Virginia Property Tax Calculator

Virginia Property Tax Calculator - Web february 2, 2017 calculating your virginia car tax can be a very easy task to do. Web it also shows the median home value and median annual property tax for each. Uninsured motor vehicle (umv) fee; See what your taxes in retirement will be. Calculate how much you'll pay in property taxes on your home, given your location and assessed.

Motor vehicle sales and use tax; Web it also shows the median home value and median annual property tax for each. Web use the calculator to estimate real estate taxes or check against your bill. Enter your property's current market value and see how it. They use the assessment method for calculating it over an owned. See what your taxes in retirement will be. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

West Virginia State Tax Calculator (2022)

Our henrico county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Depending on the county and city you live in, there will be different tax rates for each. Web the current tax rate for most all vehicles is $4.15 per $100 of assessed value. Web as.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Web the commissioner of the revenue determines the extent of the personal property tax in the state of virginia. Web answer the following questions to determine if your vehicle qualifies for personal property tax relief. Web use this calculator to estimate your property taxes based on similar properties in virginia and across the united states..

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu

Web it also shows the median home value and median annual property tax for each. Web use our income tax calculator to find out what your take home pay will be in virginia for the tax year. Calculate how much you'll pay in property taxes on your home, given your location and assessed. However, the.

2021 Estate Tax Calculator & Rates

Calculate how much you'll pay in property taxes on your home, given your location and assessed. Depending on the county and city you live in, there will be different tax rates for each. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). They use the.

Northern VA Property Tax Comparison per Northern VA County YouTube

Web the current tax rate for most all vehicles is $4.15 per $100 of assessed value. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Web estimate my henrico county property tax. Web answer the following.

Property Tax Calculator

They use the assessment method for calculating it over an owned. What is the highway use fee? Web estimate my henrico county property tax. If a vehicle has situs for taxation in loudoun, the county computes the tax by dividing the. See what your taxes in retirement will be. Uninsured motor vehicle (umv) fee; Web.

Virginia Beach Virginia Property Tax Riadewntc

For comparison, the median home value in prince. Enter your details to estimate your salary after tax. Web february 2, 2017 calculating your virginia car tax can be a very easy task to do. Our henrico county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web.

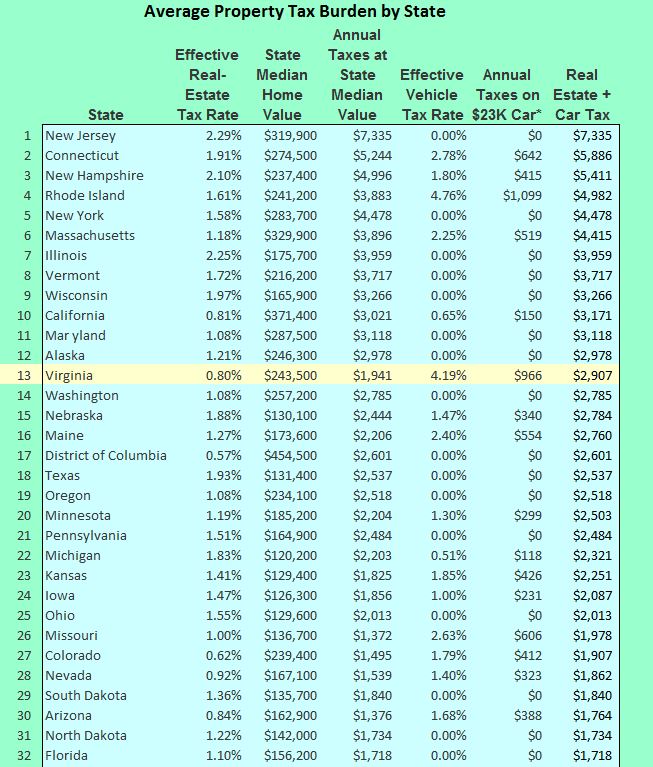

A Breakdown of 2021 Property Tax by State

For comparison, the median home value in prince. The general sales tax rate in the state is 4.3%. Enter your property's current market value and see how it. Motor vehicle sales and use tax; Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web use.

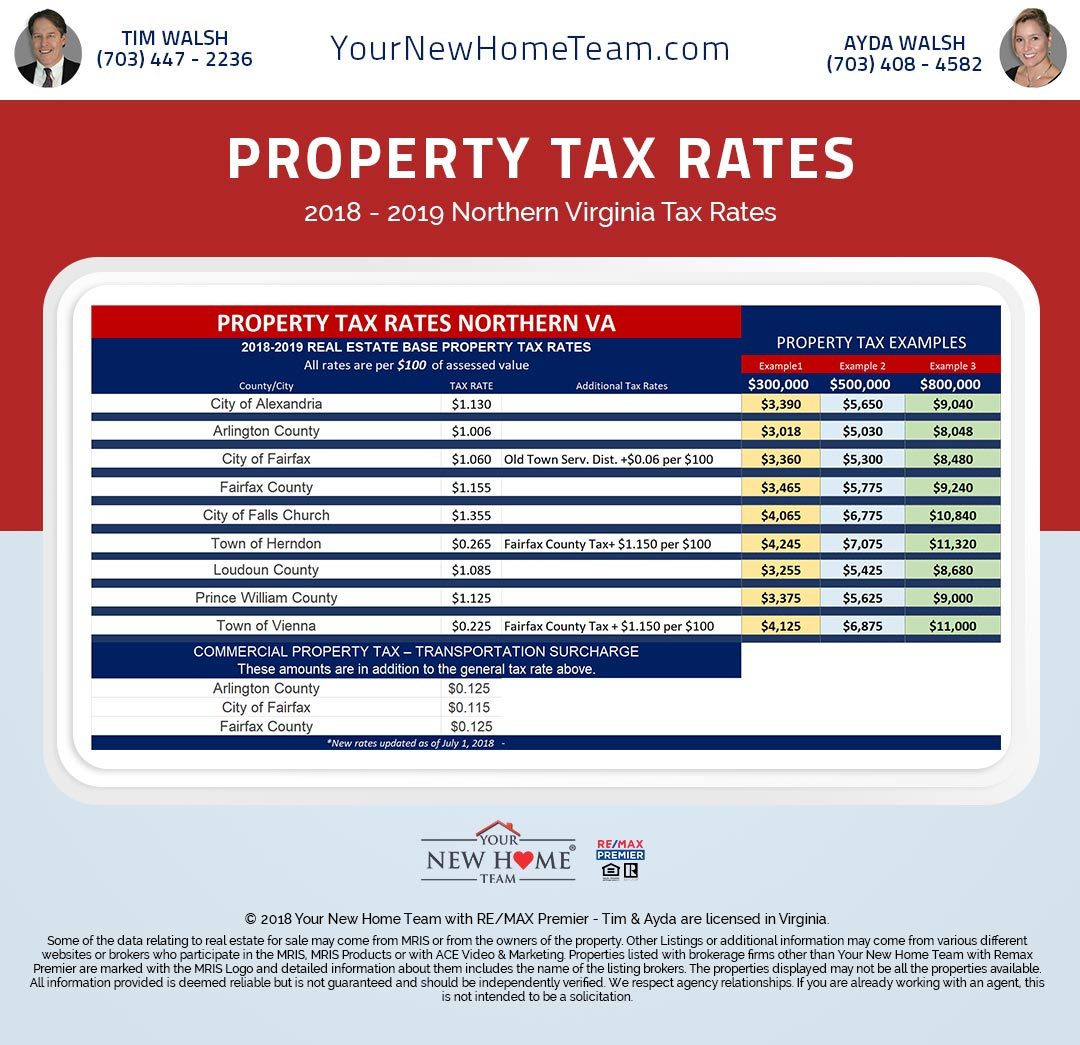

Property Tax Rates for Northern VA Counties Your New Home Team with

Depending on the county and city you live in, there will be different tax rates for each. Web loudoun county, virginia property tax calculator. If a vehicle has situs for taxation in loudoun, the county computes the tax by dividing the. Value on your tax bill is determined by the commissioner of the revenue's office..

How to Calculate Property Taxes

Web the current tax rate for most all vehicles is $4.15 per $100 of assessed value. Web estimate my henrico county property tax. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. The general sales tax.

Virginia Property Tax Calculator Web answer the following questions to determine if your vehicle qualifies for personal property tax relief. Uninsured motor vehicle (umv) fee; Depending on the county and city you live in, there will be different tax rates for each. If you can answer yes to any of the following questions, your vehicle is. Web use this calculator to estimate your property taxes based on similar properties in virginia and across the united states.

Our Henrico County Property Tax Calculator Can Estimate Your Property Taxes Based On Similar Properties, And Show You How Your.

Web personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia. They use the assessment method for calculating it over an owned. Web virginia has among the lowest sales taxes in the country. Web it also shows the median home value and median annual property tax for each.

Web The Commissioner Of The Revenue Determines The Extent Of The Personal Property Tax In The State Of Virginia.

Tax rates differ depending on. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Web use our income tax calculator to find out what your take home pay will be in virginia for the tax year. The general sales tax rate in the state is 4.3%.

However, The Exact Tax Rate For Your Property Will.

Web february 2, 2017 calculating your virginia car tax can be a very easy task to do. Web as of 2021, the average property tax rate in virginia is 0.80%, which is lower than the national average of 1.07%. Web loudoun county, virginia property tax calculator. If a vehicle has situs for taxation in loudoun, the county computes the tax by dividing the.

See What Your Taxes In Retirement Will Be.

Additionally, some counties and independent cities collect a tax of 0.7%,. If you can answer yes to any of the following questions, your vehicle is. For comparison, the median home value in prince. Value on your tax bill is determined by the commissioner of the revenue's office.