Solo 401K Calculator

Solo 401K Calculator - So if you retire at age 65, your last contribution occurs when you are actually 64. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at retirement. Investment tools & tipsfinance calculatorsveterans resourcespersonal finance & taxes Web this calculator assumes that the year you retire, you do not make any contributions to your 401 (k). The monthly income you’ll need for retirement.

Learn how to open, contribute, and tax your solo 401 (k) with this. First, all contributions and earnings to your. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. To remove the pdf, refresh. Web ubiquity’s solo 401(k) calculator helps you determine: Investment tools & tipsfinance calculatorsveterans resourcespersonal finance & taxes Compare the features and amounts of.

How To Calculate Solo 401k Contribution Limits Above the Canopy

Web the maximum social security benefit you can receive in 2023 ranges from $2,572 to $4,555 per month, depending on the age you retire. Web calculate your contribution to a solo 401 (k) plan based on your age, profit from business, and earnings from other jobs. This is by far the hardest part in determining.

Our Favorite Solo 401k Calculators

To remove the pdf, refresh. Compare the features and amounts of. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at retirement. So if you retire at age 65, your last contribution occurs when you are actually 64. Investment tools & tipsfinance.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web estimate the potential contribution to a solo 401 (k) plan, compared to profit sharing, simple, or sep plan, using this interactive tool. Web use our calculator to calculate how much you could contribute to an individual 401k based on your age and income. Knowledgeable teama+ ratings with bbbover 24 yrs of experience First, all.

How To Calculate Solo 401k Contribution Limits Above the Canopy

The amount you’ll receive from retirement based on monthly contributions. Web considering a solo 401k plan to increase your retirement assets? Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Web input $155,000 into the calculator..

401k withdrawal calculator fidelity PoppyLleyton

Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Web estimate the potential contribution to a solo 401 (k) plan, compared to profit sharing, simple, or sep plan, using this interactive tool. Web use this tool.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web estimate the potential contribution to an individual 401 (k) plan for 2008 with this calculator. Web each option has distinct features and amounts that can be contributed to the plan each year. Web use our calculator to calculate how much you could contribute to an individual 401k based on your age and income. The.

Solo 401k Calculator (2024)

So if you retire at age 65, your last contribution occurs when you are actually 64. Web each option has distinct features and amounts that can be contributed to the plan each year. Web input $155,000 into the calculator. The monthly income you’ll need for retirement. This calculator is for sole proprietors or llcs taxed.

Solo 401k Contribution Calculator Ocho

The amount you’ll receive from retirement based on monthly contributions. This calculator is for sole proprietors or llcs taxed as. Knowledgeable teama+ ratings with bbbover 24 yrs of experience A pdf document will be created that you can print or save. The farther away you are from retirement, the more. Web the maximum social security.

SelfDirected Solo 401k Required Minimum Distribution (RMD) Calculator

Find out the advantages, disadvantages, and alternatives of this retirement plan for self. Learn about the features and benefits. Web use this calculator to determine how much you can contribute into your solo 401k for the 2023 tax year. The farther away you are from retirement, the more. Knowledgeable teama+ ratings with bbbover 24 yrs.

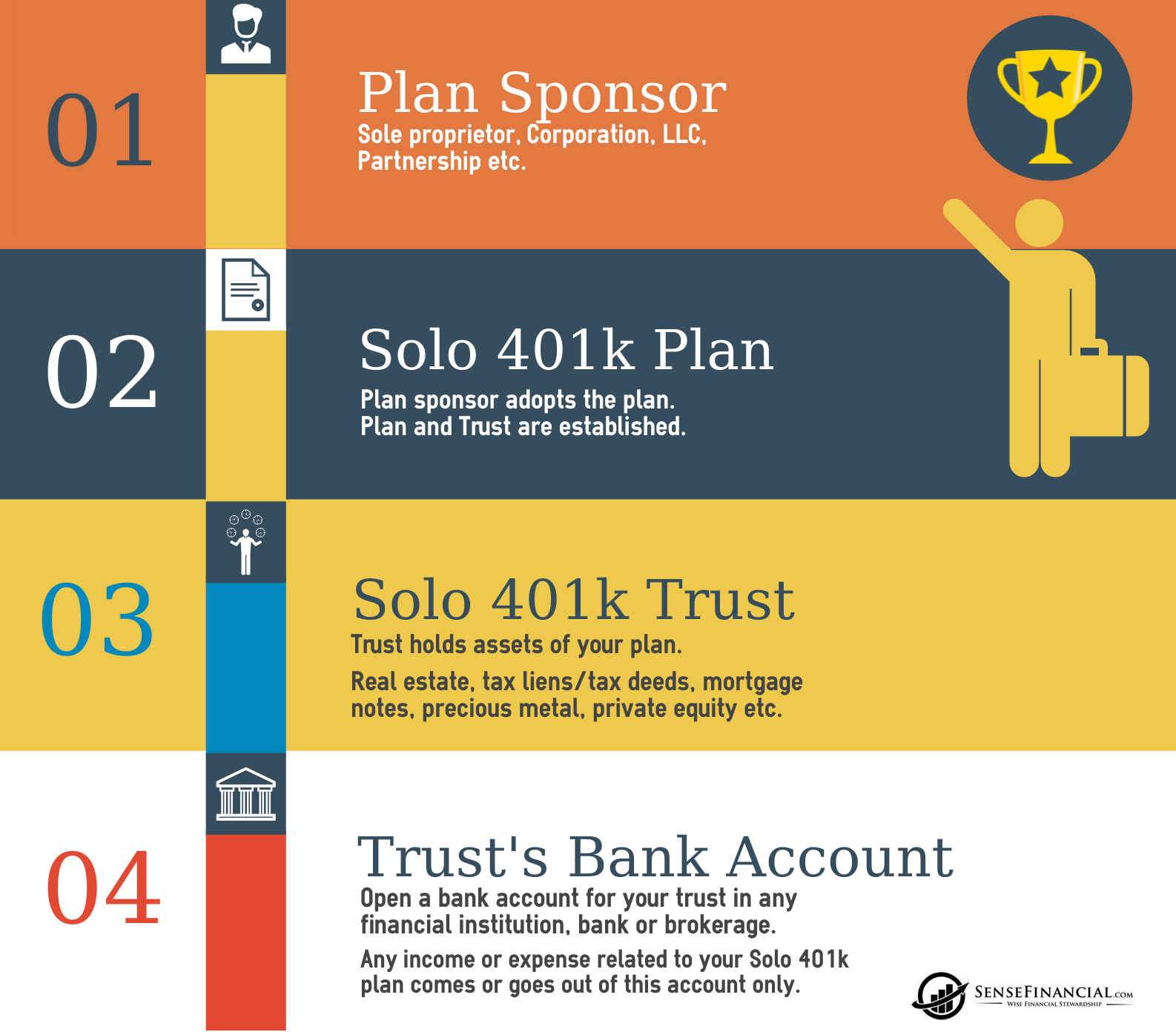

401k Infographics How does a selfdirected Solo k plan work?

Web input $155,000 into the calculator. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at retirement. The amount you’ll receive from retirement based on monthly contributions. Compare the features and amounts of. Web use this calculator to determine how much you.

Solo 401K Calculator Web calculate your contribution to a solo 401 (k) plan based on your age, profit from business, and earnings from other jobs. Web this calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Web each option has distinct features and amounts that can be contributed to the plan each year. First, all contributions and earnings to your. Learn how to open, contribute, and tax your solo 401 (k) with this.

A Pdf Document Will Be Created That You Can Print Or Save.

Web calculate your contribution to a solo 401 (k) plan based on your age, profit from business, and earnings from other jobs. Web estimate the potential contribution to an individual 401 (k) plan for 2008 with this calculator. Web this calculator assumes that the year you retire, you do not make any contributions to your 401 (k). Web solo 401 (k) contribution limits.

Web Estimate The Potential Contribution To A Solo 401 (K) Plan, Compared To Profit Sharing, Simple, Or Sep Plan, Using This Interactive Tool.

Web the maximum social security benefit you can receive in 2023 ranges from $2,572 to $4,555 per month, depending on the age you retire. This is by far the hardest part in determining how much you'll need in retirement. Web ubiquity’s solo 401(k) calculator helps you determine: Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning.

Learn How To Open, Contribute, And Tax Your Solo 401 (K) With This.

To remove the pdf, refresh. Learn about the contribution limits, types, and rules for a. So if you retire at age 65, your last contribution occurs when you are actually 64. First, all contributions and earnings to your.

Web Input $155,000 Into The Calculator.

Web each option has distinct features and amounts that can be contributed to the plan each year. Learn about the features and benefits. Web considering a solo 401k plan to increase your retirement assets? Use our free solo 401k retirement calculator to see how much your nest egg can grow.