State Of Maine Tax Calculator

State Of Maine Tax Calculator - Web this maine bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If your gross pay is $71,139.00 per year in the state of maine, your net pay (or take home pay) will be $52,709 after tax deductions of 25.91%. Maine tax portal file upload specifications & instructions; Web maine salary tax calculator for the tax year 2023/24. Web the maine income taxes calculator lets you calculate your state taxes for the tax year.

Web welcome to maine electronic filing; Web you can use our maine sales tax calculator to look up sales tax rates in maine by address / zip code. Web maine income tax calculator estimate your maine income tax burden updated for 2023 tax year on dec 8, 2023 what was updated? Use our paycheck tax calculator. Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Web use the maine paycheck calculator to see your take home pay after taxes are withheld. Outgrow.us has been visited by 10k+ users in the past month

2021 Form ME 1040ME Booklet Fill Online, Printable, Fillable, Blank

Web you can use our maine sales tax calculator to look up sales tax rates in maine by address / zip code. Intuit.com has been visited by 1m+ users in the past month Web what is the income tax rate in maine? Now that we’re done with federal taxes, let’s look at maine’s state income.

Maine Tax Calculator 2023 2024

Use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web you can use our maine sales tax calculator to look up sales tax rates in maine by address / zip code. Just enter the wages, tax. Number of children [for eitc] advanced maine salary calculator 2024..

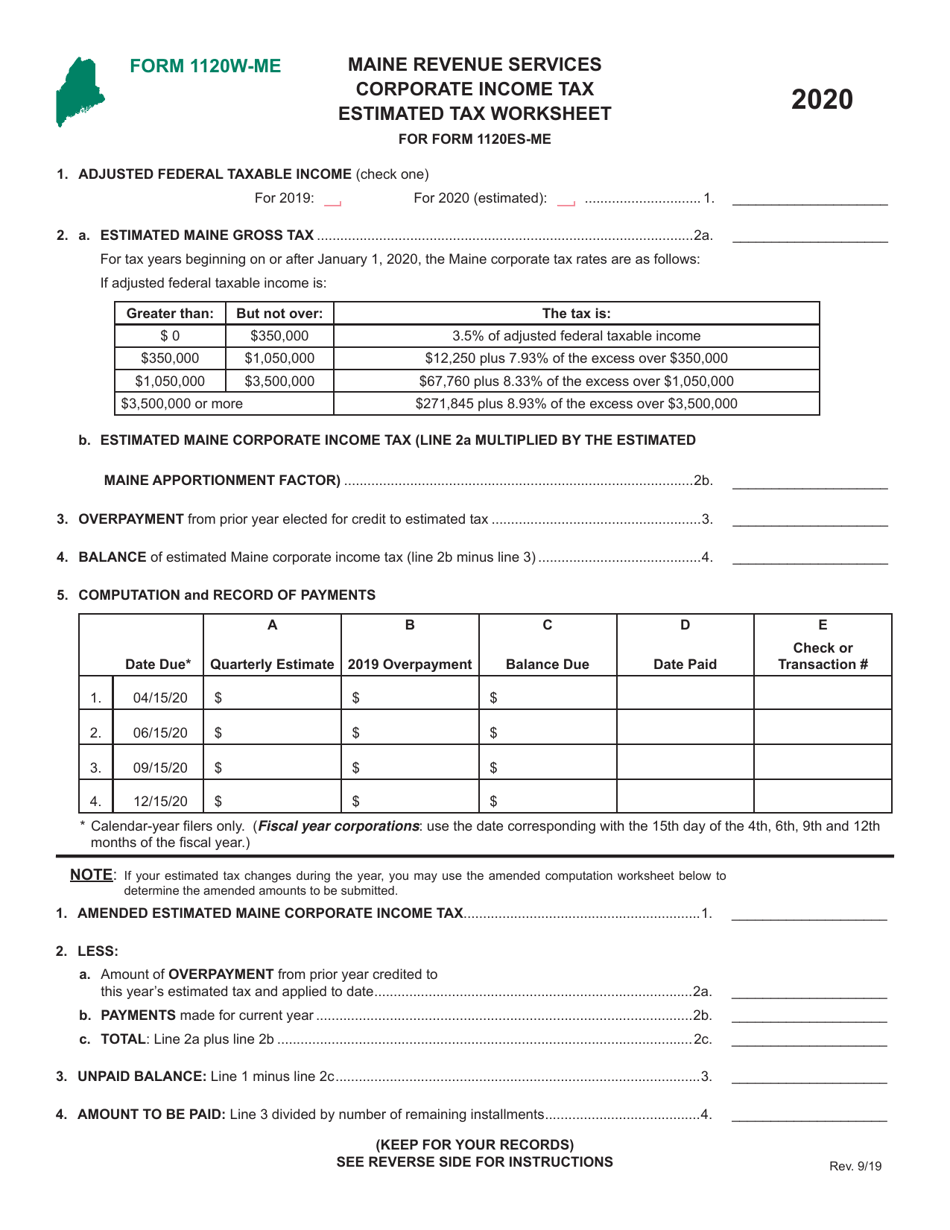

Form 1120WME Download Printable PDF or Fill Online Corporate

Web the maine state tax calculator (mes tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. The calculator will show you the total sales tax amount, as well as. Use our paycheck tax calculator. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary.

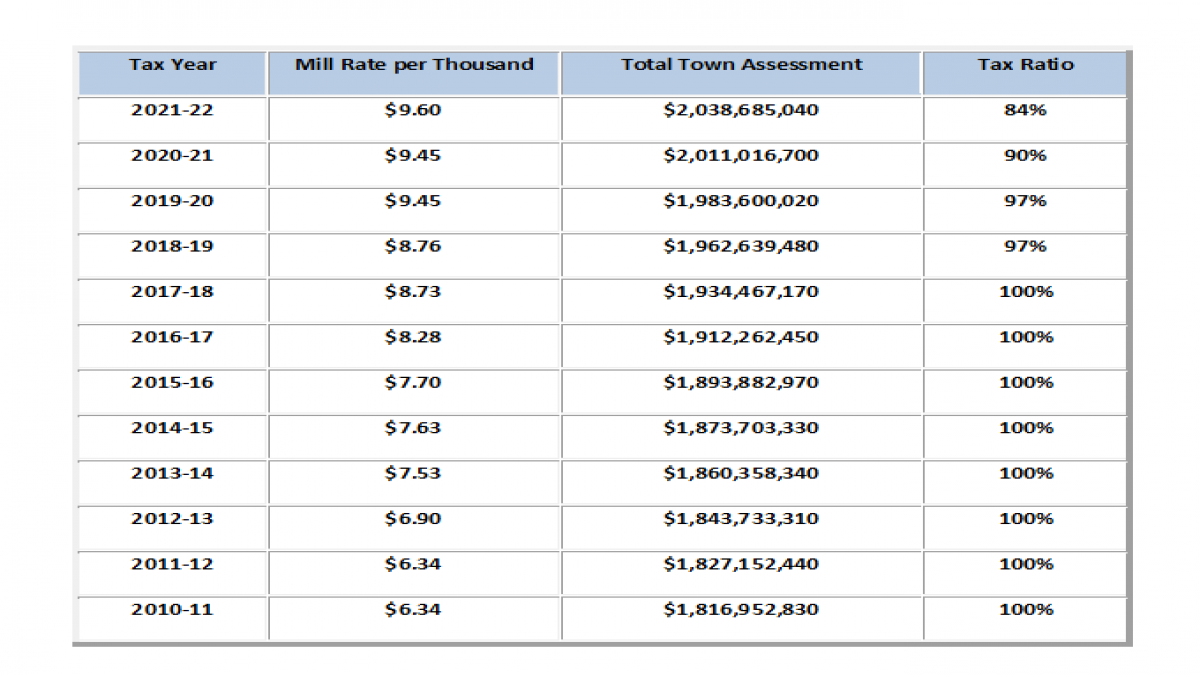

Chart 4 Maine Local Tax Burden by County FY 2015.JPG Maine, Burden, Tax

Web you can use our maine sales tax calculator to look up sales tax rates in maine by address / zip code. If your gross pay is $71,139.00 per year in the state of maine, your net pay (or take home pay) will be $52,709 after tax deductions of 25.91%. Web view all tax calculators.

Maine Tax ME State Tax Calculator Community Tax

Web maine income tax calculator estimate your maine income tax burden updated for 2023 tax year on dec 8, 2023 what was updated? Maine tax portal file upload specifications & instructions; Outgrow.us has been visited by 10k+ users in the past month Web the irs has adjusted its tax brackets for inflation for both 2023.

Maine Tax ME State Tax Calculator Community Tax

The federal or irs taxes are listed. Web this maine bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If your gross pay is $71,139.00 per year in the state of maine, your net pay (or take home pay) will be $52,709 after tax deductions of 25.91%..

2020 Tax Brackets State Of Maine DTAXC

Outgrow.us has been visited by 10k+ users in the past month Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes.

Maine tax Fill out & sign online DocHub

Web maine income tax calculator estimate your maine income tax burden updated for 2023 tax year on dec 8, 2023 what was updated? Now that we’re done with federal taxes, let’s look at maine’s state income taxes. Web the maine state tax calculator (mes tax calculator) uses the latest federal tax tables and state tax.

Maine State Tax Tables 2023 US iCalculator™

Use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web maine salary tax calculator for the tax year 2023/24. Maine charges a progressive.

maine transfer tax calculator Laure Greathouse

If your gross pay is $71,139.00 per year in the state of maine, your net pay (or take home pay) will be $52,709 after tax deductions of 25.91%. Web maine salary tax calculator for the tax year 2023/24. To effectively use the maine paycheck. Web enter your gross salary, pay frequency, and other relevant details.

State Of Maine Tax Calculator You are able to use our maine state tax calculator to calculate your total tax costs in the tax year 2023/24. Web view all tax calculators and tools in the or use the maine tax calculator for 2024 (2025 tax return). Web maine state payroll taxes for 2024. Use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web maine income tax calculator estimate your maine income tax burden updated for 2023 tax year on dec 8, 2023 what was updated?

To Effectively Use The Maine Paycheck.

Maine charges a progressive income tax,. What states have local income taxes? Web enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. If your gross pay is $71,139.00 per year in the state of maine, your net pay (or take home pay) will be $52,709 after tax deductions of 25.91%.

Customize Using Your Filing Status, Deductions,.

Web maine paycheck tax calculator. Web the minimum rate for the federal government is 0% tax under about $40,000, and the maximum rate is 23% for amounts above around $440,000. Web welcome to maine electronic filing; Web what is the income tax rate in maine?

Web The Maine State Tax Calculator (Mes Tax Calculator) Uses The Latest Federal Tax Tables And State Tax Tables For 2024/25.

Use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. You are able to use our maine state tax calculator to calculate your total tax costs in the tax year 2023/24. Now that we’re done with federal taxes, let’s look at maine’s state income taxes. Just enter the wages, tax.

Web Maine Salary Tax Calculator For The Tax Year 2023/24.

Use our paycheck tax calculator. Web if you make $55,000 a year living in the region of maine, usa, you will be taxed $11,888. Web use the maine paycheck calculator to see your take home pay after taxes are withheld. The state income tax rate in maine is progressive and ranges from 5.8% to 7.15% while federal income tax rates range from 10% to 37%.