Tax Calculator S Corp

Tax Calculator S Corp - Free estimate of your tax savings becoming an s corporation. And even if you get an. Paying as an s corp if you are taxed as an s corporation, you can choose to take money out of the business in two. Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Business formations > s corporations > s corporation cost calculate your s corporation tax savings.

Web s corp tax calculator. Enter your estimated annual business net income and the. $27,700 for married couples filing jointly or qualifying surviving spouse. Simulating the economic effects of romney’s tax plan. This is the total of state, county and city sales tax. And even if you get an. Web when you operate an s corp, the more money you pay yourself as a distribution, the more social security and medicare tax you will save.

s corp tax calculator Fill Online, Printable, Fillable Blank form

Free estimate of your tax savings becoming an s corporation. And even if you get an. The se tax rate for business. Web as a salary you will pay employment tax on this as normal. Including how to check your records, rates and reliefs, refunds and pensions. Web what is the sales tax rate in.

S Corp Tax Savings Calculator

Including how to check your records, rates and reliefs, refunds and pensions. Web s corp tax calculator. Guidance and forms for income tax. Expense estimatorfile with confidenceeasy and accurateaudit support guarantee Web when you operate an s corp, the more money you pay yourself as a distribution, the more social security and medicare tax you.

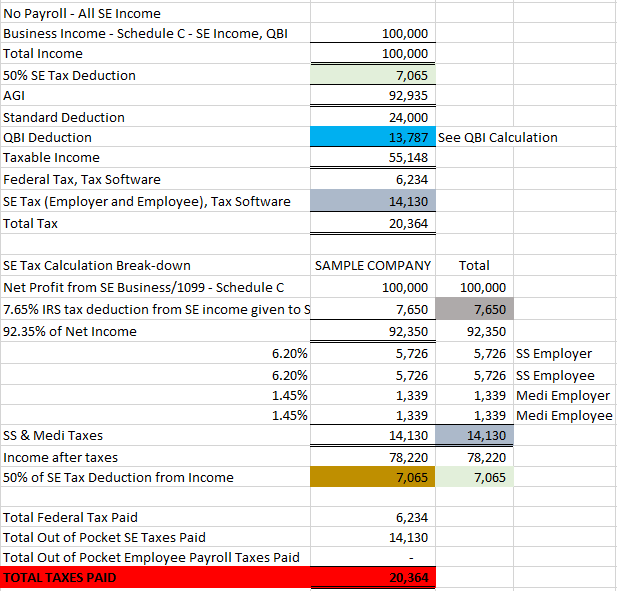

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Income tax return for an s corporation. Web s corp tax calculator. And even if you get an. Before using the s corp tax calculator, you will. The model and tax calculator. From the authors of limited liability companies for dummies. S corporation tax calculator can help you determine your tax obligations based on the.

s corp tax calculator excel Have High Binnacle Slideshow

Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Web the ey 2024 personal tax calculator shows a dramatic difference in tax rates between provinces. Web what is the sales tax rate in romney, west virginia? Income tax return for an s corporation. Use.

How to Convert to an SCorp 4 Easy Steps Taxhub

S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web our s corp tax rate guide explains how s corp taxes work and how to determine if an s corp is right for your business. Use a holding company—transfer your company’s “safe income”.

Tax CPA Tips S Corp v C Corp Which is Best?

Both c and s corps follow the same guidelines for filing taxes with no. Free estimate of your tax savings becoming an s corporation. Guidance and forms for income tax. The minimum combined 2024 sales tax rate for romney, west virginia is. Web we then analyze the president’s corporate tax proposals as outlined in the.

What Is An S Corp?

Including how to check your records, rates and reliefs, refunds and pensions. Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Web when you operate an s corp, the more money you pay yourself as a distribution, the more social security and medicare tax.

SCorp Eligibility Qualifications & Guidelines for 2023

Web our s corp tax calculator will estimate whether electing an s corp will result in a tax win for your business. Those alberta marginal tax rates cited above compared with 43.5. $27,700 for married couples filing jointly or qualifying surviving spouse. Guidance and forms for income tax. Web our s corp tax rate guide.

S corp payroll tax calculator RazeenaEivie

The minimum combined 2024 sales tax rate for romney, west virginia is. Web s corp tax calculator. This is the total of state, county and city sales tax. Paying as an s corp if you are taxed as an s corporation, you can choose to take money out of the business in two. The model.

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN SCORP Houston TX

Including how to check your records, rates and reliefs, refunds and pensions. Before using the s corp tax calculator, you will. Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Web what is the sales tax rate in romney, west virginia? Use a holding.

Tax Calculator S Corp $13,850 for single or married filing separately. This calculator helps you estimate your potential savings. Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform. Web the ey 2024 personal tax calculator shows a dramatic difference in tax rates between provinces. Web when you operate an s corp, the more money you pay yourself as a distribution, the more social security and medicare tax you will save.

Expense Estimatorfile With Confidenceeasy And Accurateaudit Support Guarantee

Web what is the sales tax rate in romney, west virginia? Simulating the economic effects of romney’s tax plan. The se tax rate for business. Business formations > s corporations > s corporation cost calculate your s corporation tax savings.

Web The Ey 2024 Personal Tax Calculator Shows A Dramatic Difference In Tax Rates Between Provinces.

Before using the s corp tax calculator, you will. Those alberta marginal tax rates cited above compared with 43.5. Paying as an s corp if you are taxed as an s corporation, you can choose to take money out of the business in two. Web we then analyze the president’s corporate tax proposals as outlined in the white house’s framework for business tax reform.

Web S Corporations Are Corporations That Elect To Pass Corporate Income, Losses, Deductions, And Credits Through To Their Shareholders For Federal Tax Purposes.

Both c and s corps follow the same guidelines for filing taxes with no. The model and tax calculator. $13,850 for single or married filing separately. Enter your tax profile to get your full tax report.

Web S Corp Tax Calculator.

From the authors of limited liability companies for dummies. And even if you get an. Income tax return for an s corporation. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)