Uber Eats Tax Calculator

Uber Eats Tax Calculator - Your federal tax rate may range from 10% to 37%, and your state tax rate can range from 0% to 10.75%. Web there are two things you need to know: Web the tax year runs from 6th april to 5th april, unlike the financial year which runs from 1st january to 31st december. Web whether you're delivering for the bigger food delivery services like doordash, uber eats, grubhub, shopping for and delivering groceries for instacart or shipt, doing. This number reflects the irs's 56 cents per mile minus your fuels costs.

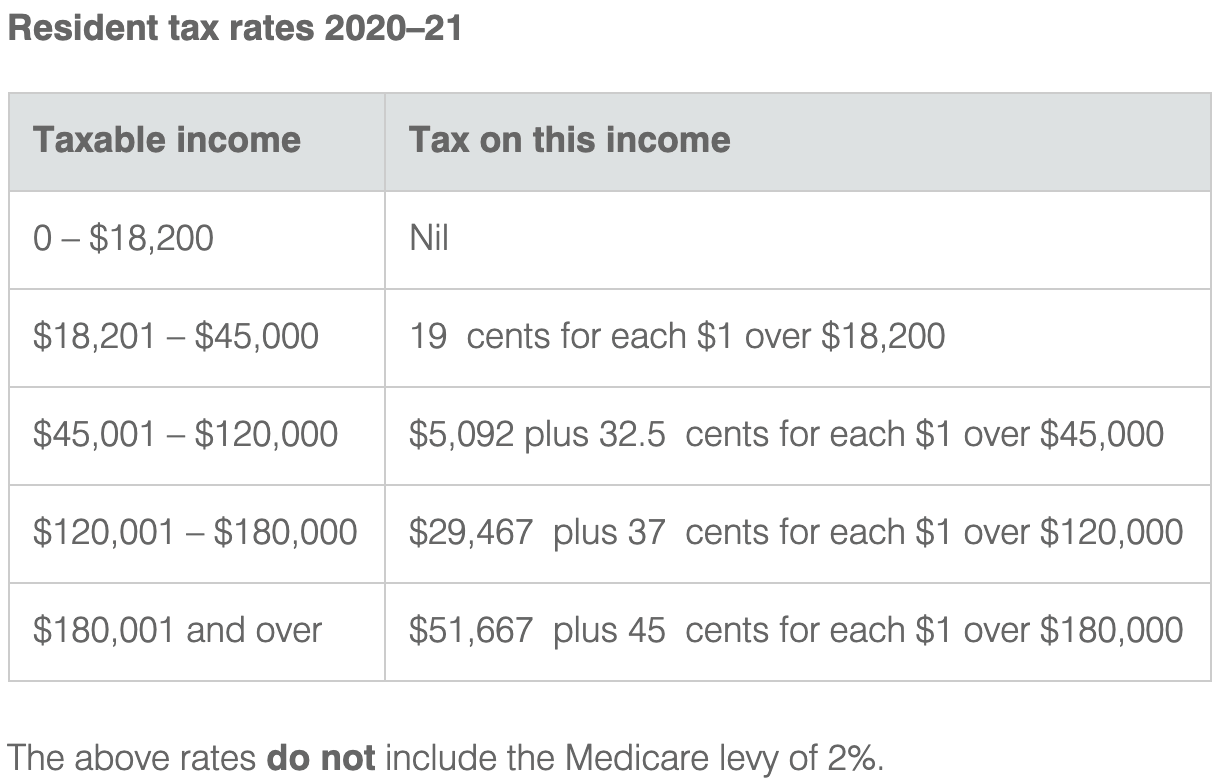

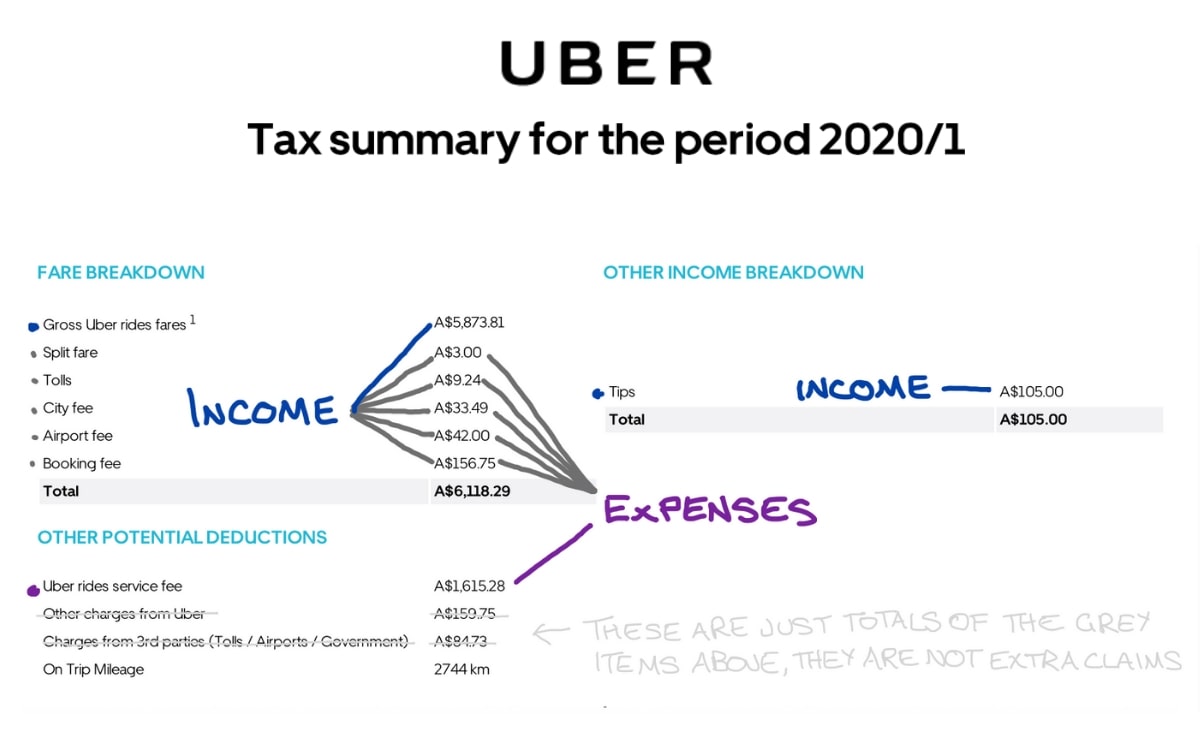

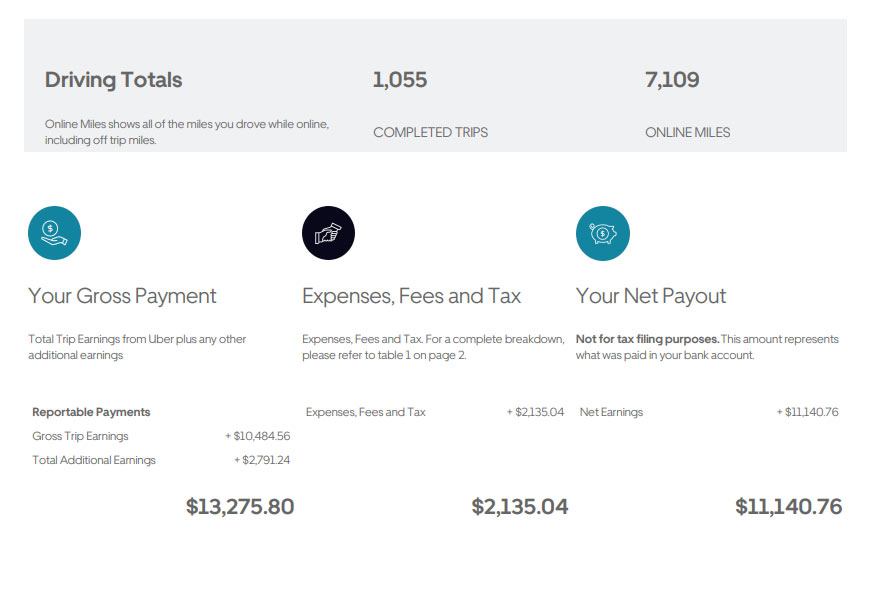

Web the largest tax deduction for most uber drivers is the business use of a car. The $11,140.76 was what the driver actually received. Web 49 common ubereats tax deductions and whether they are legitimate. Web a tax return is a form issued by hmrc (also known as an sa100). It's hard enough that you're on your. Web in 2023, uber drivers' monthly average gross earnings fell 17.1%, while those of lyft drivers increased 2.5%, according to gridwise, which analyzes gig mobility. Are there business expenses that are deductible?

Uber eats taxes explained, save uber eats tax in canada, uber eats tax

We have a calculator for that!. Subtract other expenses (hot bags, part of your cell bill, etc). Web uber eats driver pay calculator for canada and usa by commercial driver hq have you ever wondered if your uber eats driver pay was correct? Web there are two ways to calculate your vehicle expenses: Your federal.

Uber Tax Explained Ultimate Guide to Tax for Uber & Rideshare

One, this is written about uber eats taxes in the united states. For either method, you need to know how many miles. Uber and lyft drivers allow you to have access to your tax summaries on drivers.uber.com. Web a tax return is a form issued by hmrc (also known as an sa100). Web what is.

Uber Eats Tax Calculator How Much Extra Will I Pay from Uber Eats

Web whether you're delivering for the bigger food delivery services like doordash, uber eats, grubhub, shopping for and delivering groceries for instacart or shipt, doing. For either method, you need to know how many miles. Web in the example above, $13,275.80 is what uber reports they paid the driver. The actual expenses method or the.

Uber Eats Tax Calculator How Much Extra Will I Pay from Uber Eats

Your federal tax rate may range from 10% to 37%, and your state tax rate can range from 0% to 10.75%. Web the largest tax deduction for most uber drivers is the business use of a car. We'll send you a 1099. Web whether you're delivering for the bigger food delivery services like doordash, uber.

9 Concepts You Must Know to Understand Uber Eats Taxes Guide)

Web a tax return is a form issued by hmrc (also known as an sa100). Web whether you're delivering for the bigger food delivery services like doordash, uber eats, grubhub, shopping for and delivering groceries for instacart or shipt, doing. We focus on how earnings and expenses for ubereats deliveries (and other gig companies). Web.

This Uber Eats Tax Calculator Helps Drivers Plan for Tax Day

What if my tax statement amount does not match. Enter your hours, rides, state and other details to get your take home pay and. Uber and lyft drivers allow you to have access to your tax summaries on drivers.uber.com. Web there are two ways to calculate your vehicle expenses: Your federal tax rate may range.

Uber Tax Explained Ultimate Guide to Tax for Uber & Rideshare

Here are the steps we'll take: The $11,140.76 was what the driver actually received. Web taxes are tricky enough. Gross trip earnings (under gross. Web this applies to earnings on both uber rides and uber eats. Web the first one is income taxes, both on federal and state levels. Web how to find your rideshare.

Uber eats taxes calculator KellyannOcean

Web for example, if you made $10,000 as gross income on uber eats including your tips, and your deductions were $2000 and all the expenses were $4000, so your net income will. Add all income from uber eats (and from other gigs if you work multiple platforms) subtract the standard mileage amount (65.5 cents per.

What You Need To Know About Uber Eats Taxes Your Complete Guide

Web there are two ways to calculate your vehicle expenses: The actual expenses method or the mileage method. Web whether you're delivering for the bigger food delivery services like doordash, uber eats, grubhub, shopping for and delivering groceries for instacart or shipt, doing. You can deduct the actual expenses of operating the vehicle or you.

how to get uber eats tax summary Irmgard Talbot

Web the tax year runs from 6th april to 5th april, unlike the financial year which runs from 1st january to 31st december. Where can i find my tax documents? Web 49 common ubereats tax deductions and whether they are legitimate. It's hard enough that you're on your. Web a tax return is a form.

Uber Eats Tax Calculator The $11,140.76 was what the driver actually received. We'll send you a 1099. Web what is the uber tax summary used for? Web the first one is income taxes, both on federal and state levels. Web a tax return is a form issued by hmrc (also known as an sa100).

One, This Is Written About Uber Eats Taxes In The United States.

Web there are two things you need to know: Where can i find my tax documents? Different countries have different tax structures, especially. Web the first one is income taxes, both on federal and state levels.

It's Hard Enough That You're On Your.

Web uber eats driver pay calculator for canada and usa by commercial driver hq have you ever wondered if your uber eats driver pay was correct? Here are the steps we'll take: Uber and lyft drivers allow you to have access to your tax summaries on drivers.uber.com. For either method, you need to know how many miles.

Web A Tax Return Is A Form Issued By Hmrc (Also Known As An Sa100).

Web taxes are tricky enough. Calculating your taxes from doordash and other gig work earnings can really make your head spin. This number reflects the irs's 56 cents per mile minus your fuels costs. Web hi memphisdad, since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual return.

You Are Responsible To Collect, Remit, And File Sales Tax On All Your Ridesharing Trips To The Canada Revenue Agency.

Web how to find your rideshare tax information. Freetaxusa.com has been visited by 100k+ users in the past month Web the largest tax deduction for most uber drivers is the business use of a car. We focus on how earnings and expenses for ubereats deliveries (and other gig companies).