Virginia Pay Calculator

Virginia Pay Calculator - Find out the withholding requirements, local occupational taxes,. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web use virginia paycheck calculator to estimate net or “take home” pay for salaried employees.

Simply input salary details, benefits and deductions, and any other. Web the largest city in virginia is virginia beach, with about 445,000 residents. Web us tax 2024 virginia salary and tax calculators welcome to icalculator™ us's dedicated page for income tax calculators tailored for virginia. Web virginia salary tax calculator for the tax year 2023/24. Find out the withholding requirements, local occupational taxes,. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

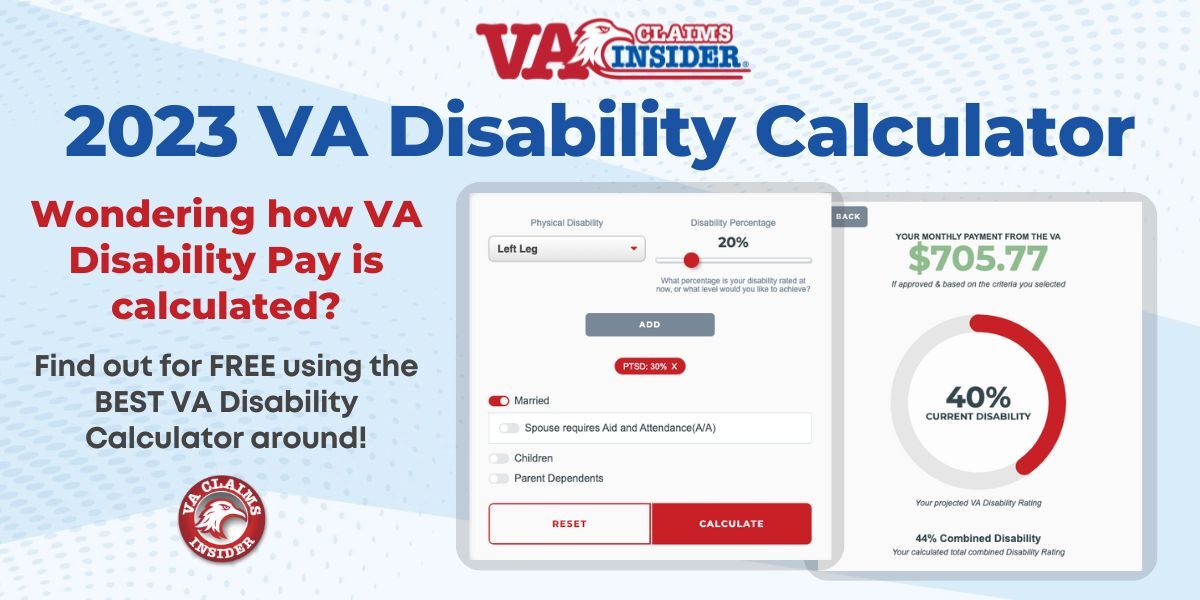

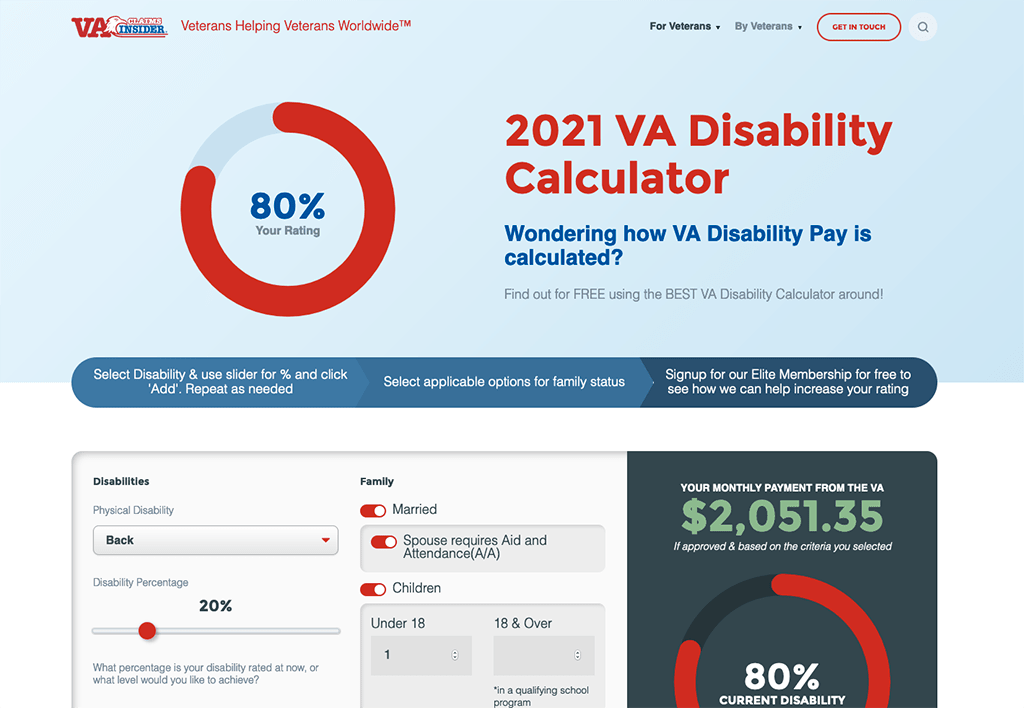

VACI's 2023 VA Disability Calculator

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. You are able to use our virginia state tax calculator to calculate your total tax costs in.

Official 2023 Pay Chart for VA Disability (The Insider’s Guide) (2023)

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web use virginia paycheck calculator to estimate net or “take home” pay for salaried employees. Web calculate your net pay and taxes for virginia in 2023 with this online tool. Web this paycheck calculator also works.

VA Back Pay Calculator Bergmann & Moore

The amount can range from $165. We’ll do the math for you—all you. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. If your employee is being paid hourly, simply multiply the number of hours worked.

20182019 VA Disability Rate Pay Charts CCK Law

Web the largest city in virginia is virginia beach, with about 445,000 residents. Simply input salary details, benefits and deductions, and any other. Web first, calculate gross wages. Web use virginia paycheck calculator to estimate net or “take home” pay for salaried employees. It will calculate net paycheck amount that an employee will receive based..

VA Disability Pay Dates 2021 (with VA Pay Dates Calendar)

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). It will calculate net paycheck amount that an employee will receive based. We’ll do the math for you—all you. If your employee is being paid hourly, simply multiply the number of hours worked during the pay.

West Virginia Paycheck Calculator 2023

You can add multiple rates. Simply enter their federal and state w. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. If your employee is.

Pay Scale Va GS Pay Scale 2022/2023

Web how to calculate your paycheck in virginia. Web use virginia paycheck calculator to estimate net or “take home” pay for salaried employees. You are able to use our virginia state tax calculator to calculate your total tax costs in the tax year 2023/24. Web use the virginia paycheck calculators to see the taxes on.

VA Disability Pay Schedule (2022 UPDATE) Hill & Ponton, P.A.

Payroll check calculator is updated for payroll year 2024 and new w4. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Simply input salary details, benefits and deductions, and any other. Just enter the wages, tax. Web this paycheck calculator also works as an income tax calculator.

2023 VA Special Monthly Compensation (SMC) Pay Rates (2023)

Web this paycheck calculator also works as an income tax calculator for virginia, as it shows you how much income tax you have to pay based on your salary. If you earn $80,268.00 per year in virginia, your net pay, which is the amount you take home after taxes, will be $59,342. Payroll check calculator.

Virginia Paycheck Calculator 2023 Paycheck Calculator VA

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. If you earn $80,268.00 per year in virginia, your net pay, which is the amount you take home after taxes, will be $59,342. Just enter the wages, tax. You are able to use our virginia.

Virginia Pay Calculator If your employee is being paid hourly, simply multiply the number of hours worked during the pay period by the hourly rate. You are able to use our virginia state tax calculator to calculate your total tax costs in the tax year 2023/24. Web us tax 2024 virginia salary and tax calculators welcome to icalculator™ us's dedicated page for income tax calculators tailored for virginia. We’ll do the math for you—all you. Web use the virginia paycheck calculators to see the taxes on your paycheck or the employer's payroll taxes.

Web Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

We’ll do the math for you—all you. Web virginia payroll tax calculator. Simply input salary details, benefits and deductions, and any other. The amount can range from $165.

Find Out The Withholding Requirements, Local Occupational Taxes,.

Web first, calculate gross wages. If you earn $80,268.00 per year in virginia, your net pay, which is the amount you take home after taxes, will be $59,342. Just enter the wages, tax. You can add multiple rates.

Web Federal Paycheck Calculator Photo Credit:

Web how to calculate your paycheck in virginia. Web oysterlink's virginia paycheck calculator shows your net pay after taxes. You are able to use our virginia state tax calculator to calculate your total tax costs in the tax year 2023/24. Web virginia salary tax calculator for the tax year 2023/24.

Web Rates Are Louisiana (9.56 Percent), Tennessee (9.55 Percent), Arkansas (9.45 Percent), Washington (9.38 Percent), And Alabama (9.29 Percent).

Web use virginia paycheck calculator to estimate net or “take home” pay for salaried employees. Find out how much you'll pay in virginia state income taxes given your annual income. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web this paycheck calculator also works as an income tax calculator for virginia, as it shows you how much income tax you have to pay based on your salary.