Trs Illinois Retirement Calculator

Trs Illinois Retirement Calculator - Web the illinois general assembly created the teachers’ retirement system of the state of illinois (trs or the system) in 1939 for the purpose of providing retirement annuities,. Request a pension income verification (retired mbrs. Web tier 2 retirement eligibility table; See examples of the calculation of the contributions. Web trs allows for an unreduced retirement annuity with the following:

Formerly your retirement benefit accrued at. Web learn how to use the formula to calculate your trs retirement benefits based on your years of service credit and salary. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web you might be wondering how to calculate your pension amount. Age 55 with 35 years of service. Find out the exceptions and tips for the standard age. Web sers does not cold call members for retirement consultations, and only schedules retirement counseling appointments at the request of the member.

Trs retirement calculator JamieleeDena

67 * tier 2 members may retire at age 62 with at least 10 years of service, but will. Web trs allows for an unreduced retirement annuity with the following: The illinois state retirement system offers an illinois state retirement calculator that will help you. Web illinois public pensions database. By collecting data from the.

The 10 Best Retirement Calculators NewRetirement

Age 62 with 5 years of service. Veterans parkway springfield, il 62704 phone: No commissionsfinancial plannerplan retirement incomeadvice on how to invest Web illinois public pensions database. Request a pension income verification (retired mbrs. Web calculate your retirement taxes in these other states. Age 55 with 35 years of service. Web the illinois general assembly.

Home Teachers' Retirement System of the State of Illinois

Annuity & life insuranceretirement products.annuity & life insurance.learn more today. Web the secure session will automatically end after 20 minutes of inactivity. Web sers does not cold call members for retirement consultations, and only schedules retirement counseling appointments at the request of the member. By collecting data from the largest. Age 55 with 35 years.

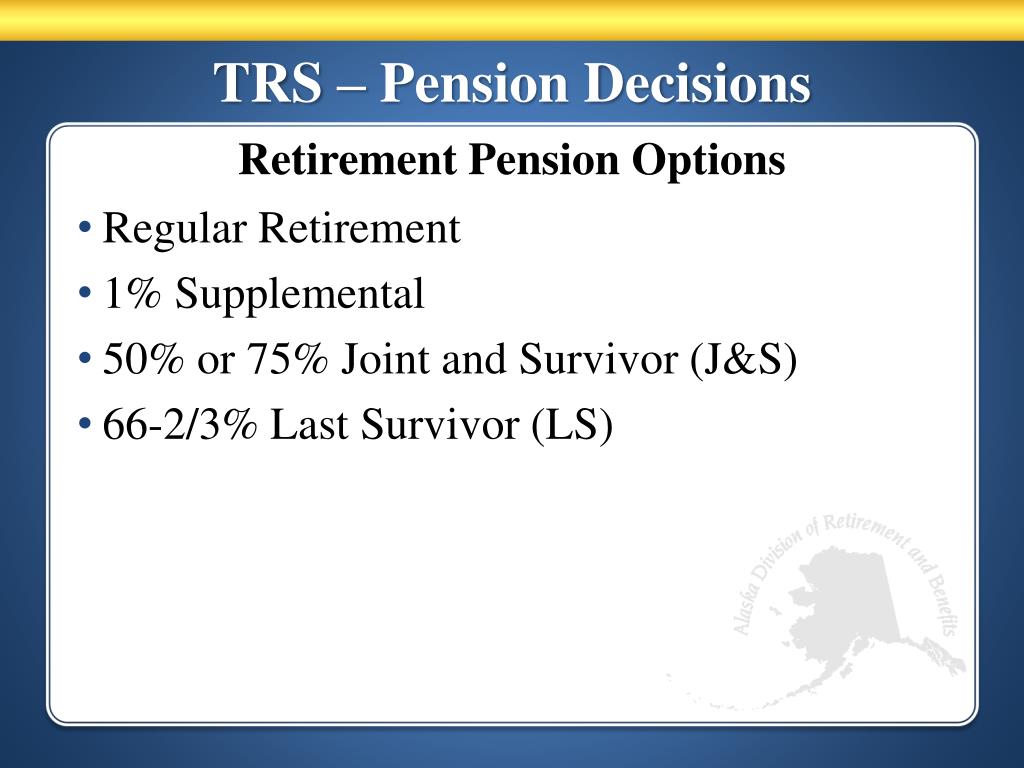

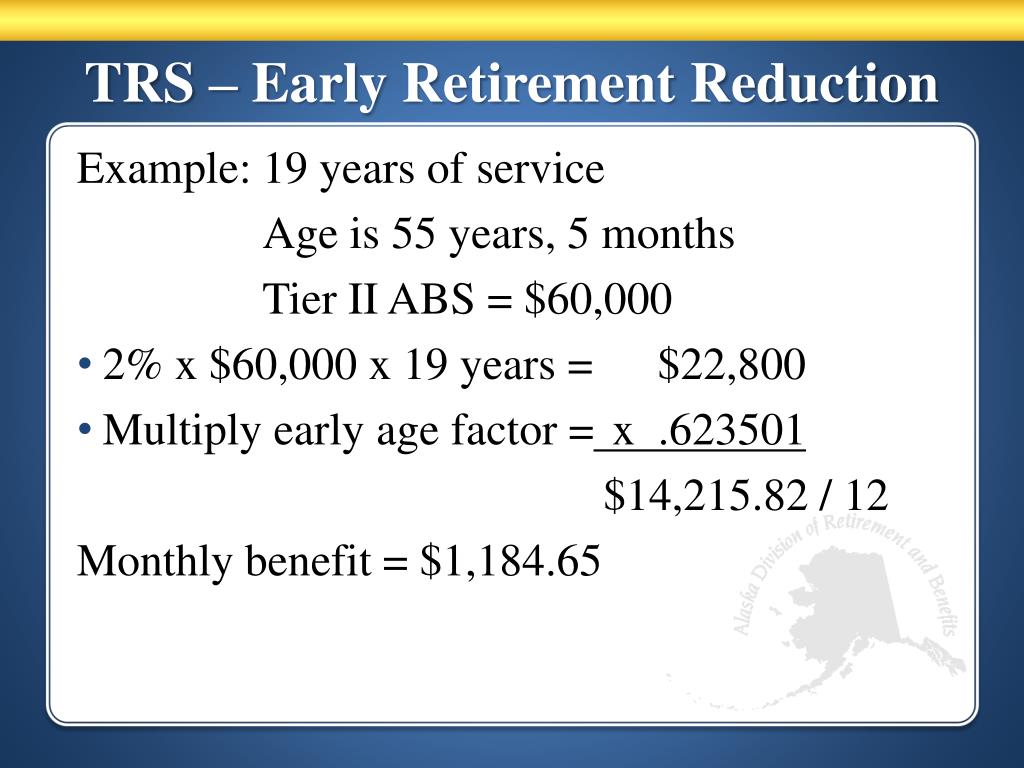

PPT PERS and TRS The Retirement Process PowerPoint Presentation, free

Request a pension income verification (retired mbrs. Web the secure session will automatically end after 20 minutes of inactivity. Find out the exceptions and tips for the standard age. Formerly your retirement benefit accrued at. 67 * tier 2 members may retire at age 62 with at least 10 years of service, but will. Inspired.

The Best Retirement Calculators You Need to Try

Web tier 2 retirement eligibility table; Age 60 with 10 years of service. Web your retirement benefit is based on final average compensation and credited service. Web calculate your retirement taxes in these other states. Formerly your retirement benefit accrued at. Enter your basic retirement information: Web illinois public pensions database. Web the 2.2 formula.

Illinois Teachers’ Retirement System Bring More to Your Future with the

Request a pension income verification (retired mbrs. Only) print an insurance premium confirmation letter. Web your retirement benefit is based on final average compensation and credited service. Web the illinois general assembly created the teachers’ retirement system of the state of illinois (trs or the system) in 1939 for the purpose of providing retirement annuities,..

Trs retirement calculator KierranNanci

Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web calculate your retirement taxes in these other states. Age 62 with 5 years of service. Web the calculator below can help you estimate your monthly ctpf pension income at retirement. See examples of the calculation of the.

5 Best Retirement Calculators Which Are Totally Free Financial

Age 55 with 35 years of service. 67 * tier 2 members may retire at age 62 with at least 10 years of service, but will. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Inspired by this, tim contributes 6 percent of his salary. Find out.

PPT PERS and TRS The Retirement Process PowerPoint Presentation, free

Web calculate your retirement taxes in these other states. Our illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your. By collecting data from the largest. Age 62 with 5 years of service. Web sers does not cold call members for retirement consultations, and only schedules retirement counseling appointments.

The 10 Best Retirement Calculators NewRetirement

Web the calculator below can help you estimate your monthly ctpf pension income at retirement. Find out the exceptions and tips for the standard age. See examples of the calculation of the contributions. If any of the information entered differs. Inspired by this, tim contributes 6 percent of his salary. Age 62 with 5 years.

Trs Illinois Retirement Calculator Web your retirement benefit is based on final average compensation and credited service. Web calculate your retirement taxes in these other states. The illinois state retirement system offers an illinois state retirement calculator that will help you. If any of the information entered differs. The benefit maximum is 75% of final average compensation.

By Collecting Data From The Largest.

Web this calculator allows participants to calculate an unofficial estimated projection of a pension benefit based on information entered. Web calculate your retirement taxes in these other states. Request a pension income verification (retired mbrs. Enter your basic retirement information:

Only) Print An Insurance Premium Confirmation Letter.

Web trs allows for an unreduced retirement annuity with the following: See examples of the calculation of the contributions. No commissionsfinancial plannerplan retirement incomeadvice on how to invest Age 62 with 5 years of service.

Veterans Parkway Springfield, Il 62704 Phone:

Web sers does not cold call members for retirement consultations, and only schedules retirement counseling appointments at the request of the member. Web the secure session will automatically end after 20 minutes of inactivity. If any of the information entered differs. Web tier 2 retirement eligibility table;

The Benefit Maximum Is 75% Of Final Average Compensation.

The illinois state retirement system offers an illinois state retirement calculator that will help you. Our illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your. Web the illinois general assembly created the teachers’ retirement system of the state of illinois (trs or the system) in 1939 for the purpose of providing retirement annuities,. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent.