Stock Volatility Calculator

Stock Volatility Calculator - State the expected volatility of the stock, i.e., 20%. Is the return of a given stock over the period. You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. Input the expected dividend yield as 1%. Mobile users may need to scroll horizontally to see the full volatility.

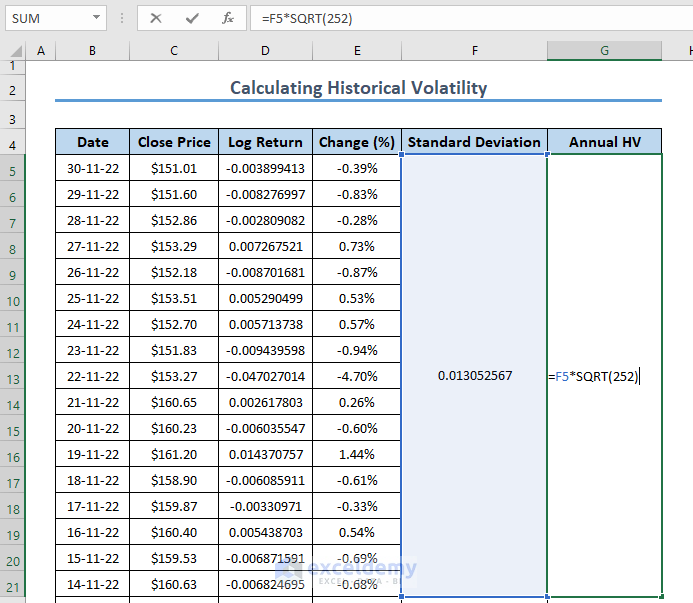

Excel function to calculate volatility is stdev. State the expected volatility of the stock, i.e., 20%. Web the formula for square root in excel is =sqrt (). You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. Click on the calculate button to generate the results. It also calculates the return on investment for stocks and. In our example, 1.73% times the square root of 252 is 27.4%.

Stock Volatility Calculator Download Spreadsheet that extracts free

Mobile users may need to scroll horizontally to see the full volatility. It also calculates the return on investment for stocks and. Volatilitycalc has been added to the online suite of calculators at fincalcs.net. Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels. Web volatility is derived.

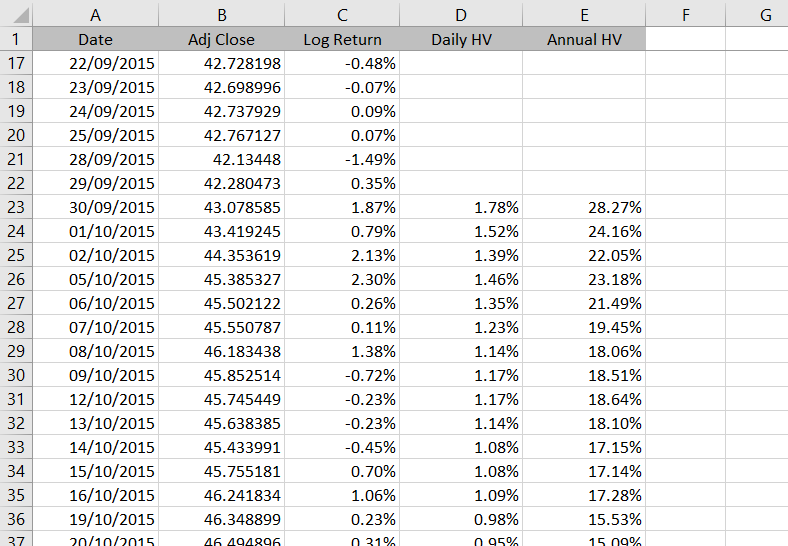

Calculating Volatility A Simplified Approach

Is the return of a given stock over the period. It is usually measured by calculating the standard deviation of the daily price changes over. Excel function to calculate volatility is stdev. Web stock volatility is a measure of how much the price of a stock fluctuates. Web this volatility calculator uses volatility to create.

Volatility Formula Calculator (Examples With Excel Template)

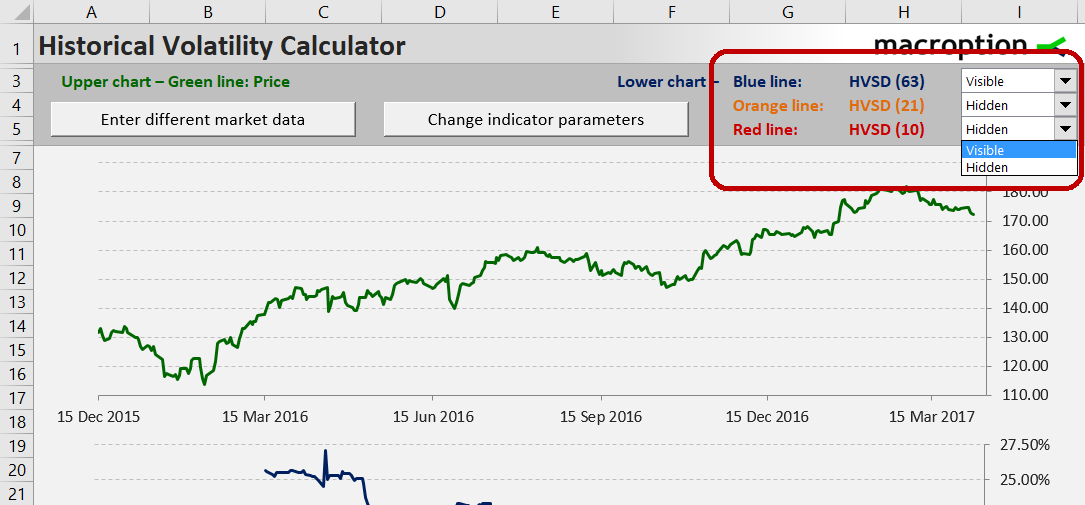

It also calculates the return on investment for stocks and. Input the expected dividend yield as 1%. Web the historic volatility calculator will calculate and graph historic volatility using historical price data retrieved from yahoo finance, quandl or from a csv text file. In our example, 1.73% times the square root of 252 is 27.4%..

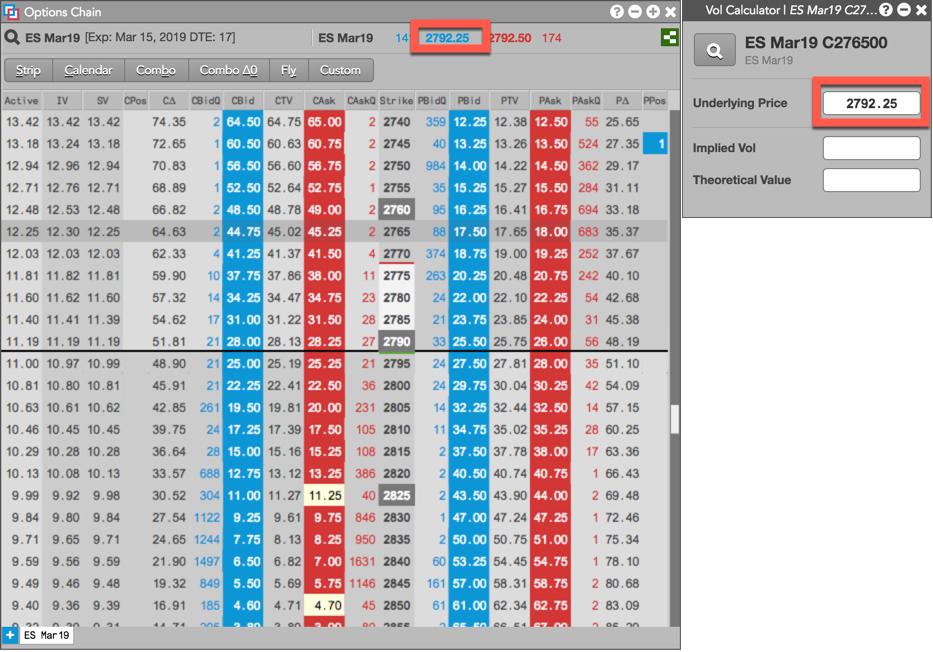

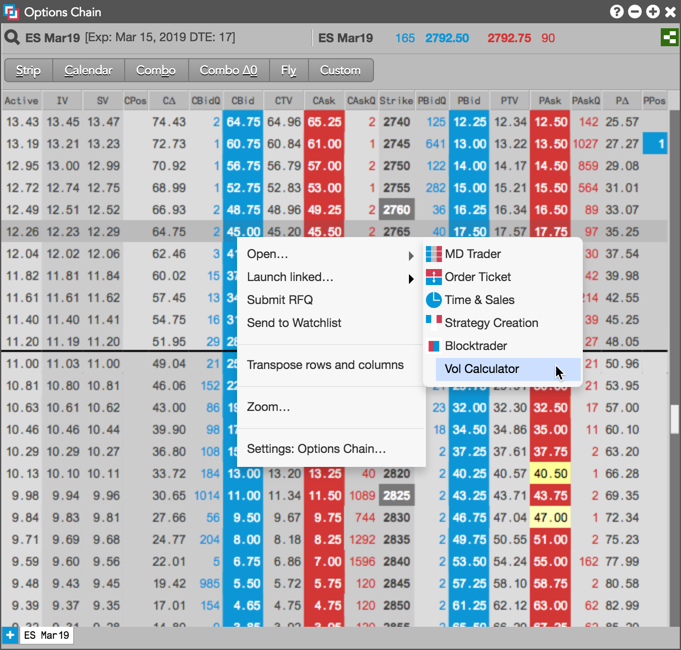

Using the Volatility Calculator Volatility Calculator Help and Tutorials

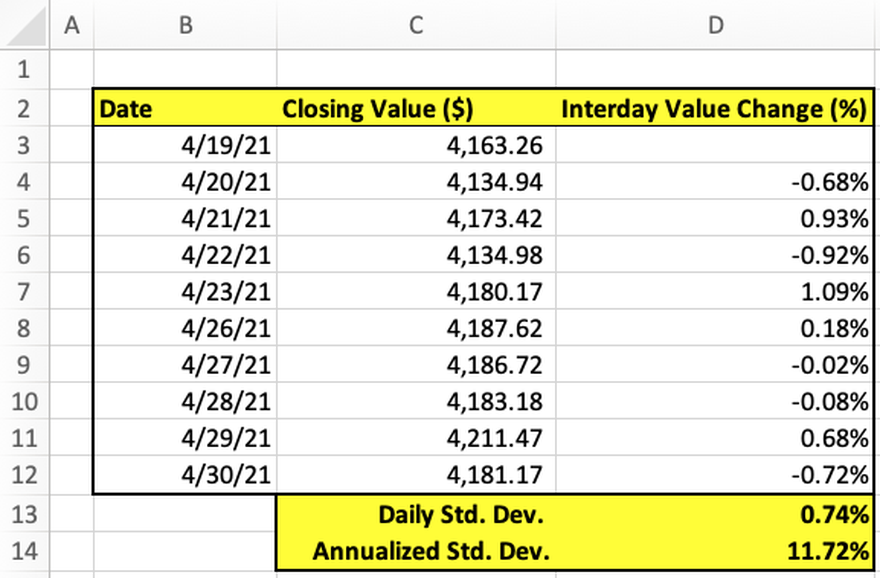

Web the formula for square root in excel is =sqrt (). Web if this standard holds true, then approximately 68% of the expected outcomes should lie between ±1 standard deviations from the investment's expected return, 95%. State the expected volatility of the stock, i.e., 20%. Volatilitycalc has been added to the online suite of calculators.

Using the Volatility Calculator Volatility Calculator Help and Tutorials

Web learn how to measure the historical volatility of a stock using microsoft excel, a tool that calculates the dispersion of returns over a given period of time. Click on the calculate button to generate the results. Excel function to calculate volatility is stdev. Therefore, based on the daily price movements in. Veterans resourcesinvestment tools.

Historical Volatility Calculator Macroption

State the expected volatility of the stock, i.e., 20%. Web the formula for square root in excel is =sqrt (). In our example, 1.73% times the square root of 252 is 27.4%. Click on the calculate button to generate the results. Therefore, based on the daily price movements in. Web if this standard holds true,.

How to Calculate Historical Volatility in Excel (with Easy Steps)

Veterans resourcesinvestment tools & tipspersonal finance & taxesfinance calculators You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels. Therefore, based on the daily price movements in. Is the return.

How To Calculate Annualized Return From Monthly Returns In Excel

Is the return of a given stock over the period. Web the formula for square root in excel is =sqrt (). It also calculates the return on investment for stocks and. Mobile users may need to scroll horizontally to see the full volatility. In our example, 1.73% times the square root of 252 is 27.4%..

How to Calculate Volatility of a Stock or Index in Excel The Motley Fool

Volatilitycalc has been added to the online suite of calculators at fincalcs.net. Excel function to calculate volatility is stdev. Click on the calculate button to generate the results. Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels. Web if this standard holds true, then approximately 68% of.

How to Calculate Historical Stock Volatility 12 Steps

Excel function to calculate volatility is stdev. Veterans resourcesinvestment tools & tipspersonal finance & taxesfinance calculators Web the formula for square root in excel is =sqrt (). Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels. Mobile users may need to scroll horizontally to see the full.

Stock Volatility Calculator In our example, 1.73% times the square root of 252 is 27.4%. Web this free investment calculator will calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments. Therefore, based on the daily price movements in. Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels. Web the formula for square root in excel is =sqrt ().

Volatilitycalc Has Been Added To The Online Suite Of Calculators At Fincalcs.net.

Veterans resourcesinvestment tools & tipspersonal finance & taxesfinance calculators Is the return of a given stock over the period. It also calculates the return on investment for stocks and. Web volatility is derived from the variance of price movements on an annualized basis.

State The Expected Volatility Of The Stock, I.e., 20%.

Web the formula for square root in excel is =sqrt (). Therefore, based on the daily price movements in. It is usually measured by calculating the standard deviation of the daily price changes over. Web this volatility calculator uses volatility to create a intraday trading system and generate buy sell levels.

In Our Example, 1.73% Times The Square Root Of 252 Is 27.4%.

Excel function to calculate volatility is stdev. Web stock volatility is a measure of how much the price of a stock fluctuates. Mobile users may need to scroll horizontally to see the full volatility. Web learn how to measure the historical volatility of a stock using microsoft excel, a tool that calculates the dispersion of returns over a given period of time.

Web This Free Investment Calculator Will Calculate How Much Your Money May Grow And Return Over Time When Invested In Stocks, Mutual Funds Or Other Investments.

You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. Web if this standard holds true, then approximately 68% of the expected outcomes should lie between ±1 standard deviations from the investment's expected return, 95%. Click on the calculate button to generate the results. Web the historic volatility calculator will calculate and graph historic volatility using historical price data retrieved from yahoo finance, quandl or from a csv text file.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_volatility_A_simplified_approach_Nov_2020-01-32559f8dcf3d45f0b86721bf6ac80a05.jpg)