Volatility Of A Portfolio Calculator

Volatility Of A Portfolio Calculator - Web using the formula given above we can now calculate the portfolio volatility: Web beta is a measure of a stock’s volatility in relation to the overall market. Beta is used in the capital asset. This calculator computes historical volatility using two different approaches: Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion of returns.

Web by utilizing a modern portfolio theory calculator, you can take advantage of advanced algorithms and data analysis to build a portfolio that maximizes returns while. Asset 2 makes up 61% of a portfolio has an. Web beta is a measure of the volatility , or systematic risk , of a security or a portfolio in comparison to the market as a whole. Web to further explore portfolio optimisation, we conduct a monte carlo simulation with 10,000 iterations and plot the results to visualise the efficient frontier. Web you can calculate your portfolio’s volatility of returns in a precise way using a portfolio volatility formula that computes the variance of each stock in the collection. Web in my 'volatility adjusted profit target' indicator, i've crafted a dynamic tool for calculating target profit percentages suitable for both long and short trading strategies. In this section, we will calculate portfolio volatility.

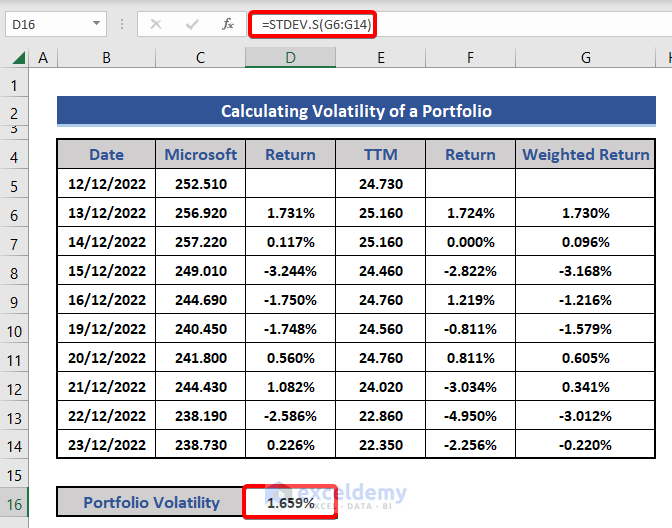

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

Web next, add the resulting value to two multiplied by the weights of the first and second assets multiplied by the covariance of the two assets. Web how to calculate the volatility of a portfolio in excel. Web in my 'volatility adjusted profit target' indicator, i've crafted a dynamic tool for calculating target profit percentages.

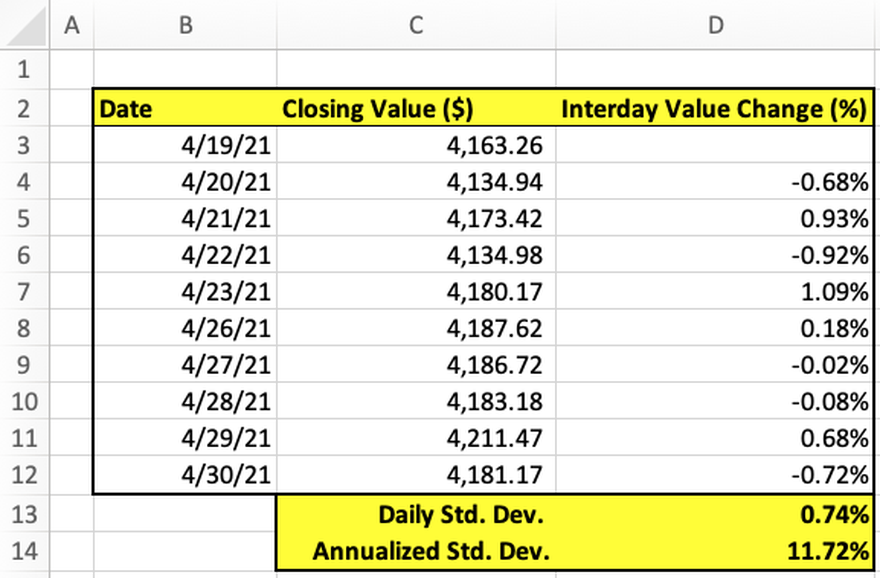

How to Calculate Volatility of a Stock or Index in Excel The Motley Fool

For this, we will consider the closing stock price of. Web in my 'volatility adjusted profit target' indicator, i've crafted a dynamic tool for calculating target profit percentages suitable for both long and short trading strategies. Portfolio volatility = root(89% 2 ×0.141%+11% 2. The standard deviation of logarithmic. Web it computes the total return of.

Volatility Formula Calculator (Examples With Excel Template)

Web if this standard holds true, then approximately 68% of the expected outcomes should lie between ±1 standard deviations from the investment's expected return, 95%. Web beta is a measure of a stock’s volatility in relation to the overall market. Portfolio volatility = root(89% 2 ×0.141%+11% 2. This calculator computes historical volatility using two different.

Understanding Volatility Measurements

Beta is used in the capital asset. Web use our investment calculator to calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments. Web to further explore portfolio optimisation, we conduct a monte carlo simulation with 10,000 iterations and plot the results to visualise the.

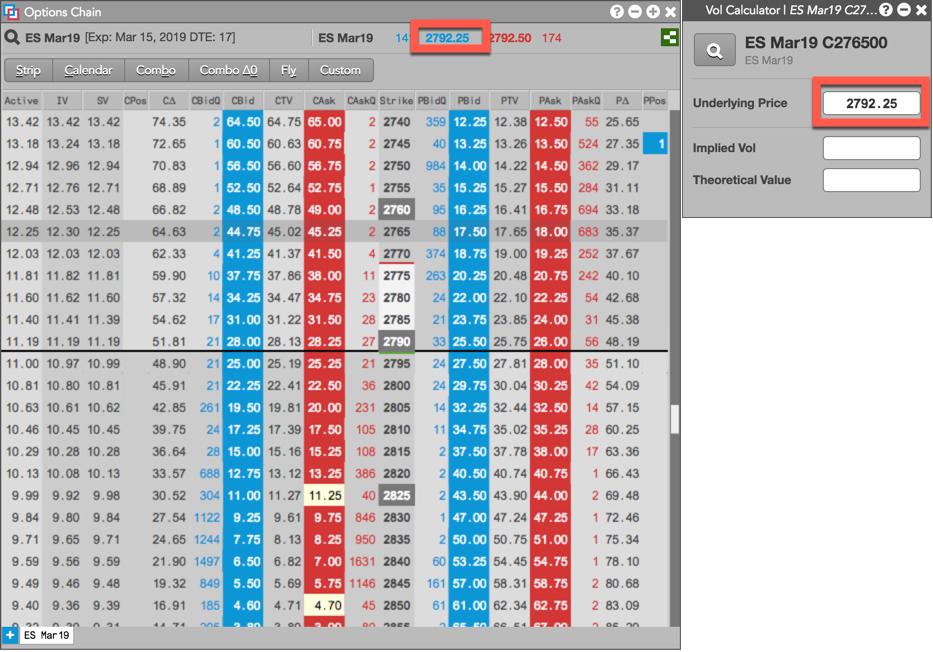

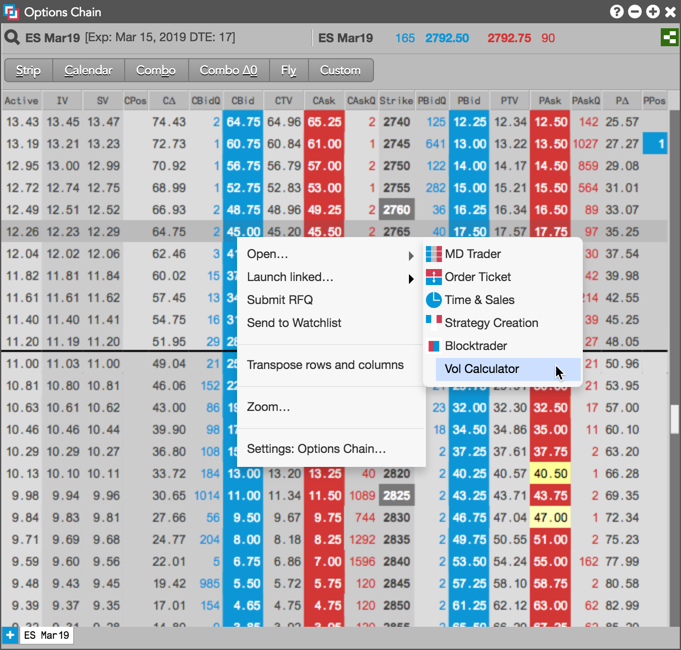

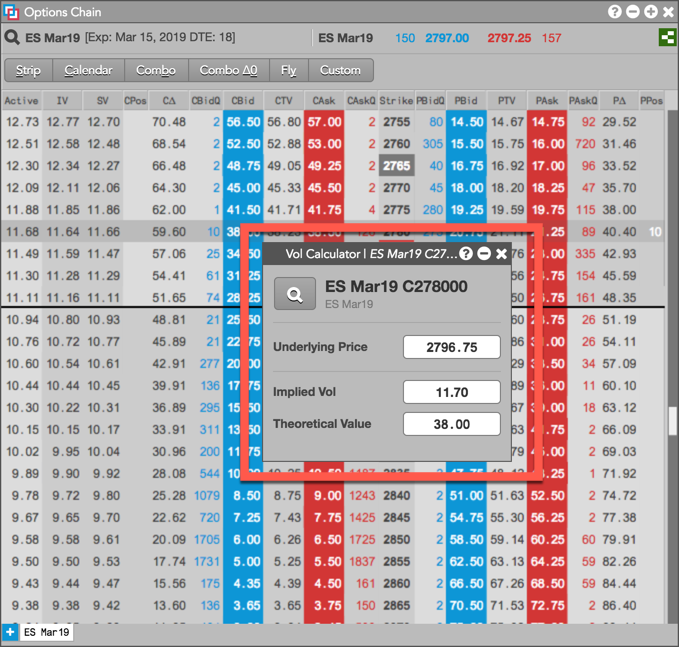

Using the Volatility Calculator Volatility Calculator Help and Tutorials

The beta of a portfolio is calculated as the weighted average of the individual betas of the stocks in. Web asset 1 makes up 39% of a portfolio and has an expected return (mean) of 23% and volatility (standard deviation) of 10%. The compound adjusted growth rate in both real and inflation adjusted. Nerdwallet.com has.

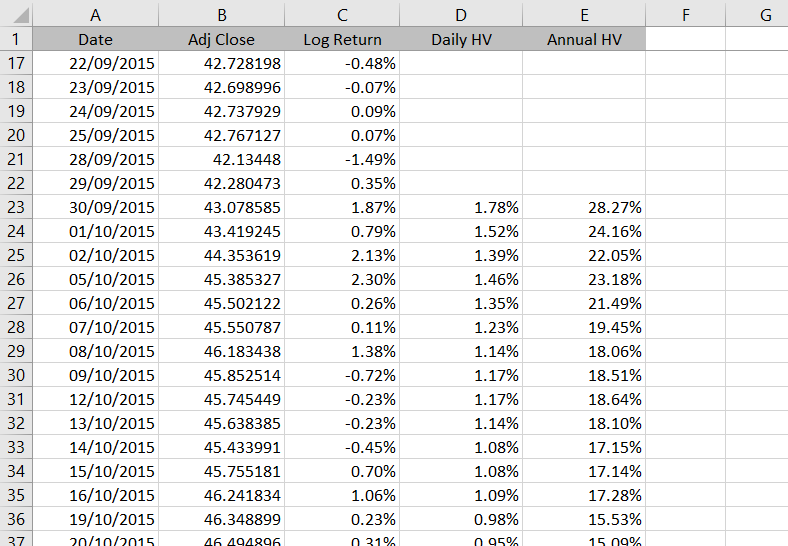

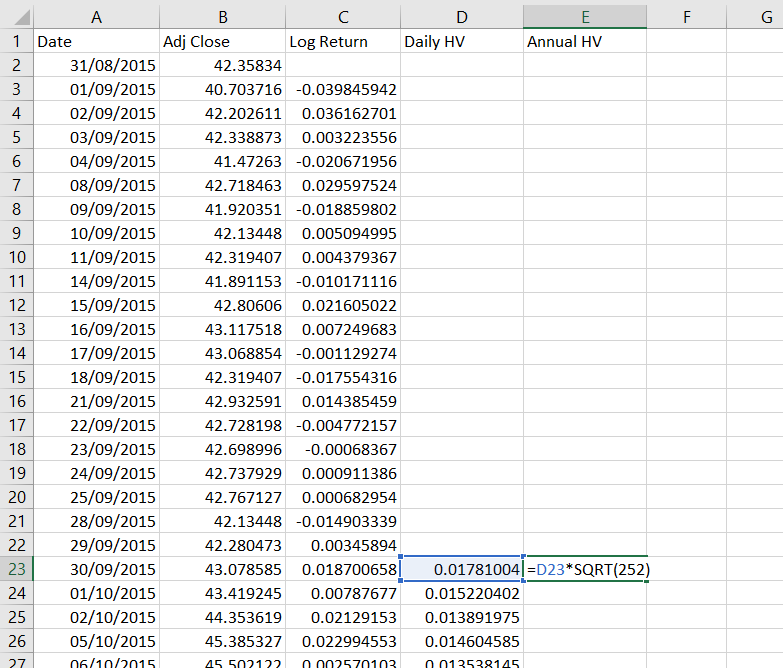

How to Calculate Historical Volatility in Excel Macroption

Web how does the 2 asset portfolio calculator work? Web asset 1 makes up 39% of a portfolio and has an expected return (mean) of 23% and volatility (standard deviation) of 10%. The beta of a portfolio is calculated as the weighted average of the individual betas of the stocks in. Web key takeaways volatility.

Using the Volatility Calculator Volatility Calculator Help and Tutorials

This calculator computes historical volatility using two different approaches: Beta is used in the capital asset. Web if this standard holds true, then approximately 68% of the expected outcomes should lie between ±1 standard deviations from the investment's expected return, 95%. Web historical volatility can be measured in a myriad of ways. Web next, add.

How to Calculate Historical Volatility in Excel Macroption

Web beta is a measure of the volatility , or systematic risk , of a security or a portfolio in comparison to the market as a whole. Web how does the 2 asset portfolio calculator work? Stout.com has been visited by 10k+ users in the past month The compound adjusted growth rate in both real.

How To Calculate VolatilityAdjusted Portfolio Metrics To Assess

In general, the higher the standard deviation, the more volatile the. Web beta is a measure of the volatility , or systematic risk , of a security or a portfolio in comparison to the market as a whole. Web it computes the total return of $1000 and uses that to determine the following for each.

Volatility Calculator Overview Volatility Calculator Help and Tutorials

The standard deviation of logarithmic. New drug approvals and pipeline progress are likely to help maintain momentum for the zacks biomedical and genetics industry. Web it computes the total return of $1000 and uses that to determine the following for each portfolio: Beta is used in the capital asset. Web how does the 2 asset.

Volatility Of A Portfolio Calculator Asset 2 makes up 61% of a portfolio has an. In this section, we will calculate portfolio volatility. Web using the formula given above we can now calculate the portfolio volatility: Web by utilizing a modern portfolio theory calculator, you can take advantage of advanced algorithms and data analysis to build a portfolio that maximizes returns while. New drug approvals and pipeline progress are likely to help maintain momentum for the zacks biomedical and genetics industry.

For This, We Will Consider The Closing Stock Price Of.

Stout.com has been visited by 10k+ users in the past month The beta of a portfolio is calculated as the weighted average of the individual betas of the stocks in. Web using the formula given above we can now calculate the portfolio volatility: Web how to calculate the volatility of a portfolio in excel.

In This Section, We Will Calculate Portfolio Volatility.

Web asset 1 makes up 39% of a portfolio and has an expected return (mean) of 23% and volatility (standard deviation) of 10%. Asset 2 makes up 61% of a portfolio has an. Nerdwallet.com has been visited by 1m+ users in the past month The compound adjusted growth rate in both real and inflation adjusted.

Web Use Our Investment Calculator To Calculate How Much Your Money May Grow And Return Over Time When Invested In Stocks, Mutual Funds Or Other Investments.

Web take the square root of that number, and you'll get the standard deviation of the portfolio. Web it computes the total return of $1000 and uses that to determine the following for each portfolio: Web to further explore portfolio optimisation, we conduct a monte carlo simulation with 10,000 iterations and plot the results to visualise the efficient frontier. Web you can calculate your portfolio’s volatility of returns in a precise way using a portfolio volatility formula that computes the variance of each stock in the collection.

In General, The Higher The Standard Deviation, The More Volatile The.

Web next, add the resulting value to two multiplied by the weights of the first and second assets multiplied by the covariance of the two assets. Volatilitycalc has been added to the online suite of calculators at fincalcs.net. The standard deviation of logarithmic. Web how does the 2 asset portfolio calculator work?

:max_bytes(150000):strip_icc()/OptimalPortfolioTheoryandMutualFunds4-4a12df831cfb4eacaab8c8188b15a911.png)