Sales Tax Calculator New Orleans

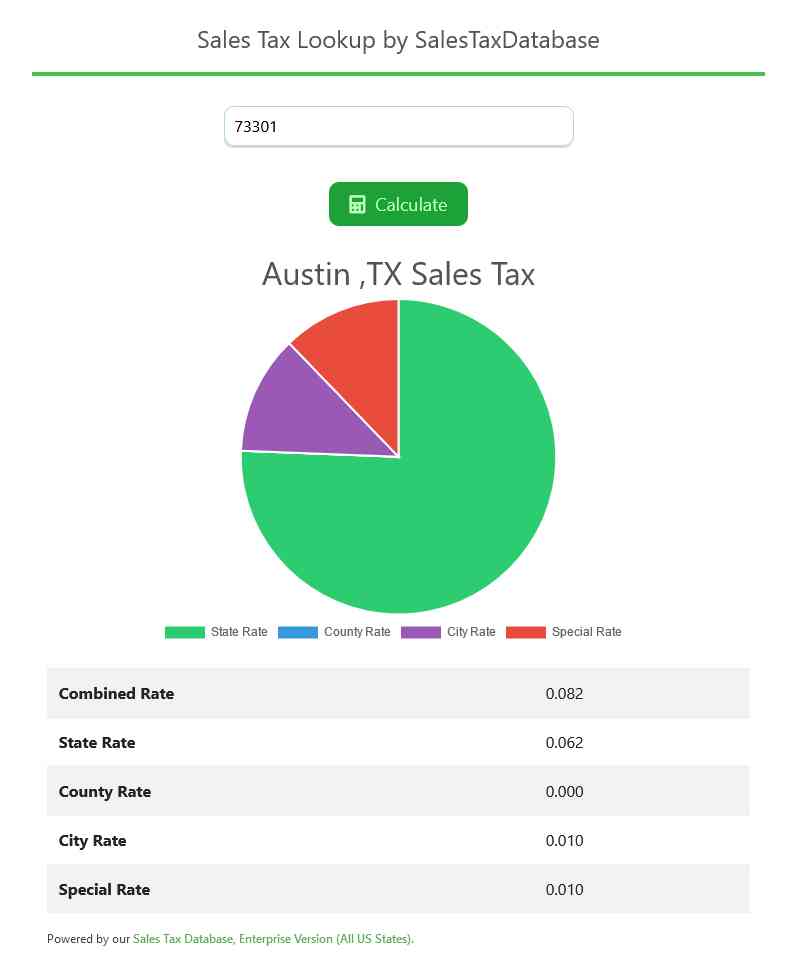

Sales Tax Calculator New Orleans - The combined rate used in this calculator. Web every 2021 q1 combined rates mentioned above are the results of louisiana state rate (4.45%), the county rate (4.75% to 5%). Web the sales tax rate in new orleans is 10%, and consists of 5% louisiana state sales tax and 5% orleans parish sales tax. The combined louisiana and orleans parish tax rate is 9.45%. Us sales tax rates | la rates | sales tax calculator | sales tax table.

Web $225.90 for a $200.00 purchase monroe, la 12.95% sales tax in ouachita parish $208.90 for a $200.00 purchase hackberry, la 4.45% sales tax in cameron parish you can use. There is no city sale tax for new orleans. Us sales tax rates | la rates | sales tax calculator | sales tax table. The combined rate used in this calculator. Web sales tax calculator of 70112, new orleans for 2023. Web the louisiana (la) state sales tax rate is currently 4.45%. Tax rates are provided by avalara and updated monthly.

How to Calculate Sales Tax overview

The 70112, new orleans, louisiana, general sales tax rate is 9.695%. Web orleans parish sales tax rate. There is an additional 0.245% rate in the french quarter economic development. Depending on local municipalities, the total tax rate can be as high as 11.45%. You can simply select one rate or. There is no city sale.

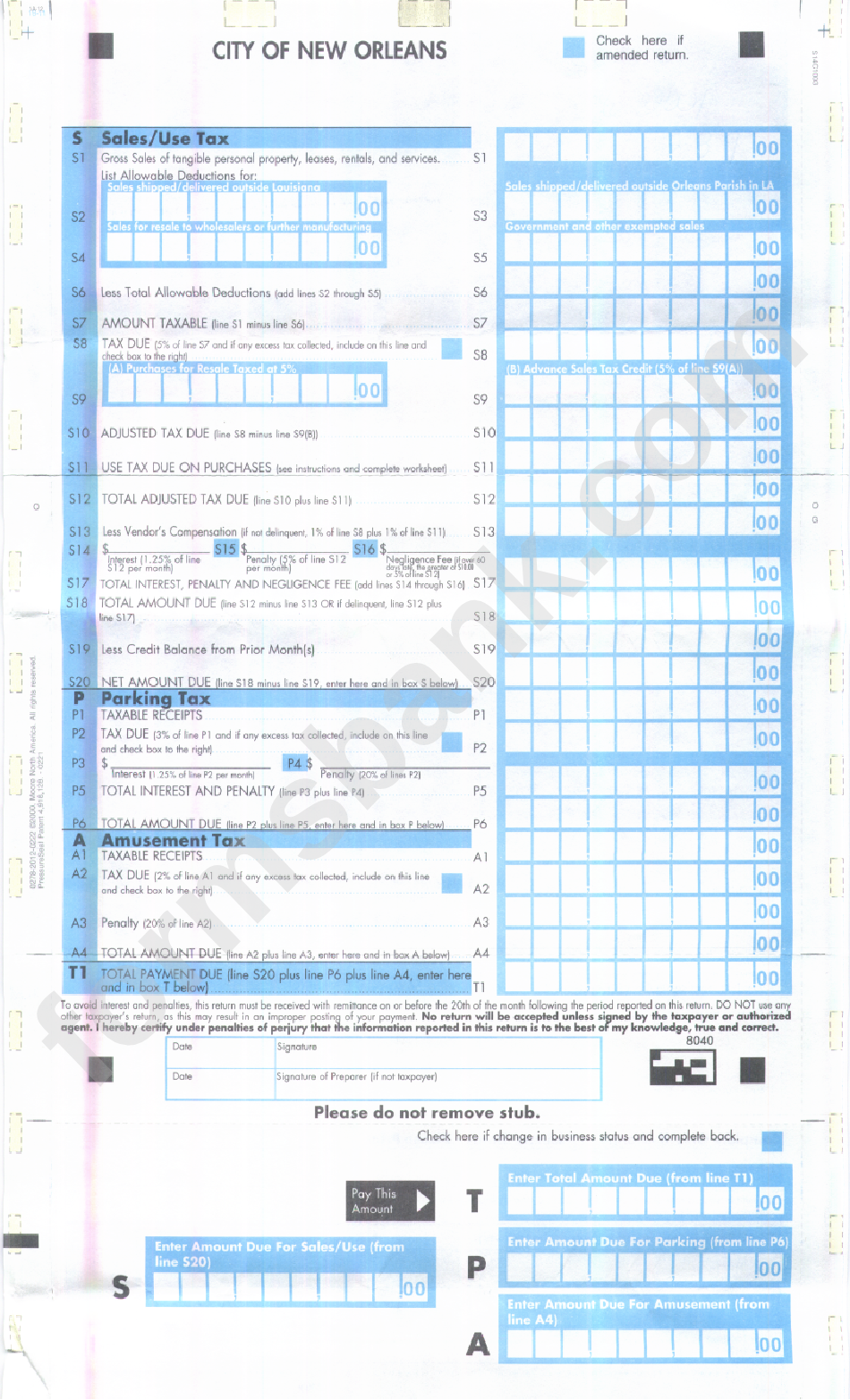

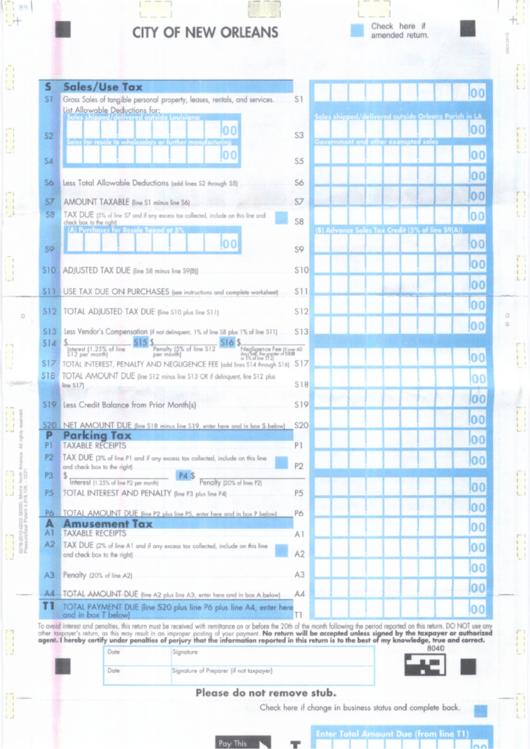

Sales/use Tax City Of New Orleans printable pdf download

Web louisiana has state sales tax of 4.45%, and allows local governments to collect a local option sales tax of up to 7%. There are a total of 266 local tax jurisdictions across the. New orleans is located within orleans parish and. Web orleans parish in louisiana has a tax rate of 10% for 2024,.

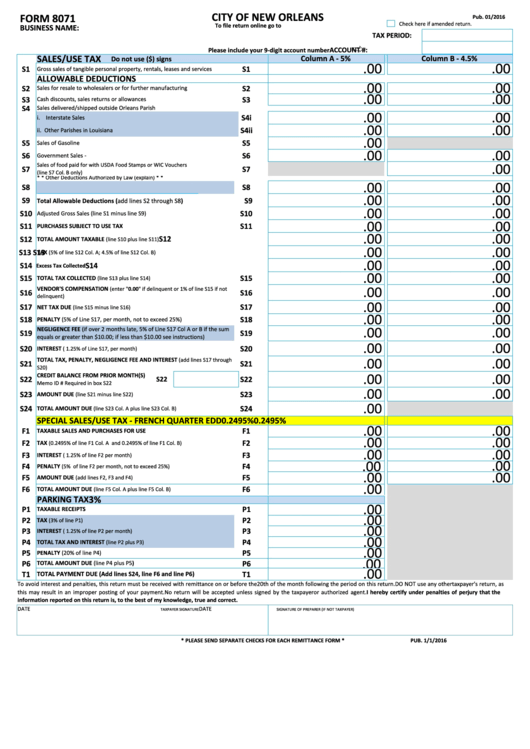

Form 8071 Sales/use Tax City Of New Orleans printable pdf download

Web how 2024 sales taxes are calculated for zip code 70112. Also, check the sales tax rates in different states of the u.s. Depending on local municipalities, the total tax rate can be as high as 11.45%. The combined rate used in this calculator. Tax rates are provided by avalara and updated monthly. Web orleans.

What is Sales Tax Nexus Learn all about Nexus

You can simply select one rate or. Us sales tax rates | la rates | sales tax calculator | sales tax table. Web the louisiana (la) state sales tax rate is currently 4.45%. The 70112, new orleans, louisiana, general sales tax rate is 9.695%. Web every 2021 q1 combined rates mentioned above are the results.

Sales Tax by State Here's How Much You're Really Paying GOBankingRates

Web sales tax calculator of 70112, new orleans for 2023. Any of these websites will calculate taxes due. Web $225.90 for a $200.00 purchase monroe, la 12.95% sales tax in ouachita parish $208.90 for a $200.00 purchase hackberry, la 4.45% sales tax in cameron parish you can use. New orleans is located within orleans parish.

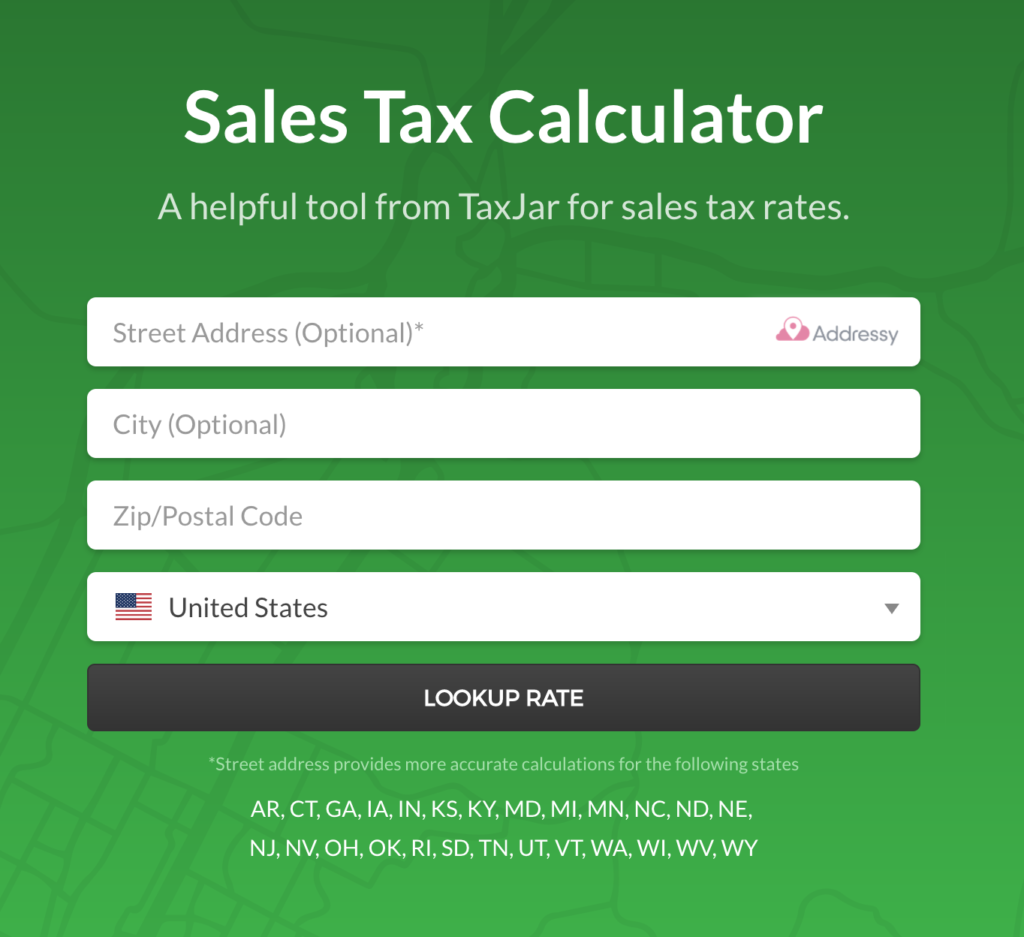

Sales Tax Calculator

Web how 2024 sales taxes are calculated for zip code 70112. Web every 2021 q1 combined rates mentioned above are the results of louisiana state rate (4.45%), the county rate (4.75% to 5%). There is an additional 0.245% rate in the french quarter economic development. Web amount after taxes how 2023 sales taxes are calculated.

Sales Tax Database

The combined rate used in this calculator. Web every 2021 q1 combined rates mentioned above are the results of louisiana state rate (4.45%), the county rate (4.75% to 5%). Also, check the sales tax rates in different states of the u.s. Us sales tax rates | la rates | sales tax calculator | sales tax.

4 Ways to Calculate Sales Tax wikiHow

Web amount after taxes how 2023 sales taxes are calculated for zip code 70123 the 70123, new orleans, louisiana, general sales tax rate is 10%. Web orleans parish sales tax rate. Depending on the zipcode, the sales tax rate of new orleans may vary from 4% to 10%. New orleans is located within orleans parish.

US Sales Tax for Online Sellers The Essential Guide

Calculation of the general sales taxes of 70112, new orleans, 70118 for 2023. There are a total of 266 local tax jurisdictions across the. Web the louisiana (la) state sales tax rate is currently 4.45%. The combined louisiana and orleans parish tax rate is 9.45%. Web $225.90 for a $200.00 purchase monroe, la 12.95% sales.

Sales/use Tax City Of New Orleans printable pdf download

You can simply select one rate or. Web calculate car sales tax in louisiana example: The 70112, new orleans, louisiana, general sales tax rate is 9.695%. Web 3 rows the 9.45% sales tax rate in new orleans consists of 4.45% louisiana state sales tax and. The websites are secure, reliable, and will save you time..

Sales Tax Calculator New Orleans Web locations related to new orleans. Web the louisiana (la) state sales tax rate is currently 4.45%. Web 3 rows the 9.45% sales tax rate in new orleans consists of 4.45% louisiana state sales tax and. There is an additional 0.245% rate in the french quarter economic development. Web 4 rows show 60 more.

The Combined Rate Used In This.

Web $225.90 for a $200.00 purchase monroe, la 12.95% sales tax in ouachita parish $208.90 for a $200.00 purchase hackberry, la 4.45% sales tax in cameron parish you can use. Web locations related to new orleans. The combined rate used in this calculator. Depending on the zipcode, the sales tax rate of new orleans may vary from 4% to 10%.

Tax Rates Are Provided By Avalara And Updated Monthly.

Calculation of the general sales taxes of 70112, new orleans, 70118 for 2023. Web orleans parish sales tax rate. The combined rate used in this calculator. Web 3 rows the 9.45% sales tax rate in new orleans consists of 4.45% louisiana state sales tax and.

Web How 2024 Sales Taxes Are Calculated For Zip Code 70112.

You can simply select one rate or. Web sales tax calculator of 70112, new orleans for 2023. Web calculate car sales tax in louisiana example: Web louisiana has state sales tax of 4.45%, and allows local governments to collect a local option sales tax of up to 7%.

Administer And Enforce Ordinances Pertaining To.

Also, check the sales tax rates in different states of the u.s. Web how 2023 sales taxes are calculated for zip code 70114 the 70114, new orleans, louisiana, general sales tax rate is 9.45%. Any of these websites will calculate taxes due. Depending on local municipalities, the total tax rate can be as high as 11.45%.