Sc Tax Calculator Paycheck

Sc Tax Calculator Paycheck - Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web if you make $55,000 a year living in the region of south carolina, usa, you will be taxed $12,425.that means that your net pay will be $42,575 per year, or $3,548 per month. His/her take home pay will be $40,804.90. $27,700 for married couples filing jointly or qualifying surviving spouse. Us income tax calculator 2023;

Use gusto’s salary paycheck calculator to determine withholdings and. Updated on dec 05 2023. $13,850 for single or married filing separately. Just enter the wages, tax withholdings and other. Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Us income tax calculator 2024; Web if you make $55,000 a year living in the region of south carolina, usa, you will be taxed $12,425.that means that your net pay will be $42,575 per year, or $3,548 per month.

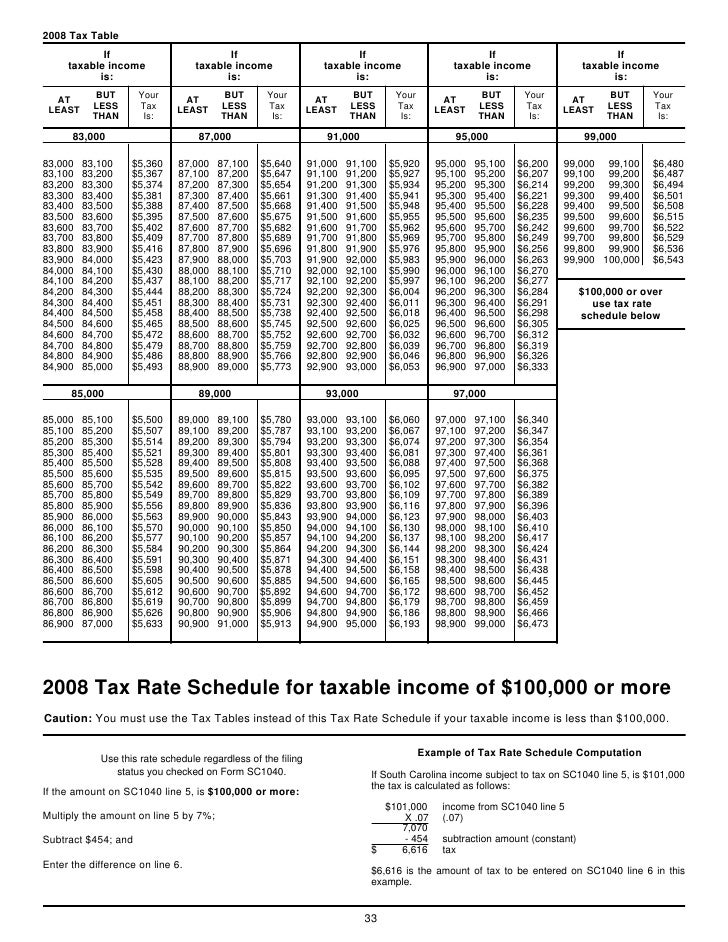

South carolina tax brackets 2021 kloprc

Web south carolina income tax calculators. Web to use our south carolina salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Web south carolina salary paycheck and payroll calculator calculating paychecks and need some help? The easy way to calculate your take. Simply enter their.

Free South Carolina Paycheck Calculator 2024

$13,850 for single or married filing separately. The easy way to calculate your take. Web this paycheck calculator also works as an income tax calculator for south carolina, as it shows you how much income tax you have to pay based on your salary. Us income tax calculator 2024; Use gusto’s salary paycheck calculator to.

South Carolina State Tax Tables 2023 US iCalculator™

Web smartasset's south carolina paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web you can quickly estimate your south carolina state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web use adp’s south carolina.

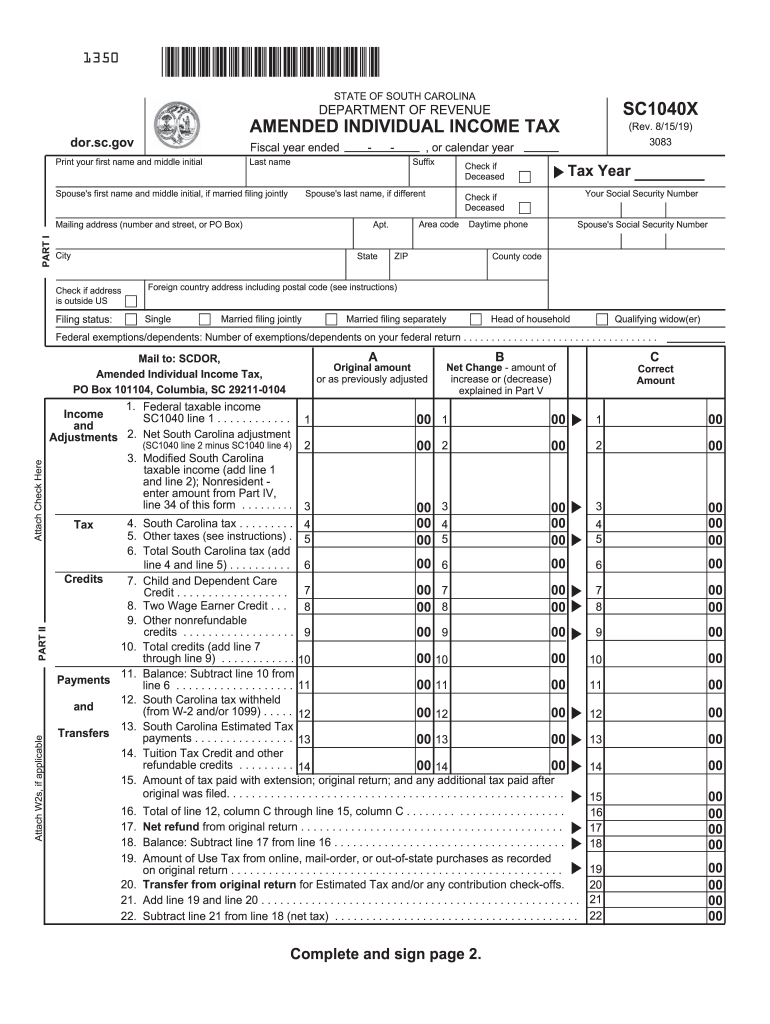

20212023 Form SC DoR SC1040 Fill Online, Printable, Fillable, Blank

How to calculate annual income. $27,700 for married couples filing jointly or qualifying surviving spouse. Web federal paycheck calculator photo credit: Web smartasset's south carolina paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web south carolina salary paycheck and payroll calculator calculating paychecks and need some help? Web the.

South Carolina Paycheck Calculator (Updated for 2024)

After a few seconds, you will be provided with. Web south carolina salary paycheck and payroll calculator calculating paychecks and need some help? Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. $27,700 for married couples filing jointly or qualifying surviving spouse. Web the standard deduction.

South Carolina Tax Tables

How to calculate annual income. Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Updated on dec 05 2023. $13,850 for single or married filing separately. Web this paycheck calculator also works as an income tax calculator for south carolina, as it shows you.

A closer look at S.C. and the taxes you pay to live here News and Press

The easy way to calculate your take. Web the result is net income; Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. The deadline to file returns in 2024 is april 15 (this. Updated on dec 05 2023. Web this paycheck calculator also works as an.

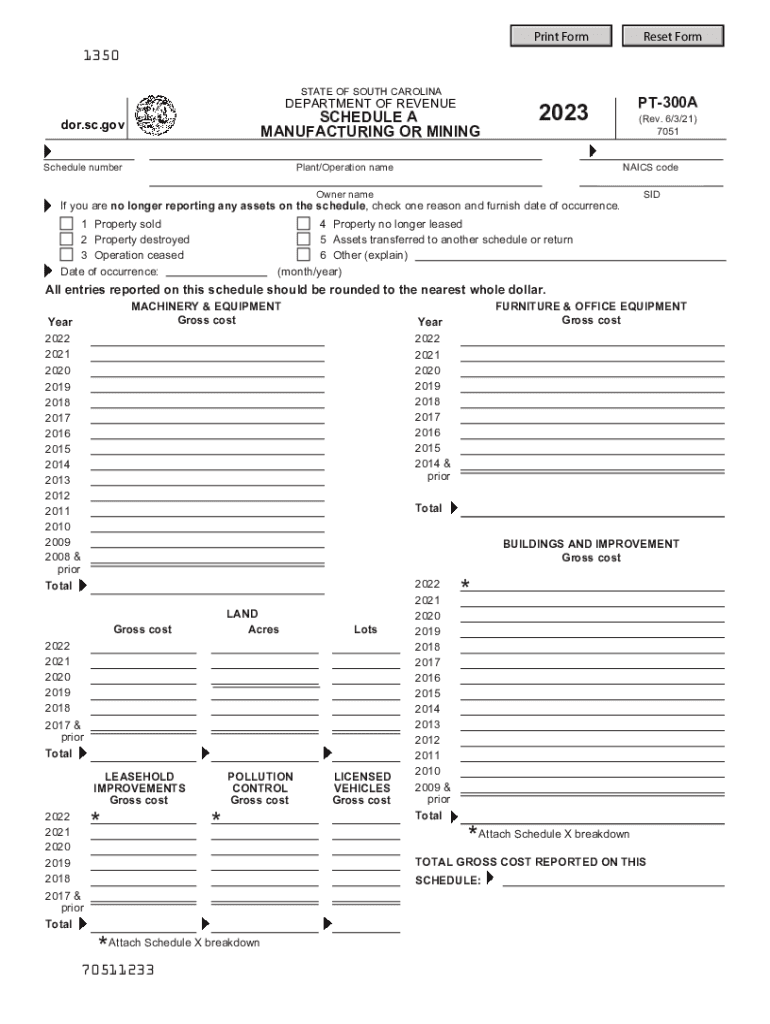

2023 Form SC PT300A Fill Online, Printable, Fillable, Blank pdfFiller

Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. $13,850 for single or married filing separately. Web south carolina paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Free tool to calculate.

South Carolina Tax Rate 20192023 Form Fill Out and Sign

Web to use our south carolina salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. The irs started accepting and processing income tax returns on.

South Carolina Tax Tables

Just enter the wages, tax withholdings and other. $27,700 for married couples filing jointly or qualifying surviving spouse. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Us income tax calculator 2024; $13,850 for single or married filing separately. Multiply that $10,500 by 15%,.

Sc Tax Calculator Paycheck Web the result is net income; Simply enter their federal and. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Web we designed a handy payroll tax calculator to help you with all of your payroll needs. Us income tax calculator 2023;

Just Enter The Wages, Tax Withholdings And Other.

Web federal paycheck calculator photo credit: $13,850 for single or married filing separately. Web with an annual salary of $51,000, a single filing south carolinian will have a income tax of $10,195.10. Web this paycheck calculator also works as an income tax calculator for south carolina, as it shows you how much income tax you have to pay based on your salary.

Simply Enter Their Federal And.

Web you can quickly estimate your south carolina state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in south carolina, the calculator allows you to calculate. Web select a specific south carolina tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year. Us income tax calculator 2022;

Web South Carolina Income Tax Calculators.

How to calculate annual income. Updated on dec 05 2023. Web smartasset's south carolina paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web to use our south carolina salary tax calculator, all you need to do is enter the necessary details and click on the calculate button.

Web South Carolina Paycheck Calculator For Salary & Hourly Payment 2023 Curious To Know How Much Taxes And Other Deductions Will Reduce Your Paycheck?

Us income tax calculator 2023; Free tool to calculate your hourly and salary income. Web south carolina salary paycheck and payroll calculator calculating paychecks and need some help? $27,700 for married couples filing jointly or qualifying surviving spouse.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)