Taxable Brokerage Account Calculator

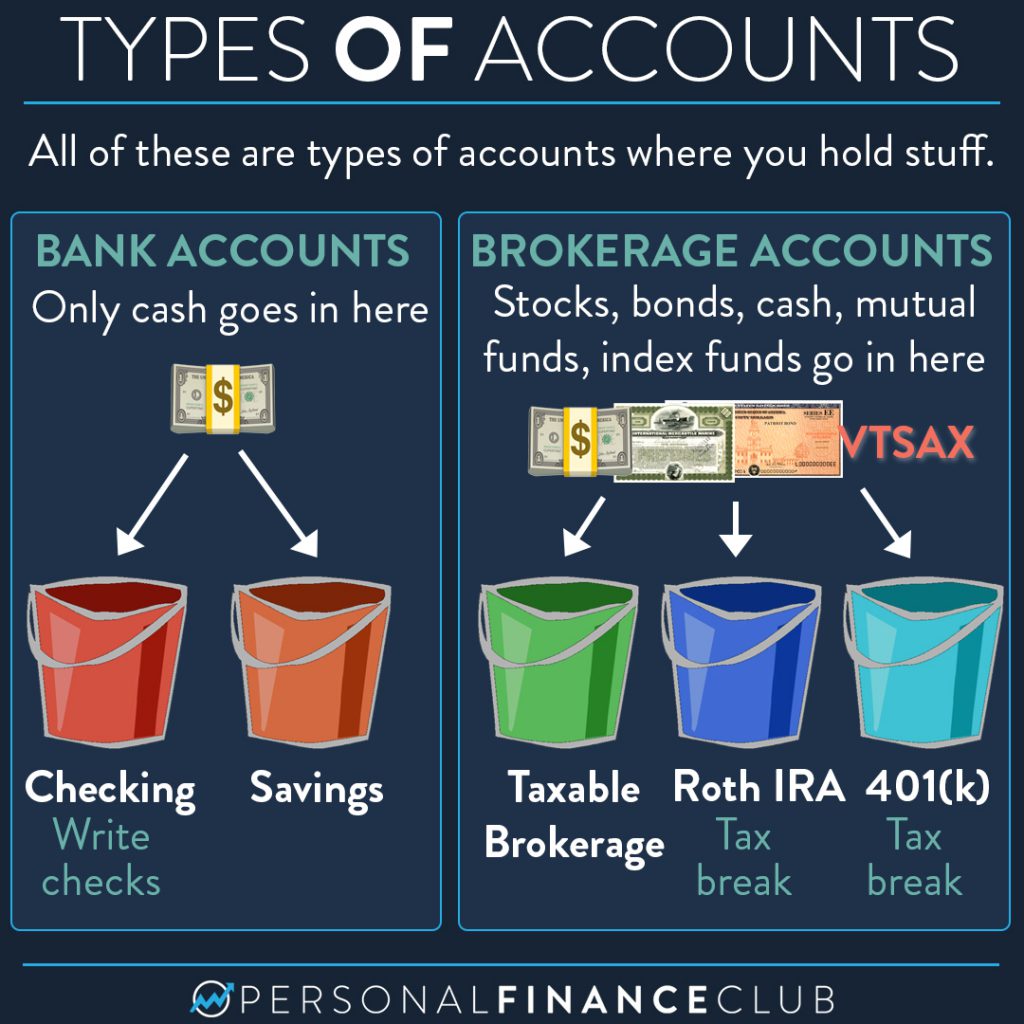

Taxable Brokerage Account Calculator - See how a roth ira conversion, qualified charitable distributions (qcds),. Retirement accounts, like iras and 401(k)s, are a type of brokerage. Standard taxable investment accounts don't have contribution. Web calculate your investment earnings are you on track to reach your investment goal? Web brokerage accounts that don't get special tax breaks (like iras or other retirement investment accounts) are called taxable brokerage accounts.

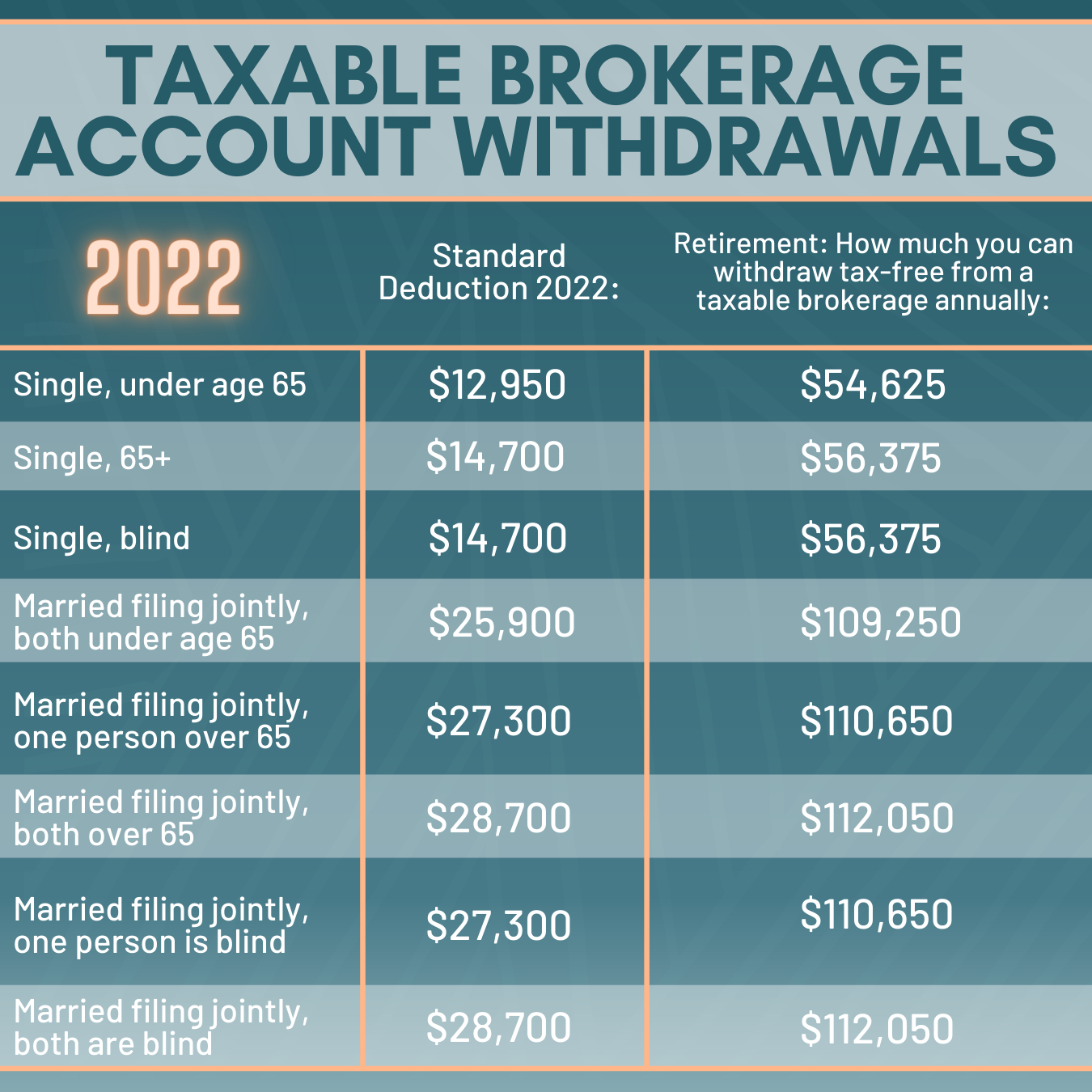

Web once you hit the contribution limit, you could begin investing in a taxable brokerage account. Web use this investment calculator to estimate how much your investment could grow over time. Web each time you sell an investment in your taxable brokerage account, there's the potential to create income from a capital gain. Examples of taxable investment account. Web a brokerage account is a taxable investment account used for buying and selling securities. Web calculate your investment earnings are you on track to reach your investment goal? $27,700 for married couples filing jointly or qualifying surviving spouse.

Why You Shouldn’t Underfund Your Brokerage Account — Female in Finance

Web taxable accounts can offer more flexibility than 401(k)s and iras do, and they come with their own set of tax advantages. Web use this investment calculator to estimate how much your investment could grow over time. How to use nerdwallet's investment calculator enter an initial investment. $27,700 for married couples filing jointly or qualifying.

Brokerage Account là gì? Bạn cần biết gì về Brokerage Account

Web calculate your investment earnings are you on track to reach your investment goal? Say, for example, you buy. $27,700 for married couples filing jointly or qualifying surviving spouse. Web a brokerage account is a taxable investment account used for buying and selling securities. Easy and accurateexpense estimatoraudit support guarantee Web brokerage accounts can be.

Integrated Enterprises Brokerage Calculator Calculate Brokerage Now

Web whether or not a brokerage account is taxable depends on the type of account. How to use nerdwallet's investment calculator enter an initial investment. Web the standard deduction for 2023 is: Standard taxable investment accounts don't have contribution. Web once you hit the contribution limit, you could begin investing in a taxable brokerage account..

Taxable vs TaxDeferred Calculator — VisualCalc

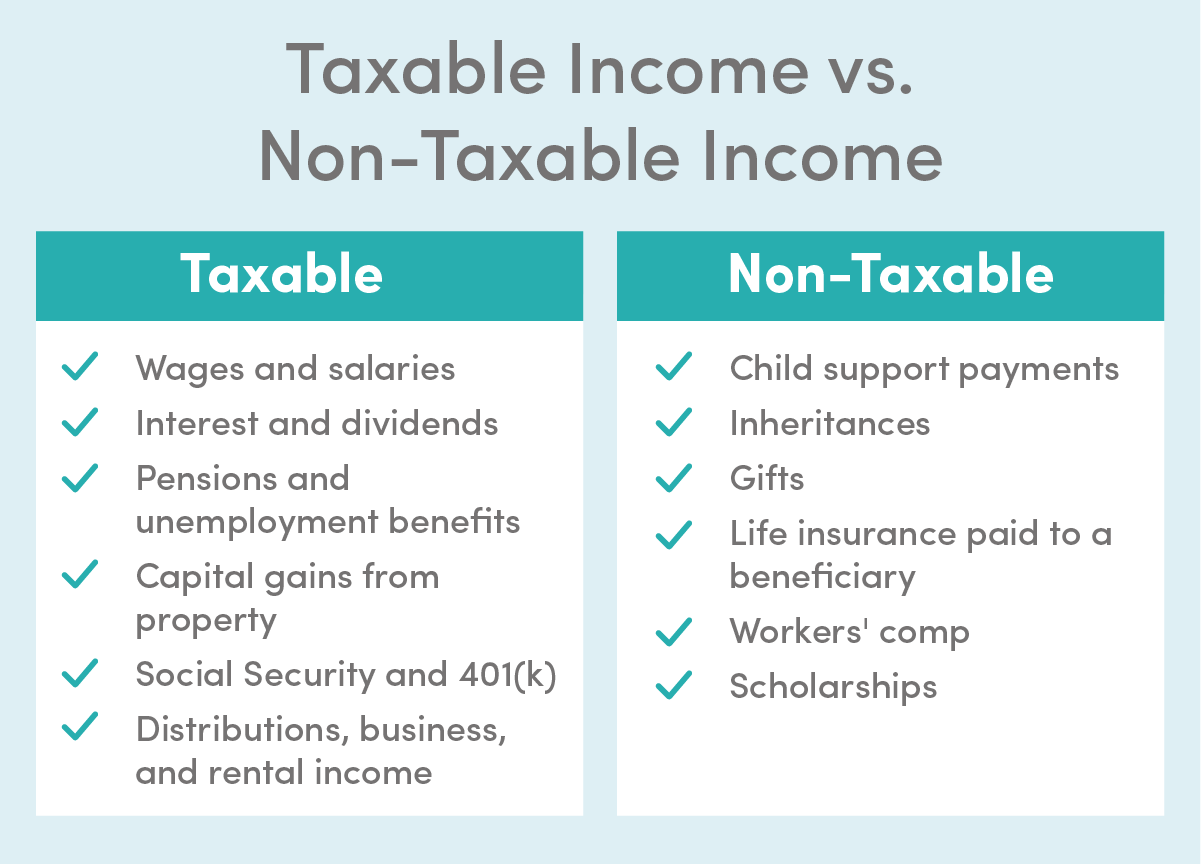

Web when you have a taxable brokerage account, you will have to pay taxes if you make a profit on your investments when you sell them. Say, for example, you buy. How to use nerdwallet's investment calculator enter an initial investment. Web whether you're paying ordinary income tax or capital gains tax, you'll owe those.

Brokerage account calculator LeilaEwelina

The tax lot optimizer uses an. Find out using bankrate's investment calculator below. Retirement accounts, like iras and 401(k)s, are a type of brokerage. An investment where taxes are deferred until withdrawals. Web brokerage accounts can be taxed depending on the type of account. Before you open one of these accounts, here are a few.

10 Incredible Benefits of a Taxable Brokerage Account! YouTube

Web once you hit the contribution limit, you could begin investing in a taxable brokerage account. An investment where taxes are deferred until withdrawals. Web a brokerage account is a taxable investment account used for buying and selling securities. Web in just one screen, this capital gains tax calculator answers burning questions about your stock.

Taxable Formula financepal

How to use nerdwallet's investment calculator enter an initial investment. Before you open one of these accounts, here are a few things to. Categories of taxable investment account calculations. See how a roth ira conversion, qualified charitable distributions (qcds),. Web in just one screen, this capital gains tax calculator answers burning questions about your stock.

IDBI Direct Brokerage Calculator Calculate Net Profit or Loss2021

Before you open one of these accounts, here are a few things to. Web the standard deduction for 2023 is: Standard taxable investment accounts don't have contribution. Web whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take.

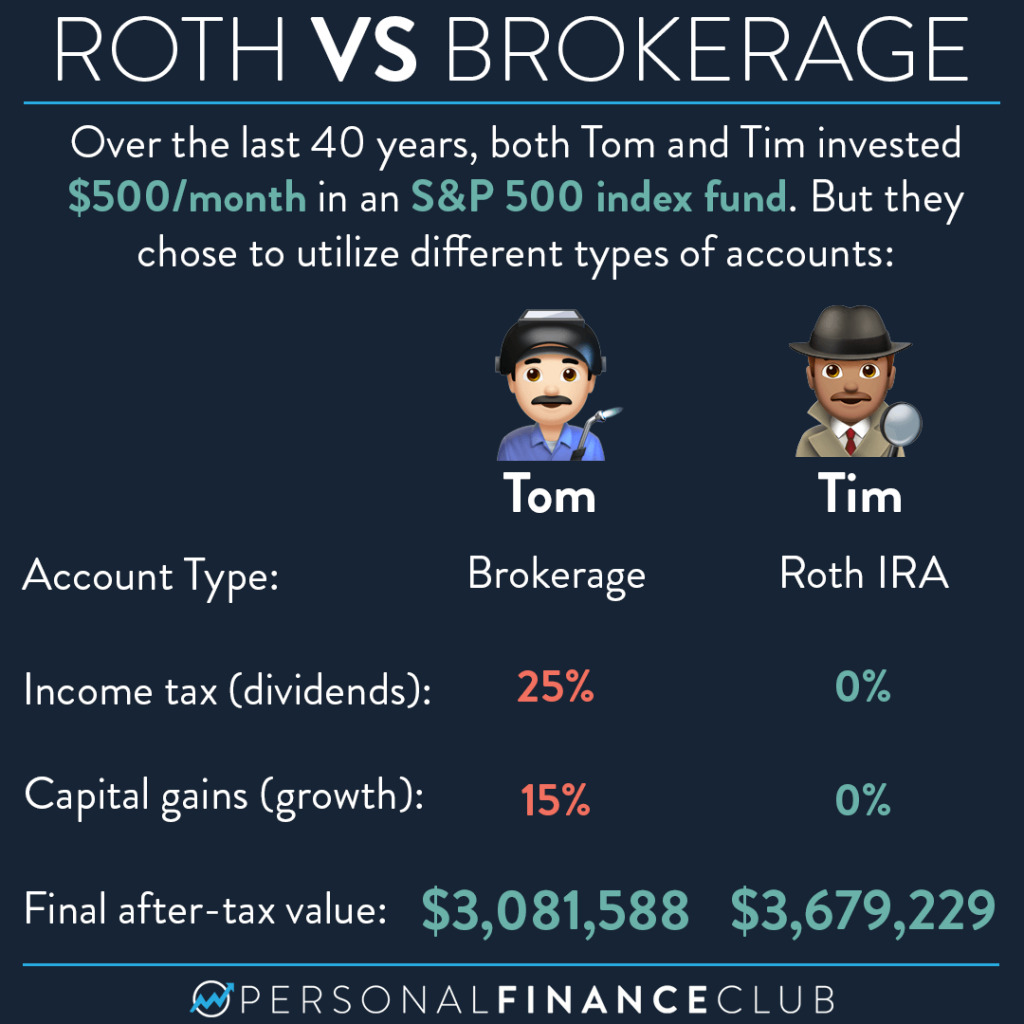

Roth IRA vs brokerage account how much of a difference do taxes make

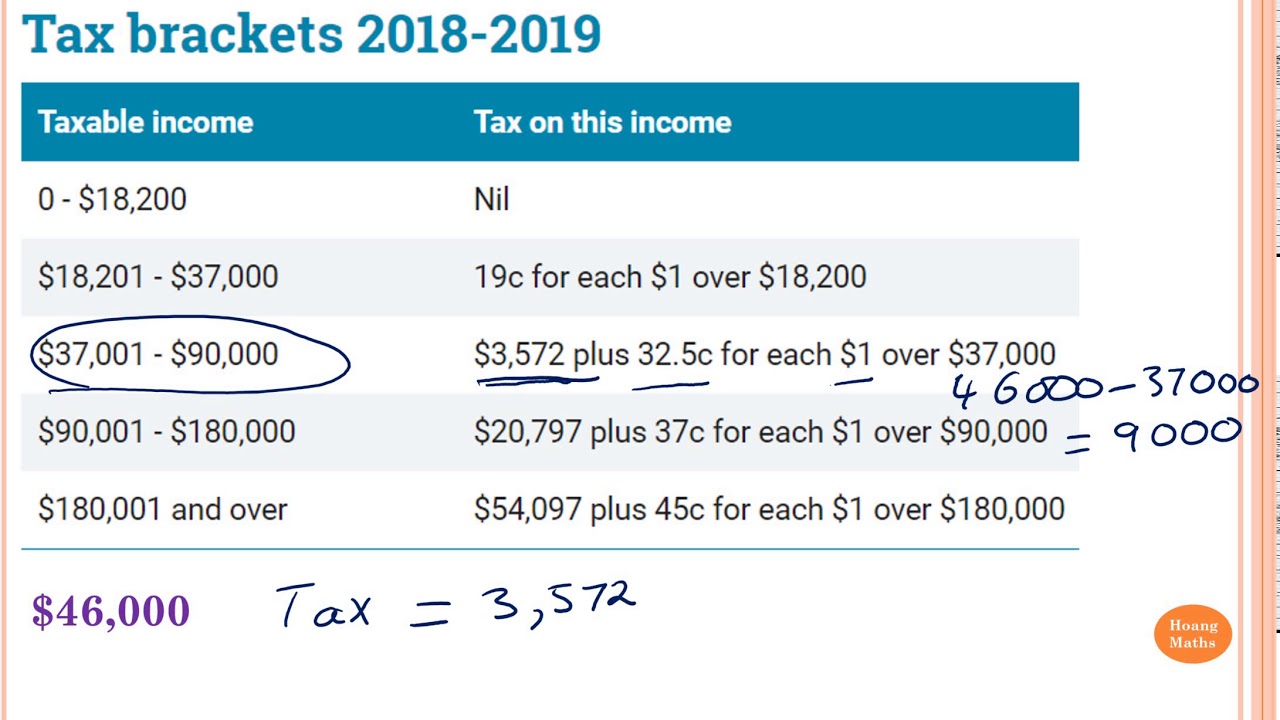

Find the pros and cons and learn how different types of investment returns are taxed to maximize savings this year. Web in just one screen, this capital gains tax calculator answers burning questions about your stock sales and gives you an estimate of how much your stock sales will be taxed. Examples of taxable investment.

Tax on taxable calculator RebeccaLochie

Web taxable accounts offer a more comprehensive investment menu than 401 (k)s and some iras. Categories of taxable investment account calculations. The tax lot optimizer uses an. $13,850 for single or married filing separately. Web in just one screen, this capital gains tax calculator answers burning questions about your stock sales and gives you an.

Taxable Brokerage Account Calculator Web each time you sell an investment in your taxable brokerage account, there's the potential to create income from a capital gain. Web the internal revenue service taxes capital gains from a brokerage account at one of two possible rates depending on how long an investor held an asset. Say, for example, you buy. Web the standard deduction for 2023 is: Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you.

401 (K) Accounts Offer Significant Tax Advantages At The Cost Of.

Web the internal revenue service taxes capital gains from a brokerage account at one of two possible rates depending on how long an investor held an asset. Web taxable accounts offer a more comprehensive investment menu than 401 (k)s and some iras. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Web calculate your investment earnings are you on track to reach your investment goal?

Web Taxable Accounts Can Offer More Flexibility Than 401(K)S And Iras Do, And They Come With Their Own Set Of Tax Advantages.

Web when you have a taxable brokerage account, you will have to pay taxes if you make a profit on your investments when you sell them. Categories of taxable investment account calculations. Web brokerage accounts that don't get special tax breaks (like iras or other retirement investment accounts) are called taxable brokerage accounts. Find the pros and cons and learn how different types of investment returns are taxed to maximize savings this year.

Retirement Accounts, Like Iras And 401(K)S, Are A Type Of Brokerage.

Find out using bankrate's investment calculator below. There are three main types of brokerage accounts: Web use this investment calculator to estimate how much your investment could grow over time. Web do you need taxable brokerage accounts?

Before You Open One Of These Accounts, Here Are A Few Things To.

Web brokerage accounts can be taxed depending on the type of account. Easy and accurateexpense estimatoraudit support guarantee How to use nerdwallet's investment calculator enter an initial investment. Web introduction to taxable investment account calculation formula.