South Dakota Tax Calculator

South Dakota Tax Calculator - Web what is south dakota's sales tax rate? Web purchasing power is after tax wages divided by the local cost of living index. The south dakota sales tax and use tax rates are 4.2%. Use south dakota paycheck calculator to estimate net or “take home” pay for salaried employees. Enter your info to see your take home pay.

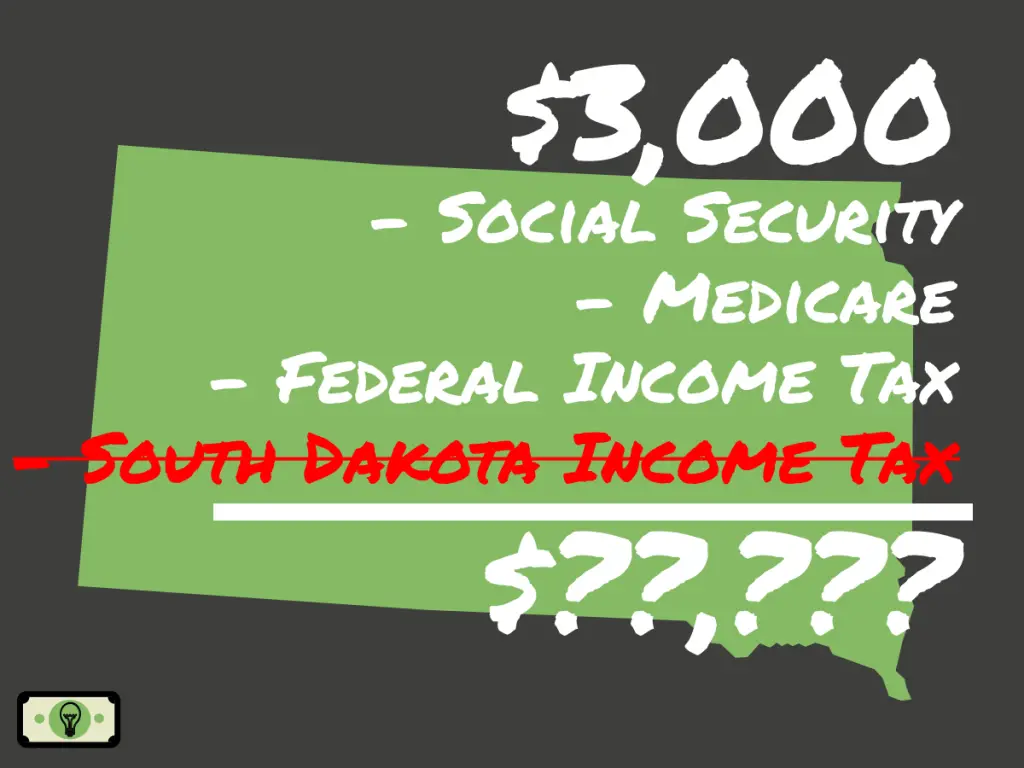

Web the state income tax rate in south dakota is 0% while federal income tax rates range from 10% to 37% depending on your income. File with confidenceexpense estimatoreasy and accurateaudit support guarantee Web smartasset's south dakota paycheck calculator shows your hourly and salary income after federal, state and local taxes. Free tool to calculate your hourly and salary income. The south dakota tax calculator. Web paying payroll taxes. Simply enter their federal and.

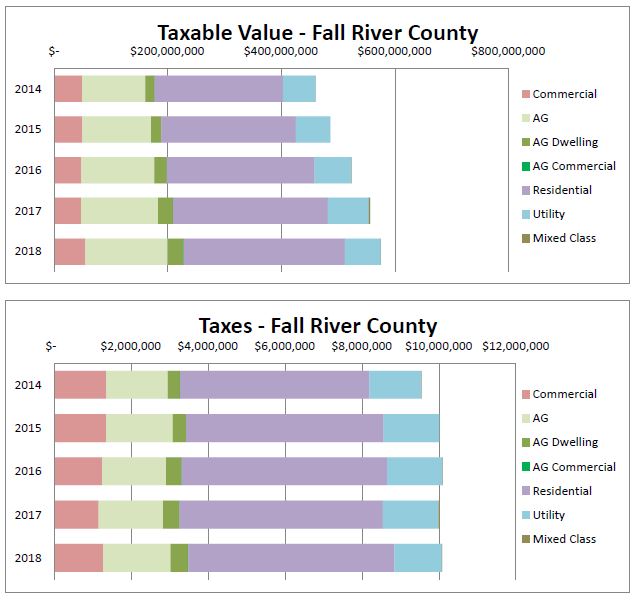

Chart 4 South Dakota Local Tax Burden by County FY 2015.JPG South

Web the calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Web the take home pay will be $47,681.50 with a total income tax of $9,318.50 for a single filer in south dakota earning $57,000 in 2023. Web smartasset's south.

South Dakota Sales Tax Calculator Step By Step Business

Web you can quickly estimate your south dakota state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web what is south dakota's sales tax rate? Enter an amount for dependents.the old w4 used to ask for the number of dependents..

South Dakota State Tax Tables 2023 US iCalculator™

Web south dakota paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web if you make $55,000 a year living in the region of south dakota, usa, you will be taxed $9,076. Web you can quickly estimate your south dakota state tax and.

South Dakota Tax Brackets 2020

Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Web south dakota salary tax calculator for the tax year 2023/24. That means that your net pay will be $45,925 per year, or $3,827 per month. Here’s how to calculate it: Web all of the tax.

south dakota sales tax calculator Heavyweight Profile Photos

Here’s how to calculate it: What rates may municipalities impose? Web south dakota paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Compare your rate to the south dakota and u.s. Updated on dec 05 2023. Web you can quickly estimate your south.

Does South Dakota Have Tax

You are able to use our south dakota state tax calculator to calculate your total tax costs in the tax year. Enter your info to see your take home pay. Using a payroll tax service. Web paying payroll taxes. Enter your estimated annual gross wages, choose a location, and click. Web the calculator will show.

3,000 Dollars a Year After Taxes in South Dakota (single) [2023

Enter an amount for dependents.the old w4 used to ask for the number of dependents. That means that your net pay will be $45,925 per year, or $3,827 per month. Web the calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected.

South Dakota Sales Tax Guide for Businesses

The south dakota tax calculator. Web the salary tax calculator for south dakota income tax calculations. File with confidenceexpense estimatoreasy and accurateaudit support guarantee Web south dakota salary tax calculator for the tax year 2023/24. The federal federal allowance for over 65 years of age married (joint) filer in 2023 is $ 1,550.00. Enter your.

Breakdown of Taxes 2018 Fall River County, South Dakota

Web south dakota paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Use south dakota paycheck calculator to estimate net or “take home” pay for salaried employees. Free tool to calculate your hourly and salary income. Updated for 2024 with income tax and.

South Dakota Sales Tax Calculator Online Calculator.guide

Enter your estimated annual gross wages, choose a location, and click. Updated on dec 05 2023. Web if you make $55,000 a year living in the region of south dakota, usa, you will be taxed $9,076. The federal federal allowance for over 65 years of age married (joint) filer in 2023 is $ 1,550.00. Updated.

South Dakota Tax Calculator Compare your rate to the south dakota and u.s. Updated for 2024 with income tax and social security deductables. Web what is south dakota's sales tax rate? Using a payroll tax service. What rates may municipalities impose?

The Federal Federal Allowance For Over 65 Years Of Age Married (Joint) Filer In 2023 Is $ 1,550.00.

Simply enter their federal and. Web what is south dakota's sales tax rate? Web if you make $55,000 a year living in the region of south dakota, usa, you will be taxed $9,076. South dakota salary and tax.

Enter Your Estimated Annual Gross Wages, Choose A Location, And Click.

File with confidenceexpense estimatoreasy and accurateaudit support guarantee Here’s how to calculate it: Web the state income tax rate in south dakota is 0% while federal income tax rates range from 10% to 37% depending on your income. Enter your info to see your take home pay.

What Rates May Municipalities Impose?

Web use our easy payroll tax calculator to quickly run payroll in south dakota, or look up 2024 state tax rates. You are able to use our south dakota state tax calculator to calculate your total tax costs in the tax year. Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web paying payroll taxes.

Web The Federal Standard Deduction For A Married (Joint) Filer In 2023 Is $ 27,700.00.

Updated for 2024 with income tax and social security deductables. Web south dakota paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Updated on dec 05 2023. The new w4 asks for a dollar amount.