Solo 401K Employer Contribution Calculator

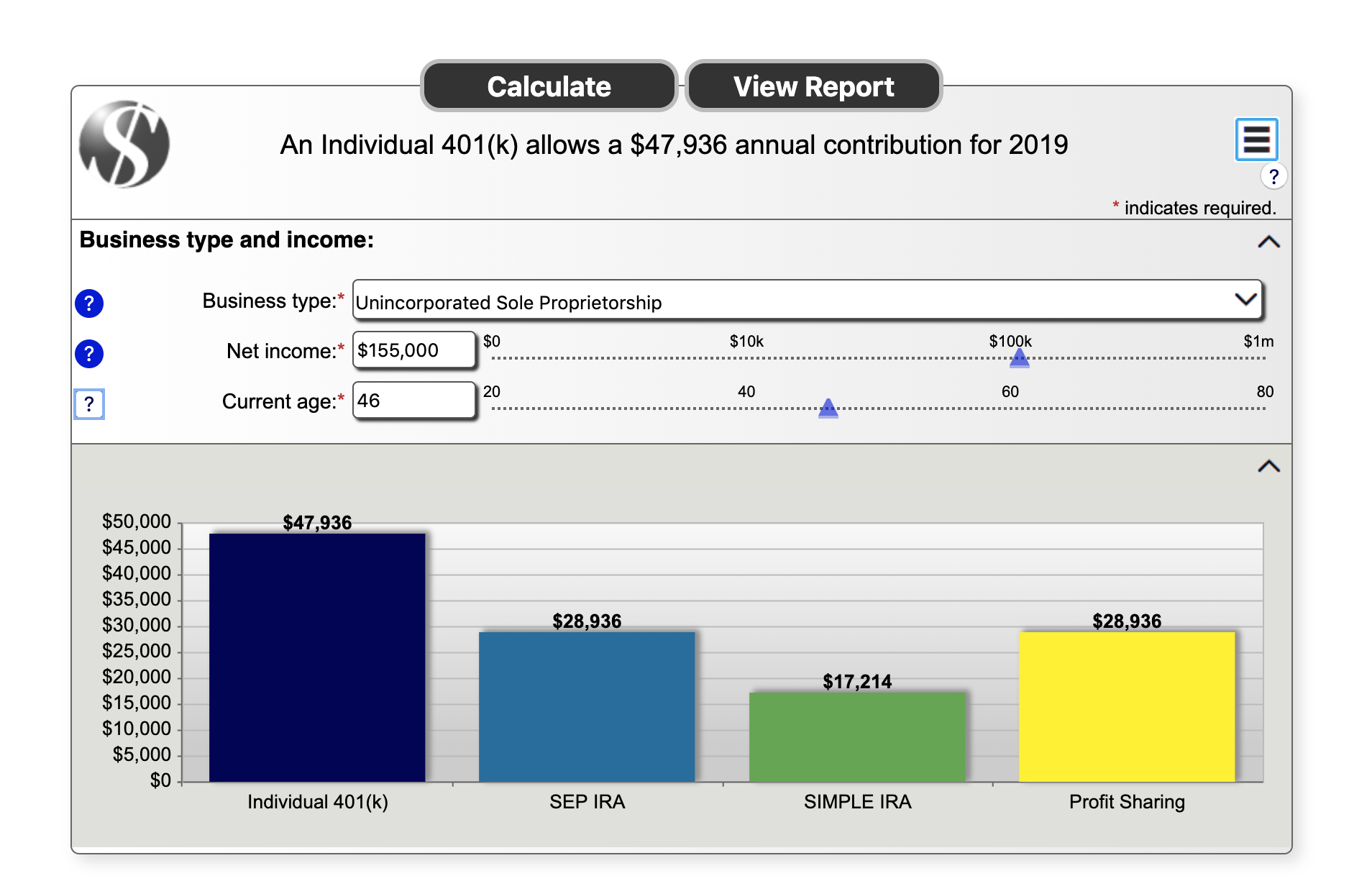

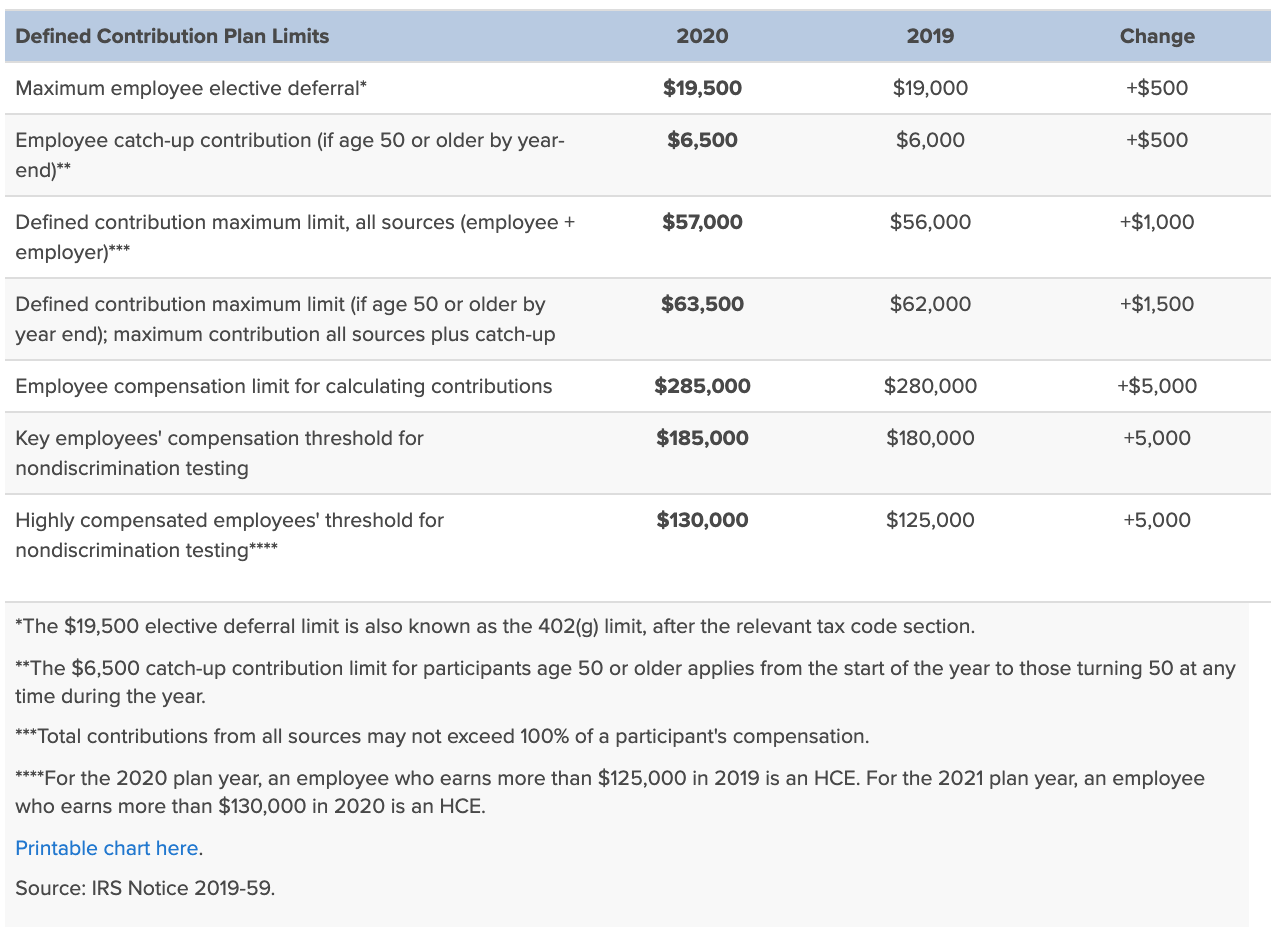

Solo 401K Employer Contribution Calculator - Web the total solo 401(k) contribution limit (employee + employer contribution) is up to $66,000 in 2023. This is where many business owners get tripped up. Calculated as schedule c income minus the deduction for se taxes. We'll show you the #1 tax and retirement strategy! Web solo 401 (k) contribution calculator.

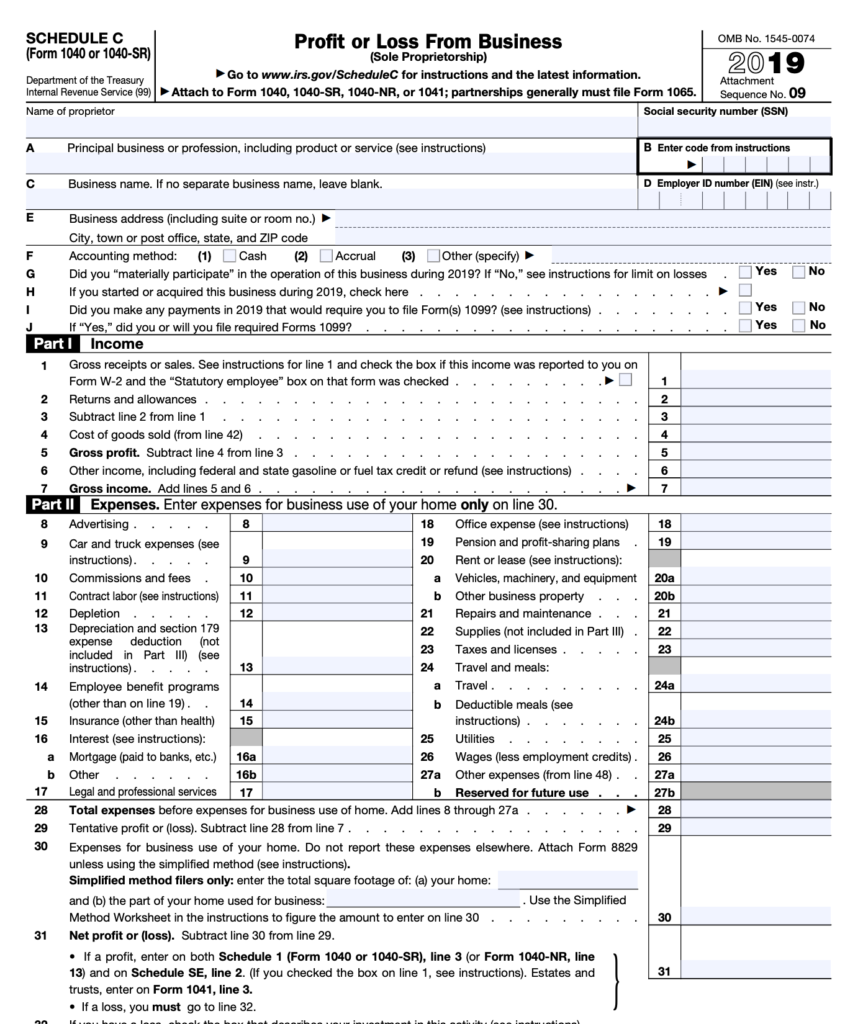

Please note that this calculator is only intended for sole proprietors (or llcs taxed as such). The exact amount you’re allowed to contribute to a solo 401(k) plan. Web paul sundin, cpa november 20, 2022 looking to get $100,000+ into retirement? First, all contributions and earnings to your. Calculated as schedule c income minus the deduction for se taxes. Web solo 401 (k) contribution calculator. Web the solo 401 (k) plan contribution rules are the foundation of the solo 401 (k) plan.

Individual 401k contribution calculator KiereanOlivia

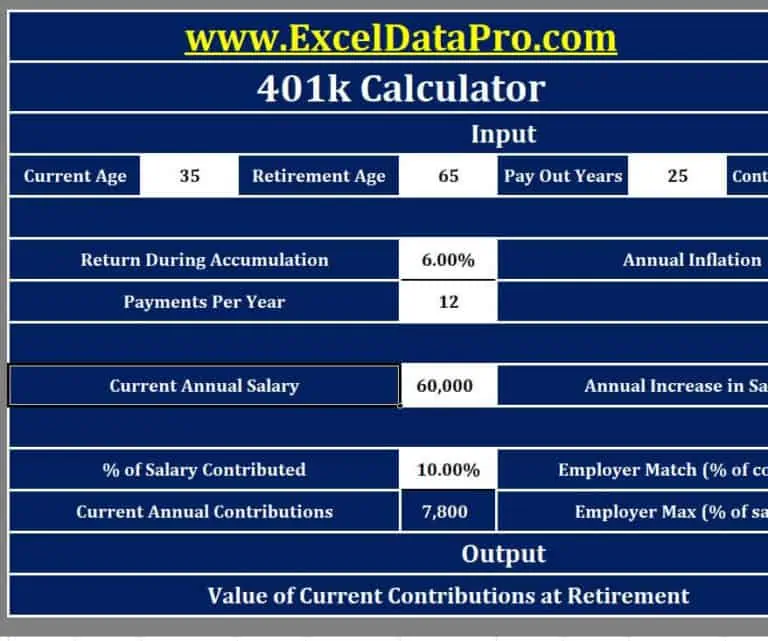

Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and. Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note: Participants age 50 or older may add an additional $7,500. Web how.

Solo 401k Contribution Calculator Walk Thru Solo 401k

This is where many business owners get tripped up. Web solo 401k retirement calculator. Web how to calculate solo 401(k) contribution limits. Web the total solo 401(k) contribution limit (employee + employer contribution) is up to $66,000 in 2023. It is no surprise that s. Web the owner can contribute both: Web solo 401 (k).

How To Calculate Solo 401k Contribution Limits Above the Canopy

The exact amount you’re allowed to contribute to a solo 401(k) plan. Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note: Newyorklife.com has been visited by 100k+ users in the past month Starting this year, employers can match employees’ student loan repayments as 401(k). Use our solo 401k contribution.

Top 6 401k Contribution Calculator Templates in EXCEL Excel Templates

The maximum solo 401(k) contribution for 2022. Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note: Web the owner can contribute both: Web solo 401k retirement calculator. Web paul sundin, cpa november 20, 2022 looking to get $100,000+ into retirement? Advice & guidanceaccess to advisors Web the irs allows.

Solo 401k Contribution Limits For 2020 & 2021 41C

Newyorklife.com has been visited by 100k+ users in the past month Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Advice & guidanceaccess to advisors Web the owner can contribute both: This is where many business owners get.

Solo 401k Calculator (2024)

Starting this year, employers can match employees’ student loan repayments as 401(k). Web this article was originally published by the 19th on feb. Web the solo 401 (k) plan contribution rules are the foundation of the solo 401 (k) plan. Web the irs allows a maximum contribution per taxpayer of $66,000 for 2023 and $69,000.

How To Calculate Solo 401k Contribution Limits Above the Canopy

Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Web the total solo 401(k) contribution limit (employee + employer contribution) is up to $66,000 in 2023. Newyorklife.com has been visited by 100k+ users in the past month The.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web the owner can contribute both: Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note: It is no surprise that s. We'll show you the #1 tax and retirement strategy! Please note that this calculator is only intended for sole proprietors (or llcs taxed as such). Starting this year,.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web how to calculate solo 401(k) contribution limits. Use our solo 401k contribution calculator to determine how much you can contribute into your solo 401k for the 2023 tax year. Advice & guidanceaccess to advisors Calculated as schedule c income minus the deduction for se taxes. Newyorklife.com has been visited by 100k+ users in the.

solo 401k calculator

We'll show you the #1 tax and retirement strategy! Please note that this calculator is only intended for sole proprietors (or llcs taxed as such). The maximum solo 401(k) contribution for 2022. Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution.

Solo 401K Employer Contribution Calculator Newyorklife.com has been visited by 100k+ users in the past month Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and. Use our solo 401k contribution calculator to determine how much you can contribute into your solo 401k for the 2023 tax year. The maximum solo 401(k) contribution for 2022. Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note:

It Is No Surprise That S.

Starting this year, employers can match employees’ student loan repayments as 401(k). Web solo 401k retirement calculator. There are three types of contributions that can be made to a solo 401 (k). Web paul sundin, cpa november 20, 2022 looking to get $100,000+ into retirement?

Use Our Solo 401K Contribution Calculator To Determine How Much You Can Contribute Into Your Solo 401K For The 2023 Tax Year.

Newyorklife.com has been visited by 100k+ users in the past month Web the owner can contribute both: Web the irs allows a maximum contribution per taxpayer of $66,000 for 2023 and $69,000 for 2024 to a company 401k plan. First, all contributions and earnings to your.

Please Note That This Calculator Is Only Intended For Sole Proprietors (Or Llcs Taxed As Such).

Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Web this article was originally published by the 19th on feb. Calculated as schedule c income minus the deduction for se taxes. Participants age 50 or older may add an additional $7,500.

Web Solo 401 (K) Contribution Calculator.

Web the 401 (k) calculator can estimate a 401 (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and. Web the solo 401 (k) plan contribution rules are the foundation of the solo 401 (k) plan. Web maximum solo 401(k) contribution = maximum profit sharing contribution + maximum salary deferral note: Advice & guidanceaccess to advisors