(k) setup; Learn how secure act 2.0 tax. Web $1,750 3% +.5% +.5% (equal to 4%) of employee pay $1,400 straight match match 100% of the employee’s contribution up to 4% of pay *. Employers with safe harbor 401 (k)s must contribute to employee. Every.

Safe Harbor 401(k) 2023 Guide For Employers ForUsAll Blog

Safe harbor 401(k) plans in a nutshell. For every dollar you contribute to your. Web $1,750 3% +.5% +.5% (equal to 4%) of employee pay $1,400 straight match match 100% of the employee’s contribution up to 4% of pay *. Web 401 (k) plan cost calculator: Web a safe harbor 401(k) is a specific type.

What Is a Safe Harbor 401(k)?

In 2024, individuals can contribute up. Web key takeaways a safe harbor 401 (k) plan provides all eligible plan participants with an employer contribution. Employers must match or contribute to their employees'. The employer match helps you accelerate your retirement contributions. For every dollar you contribute to your. Web nerdwallet’s free 401(k) retirement calculator calculates.

Simple Ira Simple Ira Vs Safe Harbor 401(k)

Web how many employees do you have? Employers with safe harbor 401 (k)s must contribute to employee. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at. Web a safe harbor 401(k) is a specific type of workplace retirement plan. It allows.

Safe Harbor 401(k) 2023 Guide For Employers ForUsAll Blog

Failing compliance testing isn't uncommon but a safe harbor plan can help you automatically pass several. Web a safe harbor plan is a special kind of 401 (k) that automatically satisfies most nondiscrimination testing. In 2024, individuals can contribute up. In exchange, safe harbor plans allow. Web what betterment at work brings to your safe.

Safe Harbor 401K Calculator Employers with safe harbor 401 (k)s must contribute to employee. Failing compliance testing isn't uncommon but a safe harbor plan can help you automatically pass several. Web how many employees do you have? Every year, 401 (k) plans undergo irs compliance testing. Web for 2024, the contribution limit for employees in a safe harbor 401(k) is $23,000 (up from $22,500 in 2023), with an additional $7,500 for those aged 50 or older.

Web They're Designed To Help Your Business Avoid Irs Nondiscrimination Testing—And The Costly Consequences If You Were To Fail.

Employers must match or contribute to their employees'. The employer match helps you accelerate your retirement contributions. Web key takeaways a safe harbor 401 (k) plan provides all eligible plan participants with an employer contribution. Failing compliance testing isn't uncommon but a safe harbor plan can help you automatically pass several.

For Every Dollar You Contribute To Your.

Safe harbor 401(k) plans in a nutshell. Employers with safe harbor 401 (k)s must contribute to employee. Web a safe harbor 401 (k) plan is a simpler version of a traditional 401 (k) retirement plan. Gainbridge.io has been visited by 10k+ users in the past month

Web Your Employer Might Match Your Contributions To Your 401(K).

Safe harbor plans offer companies an enticing deal. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at. Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and. Web employers can choose from the following safe harbor 401 (k) formulas:

Learn How Secure Act 2.0 Tax.

Web $1,750 3% +.5% +.5% (equal to 4%) of employee pay $1,400 straight match match 100% of the employee’s contribution up to 4% of pay *. Web a safe harbor 401(k) is a specific type of workplace retirement plan. Web 401 (k) plan cost calculator: It allows small business owners to avoid nondiscrimination tests that the irs subjects most 401(k).

:max_bytes(150000):strip_icc()/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)