Vehicle Sales Tax In Arkansas Calculator

Vehicle Sales Tax In Arkansas Calculator - Tax is due on the difference. Web in essence, the arkansas vehicle sales tax calculator is an online tool designed to help individuals estimate the sales tax they’ll need to pay when buying or. The percentage of sales tax charged is generally 6 percent of the total. Web the following states offer free calculators to help you determine sales and/or registration taxes: An 8% sales tax on a $15,000 car adds an extra $1,200 to your cost.

This taxed value is combined from the sale price of $ 39750 plus the doc fee of $ 129 plus the. This does not even include dmv, documentation, and registration fees. Web arkansas has a 6.5% statewide sales tax rate , but also has 411 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. Web before a new or newly purchased vehicle can be registered, the owner must pay the sales tax on it. The percentage of sales tax charged is generally 6 percent of the total. Web the use tax is based on the vehicle's purchase price and is generally calculated at a rate of 3 percent. Web arkansas sales tax calculator the arkansas car sales tax rate is 6.5% of the vehicle's purchase price.

Arkansas New Car Sales Tax Calculator Car Sale and Rentals

Web arkansas sales tax calculator the arkansas car sales tax rate is 6.5% of the vehicle's purchase price. Web the following states offer free calculators to help you determine sales and/or registration taxes: Check your car title status once you’ve registered your vehicle for a title, you can look. An 8% sales tax on a.

Arkansas New Car Sales Tax Calculator Car Sale and Rentals

The percentage of sales tax charged is generally 6 percent of the total. Web the use tax is based on the vehicle's purchase price and is generally calculated at a rate of 3 percent. Web in essence, the arkansas vehicle sales tax calculator is an online tool designed to help individuals estimate the sales tax.

Arkansas car sales tax payment plan Fill out & sign online DocHub

Web arkansas sales tax calculator the arkansas car sales tax rate is 6.5% of the vehicle's purchase price. Vehicles which were purchased at a cost of 4,000 dollars or. Web before a new or newly purchased vehicle can be registered, the owner must pay the sales tax on it. Web the use tax is based.

How much is Sales Tax in Arkansas? Unemployment Gov

Arkansas california delaware indiana michigan missouri nebraska new jersey. This can be done at the time of registration, either online at. Web the following states offer free calculators to help you determine sales and/or registration taxes: The percentage of sales tax charged is generally 6 percent of the total. In addition, you may be required.

Ultimate Arkansas Sales Tax Guide Zamp

Web in essence, the arkansas vehicle sales tax calculator is an online tool designed to help individuals estimate the sales tax they’ll need to pay when buying or. Long term rental vehicle tax: This means that if you purchase a $30,000 car, you will owe $900 in use tax. Web arkansas sales tax calculator the.

How much is Sales Tax in Arkansas? Unemployment Gov

Web this includes sales, use, aviation sales and use, mixed drink, liquor excise, beer excise, tourism, short term rental vehicle, short term rental, residential moving and city. Web the following states offer free calculators to help you determine sales and/or registration taxes: This does not even include dmv, documentation, and registration fees. This taxed value.

Arkansas Car Sales Tax Late Fee Arkansas Vehicle Registration And

Find out how much tax you can expect to pay for your new car. 6.5% + county + city = rate on 1st $2,500 — plus —. Web the following states offer free calculators to help you determine sales and/or registration taxes: The percentage of sales tax charged is generally 6 percent of the total..

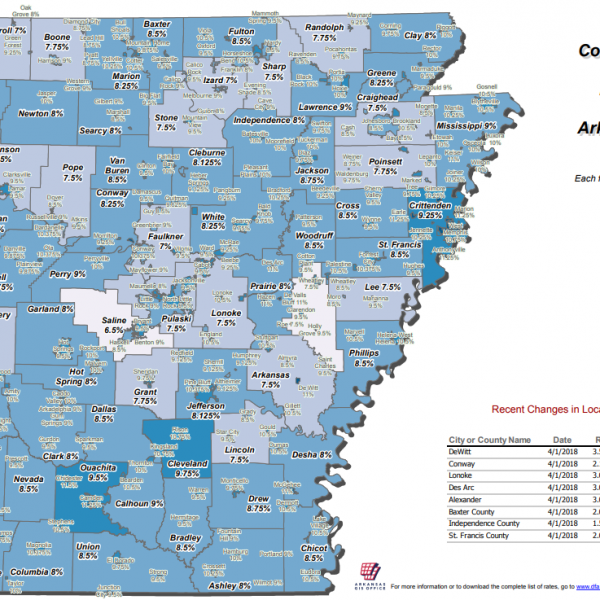

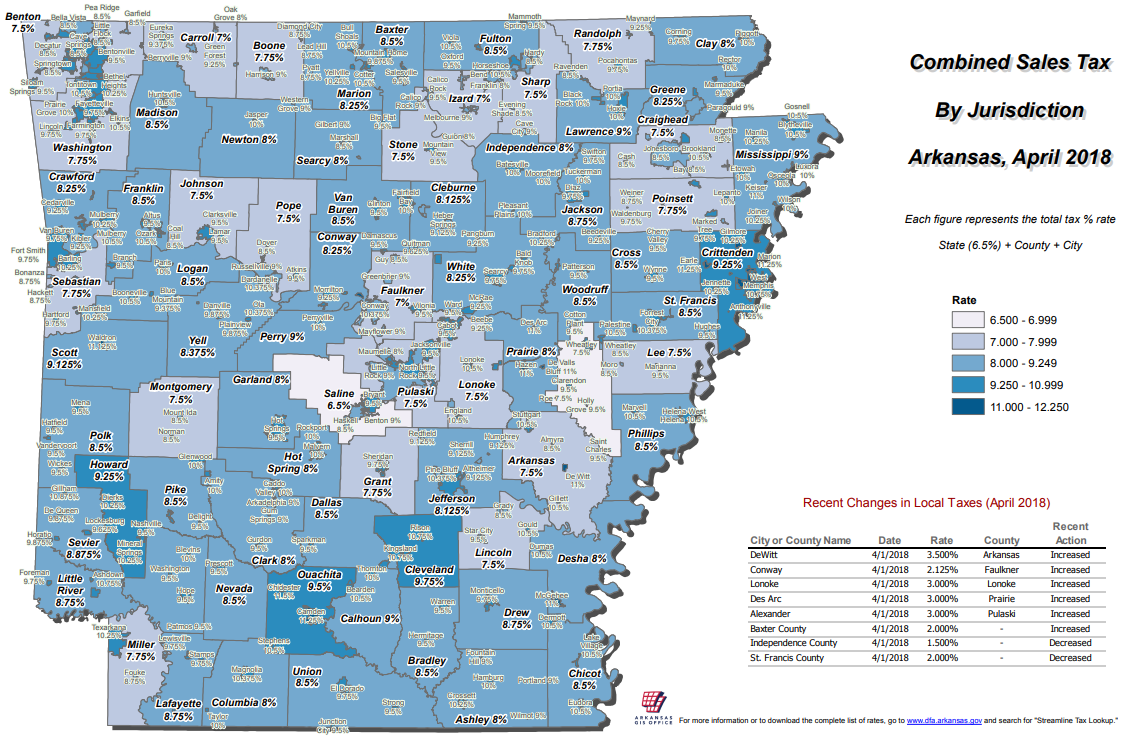

Arkansas Sales and Use Tax Rates April 2018 Arkansas GIS Office

This can be done at the time of registration, either online at. This does not even include dmv, documentation, and registration fees. Web this includes sales, use, aviation sales and use, mixed drink, liquor excise, beer excise, tourism, short term rental vehicle, short term rental, residential moving and city. 6.5% + county + city =.

Arkansas Sales Tax Small Business Guide TRUiC

6.5% + county + city = rate on 1st $2,500 — plus —. Vehicles which were purchased at a cost of 4,000 dollars or. Web arkansas sales tax calculator the arkansas car sales tax rate is 6.5% of the vehicle's purchase price. Check your car title status once you’ve registered your vehicle for a title,.

Arkansas Sales and Use Tax Rates April 2018 Arkansas GIS Office

Arkansas car tax is $ 2676.64 at 6.50 % based on an amount of $ 41179. Check your car title status once you’ve registered your vehicle for a title, you can look. The percentage of sales tax charged is generally 6 percent of the total. Web before a new or newly purchased vehicle can be.

Vehicle Sales Tax In Arkansas Calculator Web arkansas collects a 6.5% state sales tax rate on the purchase of all vehicles which cost more than 4,000 dollars. This taxed value is combined from the sale price of $ 39750 plus the doc fee of $ 129 plus the. Find out how much tax you can expect to pay for your new car. This can be done at the time of registration, either online at. An 8% sales tax on a $15,000 car adds an extra $1,200 to your cost.

An 8% Sales Tax On A $15,000 Car Adds An Extra $1,200 To Your Cost.

Web before a new or newly purchased vehicle can be registered, the owner must pay the sales tax on it. The percentage of sales tax charged is generally 6 percent of the total. Web arkansas has a 6.5% statewide sales tax rate , but also has 411 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. Web in essence, the arkansas vehicle sales tax calculator is an online tool designed to help individuals estimate the sales tax they’ll need to pay when buying or.

This Means That If You Purchase A $30,000 Car, You Will Owe $900 In Use Tax.

Arkansas car tax is $ 2676.64 at 6.50 % based on an amount of $ 41179. Web this holds true for private car sales or vehicles purchased from car dealers in arkansas. Tax is due on the difference. Web this includes sales, use, aviation sales and use, mixed drink, liquor excise, beer excise, tourism, short term rental vehicle, short term rental, residential moving and city.

This Can Be Done At The Time Of Registration, Either Online At.

Vehicles which were purchased at a cost of 4,000 dollars or. Web calculate state sales tax find out how much tax you can expect to pay for your new car. Check your car title status once you’ve registered your vehicle for a title, you can look. Web calculate state sales tax.

Arkansas California Delaware Indiana Michigan Missouri Nebraska New Jersey.

This does not even include dmv, documentation, and registration fees. Web the following states offer free calculators to help you determine sales and/or registration taxes: 6.5% + county + city = rate on 1st $2,500 — plus —. Long term rental vehicle tax: