Share Incentive Plan Calculator

Share Incentive Plan Calculator - Decide how long participants will be able. Web how much cash could i save? Web in the tax year to 5 april 2021, you could transfer shares worth up to £20,000 (£20,000 in the tax year to 5 april 2020) at the date of transfer into an isa directly from a sip, an. Web a share incentive plan works by keeping the shares awarded in a trust for employees until they either leave the job or decide to take the shares from the plan. Web 21 january 2020 | 4 min read.

Determine the target and threshold 4. Web sip in a nutshell. Many companies offer workplace investing schemes on top of a workplace pension. Web in the tax year to 5 april 2021, you could transfer shares worth up to £20,000 (£20,000 in the tax year to 5 april 2020) at the date of transfer into an isa directly from a sip, an. Web how much cash could i save? Decide how long participants will be able. Web save as you earn (saye) company share option plan enterprise management incentives (emis) employee shareholder shares transferring your shares to an isa.

Bonus Share Adjustment Calculator, Bonus Share Calculation

Uslegalforms.com has been visited by 100k+ users in the past month Web a share incentive plan works by keeping the shares awarded in a trust for employees until they either leave the job or decide to take the shares from the plan. If you buy shares worth £1,800 through a share incentive plan, then you.

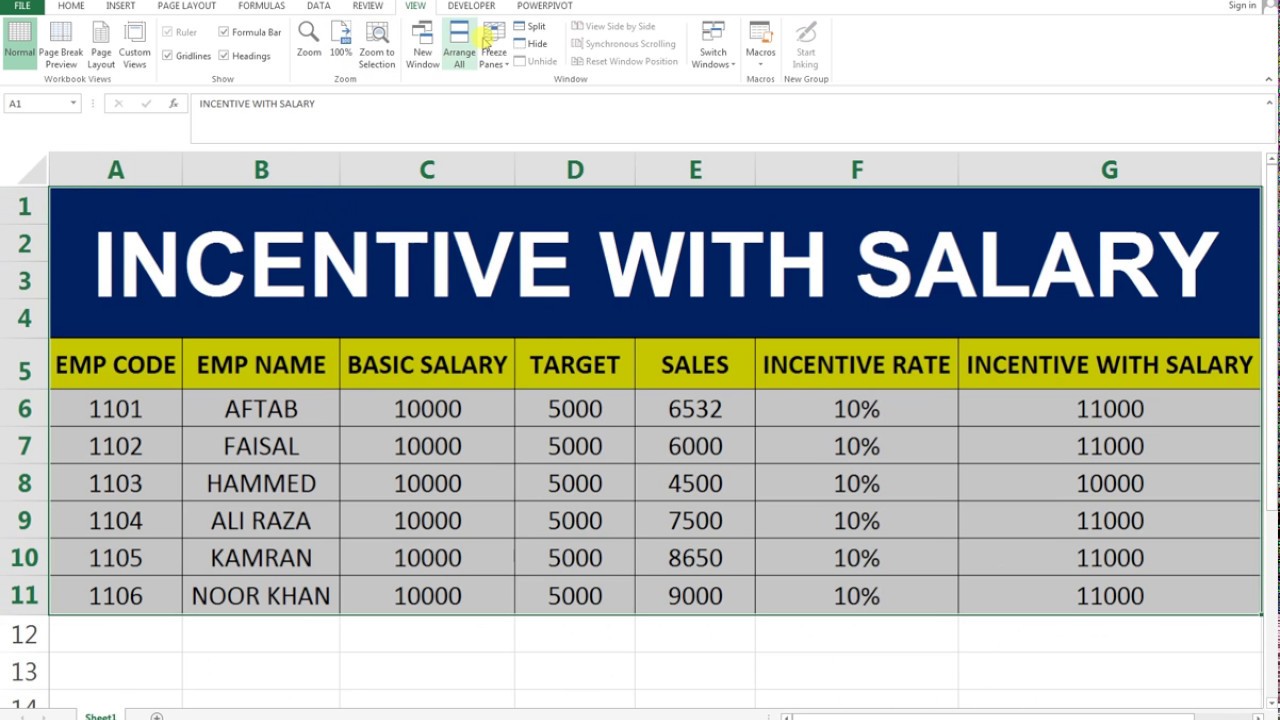

Incentive Calculate With Salary On MS Excel YouTube

Web a share incentive plan works by keeping the shares awarded in a trust for employees until they either leave the job or decide to take the shares from the plan. In this article we'll cover. Save as you earn (saye or sharesave) plans are a key part of many larger companies’ employee value propositions;.

How to Calculate Incentives based on Targets and Achievements in Excel

Web how to calculate incentive payout 1. This adds up to an. Uslegalforms.com has been visited by 100k+ users in the past month Consider the period of time that the plan should cover, such as one year, two years, or longer. Save as you earn (saye or sharesave) plans are a key part of many.

Bonus or Incentive Plan Calculation Spreadsheet ConnectsUs HR

Enterprise management incentives (emis) company share option plans (csops) share incentive plans (sips) save as you. Decide how long participants will be able. Your employer may specify whether all or only part of your salary is to be used. Web you may also have been offered a share incentive plan (sip) as an employee benefit..

3 IncentiveBased Strategies to Increase Market Share Incentive Solutions

Web save as you earn (saye) company share option plan enterprise management incentives (emis) employee shareholder shares transferring your shares to an isa. Web you may also have been offered a share incentive plan (sip) as an employee benefit. Web they’re a way to give employees shares in the company to foster a sense of.

Incentive Compensation What It Is & How to Structure a Plan

Web they’re a way to give employees shares in the company to foster a sense of ownership and engagement. Decide how long participants will be able. Web in the tax year to 5 april 2021, you could transfer shares worth up to £20,000 (£20,000 in the tax year to 5 april 2020) at the date.

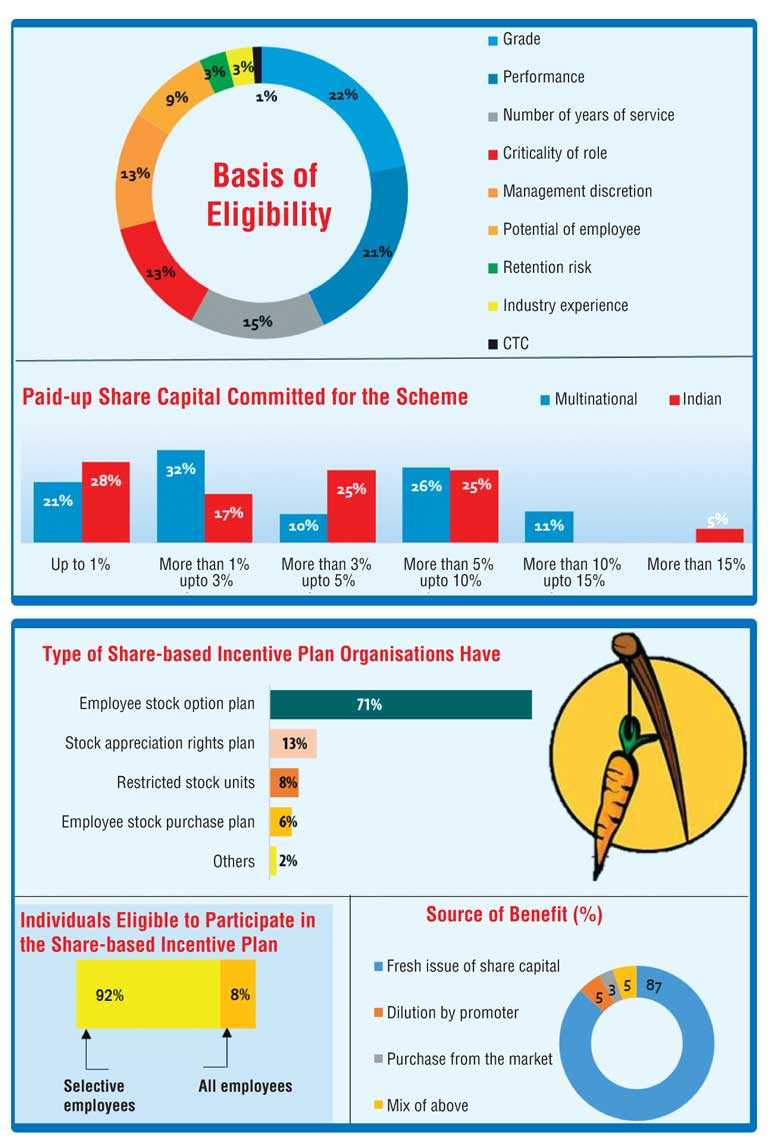

EY says Share based Incentive Plans have good potential to drive

Determine the target and threshold 4. Web how to calculate incentive payout 1. Web in the tax year to 5 april 2021, you could transfer shares worth up to £20,000 (£20,000 in the tax year to 5 april 2020) at the date of transfer into an isa directly from a sip, an. Web how much.

Share Incentive Plan Tax Calculator

Web sip in a nutshell. Web • £1,500 per tax year (£125 a month), or • 10% of your total salary for the tax year. Many companies offer workplace investing schemes on top of a workplace pension. The main two are save as you earn (saye) schemes and share. This adds up to an. These.

How to Calculate Bonus in Excel (5 Handy Methods) ExcelDemy

This adds up to an. Uslegalforms.com has been visited by 100k+ users in the past month These plans let you buy shares in your company on a monthly basis. Save as you earn (saye or sharesave) plans are a key part of many larger companies’ employee value propositions; The main two are save as you.

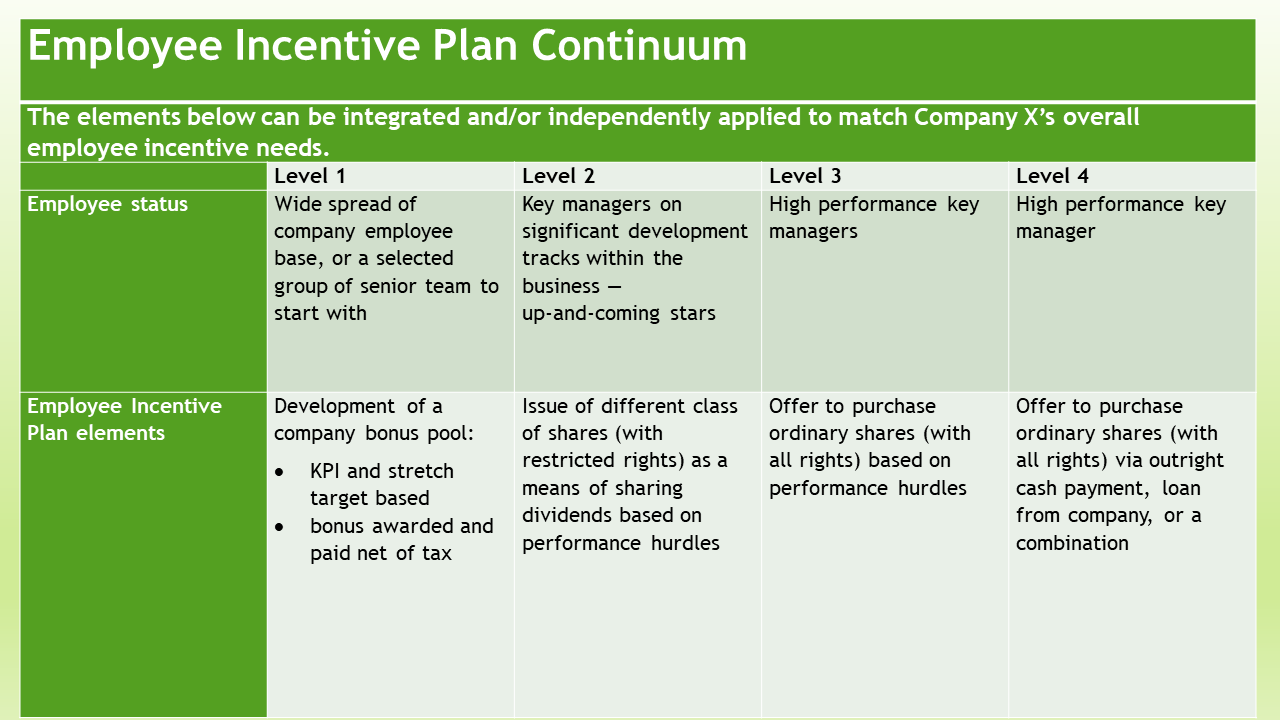

How to set up an employee incentive or share plan

Web save as you earn (saye) company share option plan enterprise management incentives (emis) employee shareholder shares transferring your shares to an isa. This adds up to an. Define clear objectives and metrics 2. Save as you earn (saye or sharesave) plans are a key part of many larger companies’ employee value propositions; Consider the.

Share Incentive Plan Calculator Determine the target and threshold 4. Web specifying the time period for the plan. These plans let you buy shares in your company on a monthly basis. You can buy shares out of your salary before tax deductions. Web how much cash could i save?

Uslegalforms.com Has Been Visited By 100K+ Users In The Past Month

Web specifying the time period for the plan. These plans let you buy shares in your company on a monthly basis. Many companies offer workplace investing schemes on top of a workplace pension. Save as you earn (saye or sharesave) plans are a key part of many larger companies’ employee value propositions;

Web In The Tax Year To 5 April 2021, You Could Transfer Shares Worth Up To £20,000 (£20,000 In The Tax Year To 5 April 2020) At The Date Of Transfer Into An Isa Directly From A Sip, An.

Your employer may specify whether all or only part of your salary is to be used. Web sip in a nutshell. In this article, we’ll explain what share incentive plans. Web • £1,500 per tax year (£125 a month), or • 10% of your total salary for the tax year.

Define Clear Objectives And Metrics 2.

Web how to calculate incentive payout 1. Web you may also have been offered a share incentive plan (sip) as an employee benefit. This adds up to an. If you buy shares worth £1,800 through a share incentive plan, then you will save £847 per year in tax.

Web 21 January 2020 | 4 Min Read.

Consider the period of time that the plan should cover, such as one year, two years, or longer. You can buy shares out of your salary before tax deductions. Enterprise management incentives (emis) company share option plans (csops) share incentive plans (sips) save as you. Set the incentive structure 3.