Sales Tax Calculator Maine

Sales Tax Calculator Maine - Maine cities and/or municipalities don't have a city sales tax. Web you can use our maine sales tax calculator to look up sales tax rates in maine by address / zip code. Enter item price and tax rate percentage to find sales tax and total price. Web maine sales tax rate is currently 5.5%. Web our maine sales tax calculator is the ultimate tool for calculating the sales tax on transactions in the pine tree state.

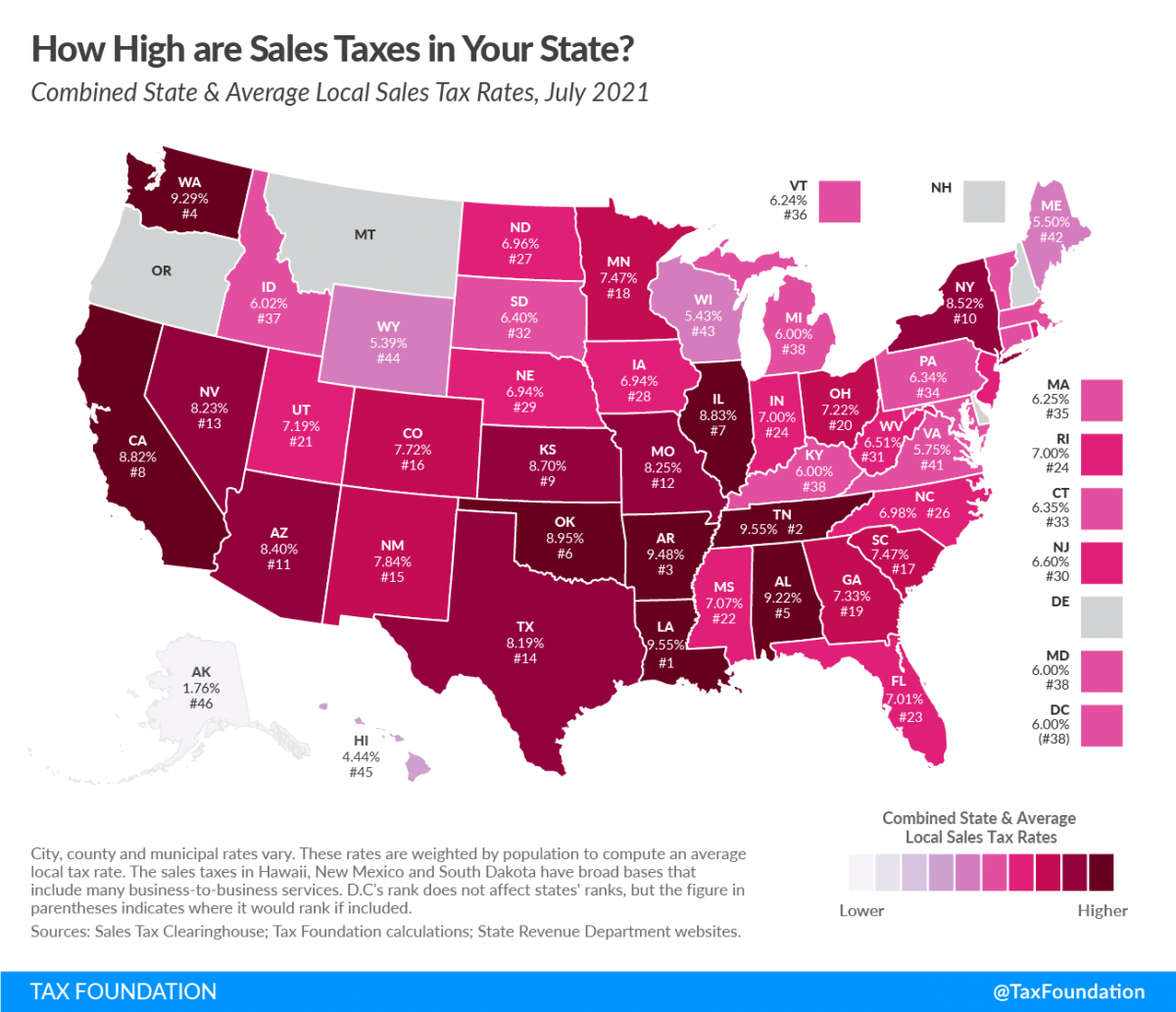

Maine sales tax rates vary. The average sales tax rate in maine in 2024 is 5.5%. Numbers represent only state taxes, not federal taxes. Web up to date, 2024 maine sales tax rates. Web the maine state sales tax rate is 5.5%, and the average me sales tax after local surtaxes is 5.5%. Web the salestaxhandbook sales tax calculator is a free tool that will let you look up sales tax rates, and calculate the sales tax owed on a taxable purchase, for anywhere in the. There is only statewide sales tax rate.

Maine Sales Tax Calculator Step By Step Business

Web the salestaxhandbook sales tax calculator is a free tool that will let you look up sales tax rates, and calculate the sales tax owed on a taxable purchase, for anywhere in the. Use our sales tax calculator or download a free maine sales tax rate table by zip code. Web calculate sales tax and.

USA Sales Tax Calculator Apps on Google Play

Customize using your filing status, deductions, exemptions. Web maine sales tax exempt organizations. Sales tax is not collected at the local level. Web how 2024 sales taxes are calculated in maine. Rental of video media and video equipment. Manset, me sales tax rate: Enter item price and tax rate percentage to find sales tax and.

Maine 2023 Sales Tax Guide

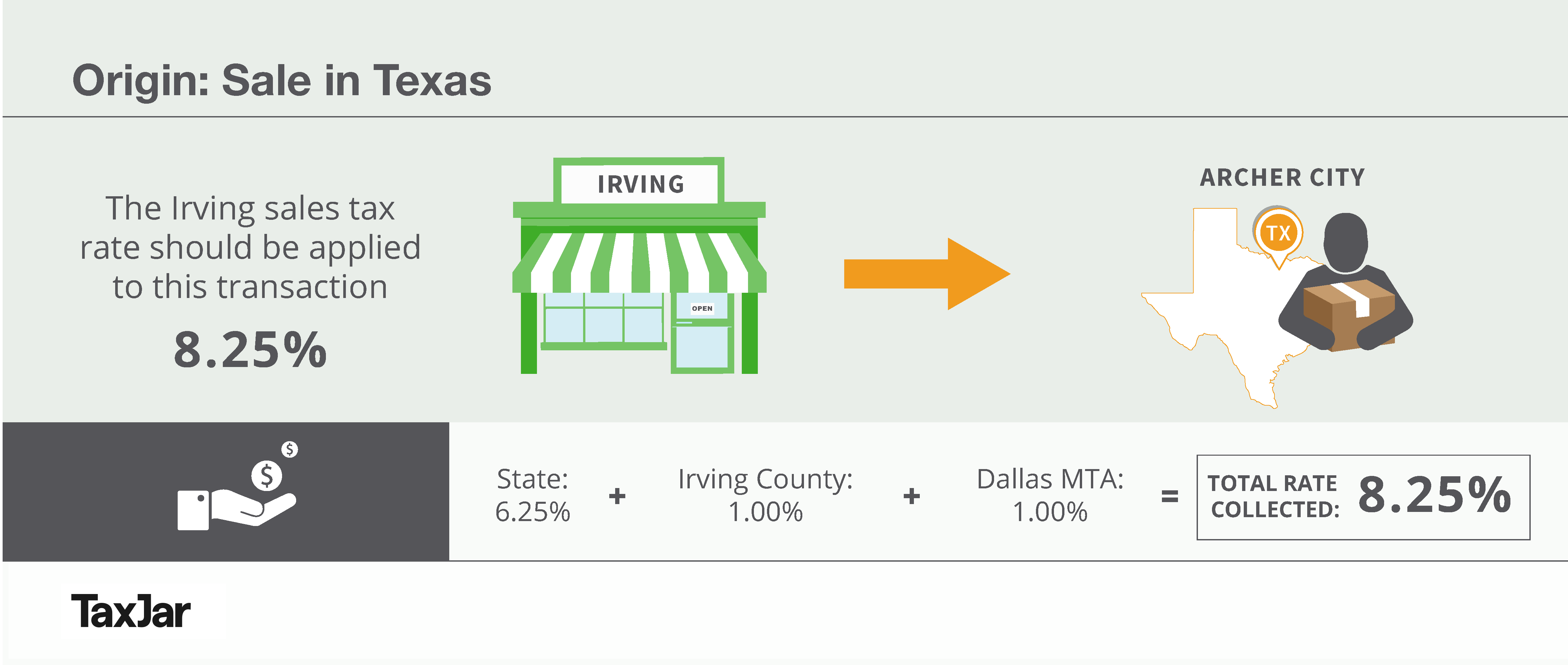

Customize using your filing status, deductions, exemptions. In addition to the state rate, local jurisdictions in maine may apply additional sales taxes. Web local tax rates in maine range from 5.50%, making the sales tax range in maine 5.50%. Sales tax and service provider tax certificate lookup. Web this gives you $2,750. Find your maine.

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny

Customize using your filing status, deductions, exemptions. View a detailed list of local sales tax rates in maine with supporting sales tax calculator. Breakdown of taxes in maine (excl. That is the sales tax on the vehicle. With a state sales tax rate of 5.5%, and additional. The state levies a sales tax on the.

What is Sales Tax Nexus Learn all about Nexus

The state levies a sales tax on the purchase of most goods and services. Breakdown of taxes in maine (excl. Groceries and prescription drugs are exempt from the maine sales tax. The average sales tax rate in maine in 2024 is 5.5%. Maine sales tax rates vary. View a detailed list of local sales tax.

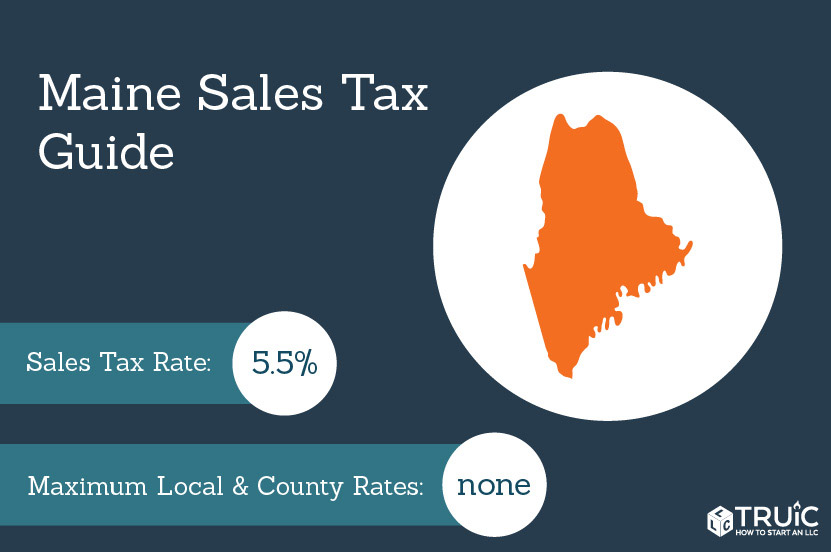

Maine Sales Tax Small Business Guide TRUiC

Web financial advisors find out how much you'll pay in maine state income taxes given your annual income. Groceries and prescription drugs are exempt from the maine sales tax. Manchester, me sales tax rate: Manset, me sales tax rate: The maine sales tax calculator contains no separate locations as maine applies a 5.5% flat rate.

maine sales tax calculator Lachelle Lindgren

To calculate maine’s retail sales tax, multiply the percentage as a decimal by the purchase price of each item the. Web madison, me sales tax rate: Numbers represent only state taxes, not federal taxes. Enter item price and tax rate percentage to find sales tax and total price. The average sales tax rate in maine.

Maine Sales Tax Guide

The maine sales tax calculator contains no separate locations as maine applies a 5.5% flat rate sales tax across the state, there. Web maine sales tax exempt organizations. To calculate maine’s retail sales tax, multiply the percentage as a decimal by the purchase price of each item the. Groceries and prescription drugs are exempt from.

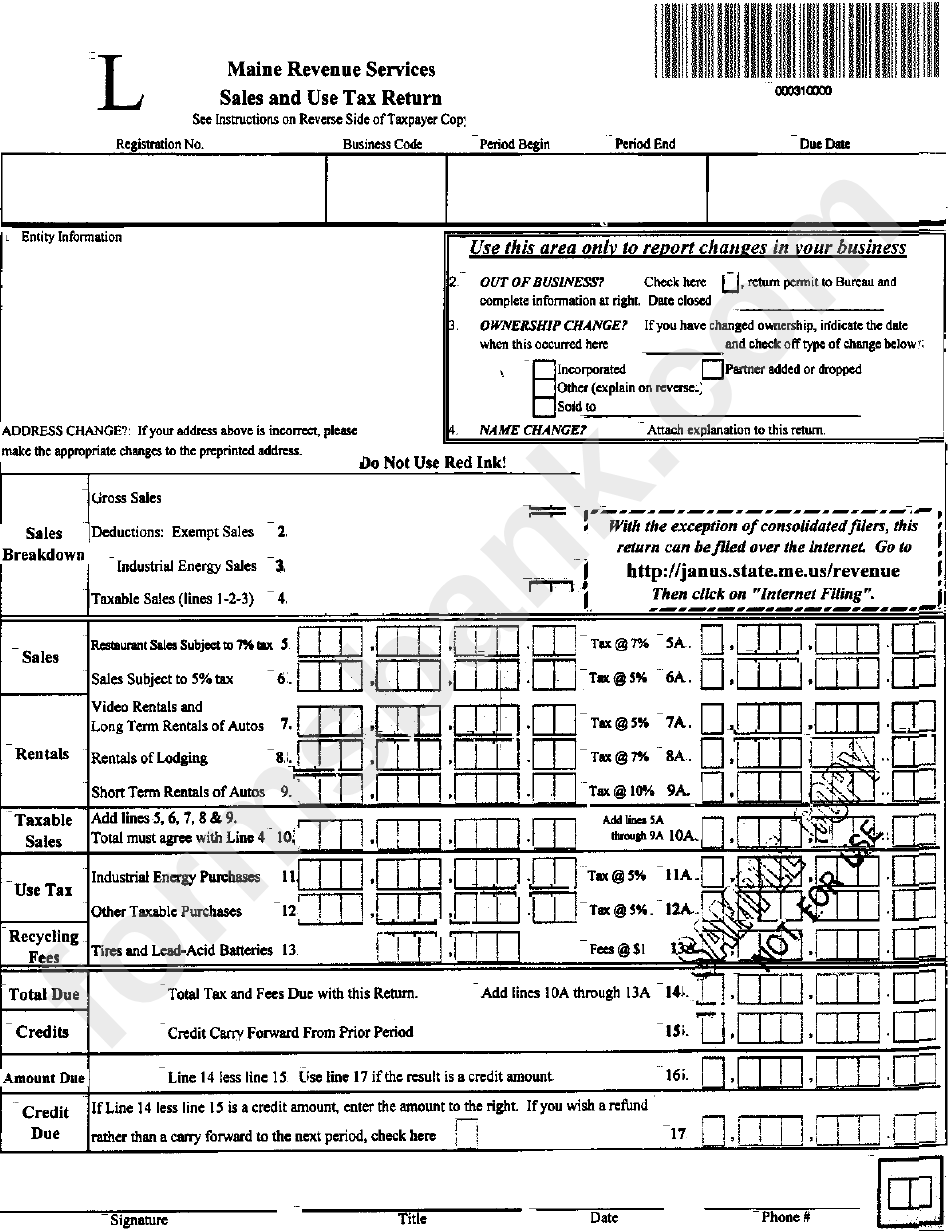

Form L Sales And Use Tax Return Maine Revenue Services printable

Manchester, me sales tax rate: Find your maine combined state and local tax rate. In addition to the state rate, local jurisdictions in maine may apply additional sales taxes. The average sales tax rate in maine in 2024 is 5.5%. Web maine sales tax calculator for 2024. Web how 2024 sales taxes are calculated in.

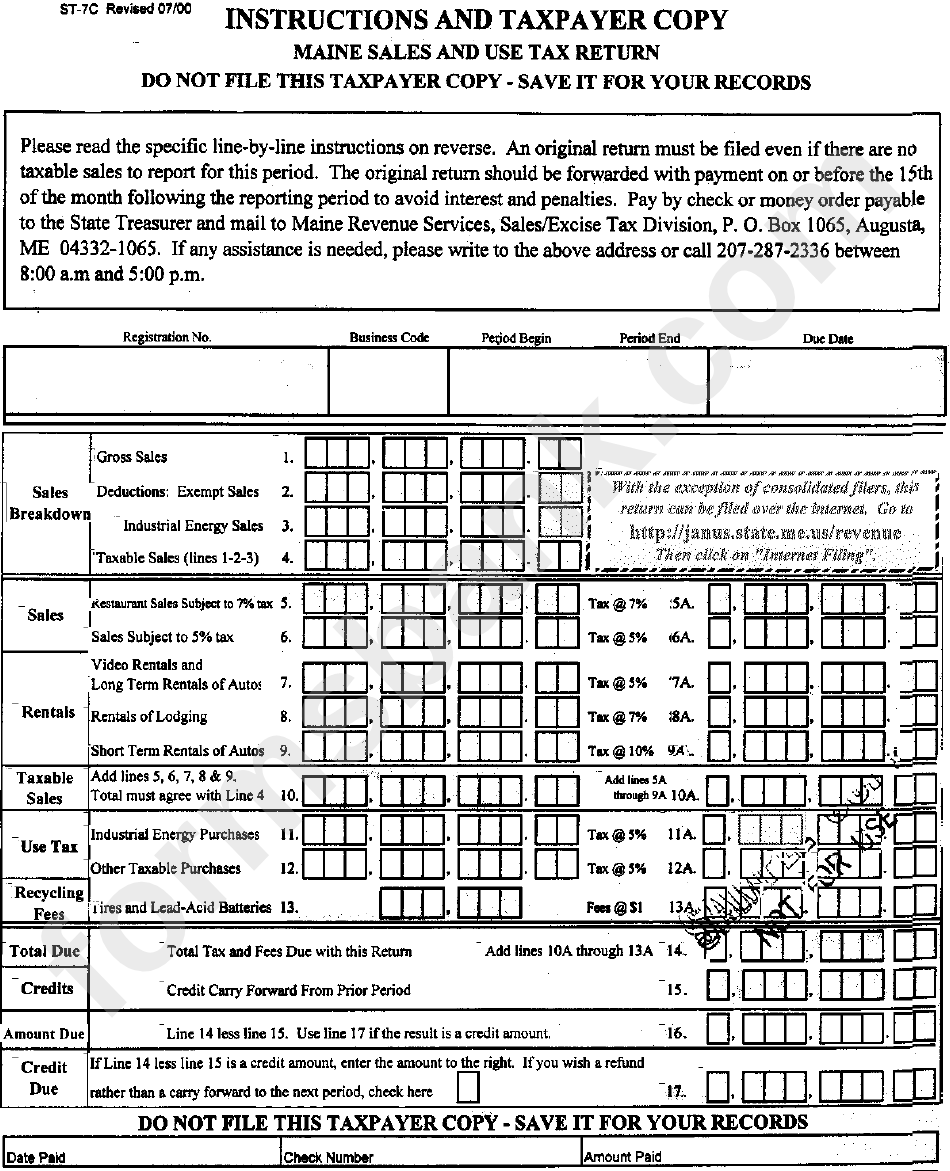

Form St7c Maine Sales And Use Tax Return printable pdf download

Customize using your filing status, deductions, exemptions. Sales tax and service provider tax certificate lookup. The state general sales tax rate of maine is 5.5%. Web local tax rates in maine range from 5.50%, making the sales tax range in maine 5.50%. Web maine sales tax calculator for 2024. Maine sales tax rates vary. Manset,.

Sales Tax Calculator Maine There is only statewide sales tax rate. The state levies a sales tax on the purchase of most goods and services. The average sales tax rate in maine in 2024 is 5.5%. Web the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on schedule a. Breakdown of taxes in maine (excl.

Groceries And Prescription Drugs Are Exempt From The Maine Sales Tax.

Web this gives you $2,750. Customize using your filing status, deductions, exemptions. Web madison, me sales tax rate: Rental of video media and video equipment.

Maine Cities And/Or Municipalities Don't Have A City Sales Tax.

Web federal and state tax tables. There is no difference what city, county or zip you are in. Manchester, me sales tax rate: Web financial advisors find out how much you'll pay in maine state income taxes given your annual income.

Web It Is 49.51 % Of The Total Taxes (4.9 Billion) Raised In Maine.

Numbers represent only state taxes, not federal taxes. Breakdown of taxes in maine (excl. Find your maine combined state and local tax rate. With a state sales tax rate of 5.5%, and additional.

Web Calculating Maine’s Sales And Use Tax Rates.

There is only statewide sales tax rate. That is the sales tax on the vehicle. Web the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on schedule a. Sales tax is not collected at the local level.